At its upcoming ‘Hi, Speed’ event on October 13, Apple is expected to unveil its first lineup of 5G iPhones. As the company continues to grow its Services segment, the iPhone remains key to Apple’s success, accounting for around half of total revenue.

While 5G has attracted a lot of hype, most of it deployed to date is low band 5G, which offers download speeds on average only 40% faster than 4G. We do not see this as a compelling reason for consumers to upgrade their phones. We have written in the past that mid band 5G, which offers speeds ~7x faster than 4G, represents consumer upgrade 5G, and we estimate it will be widely available in 2022. With that in mind, we have advocated for investors to keep modest expectations for iPhone 12 in 2021.

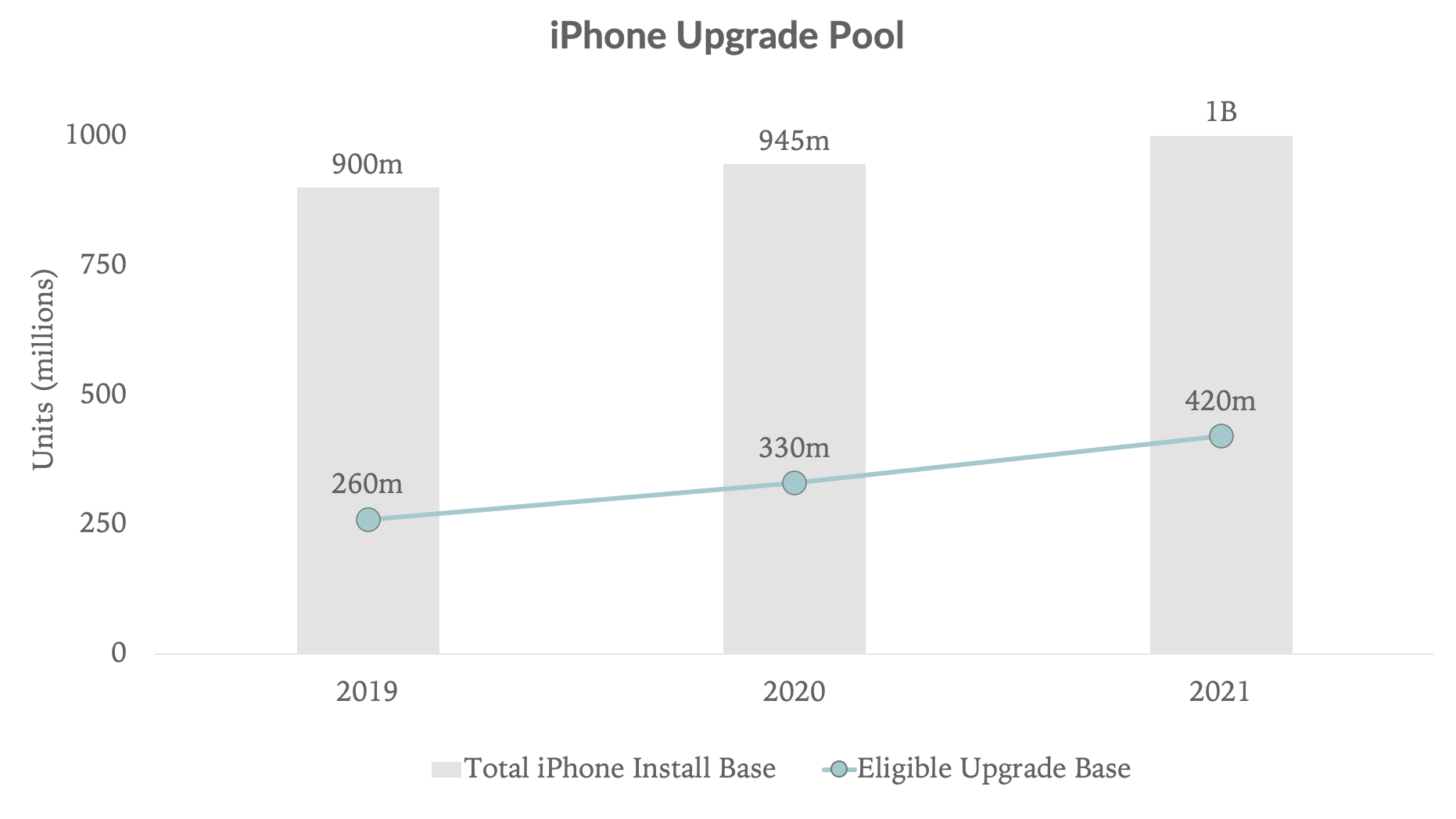

That said, data speed is only one factor in a consumer’s upgrade decision. The age of the phone is another factor, and iPhone owners have been holding on to their devices longer. To better understand the impact of this aging iPhone base, we modeled the upgrade pool entering each iPhone cycle. The upgrade pool includes all iPhones that are three years or older, going into each calendar year.

The larger the upgrade pool, the bigger the potential tailwind.

Estimating the upgrade pool

Upon entering 2021, Apple will have about 1B active iPhones, of which 420m will be older than three years, and therefore, more likely to upgrade. This compares to the company entering 2020 with 945m active iPhones, and an upgrade pool of 330m, equating to an upgrade pool increase of 90m from the beginning of 2020 to the beginning of 2021.

Impact to iPhone estimates

The Street is expecting 15% iPhone revenue growth in FY21, which is inline with our outlook, and ahead of the likely 1% growth in FY20. We expect Apple will sell 187m iPhones in 2020, and 217m in 2021. Because the iPhone upgrade pool will likely increase by 90m units, it would suggest this 30m y/y increase is achievable. It’s worth noting that backtesting our upgrade pool methodology may cause concern for the Streets outlook. Entering 2020, the upgrade pool had increased by 70m from 2019; however, we believe iPhone unit sales will likely end this year flat compared to 2019. While that is a cautionary data point, we attribute the muted iPhone performance in 2020 to the pandemic headwind. Apple’s Mac, iPad, and Services businesses have had a measurable tailwind over the past six months. Conversely, we believe the iPhone business has faced a demand headwind.

Putting it together, we see value in the upgrade pool analysis and conclude that this rising tide will help soften the headwind of limited mid band 5G coverage.