I often wonder who will be behind the next big idea.

If I wrote a book on the topic, Elon Musk would have a few chapters, which is one of the reasons I stay current on what he’s thinking. Recently, he participated in the FT’s Future of the Car event. What caught my attention was less about Elon was saying, and more about who he shared the stage with: JB Straubel.

JB, of course, was one of the Tesla co-founders and, in 2017, started Redwood Materials. Despite Straubel’s public success with Tesla, Redwood has maintained a relatively low profile when it comes to discussion of the next generation of foundational tech companies. Most people who know of the company think its focus is battery recycling, which understates the company’s potential. I believe JB is onto something… and, it’s bigger than battery recycling.

Where the world is going

Before sharing why I think Redwood is onto something, it might be helpful to understand my investment framework. It’s based on identifying where the world is going, which is a mix of social patterns along with technological innovation.

Some key areas of where the world is going include:

Redwood’s tailwinds

Applying my where the world is going view to Redwood, I see three areas of overlap or three tailwinds to the business. One can propel a company to long-term success, and three increase those chances of success. My view of Redwood’s tailwinds include:

- Everything will be electrified.

- Global trade will fade and be replaced by onshoring.

- Governments will hoard technology and raw materials.

By comparison, Redwood’s tailwinds include that transportation will be sustainable with EVs, energy will be sustainable with no fossil fuels, materials become sustainable via closed loop usage, and product mining surpasses geologic mining.

Battery recycling is a first step

Oftentimes, Redwood is incorrectly viewed as battery recycling company. It’s true, the company’s roots are in battery recycling, and Redwood aims to improve recycling technology in effort to reduce the cost of materials and displace geologic mining. Material refinement includes: the separation of unique elements (Ni/Co, Cu, Li), and the purification of metals and chemicals to a quality ready for battery materials manufacturing.

The basic goal is to reduce the costs of battery elements and compounds to make the manufacturing and subsequent purchase of anything electric more affordable. The recycling and materials refinement segments of Redwood’s business tap into large addressable markets, but miss the point of where the company is going.

Redwood wants to invent closed-loop battery manufacturing.

The next big idea: battery closed-loop manufacturing

The idea of battery closed-loop battery manufacturing is to build key, high-value cell components close to customer. This approach converts any global logistic mess (of geologic mining, copper foil and cathode production) into a vertically-integrated process which is effectively localized (in one country, versus across the pond). Redwood Materials proposed that Cathode Active Material (CAM) production would be near OEM’s that can cost-effectively transform the materials into cells for vehicle production.

The goal is for Redwood Materials to begin CAM production in 2024.

The cathode is the pressure point

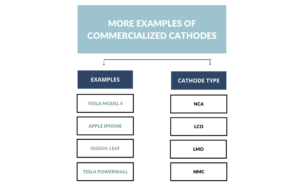

Four examples of commercialized cathode formulations.

I was unaware of the importance of the cathode in the EV value chain. Taking a step back, the cathode is—at a most basic level—the element that makes a battery work. It is the positively-charged part of a battery which discharges electrons used to power an electric motor. The battery in an EV is expensive, and accounts for between 15-20% of the overall cost of a vehicle. For example, in a $55K Model Y, the battery accounts for about $10-$12K in costs. The cathode (and, more accurately, the materials that go into it) make up about half of battery cell cost. In other words, the cathode accounts for 8-10% of the cost of an EV. The biggest factor in the cost of the cathode is the CAM, which is the pressure point that Redwood wants to address.

There’s more work to do

It’s clear that Redwood is onto something, but they have a lot of work to do in building the capacity to reach escape velocity. In the mean time, I’m going to do more work to better understand how Redwood can build capacity to enable battery closed-loop manufacturing.

In Elon’s world, Tesla’s competitive advantage is the machine (factory) that builds the machine (the vehicle).

In JB world, Redwood’s competitive advantage would be the machine (factory) that produces the CAM and Copper Foil.