- At 3:00 AM ET today, Apple began taking preorders for iPhone Xs, Xs Max, and Apple Watch.

- Compared to last year’s iPhone X launch, lead times were, on average, 68% shorter for the iPhone Xs, and 43% shorter for the iPhone Xs Max.

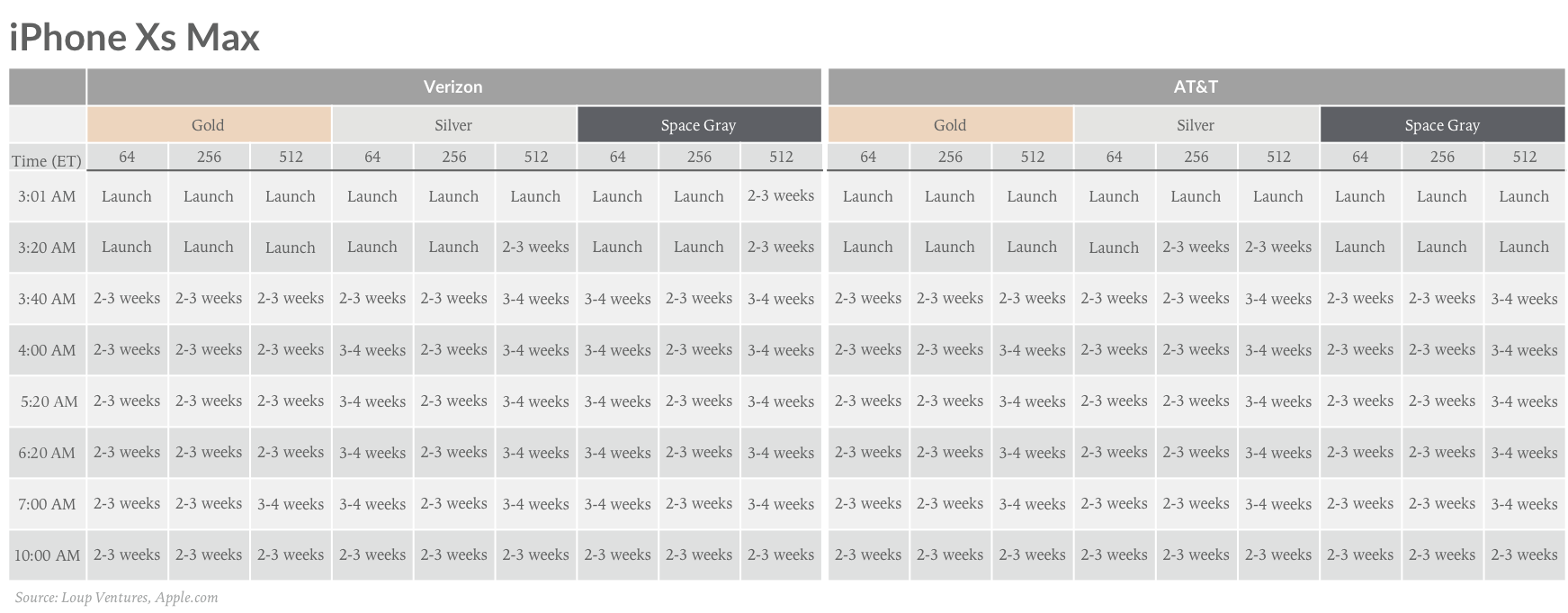

- Positive for ASPs, we noted longer lead times for the Xs Max and the higher capacity configurations overall.

- This year’s shorter lead times are consistent with our expectations, given we are modeling for almost 2x greater demand for the iPhone Xr compared to the Xs and Xs Max combined (21% vs 38% of units).

- At 10:00 AM ET we observed that lead times for the iPhone Xs Max had shortened by an average of one week. This does not change the fact that Xs Max lead times are longer than the Xs.

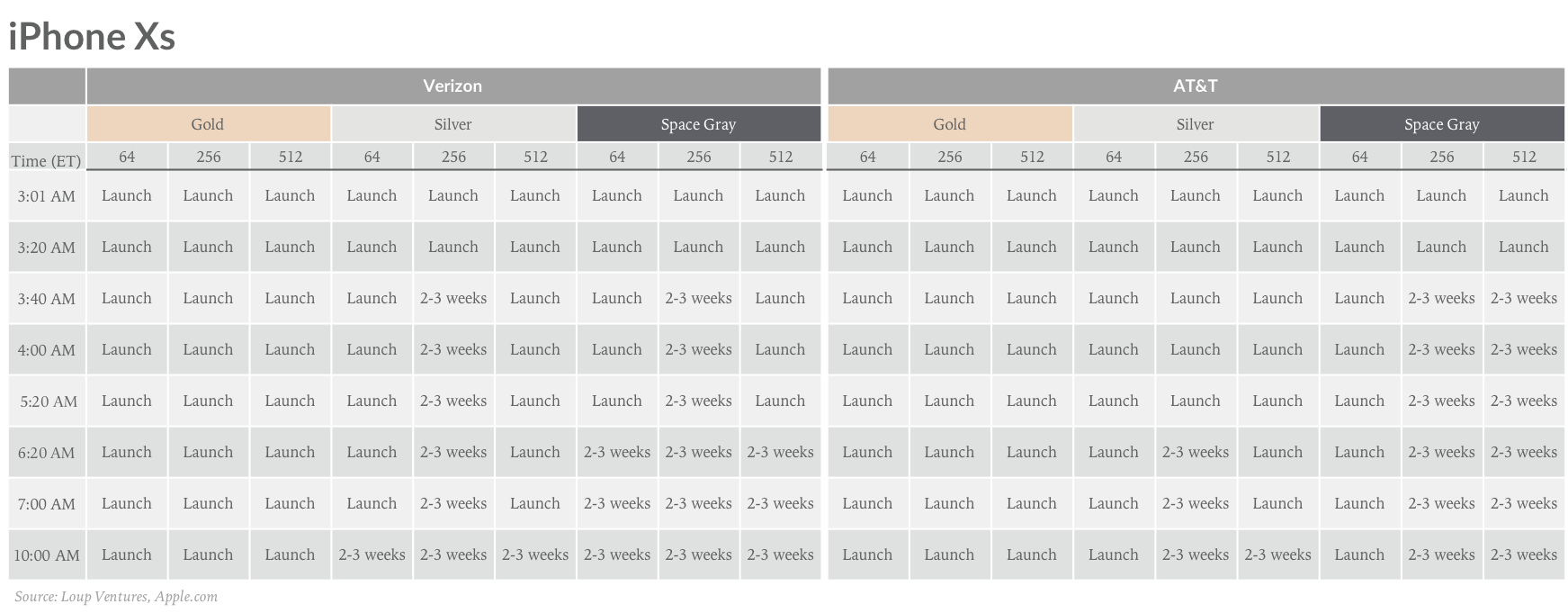

- Separately, these lead times indicate that iPhone Xs demand will be lower than iPhone Xs Max demand. This is consistent with our model, in which we anticipate 9% of units to be Xs and 12% of units to be Xs Max.

Lead Times Broken Down

Compared to the iPhone X launch last year, this year’s iPhone Xs lead times were, on average, 68% shorter, and the Xs Max lead times were 43% shorter. Put a different way, for every minute after 3:00 AM you waited to order an iPhone Xs, it cost you 3.2 hours in delayed delivery. For every minute you waited to order the Xs Max, it cost you 5.8 hours. Last year, for every minute you waited to order the X, it cost you 10.1 hours.

Methodology

Similar to last year, we checked iPhone Xs and Xs Max lead times 8 times between 3:00 AM and 10:00 AM ET, as outlined in the tables below. Reflecting on lead times is not a science, given we don’t know how many phones Apple is able to produce. That said, over the years, longer lead times have historically been an indicator of healthy demand and shorter lead times softer demand (e.g. iPhone 8 and 5C).

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.