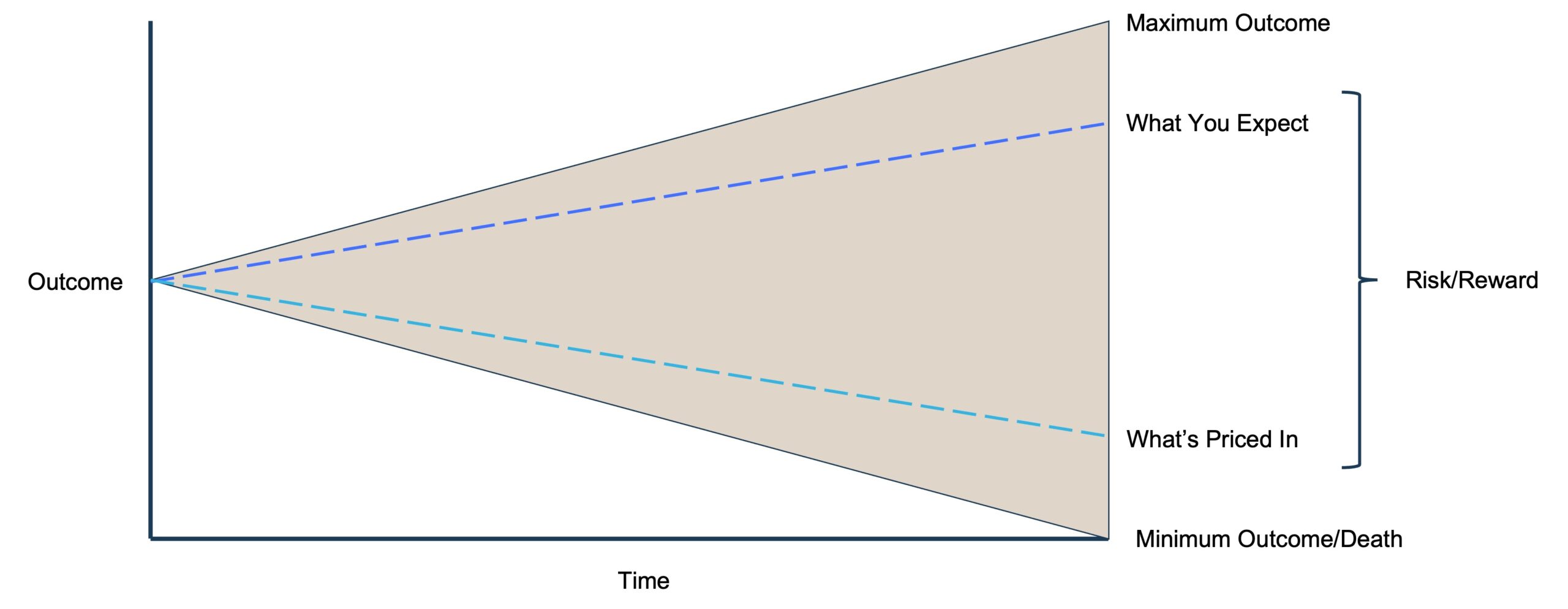

For fundamental investors, stock prices represent a demand of future business performance. Those future demands can be demonstrated in reverse DCFs where you solve to a price rather than project an outcome on your own estimates. The same thing can be done with earnings or cash flow multiples. Given priced-implied calculations, investors can assess the odds of the likelihood of the demanded outcome to make a sound investment.

While a reverse DCF or multiple-based shorthand can tell us roughly what must happen for a stock to hit some level of return, how the business actually performs will follow one of many divergent paths.

Over time, a stock price updates to reflect updated expectations for future business performance informed by the path of recent performance. There is no end point in the divergent path game unless the underlying company goes out of business. When a stock reaches the end of one path, it is just the beginning of another point of divergence. We can think of these new paths in terms of weeks or months or years depending on investing style.

At Deepwater, we invest in stocks of persistent companies we hope to hold for years, although we reassess the paths of our holdings daily. Every day we own a stock is a decision that we’re comfortable with the company’s current trajectory to deliver strong future performance.

Investing is always an embrace of future outcomes; thus, an investor’s job is to assess three things:

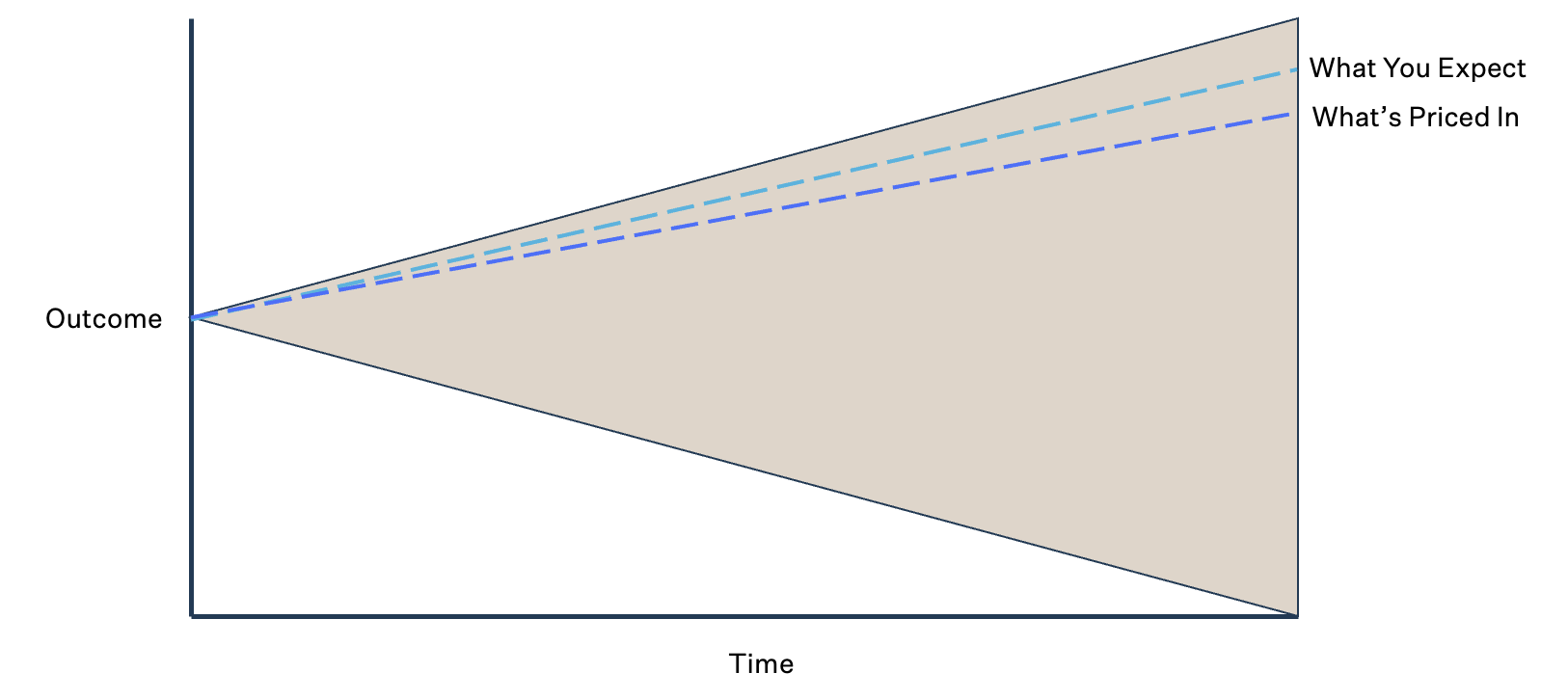

- What future path is being priced in?

- What future path do you think will actually happen?

- How divergent are these paths? This represents both your potential risk and reward. Your potential risk is determined by what’s priced in as a bar for minimum performance above which there should be little fundamentally driven decrease in stock price. Your potential reward is the difference between what you think can happen and what the price demands.

Stealing an idea from Bill Miller, I think of this as a cone of expectations bounded by some maximum and minimum possible outcome:

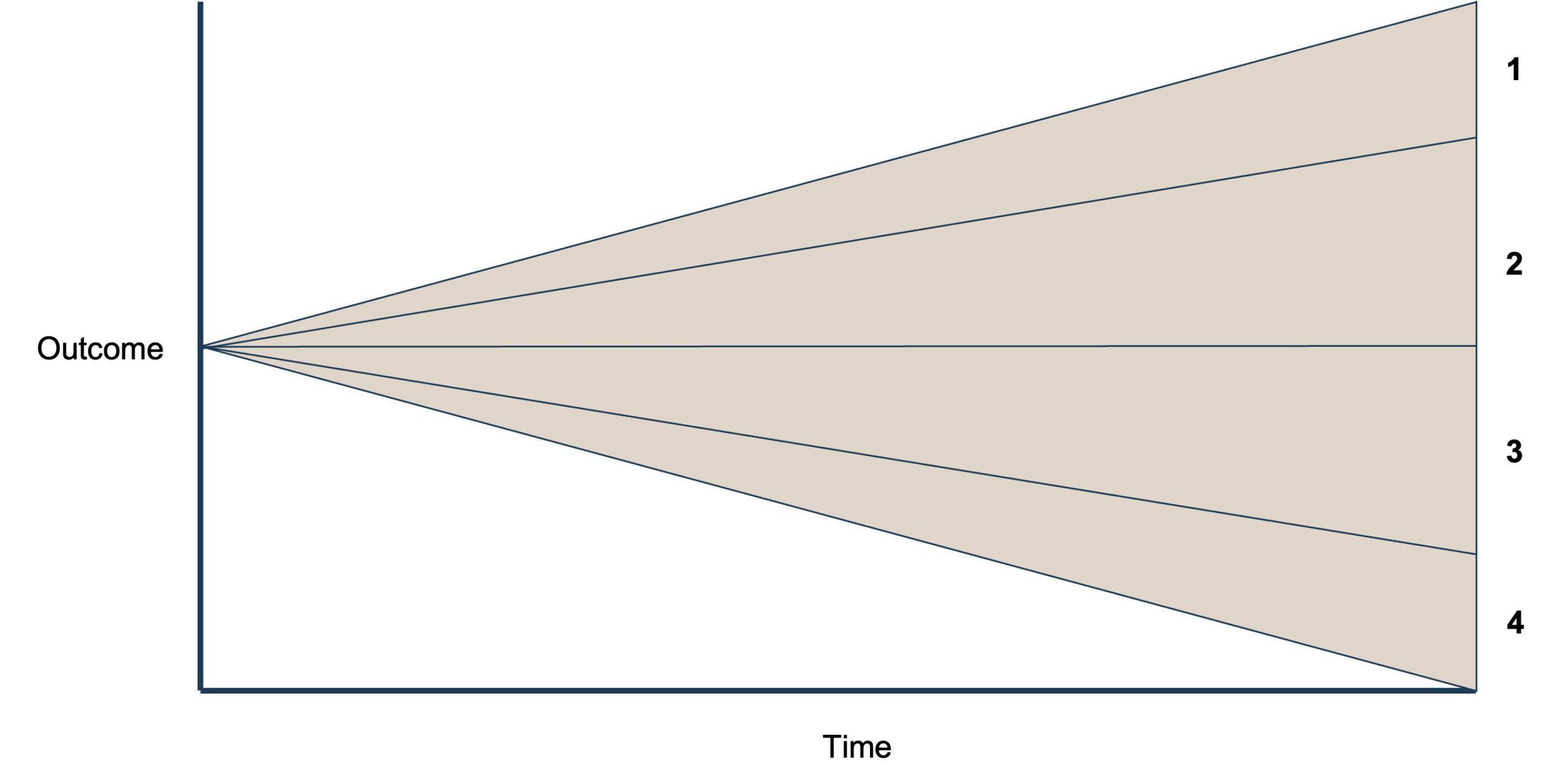

Instead of considering the thousands of abstract possible paths within the cone, it’s easier to think of potential future paths in quadrants:

- Quadrant 1: Wild Expectations.

- Quadrant 2: Optimistically Fair.

- Quadrant 3: Pessimistically Fair.

- Quadrant 4: So Bad It’s Probably Bad

How do you determine which quadrant a stock lives in given its price? We can assess each with some qualitative and quantitative ideas.

Quadrant 1: Wild Expectations

Growth investing is ultimately about finding companies that end up in quadrant 1. We want companies that achieve wild expectations with an ongoing persistence.

However, quadrant 1 is also a danger zone. Risk/reward is necessarily poor. A company must beat already high expectations to generate good stock returns, and the window between wild expectations and maximum possible outcome narrows as expectations get wilder.

Stocks priced in quadrant 1 demand an investor believe in some or all of the following:

- World-class revenue growth, often accelerating off high bases. Growth demands are often in line to better than those achieved of great growth companies of the past at similar scale.

- High growth that lasts a long time such that future revenue expectations represent the majority of market opportunity available.

- Significant revenue from future products with little to no traction today.

- Rapidly expanding margins that reach or exceed those of comparable established great companies of today.

- 30%+ downside to some a reasonable target price that factors in more conservative linear expectations.

In 2021, much of tech was in the top quadrant of the top quadrant. I might have even copied and pasted that a few more times.

While 2021 represented unrealistic bubble-driven demands on future performance, the return to sanity is emblematic of quadrant 1 over time. Many growth investments disappoint because they already price in great demands and therefore must perform at absolute extremes to generate upside. Performing to maximum expectations is hard and fraught with high odds of failure. When perfection fails, the stock follows. That’s why growth is hard. You often pay a high price, and you need a wild outcome for good returns.

The growth investor buying stocks in quadrant 1 must believe that the company deserves to end up in the hall of business fame. Some will. Many won’t. Investors are well served to remember that hall-of-fame performance is definitionally rare and magical, not commonplace. Growth is, in many ways, investing in magic.

Quadrant 2: Optimistically Fair

Quadrant 2 is where I’d argue most stocks live most of the time. Expectations are neither wild nor pessimistic.

Humans are optimistic, and our optimism reflects in markets. My partner Joe often reminds us that the broad concept of supply and demand is an incomplete metaphor for pricing of stocks. Prices aren’t set by all the participants in the market, only the marginal actors on the edge. One person is buying — the most optimistic one — while the rest of the market is not.

Stocks priced in quadrant 2 usually demands an investor believe in some or all of the following:

- Revenue growth that linearly decelerates over time to rates in line with or slightly above reasonable industry growth.

- Modest margin expansion in line with either historical norms of the company or toward an industry average.

- Modest expectation for revenue from new products only where there is real traction. Minimal expectation for early new projects.

- 10-30% away from a reasonable target.

Quadrant 2 often represents pessimism for great growth stocks. Rarely do they slip to quadrant 3. Many FAANG names have been in an out of quadrant 2 over the past decade. When great companies have modest expectations, it is often a buying opportunity.

Investors in “quality” also often traffic in quadrant 2. Quality investors deal mostly with companies the market already knows to be great. The stocks of such companies carry relatively premium multiples and investor sentiment. The objective of the quality investor is to benefit from compounded reinvestment of shareholder earnings back into the company, so he may not need the company to go from quadrant 2 to 1. He just needs it to remain in quadrant 2 as fairly priced.

Quadrant 3: Pessimistically Fair

Quadrant 3 is where poor performing stocks and challenged companies live. Investors are pessimistic about the prospects of the business, even the marginal buyer.

Stocks priced in quadrant 3 usually price in some or all of the following:

- Rapidly decelerating revenue growth, often going negative. The rate of growth implies share loss relative to the industry.

- Margin compression below either historical norms of the company or compared to the industry average.

- No expectation for success of any new projects.

Fallen angels in quadrant 3 can be attractive for the growth investor who is able to determine when a glitch in company performance has caused broader market disbelief. Even great companies can end up here during broader market panics. Meta at the depths of 2022 may prove to be an example (Deepwater owns META).

Quadrant 4: So Bad It’s Probably Bad

Quadrant 4 is where stocks are left to die. These are companies with real concerns of ongoing viability in the short to medium term.

Stocks priced in quadrant 4 usually price in some or all of the following:

- Persistent revenue contraction. Aggressive share loss.

- Losing money with minimal hope of profitability.

- A need for capital infusion.

Gems can be found in carnage, but they’re rare. Companies that fall to these depths are usually just bad companies with minimal hope of ever getting to quadrant 1 nonetheless 2 or 3.

Quadrant 4 is often where deep value or distressed investors play.

Good Growth Investing

At Deepwater, we use the cone of expectations to compare what a stock’s price demands to what we think can happen. Growth too often devolves into buying stories because stories are easy. It’s hard to buy attractive reward with modest risk, but we think that’s what defines good growth investing.