iBuying accounts for less than 1% of the US residential real estate market, which begs the question whether home sellers and buyers actually want to transact online. The argument is that because the home often represents the most significant part of a person’s net worth and carries an emotional attachment, having a human involved, i.e. a realtor, is preferable. Simply put, selling to an iBuyer is considered too risky. Our recent survey offers evidence that this skepticism will fade over time.

iBuying has two sides, starting with selling a home online, followed by another party doing an in-person tour of the home and then purchasing that home online. iBuyers are the companies doing the buying and selling and include Zillow, Opendoor, Redfin, and Offerpad among others.

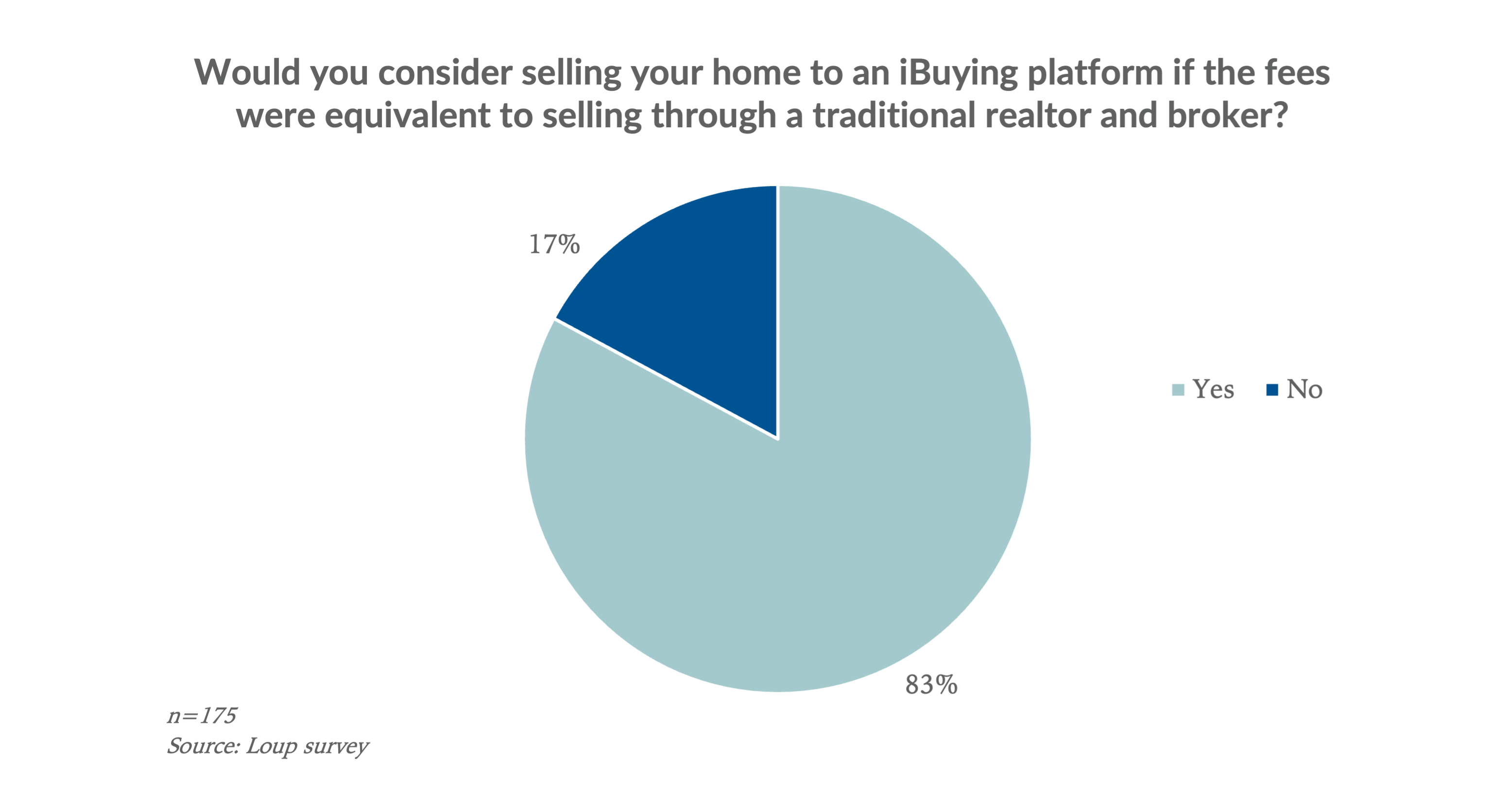

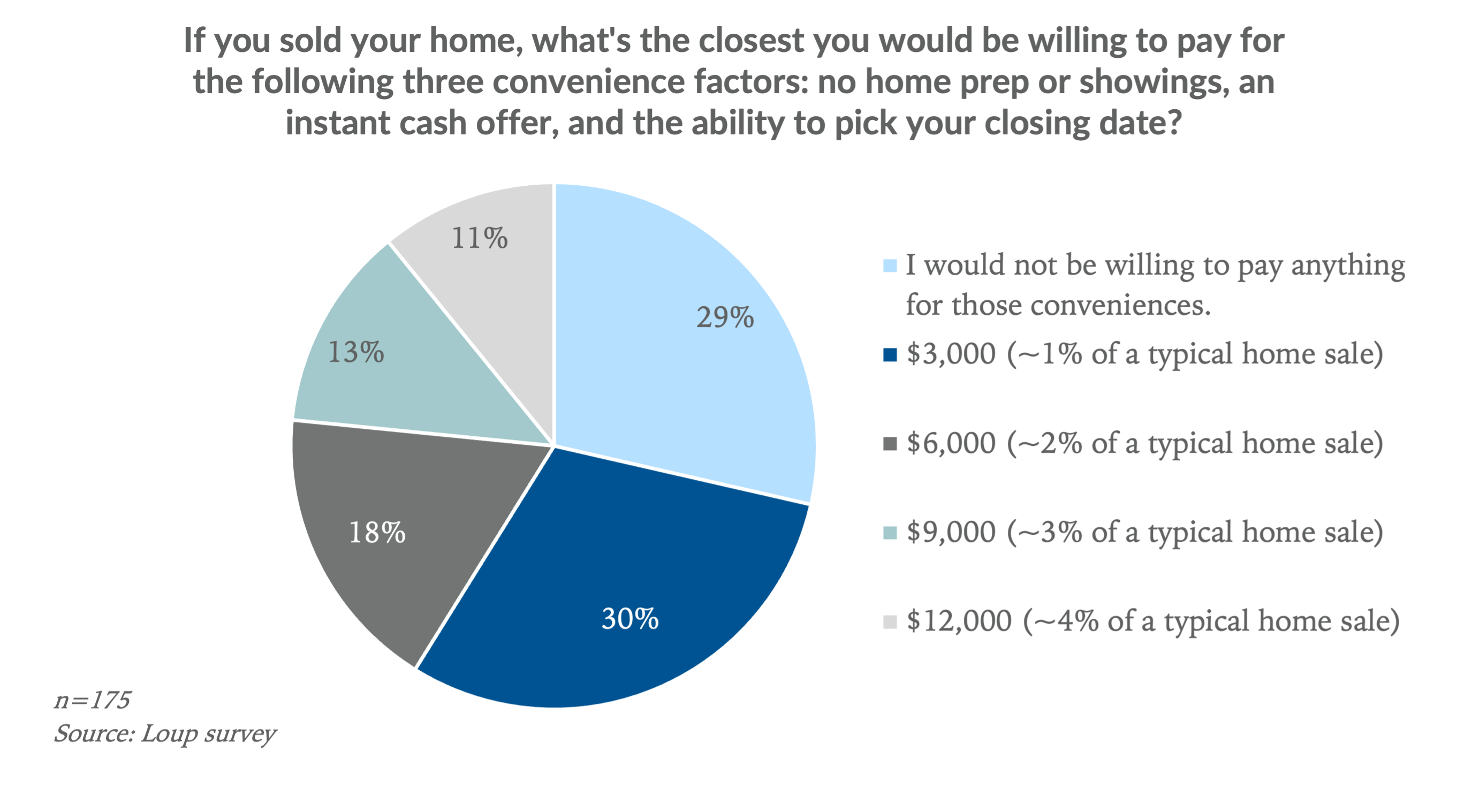

Our survey polled 175 US homeowners around their willingness to sell to an iBuyer. We were left with two takeaways:

- First, willingness to sell to an iBuyer if fees and sale price are equivalent to selling through a realtor and broker is high, 83% in our survey. The reason is because iBuying offers a simpler and more convenient solution compared to the traditional process. If fees and sale price are equivalent, consumers will go with the experience that is faster and easier.

- Second, 71% of respondents said they would be willing to pay a premium for the conveniences iBuying offers, ranging from 1% to 4% of a typical home sale. The three core convenience factors include instant cash offers, the ability to pick the closing and move out date, and no home prep or showings. This willingness to pay a premium suggests that iBuying solves real pain points in the moving process. 29% of respondents said they would not be willing to pay anything for these conveniences.

As mentioned in our iBuying Survey Part 1: Brand Awareness note, this is the first iteration of a survey we plan to conduct annually. Thus, comparative data in the future will be helpful in measuring how this willingness changes over time. That said, taken as a snapshot, our survey suggests strong consumer interest to sell to iBuyers, along with an appetite to pay a premium for convenience.

Takeaway #1

After giving survey respondents a brief description of what an iBuyer is, we asked them the following question:

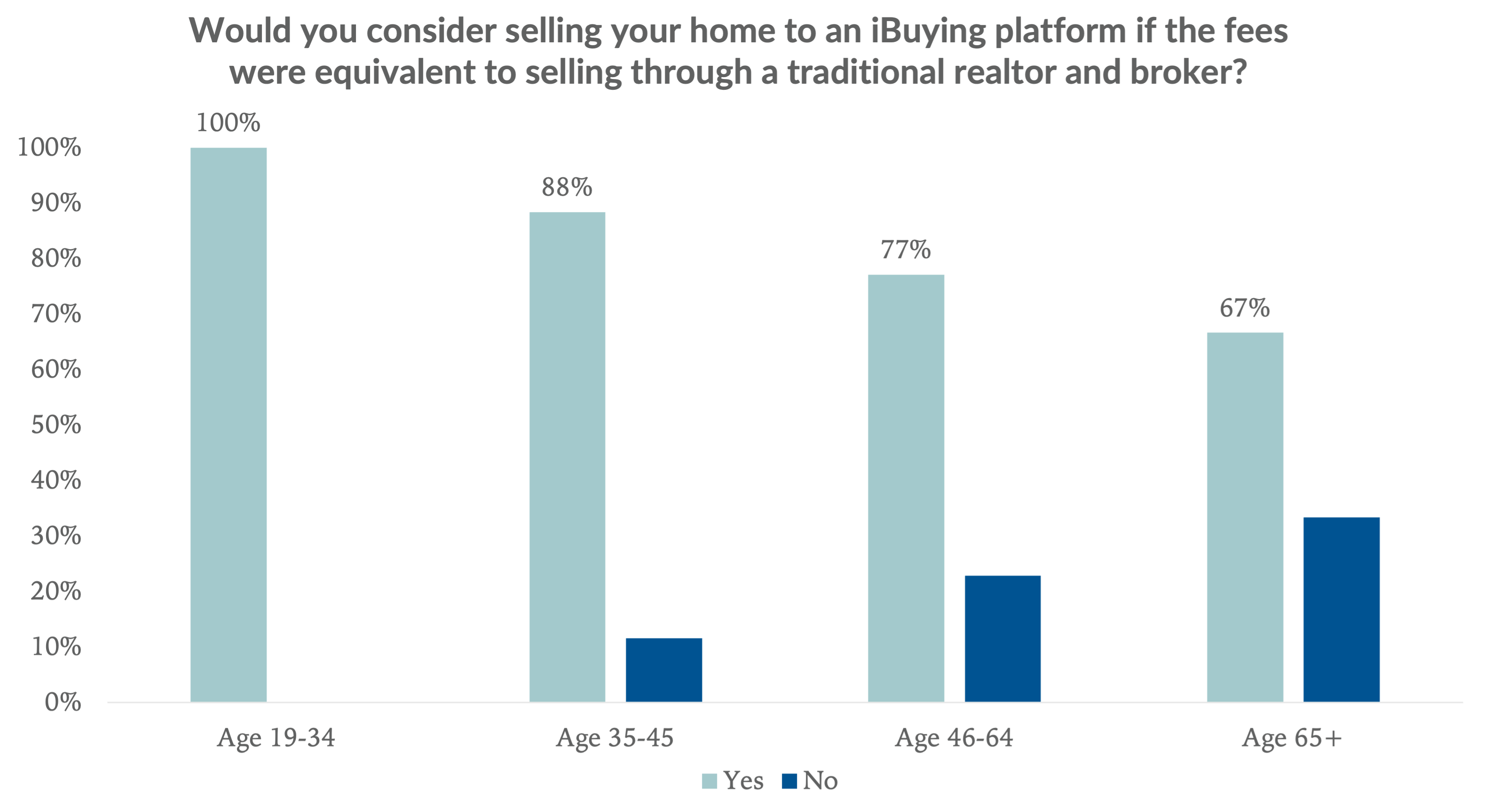

83% of respondents said yes, indicating strong overall interest to sell to iBuyers if their fees are equivalent (more on fees below). As expected, younger respondents are more likely to consider selling their home to an iBuyer than older ones. In fact, all of the 19-34 age group said they would consider selling their home online. We see this dynamic as a sign that iBuying adoption is a function of time.

Also encouraging to the theme, 77% of those aged 46-64 and 67% of those age 65+ said they would consider selling to an iBuyer. This is important because the majority of homeowners are in these two age categories and therefore play an important role in iBuyers acquiring inventory.

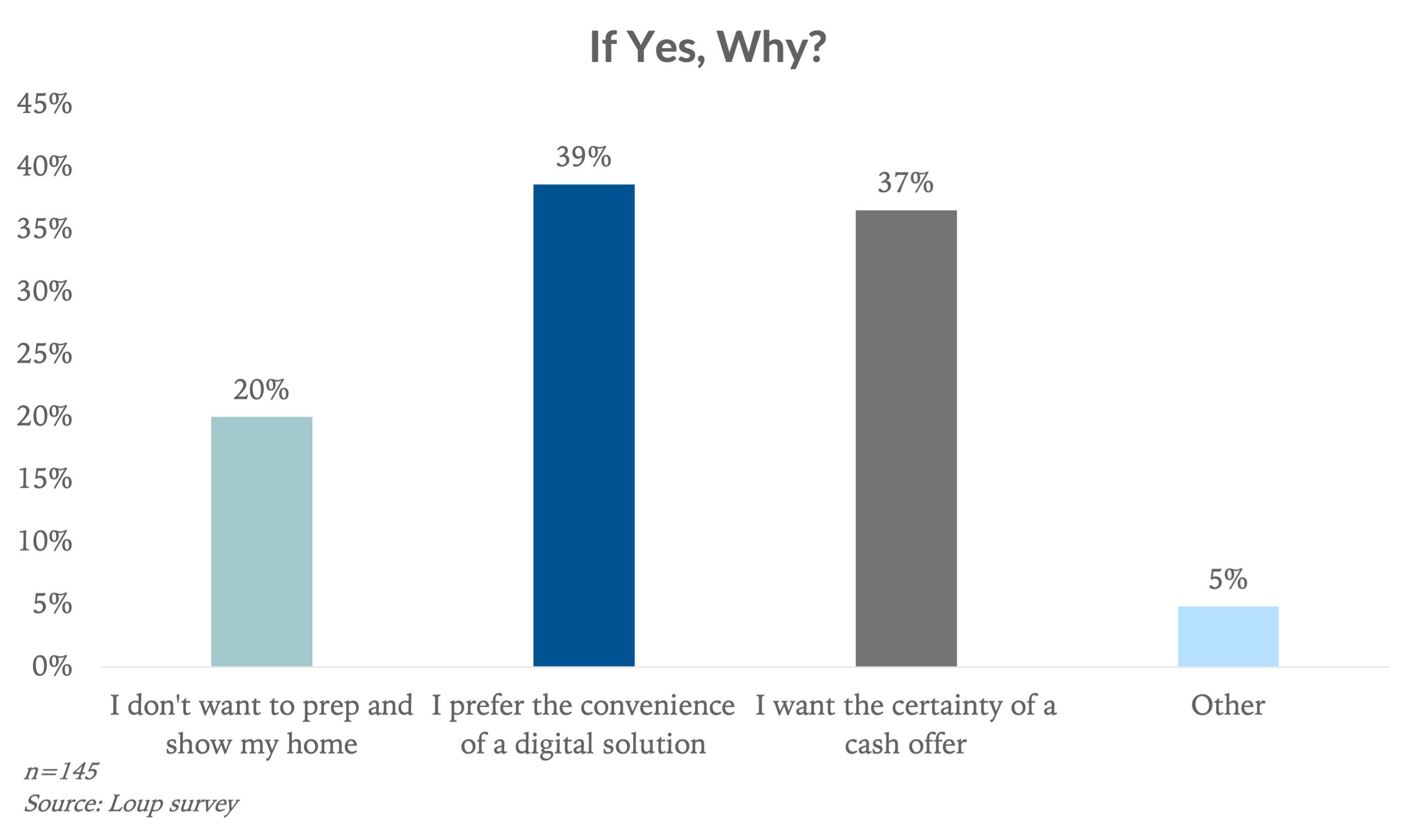

For the 83% of respondents that answered yes, the most common reasons were the convenience of a digital solution and the certainty of a cash offer.

Digital solutions reduce friction by speeding information flow, and there’s a lot of friction in a traditional home transaction. Cash offers increase liquidity because homeowners can use the cash to make an offer on their next home (two-thirds of sellers are also buyers). Given nearly 40% of home buyers use the proceeds from the sale of a primary residence to secure the downpayment on their next home, a cash offer increases their ability to compete in a fast-moving market.

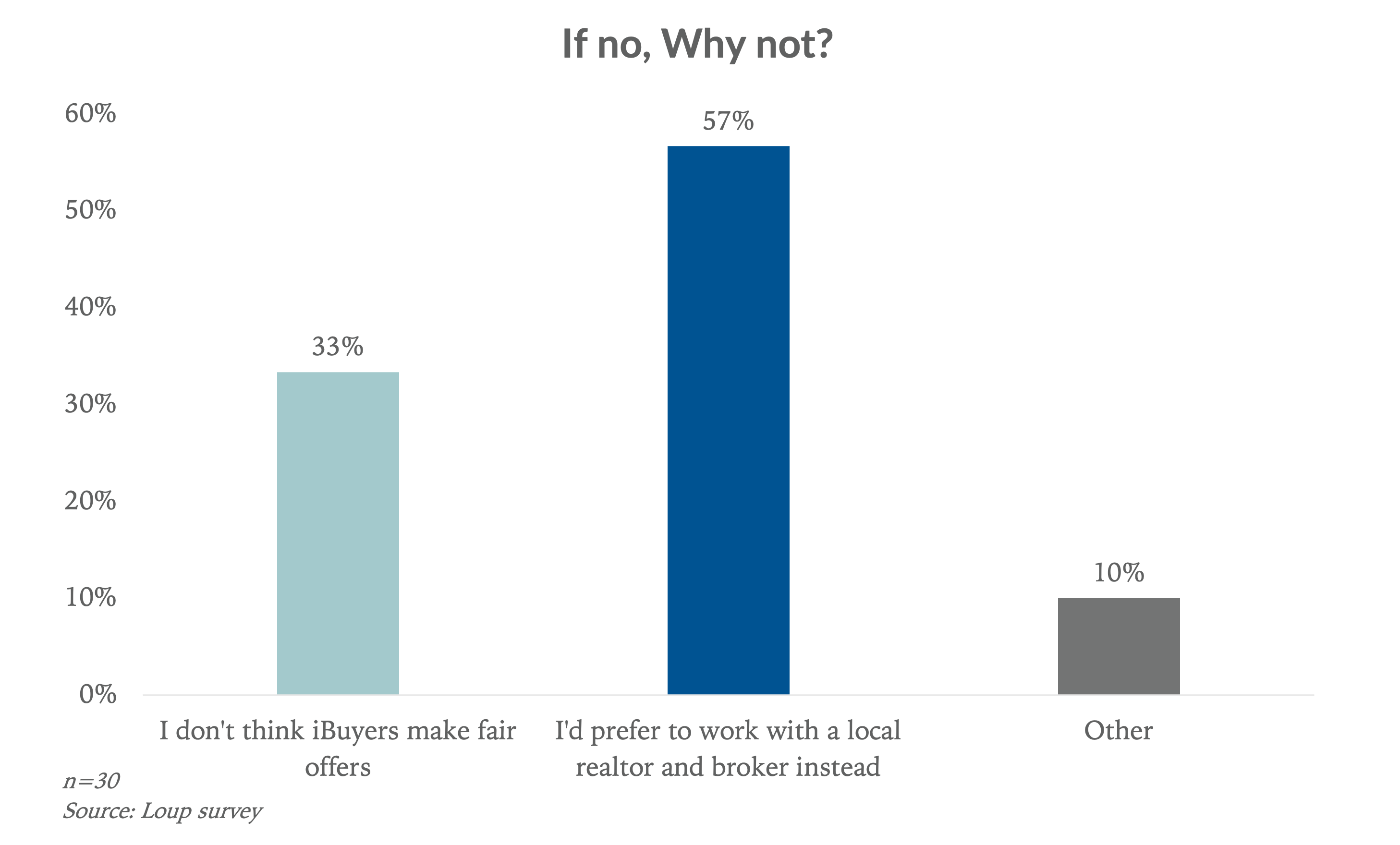

For the respondents that answered no, their preference to work with a local realtor was the most common response, followed by a view that iBuyers don’t make fair offers.

While realtors will face increasing competition from iBuyers, we believe realtors with strong individual brands will continue to do well. That’s because they bring an element of familiarity and trust that some home sellers prefer. Additionally, there is often some social pressure to work with a realtor that you know when it comes time to sell your home.

As to whether iBuyers make fair offers, historical data suggest that cash offers from Zillow and Opendoor are typically within about 1% of a home’s value. It should also be noted that homes sold through the traditional process can sell below market price as well. The National Association of Realtors reports that for recently sold homes in 2020, “the final sales price was a median of 99% of the final listing price.” In plain English, this means that if all homes had final listing prices of $300,000, half sold for less than $297,000 and half sold for more than $297,000. In other words, whether you’re selling to an iBuyer or through a realtor, the final sales price will likely differ by a percent or two or more from your asking price. Putting it together, we believe iBuyer cash offers are in line with what sellers receive on the open market.

While consumer skepticism will likely linger on this topic of fair offers, we believe it will diminish in time. It’s important to remember that Zillow and Opendoor are not trying to maximize the margin on each home they sell, but rather to maximize the number of customers they can incrementally monetize through adjacent services such as mortgages and closing services. This means volume is the most important metric. In order to increase the volume of sellers, they need to make market offers.

Takeaway #2

We asked homeowners what fee premium they would be willing to pay for three convenience factors:

71% said they would be willing to pay a premium, ranging from $3k-$12k, or 1%-4% on a $300k home sale. Depending on the iBuying platform, sellers typically pay a 1%-4% convenience premium on the sale compared to a traditional realtor-broker sale. We view this survey data point as evidence that iBuyers are solving real pain points in the moving process, and that consumers have some price insensitivity when it comes to convenience. Said another way, sellers are willing to pay up for certainty, simplicity, and time savings.

While this 71% figure was higher than our 50%-60% expectations, it is in line with Opendoor’s recent 2021 Real Estate Trend Report that found 71% of survey respondents said they were likely to consider selling their home to an iBuyer.

29% of respondents said they would not be willing to pay anything for the above three conveniences. As Buyers achieve economies of scale and bring down their fees to equivalency or below the traditional home sale process, a portion of these could become potential customers.

Methodology

This survey was conducted through Qualtrix in late March 2021 and included 175 US homeowners with the following age composition:

- 19-34: 10%

- 35-45: 40%

- 46-64: 40%

- 65+: 10%