Today, less than 1% of homes are sold online. At Loup, we believe it’s a function of time before the majority of homeowners sell their homes online. This transition begins with consumer awareness that iBuying is even an option for home buyers and sellers. Awareness is a pre-requisite for adoption. We recently surveyed 175 US homeowners to begin measuring the growth rate of consumer brand awareness in this category. On top of today’s findings, we will publish three additional reports on takeaways from our research.

At the highest level, there is a sustained headwind in changing consumer behavior around moving. That headwind is based on the reality that homes represent a significant amount of household net worth and a belief that maximizing that asset should include the hand-holding of a realtor. The reason we believe the theme will eventually prevail is that transacting on a home is an expensive and time-consuming process, and technology can help remove some of that cost and friction. We believe iBuying will transform residential real estate over the next decade.

Our two findings

This is the first iteration of this survey, and we will update it annually. Today, it represents a starting point of iBuying awareness. The results of this survey will become more valuable as we gather more comparative data in the years to come. In other words, the trend will be more insightful than an individual data point. With this in mind, two things stood out to us:

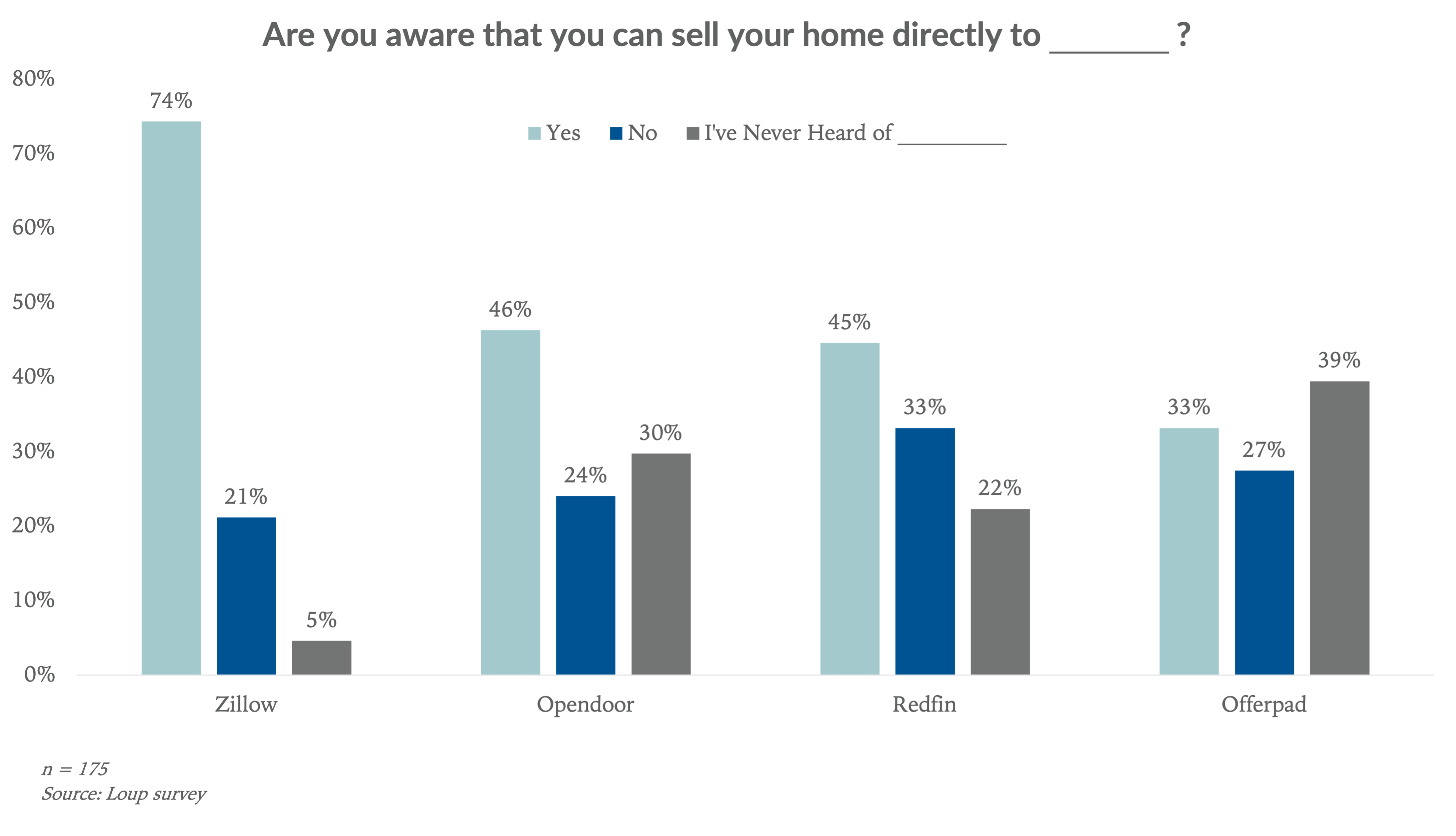

Finding #1: There are four primary companies targeting this opportunity: Offerpad, Opendoor, Zillow, and Redfin. Our survey showed a surprisingly high consumer awareness that these companies have iBuying offerings that go beyond their frequently-used home inventory search features. More recently the online home selling experience has been pushed forward by the hot real estate market, which benefits buyers who can move quickly.

We found the awareness level of iBuyer offerings ranged from 33% for Offerpad up to 74% for Zillow. Going into the survey, we had expected awareness to be about half of what we measured. We suspect a portion of these favorable responses resulted from confusion between iBuying offerings and traditional brokerage services that these companies offer. Even after adjusting for this dynamic, the results were encouraging for the iBuying theme.

Finding #2: Zillow has a clear brand recognition lead over Opendoor, Redfin, and Offerpad. This is important because iBuying is nascent today and any near-term mindshare land grab can become a long-term competitive advantage. Amazon has become synonymous with online commerce, not eBay. One of these four companies, with the potential addition of Compass in the future, will become synonymous with iBuying. That brand leadership will translate to lower customer acquisition costs (CAC) and ultimately better offers to sellers. The company that wins the brand race will likely win the iBuying war. Beyond the brand race, both Zillow and Opendoor guided to similar traction in the current March quarter at about 2,000 home sales each.

Zillow’s mindshare advantage no surprise

Thanks to their legacy ad business and the “Zillow surfing” phenomenon, Zillow enjoys the greatest awareness regarding both their iBuying offering specifically and their brand generally. The company’s control of the top of the real estate search funnel means it has a huge organic audience (200m plus monthly users) to which they can advertise their iBuying offering at zero marginal costs. As mentioned earlier, a strong brand should lead to lower customer acquisition costs, and therefore, better margins. Better margins lead to better offers for sellers and more inventory, and the iBuyer flywheel begins.

Methodology

This survey was conducted in late March 2021 and included 175 US homeowners with the following age composition:

- 19-34: 10%

- 35-45: 40%

- 46-64: 40%

- 65+: 10%