As we consider the future of transportation and the role that ridesharing will play, we want to better understand how consumers of these services use and think about them. To that end, we recently surveyed 450 US consumers about their ridesharing habits.

Room to Grow

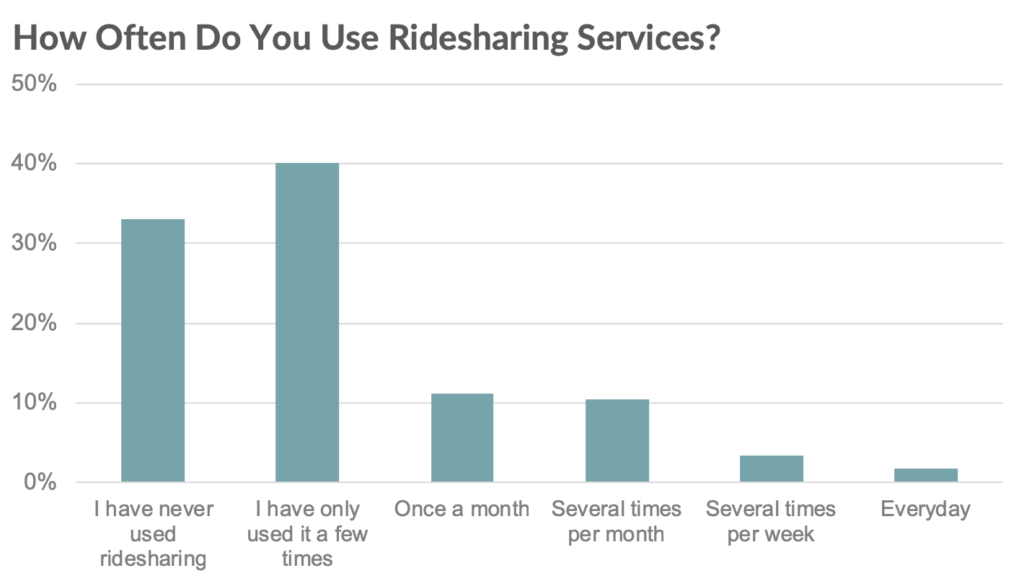

The sheer percentage of people that have ever used ridesharing or related services presents a growth opportunity and a hurdle for Lyft and Uber. One third of respondents had never used ridesharing, 36% don’t have any of the apps on their phone, 81% have never used a meal delivery service, and 85% have never used a bike or scooter sharing service.

Of those that have used ridesharing, 60% have only used it a few times, and only 23% are regular (more than 1x per month) users.

91% of respondents said that they own or have regular access to a car. The way Uber and Lyft will grow to serve their true addressable market is for people to abandon car ownership in favor of habitual use of ridesharing and other services.

Brand

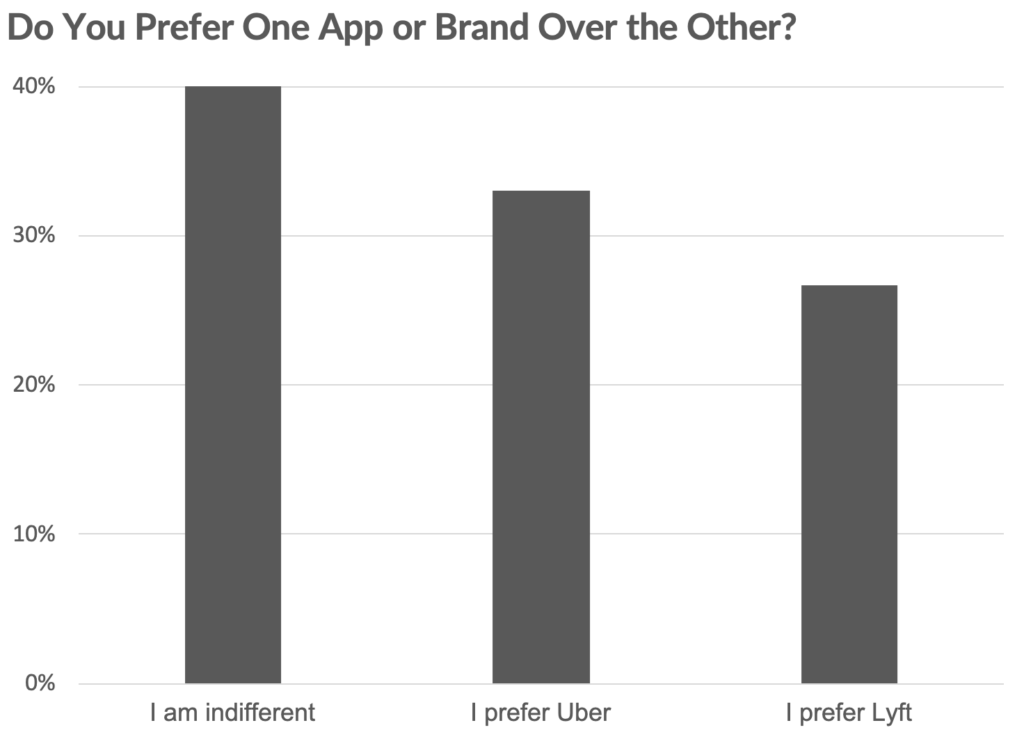

In our note on the dynamics and the future of the ridesharing market, we wrote that, while brand would be an important differentiator between Uber and Lyft, it is not a durable competitive advantage in this business. The reason brand is important is because Uber and Lyft are primarily concerned with earning more of your transportation spend. They do that by creating habitual users, and habitual users are born mostly out of unincentivized brand allegiance. In our survey, we found that 40% of respondents were indifferent between Lyft and Uber, 33% preferred Uber, and 27% preferred Lyft. The slight lean toward Uber most likely reflects its wider reach.

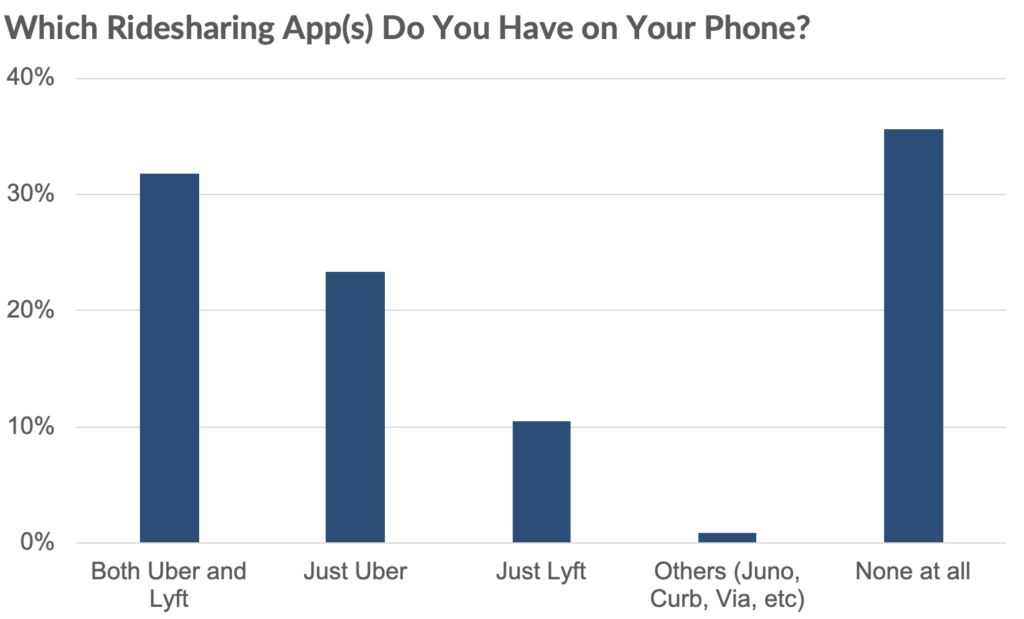

Further, we asked which app(s) users had on their smartphones. 32% had both Uber and Lyft, 23% had just Uber, 10% had just Lyft, and 36% had no ridesharing apps at all. The most common behavior in our sample is to keep both apps on your phone and be indifferent in terms of brand. This manifests itself in price-sensitive users who check both apps before hailing a ride. This is both a problem and an opportunity for Lyft and Uber.

Note that 27% of respondents preferred Lyft’s brand, while only 10% went so far as to make it the only ridesharing app on their phone. We also asked the reason for their brand preference. Comments that preferred Uber were generally about reliability and price, while comments that preferred Lyft cited friendly service, trust, and the negativity surrounding Uber’s brand. However, this shows how fragile of a competitive advantage brand is in ridesharing. If it were a real consideration, more people that preferred Lyft would use that app exclusively.

Other Insights

- The primary use cases for hailing a ride are a night out, travel-related transport (to and from airport, or while on vacation/business trip), and general mobility, i.e. replacing trips that would otherwise be in taxis, buses or personal vehicles.

- Only 10% of respondents have used Lyft or Uber to hire something other than a ridesharing car, such as a bike, scooter, or public transportation. Multimodality is key to getting consumers to think of these companies as mobility platforms, instead of just high-tech cab services. Our survey shows that this transition has not taken place, but there is significant room to capture more trips.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.