For twenty years, the team at Loup has had a pulse on technology and a point of view on how that tech will change the world. The cutting edge of that change is frontier tech, driven today by AI, fintech, robotics, autonomous and electric vehicles, and virtual/augmented reality. We provide exposure to these themes through our partners at Innovator Capital Management. For more information click here.

Why Frontier Tech?

Frontier tech represents the forward-most edge of understanding and achievement in technology. By definition, what is frontier today will not be frontier tomorrow—it is dynamic. These are the technologies with the greatest opportunity to create value for investors

Performance

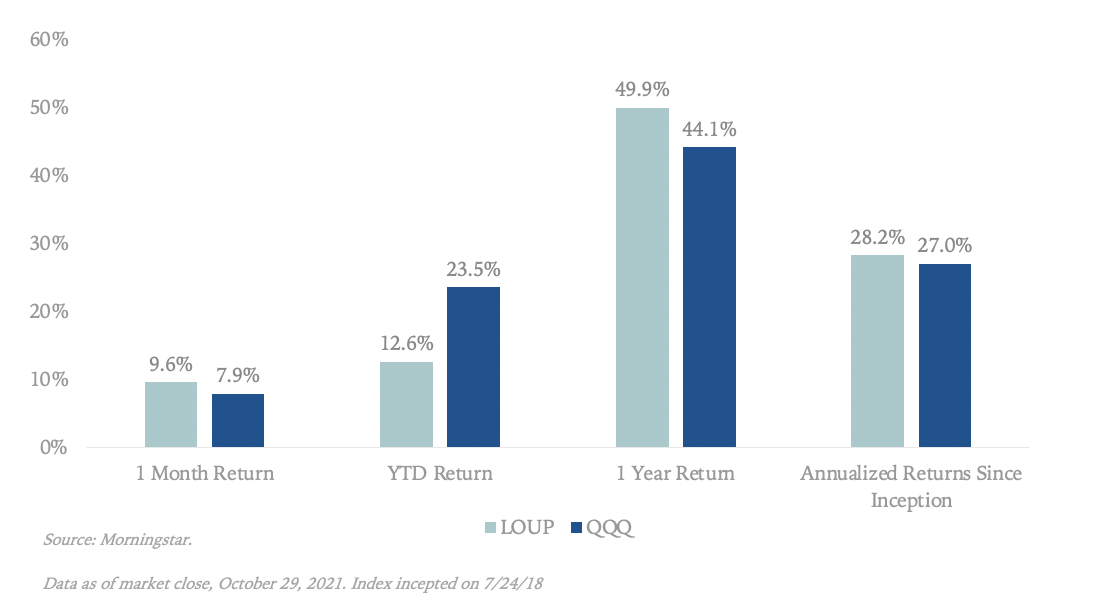

Below is the Loup Frontier Tech Index performance update as of the end of October:

What’s on our minds this month

LOUP’s performance for the month outpaced our QQQ benchmark, up 9.6% vs. the broader tech market up 7.9%. Recapping October, three topics are top of mind:

1) Coinbase was up 38% in the month of October as fears of inflation have moved shares higher. As a reminder, crypto is a hedge on inflation, and Coinbase operates the largest crypto exchange. We believe fears of inflation will continue into mid-2022 and shares of Coinbase will continue to respond well in that environment.

2) Affirm shares were up 37% in the month of October as the company continues to expand its reach with new retailers and partners. Most recently, Affirm added American Airlines to the buy now pay later platform. We believe the theme around monthly payments as the preferred way to buy remains in its infancy, with the potential to grow at similar multi-year growth rates as credit card growth a decade ago.

3) The video game market. In October, Facebook announced it changed its name to Meta to better reflect the company’s long-term vision of being a metaverse company. LOUP is invested in three gaming companies as an early way to benefit from the metaverse, which we see as a step function increase in the amount of time humans will spend computing. The first segment of monetization will be through games. While shares of Activision Blizzard (ATVI) and Nintendo were flat in October, shares of Take-Two Interactive (TTWO) increased by 15% in the month as the metaverse theme gains mindshare.

Changes to the Loup Frontier Tech Index

There were no changes in the month of October.

Top 10 Holdings (Weights as of November 1, 2021)

- Affirm Holdings Inc, 5.32%

- Rocket Companies Inc, 5.08%

- Aerovironment Inc, 4.74%

- Harmonic Drive Systems Inc, 4.71%

- Baidu Inc, 4.63%

- Galaxy Digital Holdings Ltd, 3.98%

- Coinbase Global Inc, 3.57%

- Teradyne Inc, 3.50%

- Overstock.com Inc, 3.37%

- Ambarella Inc, 3.34%

Weight by Theme

- VR/AR – 32%

- AI – 17%

- Robotics – 16%

- Fintech– 24%

- EVs/AVs– 11%

Learn More

The Loup Frontier Tech Index tracks the performance of publicly traded companies developing frontier technologies including, but not limited to, AI, fintech, robotics, autonomous and electric vehicles, and virtual/augmented reality. We’ve licensed the index to Innovator Capital Management. For more information click here.

Register for our next Tech Roundtable with the Loup team, a quarterly webinar to discuss the latest in frontier tech.