We publish our annual predictions around New Year’s and, per tradition, do a mid-year check-in in July. Here’s how our predictions for 2020 are tracking:

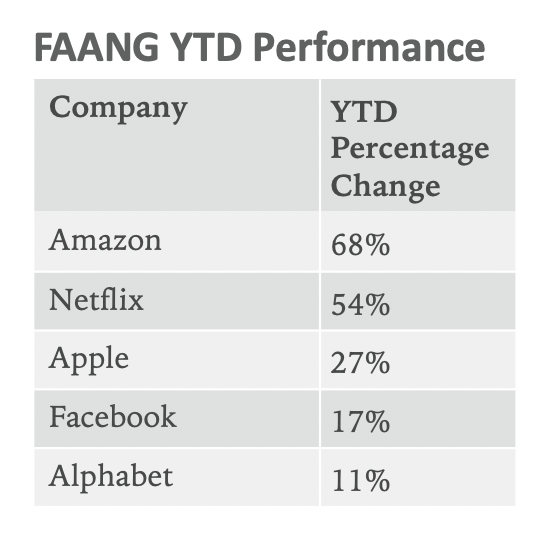

1. Apple will be the best performing FAANG stock in 2020 (by Gene Munster)

Mid-year update: AAPL is meaningfully behind Netflix and Amazon Year-to-date (see table below). Despite the stock performance gap, we continue to believe that Apple will be the top-performing FAANG stock in 2020. This belief is based on our original thesis that shares will benefit this year from:

- Easy iPhone comparables

- Continued growth in Apple Watch

- Five new iPhone models in 2020

- Investor anticipation of 5G

- AAPL will be rewarded with a proper tech multiple

2. Tesla will exceed street deliveries estimate of 463k (by Gene Munster)

Mid-year update: While behind plan, we still believe deliveries will exceed 463k. In the March and June quarters, Tesla had delivered a combined 179k vehicles, which leaves 284k additional deliveries in the back half of 2020 to exceed the original Street estimate of 463k. That is, of course, an average of 142k deliveries per quarter, compared to 91k in the second quarter. We believe this is possible given the ramp in China Gigafactory production, along with growing demand for Model 3 and Model Y.

3. Direct listings become a well-accepted alternative to an IPO (by Doug Clinton)

Original prediction: We expect at least three direct listings in 2020 to establish this fact.

Mid-year update: There have been no direct listings of tech companies in 2020. The pandemic created an uncertain market in the first half of 2020 with limited tech IPO activity, but public capital raised hit a record. We continue to view direct listings as a viable alternative to a traditional IPO that, when paired with private capital raises prior to the listing, can be superior to an IPO. Recent reports suggest that both Coinbase and Palantir are considering direct listings in the next year.

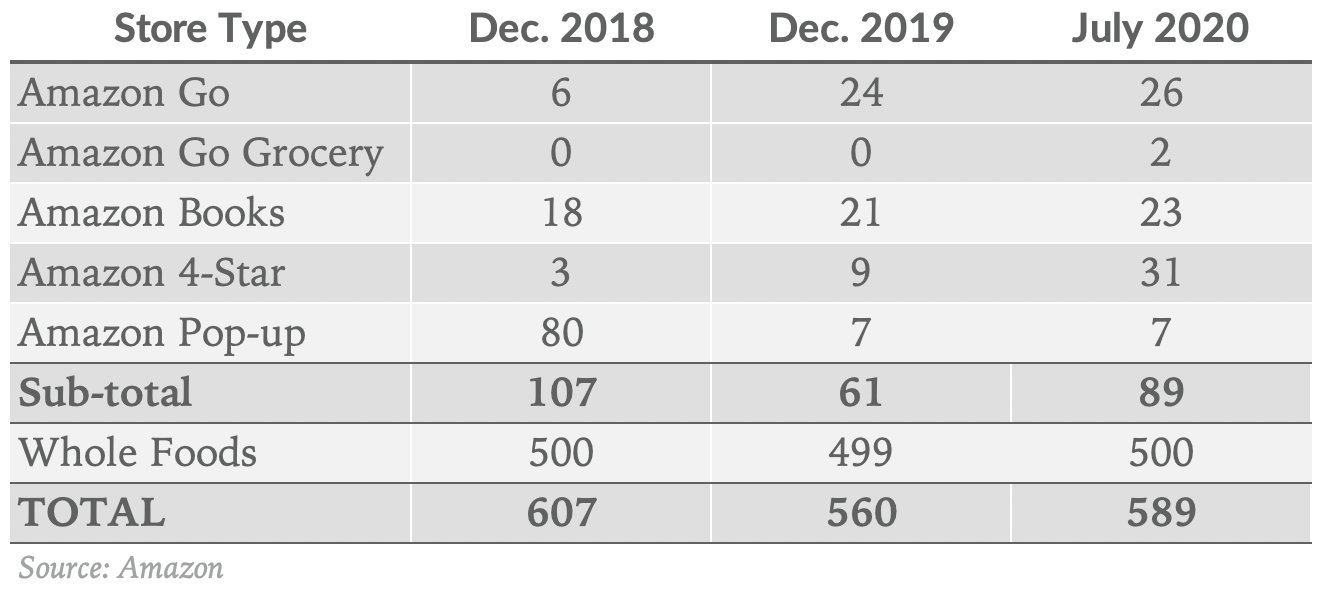

4. Amazon will add 30 Amazon Go stores (by Andrew Murphy)

Original prediction: We expect Amazon to add another 30 Amazon Go stores in 2020, and we may also see Amazon open its first store with Amazon Go technology but in a location with a footprint larger than the typical 1,000 square foot Amazon Go locations that exist today.

Mid-year update: Amazon has slowed its pace of small format Amazon Go store openings, adding just two new stores in the first half of 2020 compared to our prediction of 30 new stores in all of 2020. However, in February, Amazon announced the opening of the first Go Grocery store, a first-of-its-kind larger format automated retail store in downtown Seattle. In doing so, the company partially fulfilled our original prediction. At 11,400 square feet, the new Go Grocery store is 5x larger than the largest Amazon Go convenience store. The company has a second Go Grocery store ‘coming soon’ to Redmond, WA. The large format concept is the end-goal for Amazon’s automated retail initiative, so we expect Go Grocery store openings to continue.

Somewhat surprisingly, Amazon has opened 22 new Amazon 4-Star stores year-to-date. In total, Amazon’s physical retail store count (excluding Whole Foods) has gone from 61 at the end of 2019 to 89 as of July 2020 (including a few that are temporarily closed and a few that are ‘coming soon’).

5. Netflix will meet paid net add expectations (by Gene Munster)

Original prediction: Despite the threat of increased competition, we believe Netflix will achieve analysts’ paid net add estimates in 2020. The Street is expecting paid net adds of 26.6m (domestic 2.7m international 23.9m) exiting next year with a base of 192.5m paid subscribers.

Mid-year update: The company added 15.8m paid subs in Mar-20 (a staggering 92% upside to analyst estimates) and guided for 7.5m adds in Jun-20. Applying a typical Netflix beat for Jun-20, suggests halfway through the year the company has already added about 26m subs, compared to the Streets original 2020 paid net add estimate of 26.7m.

6. 2020 will be a year of reckoning for mobility (by Andrew Murphy)

Original prediction: 2020 will see consolidation amongst some of the largest mobility companies; specifically, we expect scooter startups like Bird to be consolidated by mobility aggregators like Uber and Lyft.

Mid-year update: In the wake of the pandemic, much has changed in the broader mobility space. Much of the M&A activity has focused on food delivery companies, including Uber’s recent $2.65 billion acquisition of Postmates. In Autonomy, Amazon’s recently announced acquisition Zoox for $1.2 billion could be the start of a new trend. The challenging private fundraising environment may push autonomy startups to accept acquisition offers from big, cash-rich tech companies playing catch-up in autonomous driving.

But the central thesis of our prediction was that micromobility would see consolidation, which has started to play out. Uber led Lime’s May 2020 $170m funding round. At the same time, Lime acquired Uber’s micromobility subsidiary Jump. Here, we see Uber consolidating scooters (Lime) and e-bikes (Jump) under their mobility platform.

The pandemic has brought new challenges for micromobility companies. They were stressed by the high cost of charging and redistribution; now, appropriately cleaning scooters and bikes further strains the economics. We continue to expect consolidation in the micromobility space to achieve scale and improve the prospects for long-term profitability.

7. No AR glasses from Apple or Facebook (by Gene Munster)

Mid-year update: On track. While there have rumblings that Apple will preview AR glasses this year, we still believe the product won’t be revealed until 2021 and ship until 2022 at the earliest. Last year Facebook announced they’re working on their own AR glasses, also likely to be available at the earliest 2022.

8. Oculus will release a new Quest with hardware improvements (by Gene Munster)

Mid-year update: We continue to believe the new Quest hardware will be released by the end of this year. One encouraging data point, in the past six months, Facebook has discontinued some of its other VR models to focus on Quest.