On November 6th, Apple announced that China’s Covid shutdowns were impacting demand for its iPhone 14 Pro/Pro Max. The announcement stopped short of providing further details on the magnitude of the impact. As the quarter progresses, we have been tracking iPhone lead times and commentary from suppliers. In the end, we believe that the best way to decode iPhone demand is to set aside iPhone assembly timing and, instead, combine the results from the December and March quarters. Using this formula, we expect the iPhone will exceed Street estimates for the next two quarters combined.

*It’s worth noting that our view is based on a stable consumer over the next four months.

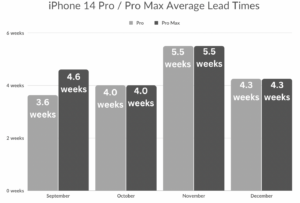

Lead times suggest a December miss

Our latest tracking of iPhone 14 Pro/Pro Max lead times in eight countries shows a modest improvement in lead times, from an average of 5.5 weeks in November to 4.3 weeks on December 9th. As a point of reference: Last year, on December 12th, we measured a 0.9 week average lead time for the iPhone 13 Pro model. That means that lead times are up 3X y/y on what we believe is a combination of tight supply driven by China’s Covid restrictions along with favorable demand for the Pro models.

Source: Apple.com

We believe that the iPhone Pro/Pro Max are Apple’s two largest products and estimate they will account for around 22% of sales in December. While encouraging to see lead times contract over the past two weeks, they remain higher than we would normally see at this point in the quarter. That means we will likely see substantially more units slip from the December quarter into the March quarter. In theory, three weeks of delayed Pro/Pro Max shipments would create a 4.5% headwind to December overall revenue.

The good news is there is a case of déjà vu in play: December’s pain will be March’s gain as Apple is likely to recapture these sales at a later date.

TSMC suggests a December beat

Chipmaker TSMC’s biggest customer is Apple, accounting for about 25% of its revenue. TSMC builds the A16 chip that powers the iPhone’s 14 Pro/Pro Max models. One benefit to using TSMC data to triangulate how iPhone demand is looking is that TSMC reports monthly revenue. For the December quarter, TSMC is tracking up 47% (October and November), essentially unchanged from their 48% revenue growth reported in the September quarter—as the iPhone grew at 10% y/y.

This begs the question: If TSMC’s December quarter finishes up 47%, does that mean iPhone revenue will be up 10% in December (well above the Street’s current 1.5% growth estimate)? The answer is that it’s highly unlikely iPhone revenue will be up 10% this quarter given the lag between when TSMC sells to Apple and when those chips are placed into phones and subsequently sold.

Putting lead times and TSMC data together

There are two negative data points for December iPhone demand. First, the company’s pre-announcement calls for soft iPhone 14 Pro/Pro Max sales. Next, the longer than normal lead times late in the quarter. On the positive side, the strength of TSMC’s October and November sales are measurably better than what we were expecting which suggests that even with lags between TSMC sales, the December quarter is poised for upside.

Adding these three forces together, it’s unclear if the iPhone will exceed December estimates. What’s important is setting aside the timing of iPhone assembly and combining estimates for the December and March periods. Within that view, we expect an upside to iPhone sales in the coming months.

Lead time methodology

We checked iPhone 14, Pro, and Pro Max lead times in eight countries throughout the quarter. Extrapolating lead times to sales is more of an art than a science given that we don’t know how many phones Apple is able to produce. That said, longer lead times have historically been an indicator of healthy demand, and shorter lead times an indicator of softer demand.