Masterworks is creating a new asset class for retail and institutional investors by offering fractional shares of artwork by “blue-chip” artists like Monet, Warhol, and others. Historically, this asset class has only been available to ultra-wealthy individuals with millions of dollars to invest in a single work of art.

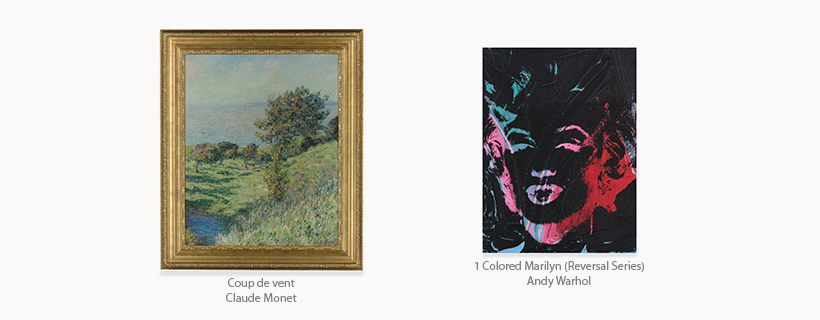

Claude Monet’s Coup de vent and Andy Warhol’s 1 Colored Marilyn are currently available. Similar to taking a company public, each offering is filed with the Securities and Exchange Commission before shares are sold.

The art market has shown returns that are uncorrelated with traditional investment vehicles (~0.10 or less for stocks, bonds, real estate, and gold). According to Artprice[1], since 2000, “blue-chip” artwork has outperformed the S&P 500 by more than 180% (with dividend reinvestment), averaging 8.9% per year.

We see Masterworks as part of the future of finance — offering investors easy access to unique investment vehicles with uncorrelated returns. The company’s founder, Scott Lynn, has a track record of building scalable technology businesses and a personal passion for art investing. We’re thrilled to partner with Scott and the Masterworks team to make art an investable asset for the masses.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.