The podcast medium is massive, with about 40% of Americans age 12 and older listening to podcasts monthly. Apple made a brief yet important announcement related to its podcast offering at its Spring Loaded event in April: a global podcast marketplace, in which listeners can subscribe to individual shows that creators put behind a paywall. A week later, Spotify announced a similar marketplace. The market reaction was that Apple was finally ramping its competitive efforts with Spotify for podcast supremacy. After helping mainstream podcasts through the iTunes store in 2005, Apple has done little with the medium since. Meanwhile, Spotify has aggressively pursued the podcast opportunity, investing hundreds of millions of dollars to acquire ad technology and exclusive content.

Apple’s and Spotify’s approaches to podcasts have some competitive overlap, as both companies want to reach more listeners and help creators better monetize an under-monetized medium. That said, we view Apple’s and Spotify’s podcast strategies as largely divergent.

For Apple, podcasts appear to fall into the hobby category, primarily aimed at:

- Maintaining leadership in an important content category.

- Providing high-margin incremental Services revenue.

For Spotify, podcasts are central to its long-term success, primarily aimed at:

- Increasing profitability, as podcasts offer the company better margins than music.

Why is this topic relevant?

This topic is relevant because podcasting has reached critical mass as an entertainment and information medium, with roughly 40% of Americans age 12 and older listening to podcasts monthly. We view audio (podcasts, radio) content as the most basic version of augmented reality, layering information over the physical world which users can consume while doing other tasks, such as driving, exercising, or working around the house.

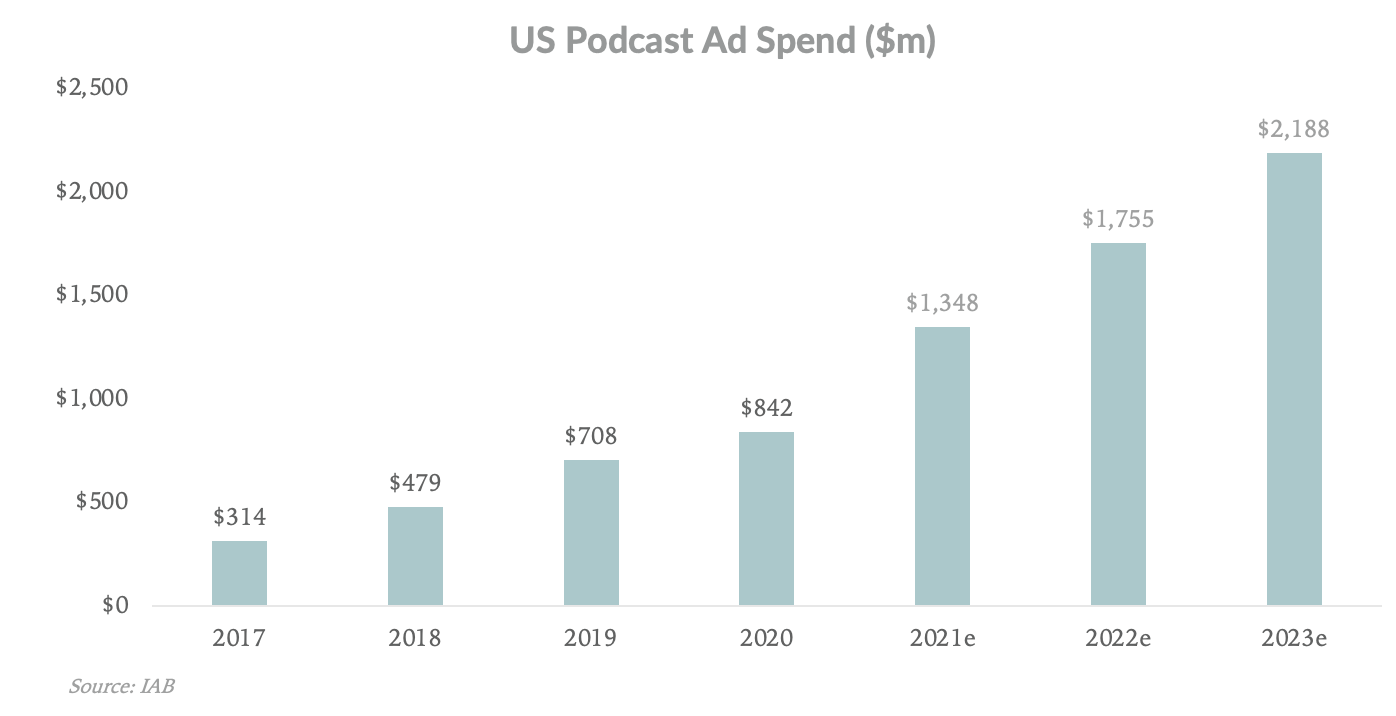

While the podcast ad market is small today, it’s growing quickly and podcasts are under-monetized as a medium:

To put these numbers in perspective, annual podcast ad revenue is less than 5% the size of radio ad revenue and about 1.5% of TV advertising. However, the daily average amount of time spent listening to podcasts is about 10% the amount of time spent listening to radio and about 5% the amount of time spent watching TV. In other words, podcasts are under-monetized compared to radio by a factor of 2x, and TV by slightly more than 3x.

Putting it together, while the podcast ad market is growing at more than 50% this year, at $1.3B in expected revenue it will likely be less than 1% the size of Apple’s total revenue this year. It makes little sense for Apple to make podcasts a central focus when it has growth opportunities in massive addressable markets, including transportation and augmented/mixed reality, which have the potential of adding a new revenue growth curve to the Apple outlook.

Conversely, for Spotify, which did about $9.5B in revenue in 2020, pushing the podcast ad market to $10B in annual revenue over the next decade and capturing 50% plus share would add $5B in annual revenue and be transformative for the company.

Apple’s podcast strategy

From a high-level, we view Apple’s podcast offering as more of a hands-off hobby than a dedicated project. While it could morph into a full-time project down the road, today we see it as a way for Apple to keep its users engaged with its first-party apps and maintain leadership in an important content category, given podcasts will play an increasing role in consumers’ lives as they allow users to consume media while multitasking.

By staying a leader in an important category, it gives Apple optionality to more aggressively pursue expansion and monetization of the medium in the future. If the podcast marketplace continues to grow, similar to other Apple hobbies including Apple TV or HomePod, the marketplace would have a small and favorable return on capital and strengthen Apple’s platform as a one-stop content offering.

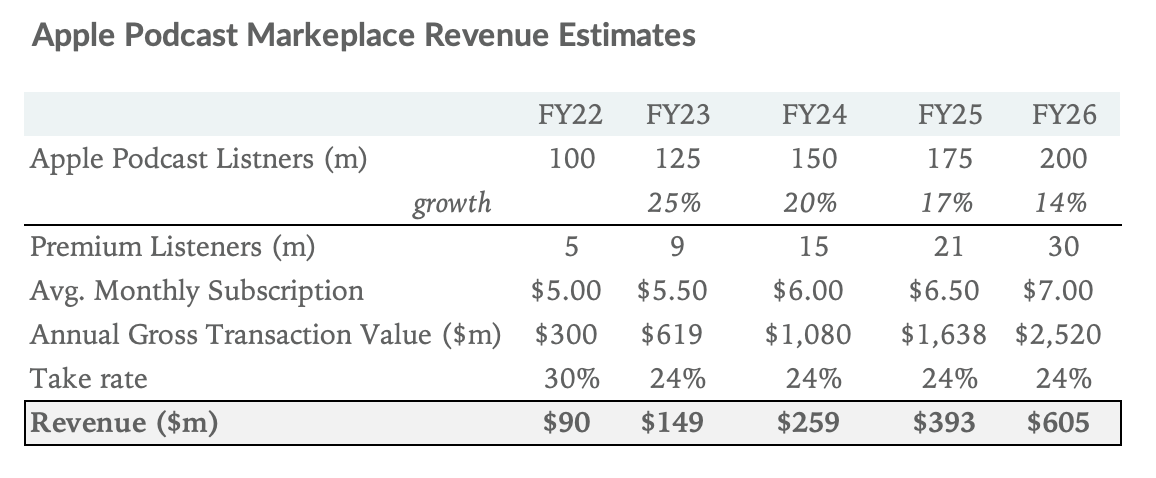

From a revenue perspective, the podcast marketplace will add incremental high-margin Services revenue, although as mentioned, not enough to move the needle. We estimate the podcast marketplace could add just over $600m in revenue by FY26, to what will likely be more than $460B in overall revenue that year. However, given the podcast marketplace will likely enjoy ~80% operating margins, this would account for around 0.5% of operating income. A small percentage, but impressive given it takes a lot to move the needle for a multi-hundred billion-dollar revenue company.

This revenue estimate is derived by taking Apple Podcasts monthly user base (we estimate about 100m globally) and estimating 5% will subscribe to a paid podcast in FY22 (begins in October), moving to 15% by FY26, with an average revenue per paid user of $5/month, increasing to $7 in FY26. Apple’s marketplace has a 30% take rate for first-year subscribers, declining to 15% in year two and beyond. We assume a two-year average subscription life, equating to an average blended take rate of 24% after year one. While Apple does charge $19.99/year for content creators to use its subscription tools, given the revenue generated will be insignificant, we excluded it from our model.

Putting it together, while the podcast marketplace will be small for Apple, it’s another offering that furthers user engagement with Apple services, increasing the stickiness of Apple’s ecosystem.

Will Apple acquire exclusive content?

While Apple may acquire some exclusive content or develop some original content in-house, we think it’s unlikely Apple meaningfully pursues this option. We view it in a similar way to how Apple has never acquired apps or TV content in the past. Culturally, we don’t think it’s a fit.

Spotify’s podcast strategy

In contrast to Apple, Spotify has made it clear over the past few years that they’re betting the company’s future on podcasts, with a mission of becoming the “world’s leading audio platform.” The reason is that podcasts offer more attractive unit economics than music.

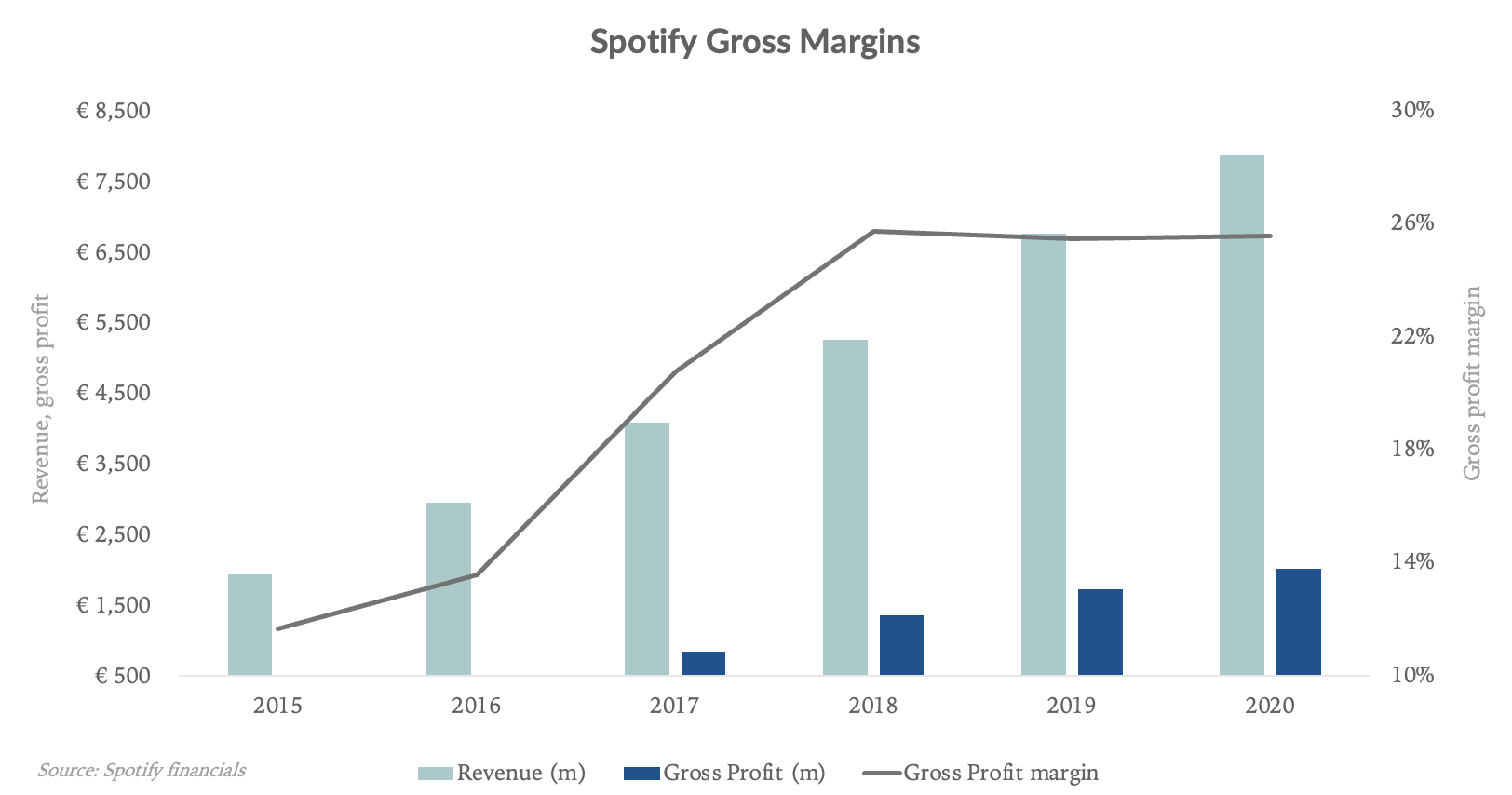

It’s costly for Spotify to acquire its supply of music content because they have to pay recurring royalties to record labels and publishers that have substantial leverage. You’ll notice that given music’s unfavorable margin profile, most leading music streaming services, including Apple Music, Amazon Music, Tencent Music, and YouTube Music are ancillary offerings housed under massively profitable companies.

As a result of this dynamic, Spotify has lower gross margins than other digital content providers. After expanded sharply in 2017 and 2018, Spotify’s gross margins have stayed flat since then, hovering around 25%:

For comparison, Netflix and Fox Corporation have mid to high-30% gross margins and the Discovery network has ~65% gross margins.

In order to achieve mid to high-30% gross margins, similar to Netflix, Spotify must add high-margin revenue, which is what makes podcasts attractive. In contrast to music, podcasts are often independently produced and user-generated, more akin to Twitter, Facebook, or blog content, than music or film content. Additionally, similar to the transition Netflix made in 2013, Spotify is producing and acquiring more original content, which offers better margins than licensed music.

With this in mind, Spotify’s more aggressive podcast strategy makes sense. The company is investing in exclusive and original content to differentiate its offerings and keep listeners loyal to the platform, it’s building an advertising network and marketplace for more targeted advertising, and it’s being creator-friendly with lower marketplace take rates. For example, in contrast to Apple, Spotify is not charging creators for its podcast monetization tools or taking a cut of revenue until the spring of 2023, at which time they will begin charging a 5% take rate. Spotify is offering better terms than Apple because if it fails to onboard creators, its long-term podcasts strategy is jeopardized. Conversely, given Apple’s future growth or profitability does not hinge on the success of its podcast marketplace, along with the fact that Apple offers creators access to consumers willing to pay for content, Apple can apply its 15%-30% take rate structure to its podcast marketplace.