On the emergence of optimistic coronavirus vaccine news, we couldn’t help but imagine what life will look like post-pandemic. That starts with a recognition that the recovery timeline is still unclear, and that even with a vaccine, scar tissue and inertia will make it a long road to full normalcy. That’s no surprise, considering over the past nine months we’ve all reset our work-life balance. While it will take time, history tells us that eventually life will return to “normal,” and it is part of our job as investors to understand what it will look like.

In March, we wrote an initial piece titled How to Think About Change in a Post-Coronavirus World, which laid out a framework for thinking about the different types of change. Nine months into the pandemic, we are revisiting these thoughts with a guiding question: what COVID-inflicted changes to work, learning, real estate, fitness, travel, and living will be temporary, and which ones are here to stay?

Work

We estimate about 1/3 (50m) of the US labor force can be classified as knowledge workers. Today, we estimate roughly 90% of them are working remote, up from 6-8% pre-pandemic.

In many ways, work-from-home has shifted control away from the employer to the employee. Employees who work from home have more flexibility in their schedules and location and less oversight from superiors. We believe this dynamic will embolden employees to demand, and ultimately be granted, more work-from-home options than were accepted pre-pandemic.

Prediction: Post-pandemic, we believe 10% of knowledge workers will be remote full-time (up from 6-8% pre-pandemic), and an additional 10% will work remote part-time. On one side, we expect the majority of knowledge workers to return to the office, increasing from 10% today to about 80% long term. On the other side, the percentage of remote US knowledge workers will essentially increase by 3x, from about 7% to 20%.

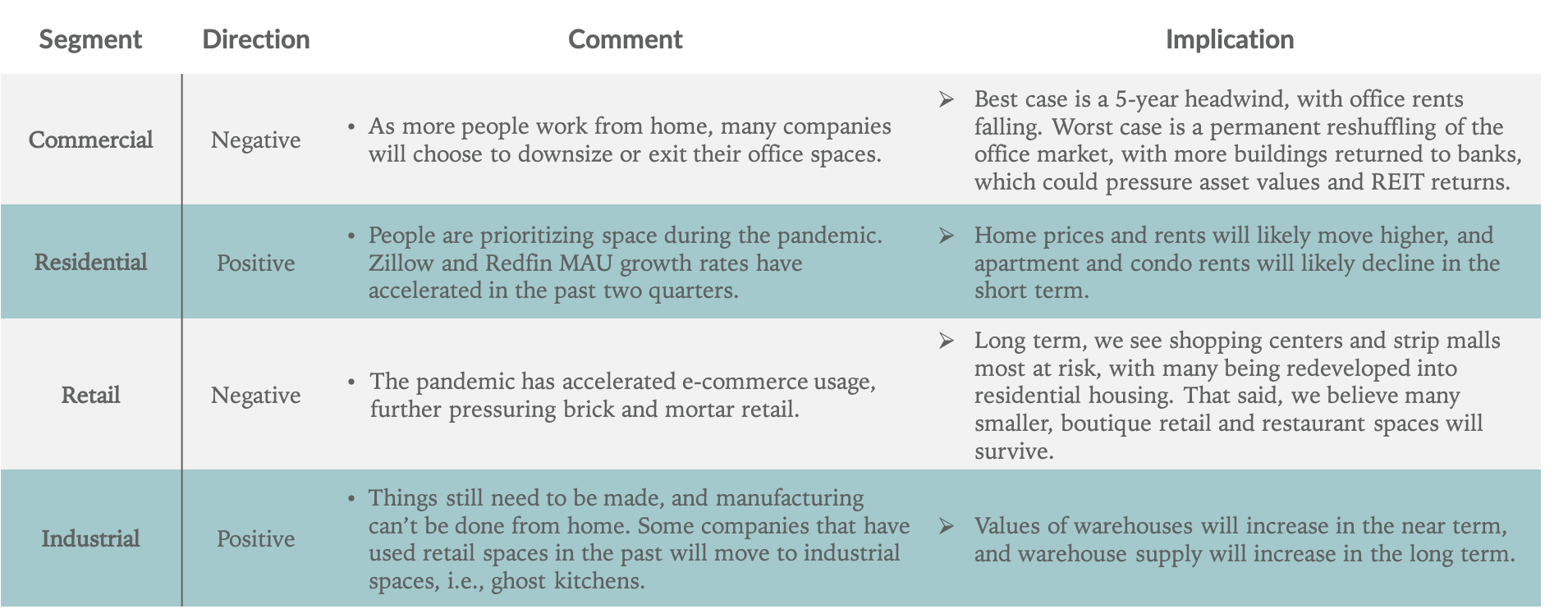

Impact: With 20% of employees working at least part-time from home long-term, some companies will downsize or exit their office spaces. This will drive a reshuffling and repurposing of commercial real estate (see more below). Another long-term impact will be more tech-outfitting for home offices. The added 6.5m full and part-time remote workers will want to better outfit their homes for work, which is likely to include a dedicated office space, faster internet, computers, monitors, and headphones. Obvious beneficiaries include remote work platforms like Zoom and Slack, along with hardware suppliers such as Apple and Lenovo.

Education

Today, we estimate about 60% of K-12 students are doing remote learning full-time, 15% are in-person, and the remaining 25% are following a hybrid model. Through our conversations with teachers, students, and administrators, we believe learning retention has declined from a combination of in-home distractions and diminished motivation to study, given its easier to cheat on tests. One tenth grader we spoke with estimated cheating on exams has increased from 30% of students before the pandemic to 65% during it. We can debate percentages, but the trend is still clear – the frequency of this behavior has increased, creating a downstream effect of grade inflation.

Prediction: While there may be a fractional percentage of families that decide to homeschool because of the pandemic, in the long term, we expect 100% of students to return to class. Multiple factors will drive this return, including the reality that students need the structure and socialization that in-person learning provides, and parents need children in school to maintain regular work schedules. Private schools have seen an enrollment boost this fall, and many of those students will remain in private programs for years, often pulling younger siblings into private ed along with them.

Separately, we believe schools will be quicker to turn on remote learning in the event of other public health situations like flu outbreaks or weather-related events. To ready for these events, we expect school districts, educators, and parents to spend more on tech outfitting to ensure there’s sufficient infrastructure to facilitate school-from-home on short notice.

Impact: Beneficiaries of this tech outfitting include hardware makers such as Microsoft, Apple, Google, and Acer, as well as education software platforms like Seesaw, Canvas, Google Classroom, Flipgrid, Veracross, and Blackboard.

Real estate

We believe the pandemic will have a material impact on real estate in both the short (2-5 years) and long term (10 years plus).

Travel

Total domestic US airline passenger volumes are down about 65% from pre-pandemic levels, with business travel down 80% plus and leisure travel down 50%.

Business Travel Prediction: Eventually, we believe 75% of all business travel will return. In other words, 1 in 4 trips will be replaced by virtual meetings. While the most important meetings will eventually return to in-person, and many salespeople will see a willingness to do in-person meetings as a competitive advantage, the pandemic has validated videoconferencing as an acceptable alternative for many in-person meetings.

Business Travel Impact: Although business trips make up about 20% of airline passenger trips, they account for 50% plus of airline revenue. Thus, we expect the pandemic to have a lasting negative impact on some airline segments. While current Zoom usage levels are unsustainable long term, videoconferencing tools like Zoom, Microsoft Teams, and Skype, will be long-term beneficiaries of this step down in business travel.

Leisure Travel Prediction: In the short term, leisure travel should benefit from pent-up vacation demand after the pandemic. Long term, we see leisure travel fully recovering from pandemic lows because while Zoom may be sufficient for a business meeting, it’s not for a vacation.

Leisure Travel Impact: Airlines will likely be more aggressive in courting leisure travelers, which make up 80% of airline passengers, to cover lost business travel revenue. This leisure travel rebound should help stabilize hotels, Airbnb, and rental car companies, which depend on leisure-related travel for about 70% of their business.

Fitness

Before the pandemic, there were roughly 65m gym memberships in the US. We estimate memberships at entry-level and mid-level gyms are down modestly, about 12%, compared to pre-pandemic levels. We used Planet Fitness as a benchmark, which ended the Sep-20 quarter with roughly 14m members, down 9% from a March peak of 15.5m members. We estimate memberships at higher-end, boutique gyms, i.e., Equinox, Lifetime Fitness, are down about 30%. These estimates are based on the belief that a lower price point means lower churn and a higher price point means higher churn. Putting it all together, we estimate total gym memberships currently stand around 50m, down about 25% overall compared to pre-pandemic levels.

As a proxy for working out from home, we looked at Peloton paid subscribers. Before the pandemic, the company had a little under 1m global paying subscribers, of which we estimate about 90% are in the US. In comparison, at the end of the September quarter, Peloton reported about 2m global paying subscribers or about 1.8m US subscribers. In sum, we estimate Peloton has gained 900K paying US subscribers since the pandemic.

Prediction: Post-pandemic, we estimate about 6.5m (10%) of former gym members will stick with alternative, exercise-from-home options.

Impact: With Peloton currently capturing about 900K of the 6.5m members that will exercise at home long term, there remains measurable upside for Peloton and other exercise-from-home companies to capture more users.

Living trends

Before the pandemic, there was a premium on density when deciding where to live because it offered proximity to work, walkability, and more convenient access to gyms, restaurants, and retail shops. During the pandemic, the premium has shifted to space, with many forecasting an urban to suburban population shift.

To examine this trend, we looked at average home sale prices in three downtown city centers (Minneapolis, San Francisco, and Chicago) before the pandemic and compared them to prices after June 2020. We used home sale prices from three suburban areas outside these cities as a comp group. We found no clear trend, with suburban and urban home prices moving similarly. Zillow found a similar pattern in its August 12 Urban-Suburban Market Report. That said, the WSJ recently reported single-family home rents, especially in suburban areas, have risen aggressively in 2020.

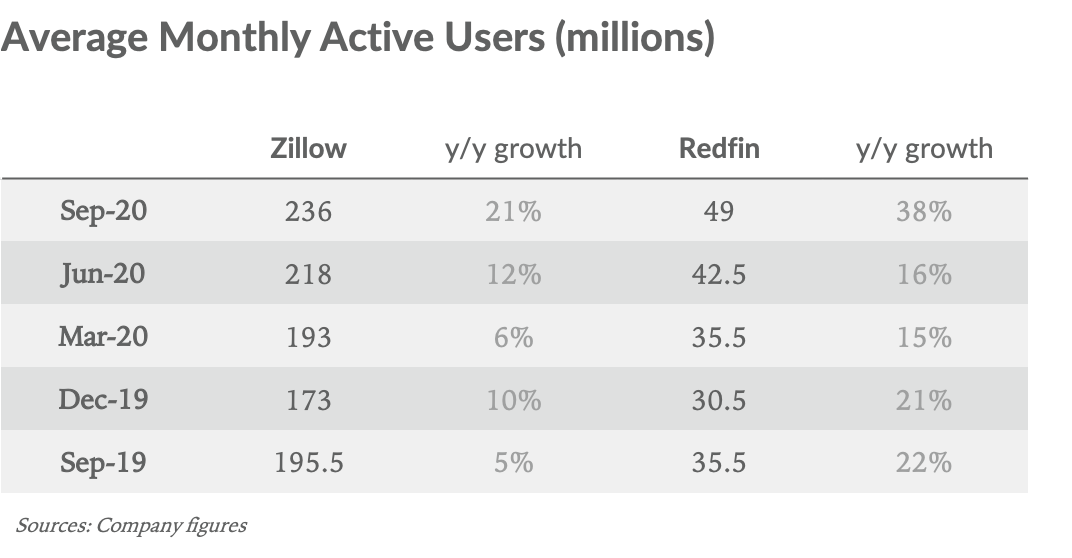

While data supporting an urban to suburban shift may not be clear yet, one thing that is clear is a surge in consumer interest around real estate as people spend more time at home. As a point of evidence, Zillow and Redfin MAU growth rates have accelerated in the past two quarters off larger bases:

This user engagement from Zillow is staggering. The US population is about 330m, of which roughly 235m are in the real estate buying/renting age range of 19 to 75-years-old. Simply taking Zillow’s 236m MAUs would suggest everyone who has the potential to buy or rent real estate in the US checks Zillow at least once per month.

Prediction: We don’t think the current data fully capture the emergence of what we believe is a decade-long trend in people moving from urban areas to suburban and rural areas. This will occur as the attractiveness of walkability declines and is replaced by homeowners seeking more space and the flexibility of working from home, coupled with growing concerns over civil unrest and safety.

Impact: We expect the next decade to be a tailwind for tech-focused real estate companies, such as Zillow, Redfin, and Frontdoor, as well as home builders, home improvement suppliers, furniture providers, and moving companies.