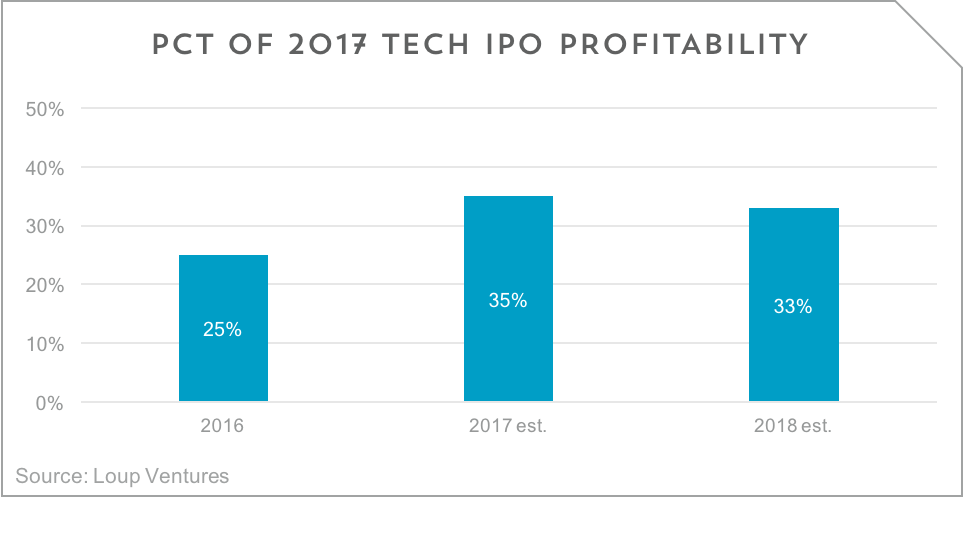

We met with a prospective LP recently to talk about investing in a specific company. This LP had a successful business career in a traditional industry where operating profits are the bar, so he had a hard time getting his head around how to value a business based on more abstract concepts like daily active users, platform engagement, and IP. To that end, he posed a simple question, “What has to happen for us to win in this investment?” A simple, but powerful question. It forced us to reflect on our experience as public market analysts and now VCs about why tech companies have liquidity events. We concluded that nearly every tech company that we’ve seen exit does so based on the promise of profit, not actual profit. There are rare exceptions like Google, Facebook, and Alibaba who were operationally profitable at their IPOs. It’s no coincidence that those companies also happen to be some of the best performing, and now biggest, public stocks of the past decade. But most exited tech companies, whether via acquisition or even IPO, do not generate an operating profit. Most don’t even generate an EBITDA profit. We analyzed 20 tech IPOs from 2017 to put some data to our observations. We found that 75% of those companies did not generate a net profit in 2016, a year prior to IPO. 65% are not expected to generate a net profit in 2017 based on consensus estimates (only 17 companies have 2017 estimates), and 67% are not expected to generate a net profit in 2018 (18 companies have 2018 estimates).

Much like venture investors, growth seems to be the more important near-term metric. Of the IPO companies for which we found data, they grew an average of 78% in 2016 and are estimated to grow 46% in 2017 and 35% in 2018.

Much like venture investors, growth seems to be the more important near-term metric. Of the IPO companies for which we found data, they grew an average of 78% in 2016 and are estimated to grow 46% in 2017 and 35% in 2018.  But what does this really mean about a win for venture investors? In lieu of net profit, public market investors are looking at growth to help them build a case for profit tomorrow. A small survey of buy side investors from earlier this year corroborates this. When we asked 12 buy side investors to rank tech IPO traits including short-term profitability, short-term growth, long-term profitability, long-term growth, and visibility of revenue, long-term profitability ranked first, followed by long-term revenue growth.

But what does this really mean about a win for venture investors? In lieu of net profit, public market investors are looking at growth to help them build a case for profit tomorrow. A small survey of buy side investors from earlier this year corroborates this. When we asked 12 buy side investors to rank tech IPO traits including short-term profitability, short-term growth, long-term profitability, long-term growth, and visibility of revenue, long-term profitability ranked first, followed by long-term revenue growth.  Even for exits that happen through acquisition, profitability factors heavily. When a Google or an Apple or a Facebook buys a company, it’s preceded by a careful analysis of what the expected return of the investment may be. That return may be very short-term in nature, or it may be long term. When Apple bought Beats, they were buying a music platform that they could quickly leverage into its own streaming service. Apple Music launched two and a half years ago (one year after the Beats acquisition) and now has 30 million subscribers. That business generates a run rate on the order of $3.5 billion per year gross, which should net enough to quickly pay for the $3 billion purchase of Beats. A similar calculus is possible for YouTube or DoubleClick or Instagram even WhatsApp, although the last still needs time to come to fruition. We’re sharing this because it’s easy to get hung up on user growth, media mentions, and other startup vanity metrics. Wins require profitability, or at least the potential of it. It’s something both VCs and companies should both remind themselves of frequently.

Even for exits that happen through acquisition, profitability factors heavily. When a Google or an Apple or a Facebook buys a company, it’s preceded by a careful analysis of what the expected return of the investment may be. That return may be very short-term in nature, or it may be long term. When Apple bought Beats, they were buying a music platform that they could quickly leverage into its own streaming service. Apple Music launched two and a half years ago (one year after the Beats acquisition) and now has 30 million subscribers. That business generates a run rate on the order of $3.5 billion per year gross, which should net enough to quickly pay for the $3 billion purchase of Beats. A similar calculus is possible for YouTube or DoubleClick or Instagram even WhatsApp, although the last still needs time to come to fruition. We’re sharing this because it’s easy to get hung up on user growth, media mentions, and other startup vanity metrics. Wins require profitability, or at least the potential of it. It’s something both VCs and companies should both remind themselves of frequently.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.