Real estate tech has sold off substantially over the past four months, with Zillow and Opendoor down roughly 40% and 50%, respectively. For perspective, over the same time period, FAANG is up 10% and the Nasdaq is up 3%. Apart from a rotation out of certain high-growth tech pockets, we believe the sharper pullback in real estate tech has been driven by an anticipation of 1) rising interest rates and 2) an eventual slowdown in the housing market.

While both factors pose risks to companies building iBuying businesses, we believe they are manageable and that investors are overweighting the potential for cyclical headwinds of interest rate increase and a slowdown in the housing market. We’re taking a different approach, and overweighting the secular growth tailwind of iBuying driving a shift in residential real estate from offline to online, which we believe will transform a massive addressable market (~$2T) over the next decade. Loup is an investor in Zillow and Opendoor.

Assessing interest rate risk

iBuyers, e.g., Zillow and Opendoor, finance the majority of home acquisitions through debt, typically holding around 20% equity in homes on their balance sheets. Thus, low interest rates are of course beneficial because it reduces expenses while homes sit in inventory. Given interest rates are at historic lows, it’s likely they will move higher over the next few years. This begs the question, how will an eventual increase in interest rates impact the profitability of the iBuying model?

For starters, the direct financial impact of rising interest rates is insignificant for Opendoor and Zillow. Taking Opendoor as the example, the company is on pace to purchase more than 20,000 homes this year. The company’s average holding period for inventory homes is about 90 days, or one quarter. Based on its current run rate, this means that on average there will be approximately 5,000 homes on the company’s balance sheet at any given time. If we assume an average purchase price of $325,000 with a 22% equity stake, a 1 percentage point increase in interest rates would result in a $13m increase in interest expense. As a reminder, Opendoor and Zillow have $2B and $3.4B in cash, respectively.

As Opendoor scales home purchases, its net interest rate exposure will of course increase. Fast forwarding to 2025, we expect Opendoor will purchase more than 75,000 homes. Assuming an average purchase price of $350,000 in 2025, a one percentage point increase in rates would equate to about a $50m impact. We think it’s judicious to think that by 2025, the 10-year treasury rate rises two percentage points to 3.6%, which would imply an incremental $100 million in annual interest expense to Opendoor. While not ideal, it’s a cost they can afford even when ignoring the financial benefit of what will be a ramp-up in cash flow to earnings from selling 75,000 homes.

The indirect impact of higher interest rates is an unknown. The script may read: higher interest rates mean fewer homes sold, leading to lower iBuyer transaction volumes which means the model never reaches escape velocity. Additionally, if this happened, investors would likely broadly sour on the real estate tech space.

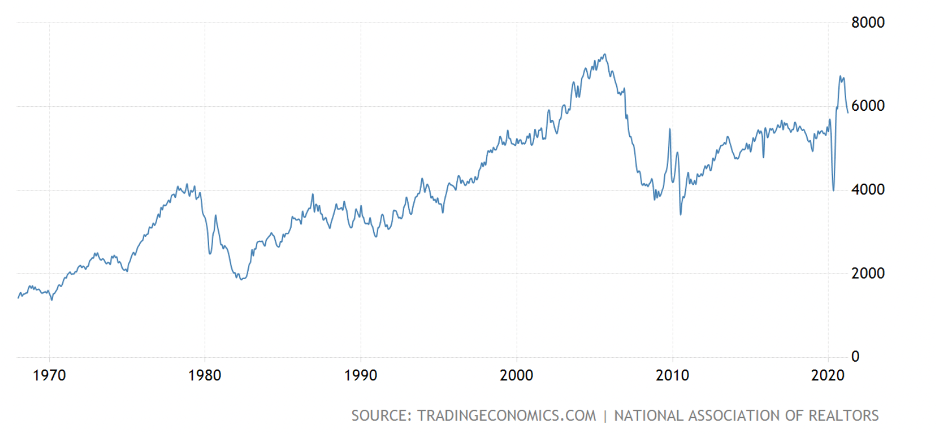

We view this indirect risk as navigable for three reasons. First, even with a 2 percentage point increase in the 30-year rate, interest rates will still be near historic lows. We believe it would likely require a substantial hike in rates to slow people’s willingness to move. One such rate hike was in the late 70s/early 80s, when interest rates went from around 5% to nearly 20%, which resulted in annual home sales falling by 50%:

Annual Home Sales (‘000s)

We view such a move in interest rates as unlikely given the Fed’s cautious approach.

Second, iBuying is a secular growth theme, and even if the overall number of homes bought and sold decline, we believe there would continue to be growth in online transactions (as a reminder, iBuying accounts for less than 1% of transactions today). It’s a similar dynamic to what played out in the auto industry over the past year, in which overall vehicle deliveries were down roughly 15%, while the EV trend, as captured by Tesla deliveries, was up 35%. Additionally, we believe a slower housing market would be a benefit to iBuyers because sellers would be more willing to work with them given sale certainty is a premium in slow markets.

Third, the housing market typically moves at glacial speeds (more on this below). Looking back to the residential real estate crash that started in 2007, it took more than five years to bottom out, and there were still ~3.7m homes sold annually (see chart above). This gives us some comfort that even if things fall apart, there are still a meaningful number of transactions. For context, the recent May housing data suggest there will be about 5.8m home sales in 2021.

The cooling housing market risk

The housing market has been hot over the past 12 months, with the median home price increasing to an all-time high of $350k in May (up 23.6% y/y). Rapid home price appreciation benefits iBuyer margins due to wider spreads between purchase and resale price. In our view, such price appreciation is unsustainable, for at a certain point supply and demand find equilibrium (see lumber prices).

The risk for iBuyers in a cooler housing market is they get caught holding inventory they overpaid to acquire and must clear the homes at discounted prices. Compounding the challenge, inventory turnover velocity would decrease in a slow market, meaning higher holding costs and interest expenses, which would weigh on margins.

Falling home prices

We view the risk of depreciating home prices as manageable for four reasons.

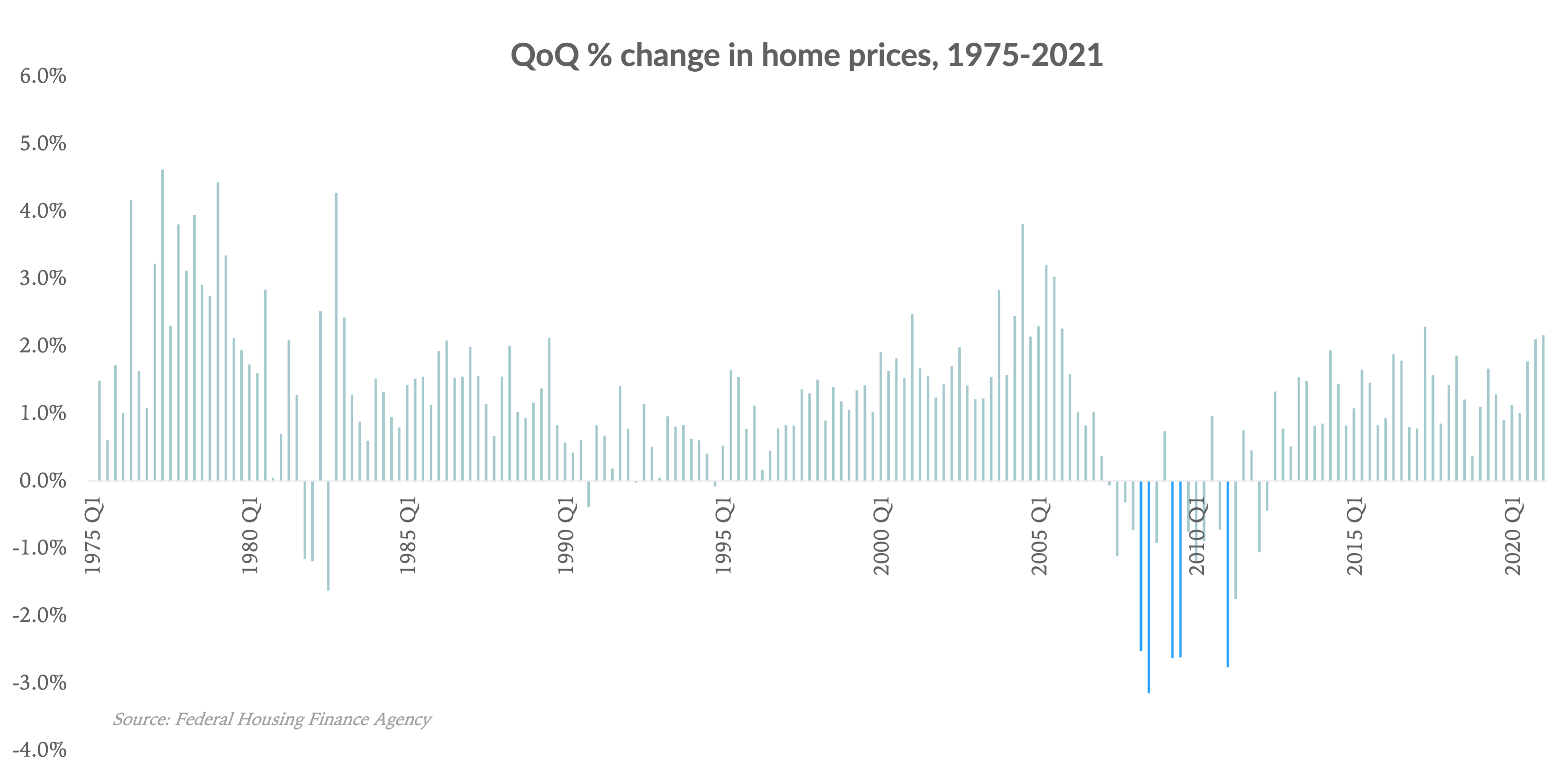

First, home prices tend to move very slowly, historically speaking. Below is a chart showing quarter-over-quarter home price changes since 1975:

Over the past 186 quarters, home prices have declined in only 12%, or 22 quarters, with the bulk of negative quarters clustered around the subprime mortgage crisis. More importantly, when home prices do decline, they typically do so gradually. In fact, it took more than five years for home prices to move from peak to trough following the housing crisis of 2007, with only five quarters experiencing price declines of more than 2.5%, meaning swift downward volatility is uncommon.

Second, iBuyers are partly insulated from the declining home price risk by the simple fact that they acquire inventory on a rolling basis, not all at once. Homes are held on average for around 90 days, meaning only a quarter of homes sold in a year would be affected by a quarterly decline in prices. Of course, if home prices decline for multiple consecutive quarters, this would get more challenging. However, outside of the 2007-2012 period, home prices have declined in back-to-back quarters only one time, in Q4 1981 and Q1 1982.

Third, one of the advantages of pricing and transacting homes online is speed. Zillow’s and Opendoor’s price algorithms receive inputs constantly and are able to dynamically adjust to changing market conditions, thereby reducing the risk of overpaying for homes. As both companies transact more homes and grow their data volumes, the more agile and accurate their neural networks will be.

Four, while we can’t predict the possibility of another macro housing crisis, we view it as unlikely given most buyers are purchasing homes with low, fixed rate mortgages, and there is greater oversight around lending practices. Additionally, given the US faces housing supply shortages that are unlikely to be alleviated soon, we expect there will be sufficient demand to keep home prices from declining for the foreseeable future.

As an aside, we do not view iBuyers as home flippers whose goal is to maximize the spread between the purchase and sale price. Instead, we view them as real estate transaction platforms that capture a percentage of the value exchanged during a home transaction through their service fees. It should be noted that in the event of higher interest rates and/or a slow housing market, Zillow likely has more downside protection given its profitable legacy ad business.

Lower turnover velocity

Another risk of a cooler housing market is longer average holding periods. The longer the resale period, the more an iBuyer pays in holding and interest expenses, thereby pressuring margins.

For both Opendoor and Zillow, holding and interest expenses account for 25%-40% of resale costs (the rest consists of buyer agent commissions, listing fees, and marketing spend). If the average holding period increased by 30%, from 90 days to 115 days, resale costs overall would increase by about 15%. Translating this impact onto contribution margins, it would reduce the contribution margin after interest from 5% to 4.25%. While longer average resale periods would compress margins, this does not jeopardize the long-term iBuying investment thesis. Their margins have benefited over the past three quarters from higher resale velocity, and a reversion to the mean should be expected. After all, at its core, iBuying is a scale and volume business, not a margin one. Further, we believe a sustainable, countervailing force to lower turnover velocity is iBuyers and tech-powered real estate brokerages themselves. That’s because these businesses will continue to bring more liquidity to real estate in hot or cold markets.

Putting it together, we view the risks detailed above as manageable and are focused on capturing the long-term prize: residential real estate’s massive addressable market moving online.