This piece is from Doug’s blog, The Contrarian Mindset.

From the age of 5 to about 20, I worked at my family’s auction house. We sold collections of all kinds, from Nakashima furniture to Lladro figures to Belleek china to rare coins to baseball cards. As a new class of collectibles bursts into relevance — NFTs — the auctioneer in me says looks familiar, the trader in me says there could be something here, and the skeptic in me says this looks like a fad.

This isn’t another 101-level explainer about NFTs. There are already thousands of those articles. If you know what they are, then you probably want to know how to value them so you can figure out whether to invest.

In all my years of helping to sell collectibles, I came to the conclusion that collectibles derive value from a set of three qualities: brand, scarcity, and market. I believe it is those same three qualities that determine the value of physical collectibles that will also govern the value of NFTs. The following is an exploration of what I think makes any collectible valuable and a framework for how to value collectibles, including NFTs.

Collectibles and Consensus

The most important thing to accept about investing in collectibles is that they have no objective intrinsic value. When you invest in a stock, you buy a share of the underlying company’s future cash flows. As such, you can estimate future cash flows and discount those flows back to the present to establish an intrinsic value. Not all investors do that, perhaps few do it today, but nonetheless, intrinsic value is estimable.

Collectibles have no such future cash flows and rely purely on consensus to establish value. It is the collective demand from the group based on its perception of the collectible that shapes value and salability. Without a group to collect something, the thing isn’t really collectible, i.e. worth collecting. Any given individual may independently love a Basquiat for what it says to him or her, but it is the collective acceptance of an artist’s brilliance that creates demand for the work, making originals worth millions instead of $20 on a street corner.

While a collectible has no intrinsic value from a financial perspective, it may have some intrinsic value given the buyer’s personal feeling about the item, which is why rule number one for any casual collector is to buy things you actually like. That way, at worst, you get some value out of the asset by way of enjoyment, even if it ends up being worthless.

Brand, Scarcity, Market

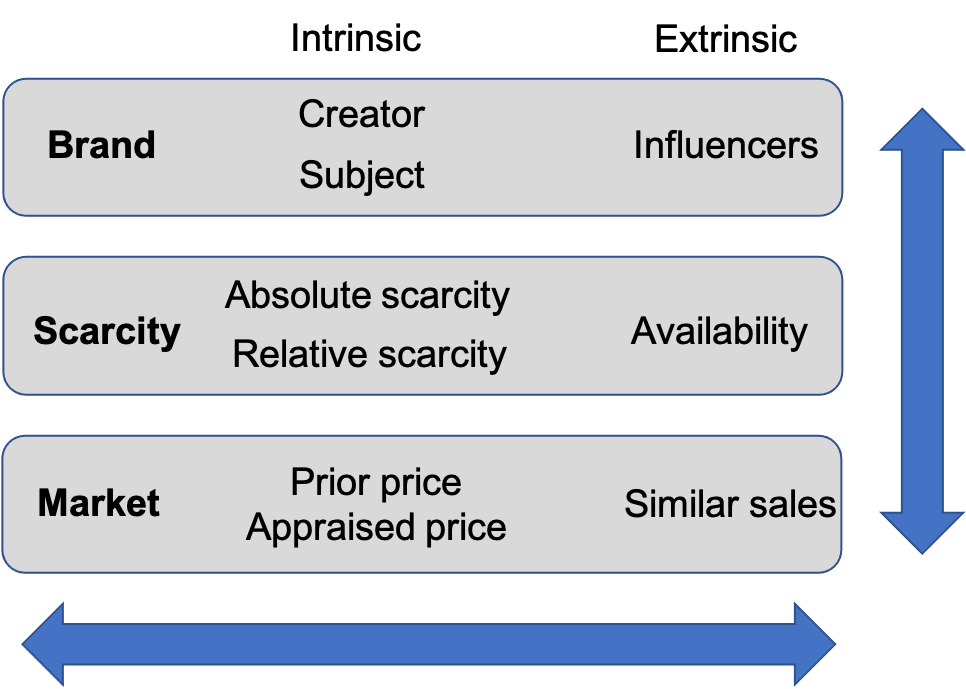

Brand, scarcity, and market are the elements that build consensus around the value of any given collectible. Brand creates value, scarcity enhances value, and markets establish price in a virtuous cycle that results in the desirability of any given collectible. Within this virtuous cycle, there are intrinsic and extrinsic factors that make up brand, scarcity, and market that flow like this:

Brand

The value of any collectible starts with brand. A collectible with no brand will have no market interested in it, and therefore has no value to be enhanced through scarcity. The brand of any given collectible is created by a mixture of the intrinsic characteristics of creator and subject and the extrinsic characteristic of influencers.

Creators are those who make the collectible. This could be an artist like Beeple or XCOPY or a company like Larva Labs (Cryptopunks) or Dapper Labs (TopShot). Musicians, writers, studios, magazines, and other creative individuals and institutions can all active as creators of NFTs.

Subjects are what the collectible is about. This could be a series of daily creations like Beeple’s Everydays: The First 5,000 Days, 8-bit art like Cryptopunks, or professional athletes like TopShot. Some NFTs are associated with influencers themselves, like the Bitclout experiment with Creator Coins that represent celebrities.

Both the artist and subject are intrinsic qualities of the collectible because they cannot be separated from it. A Beeple will always be a Beeple. A LeBron TopShot will always be a LeBron TopShot. The value of Beeple’s art will depend on his popularity over time, as will the value of LeBron collectibles.

Influencers are tastemakers that make collectibles popular by shaping consensus. Influencers in the NFT world include early crypto adopters, the artists themselves, and famous people like Elon Musk. Influencers may be interested in either the artist, the subject, or both. As influencers promote a creator or subject, they create a market by driving demand from buyers. Wherever a market of willing buyers present itself, sellers follow when the price is right.

Scarcity

Before we can talk about price that is derived from market participants, we need to consider scarcity. Scarcity serves a sort of multiplier to the value created by a collectible’s brand. Scarcity, like brand, has three sub criteria: absolute scarcity, relative scarcity, and availability.

Absolute scarcity is how many items are available from a given brand. There are 10,000 cryptopunks, and there will only ever be 10,000. There appear to be millions of TopShot moments in circulation and that number will increase as they release new moments.

Relative scarcity is how scarce a given item is amongst the absolute set. Of the 10,000 Cryptopunks, only 88 are zombies, 24 are apes, and 9 are aliens, making those punks more valuable because there are fewer of them in existence. Of the millions of TopShot moments, some moments — legendary moments — only have a small number available. The rarest have 25 copies available compared to common moments with tens of thousands of copies.

Known scarcity is a primary feature of NFTs. Buyers know exactly how many of any given item exist on an absolute and relative basis, where collectors of physical goods like sports cards or cars or shoes might never know exactly how many of a given thing are in existence.

Both absolute scarcity and relative scarcity are determined by the creator and can have an effect on the brand. Greater scarcity always augments a brand if the brand is desirable outside of the scarcity. No brand is desirable purely because it is scarce. The brand must standalone to create initial value.

Absolute and relative scarcity ultimately affect availability, which is how many items related to a given brand are available for sale at any given time. Something with more absolute scarcity means there will be fewer opportunities for buyers to collect from that brand, and an item with more relative scarcity means there will be fewer opportunities for buyers to collect that particular collectible. Greater scarcity translates into limited supply, which can create dynamic price upside when paired with strong demand driven by influencers.

Markets

Brand and scarcity are assessed by the market to establish prices. Market factors relevant to the value of any given collectible are prior sales, appraised prices, and similar sales.

Prior sales are prices for the exact item in question and establish the strongest anchor for a collectible’s value. Assuming no negative change to a brand, prior sale prices often serve as a floor to future sale prices for collectibles. There are always exceptions to this rule, particularly if a collectible category is in the midst of a bubble, the bursting of which negatively affects the brand anyway.

Appraised prices are sometimes offered in conjunction with an offering or auction, particularly for high-end goods (see Christie’s). Appraised prices are created by experts who factor in prior sale prices, the creator, the subject, and the scarcity. They also factor in similar sales, the final characteristic of market.

Similar sales are the prices at which similar collectibles sell. Similar sales are commonly used in determining real estate prices as well. In the case of Cryptopunks, any given punk price can be used as a comp for any other punk given they are in a similar collectible class; however, similar sales do not take into account the unique characteristics of the specific collectible. The sale of an ape punk might give some insight into the value of an alien, but only as a data point, not an exact value.

Macro

All collectible markets are affected by another variable completely separate from the collectible itself: the economy. Better economy generally means more willingness to spend on collectibles of all kinds. I view macro as a separate and unpredictable factor as it pertains to valuing collectibles. Other than knowing it is a factor, the only other consideration relative to NFTs is the crypto macro. I believe that generally when crypto is performing well against fiat measurement, demand for NFTs will be elevated. If the crypto markets were to crash, I think demand for NFTs would be negatively affected. In any case, NFTs sold in crypto denomination will appear to keep gaining value in fiat terms as crypto appreciates in price and lose value in the inverse case.

Establishing Value

So how does all this help calculate an NFT’s value? Unfortunately, the collectibles framework doesn’t reduce into a simple equation. All valuing of collectibles is more art than science. Those who embrace the artfulness of the exercise will do better than those who approach it more rigidly. I think the same holds true in other investing disciplines, especially equities. To that end, there are two analogies we can consider for investing in collectibles and NFTs in particular: venture capital and public equities.

Collectibles as Venture Capital

If you buy any collectible before a brand has been established, you should think of it as an early-stage venture investment (pre-seed or seed). Investing in collectibles before brand is akin to investing in a company before it finds product market fit. You’re betting on the artist or subject or both becoming popular, driven by interest in some influencer group. If you’re an influencer yourself, all the better. You’re a value-add VC in that case.

Collectible VCs need to consider scarcity in how they build a collection. Absolute scarcity should make the collectible category potentially more attractive, and you should focus your investment dollars on the more relatively scarce items. Like pre-seed and seed VC, there will be minimal market comps in the case of a pre-brand collectible. Any comps that do exist will influence current value but shouldn’t be overly influential on your assessment of the collectible class.

As with early-stage venture, you’re better off creating a fairly diverse portfolio because most brands to be never are. Expect a lot of zeroes, so again, buying things you like, not just things you think will increase in value, is the best hedge for any emerging collectible investment.

Collectibles as Public Investing

Any collectible that has an established brand is more like buying public stock. There’s a healthy market of prior and similar sales. There’s a community of buyers and sellers that actively transact. The desirability of the collectible is established.

Then the calculus is different. You might start with the trend of similar sales and apply that to the prior price of an item. You might compare that with the appraised value. Then you might make your own assumptions about how the brand will fare in the future and how scarcity might augment growing interest in the brand.

As with the public markets, blue-chip collectible portfolios can afford to be more concentrated. To generate the strongest returns relative to the market, portfolios need to be concentrated, lest they become closet indexes. For most people considering NFTs as an investment, the public equity approach is the smartest. Stick to the names with the strongest brand as they are most likely to retain value with upside from artist and category growth as compared with the hit-or-miss dynamics of trying to find the next Beeple. In other words, don’t stray too far from consensus with NFTs unless you really love the art.

Conclusion

I think NFTs are here to stay, and I think that they have application well beyond speculative art. NFTs could offer a powerful mechanism for creators to monetize music, videos, and writing as a new type of DRM. They may even build in a future cash flow mechanism that allows owners to profit and would allow investors to value them more like securities. Royalties are already a robust industry for music. NFTs could democratize that across many other industries.

As to whether NFTs are in a bubble? Maybe. It wouldn’t surprise me if most NFTs declined by 80% in value over the next few years. It also wouldn’t surprise me if blue chip NFTs, like Cryptopunks, were valued much higher in the next few years. It wouldn’t even surprise me if both things happened over that time frame as they aren’t mutually exclusive outcomes. It pays to be skeptical with NFTs but be overly skeptical at your own risk.