We’re updating our expectations on the timing of the initial availability of level 5 autonomy. Previously, we expected full autonomy to see limited availability between 2022 and 2025. We now expect most AV players to have limited availability of level 5 autonomy beginning in 2021 through 2025. We expect wide availability of level 5 technology by 2030.

The shift to autonomy is a catch-22 for Lyft and Uber: over the next 5-10 years it will boost profitability but beyond 10 years autonomy will attract a measurable increase in competition.

Autonomy is foundational to Lyft and Uber’s future

Lyft lists the inability to develop autonomous vehicles as a top ten risk factor. Uber has long classified the shift to autonomy as an “existential” risk. Once autonomy is “solved,” Lyft and Uber will gradually replace their human drivers with never-tiring robots.

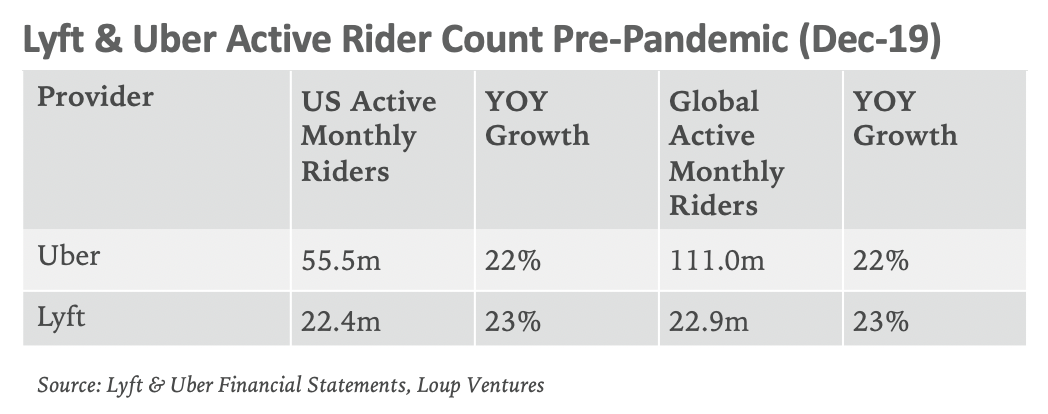

AVs will lift ride sharing take rates from 35% today to 85% or more and quicken the long-awaited path to sustained profitability. Given the two companies’ customer bases of 130 million and growing, the early years of autonomy will bode well for their bottom line growth. The long-term, however, will likely prove to be more challenging as Tesla, Google, Apple, Amazon, and several auto OEMs that have influential consumer brands begin to offer their own autonomous transportation services.

Near-term (5 plus years) tailwind

We expect full autonomy to see limited availability as soon as next year. However, we continue to believe that wide availability will take longer than most expect but will impact the world in ways we aren’t imagining. Rather than emerging from a decade(s) long R&D project with a level 5 autonomous vehicle prepared for full autonomy, we believe the rollout of level 5 tech will be more incremental, starting with fixed routes, controlled areas like campuses, or small, well-monitored, geo-fenced regions.

Habits are powerful. When we need to go somewhere, we open Lyft, Uber, or Google Maps. As each of those companies begins to offer autonomous transport (Google via Waymo), they have the built-in advantage of demand from hundreds of millions of committed customers looking to go somewhere. Even if early autonomous offerings can only operate in small areas at first, Lyft and Uber are all but guaranteed to have customers that want to travel within that area. Just as public transportation can’t take you everywhere but serves nicely as an additional offering for Lyft and Uber, the initial autonomous vehicle service would act as another channel in the app.

Given the channel strategy, Lyft and Uber may have a near-term advantage over autonomous only offerings. If an autonomous fleet can go some places but not everywhere, consumers are unlikely to download a new app for only certain routes instead of Lyft or Uber who can also leverage their human driver networks for a comprehensive offering. Since transportation is a commodity, unless a fully autonomous service has similar wait times, coverage, and prices to conventional ridesharing, it is unlikely to be successful on its own.

Long-term (10 plus years) headwind

While autonomy will make Lyft and Uber’s businesses more profitable, it also decreases the value of their two-sided network effects by making drivers less important over time. It will also increase competition because the go-to-market approach for most full autonomy projects seems to be a fleet of autonomous taxis.

Even though we expect the rollout of autonomous transport to be incremental, at some point autonomous vehicles will be widely available and capable of driving anywhere. In this future, “driver” supply has to be considered differently. Full autonomy changes the network effect of ridesharing completely. Supply may come from autonomous vehicle owners lending their vehicles to the network to make money or from transport services buying and operating their own fleet of vehicles. Wait times will gravitate to parity across a handful of providers, commencing a race to the lowest price.

In the long-term, autonomous taxis may look more like the airline business, where loyalty is the primary basis of competition. In-vehicle experience, which Lyft and Uber would have greater control of if operating their own fleets, might be a point of differentiation, but would be easily copied. Competing on brand will be a challenge for existing ride-sharing companies as Tesla, Google, Apple, Amazon, and several auto OEMs with influential consumer brands begin offering autonomous transportation services. While AVs will, in the near-term, provide a road to profitability for existing ride sharing companies, in the long-term they will likely open the door for increased competition.

Initial rollouts begin somewhere between 2021-2025

As mentioned, we believe that autonomy will take longer than we expect but will impact the world in ways we aren’t imagining. Not surprisingly, given the mix of unknowns around the tech and regulation, most of the major companies pursuing this future have been reluctant to speculate on the timing of public availability. Based on the most recent public comments, the key players are targeting initial level 5 availability anywhere from 2021 to 2025 to fully roll out their autonomous vehicle fleets.

Ford has publicly stated that they are aiming for 2022 to release a fleet of their own self-driving cars, numbered in the thousands. Aptiv, another self-driving car company, has said they expect widespread adoption of self-driving cars by 2025. Thus far, Waymo has been the leader with over 20 million miles driven with their autonomous vehicles. Uber has said they have driven “millions” of autonomous miles. Ford has indicated they’ve driven 650,000 miles. Cruise drove over 800,000 miles in 2019, but it is unclear how many total miles they have driven. In terms of the technology these companies are employing, all are using a combination of LiDAR, radar, and cameras. Tesla is the exception here and has vocally spoken out against LiDAR. Instead, they rely on radar, GPS, maps, and other sensors.