After Elon Musk tweeted that Tesla is currently scouting locations for a Cybertruck/Model Y Gigafactory, we began exploring the potential impact of Tesla producing cars in locations outside of Fremont, CA. As expected, we found that diversifying manufacturing locations is a small yet material lever to drive margins higher.

Scouting locations for Cybertruck Gigafactory. Will be central USA.

— Elon Musk (@elonmusk) March 11, 2020

We estimate that, in three years (end of 2022), Tesla can improve its operating margin by 8% just by building cars in areas with a lower cost of living than California. Further, we found that the weighted average cost of living for Tesla manufacturing facilities is currently 54% higher than that of Toyota and Ford.

The idea is simple – by manufacturing in areas with a lower cost of living, a company is able to pay lower wages for workers and, presumably, many other overhead costs like rent and utilities. In this exercise, we use cost of living as a proxy for an automaker’s overhead costs in a given region.

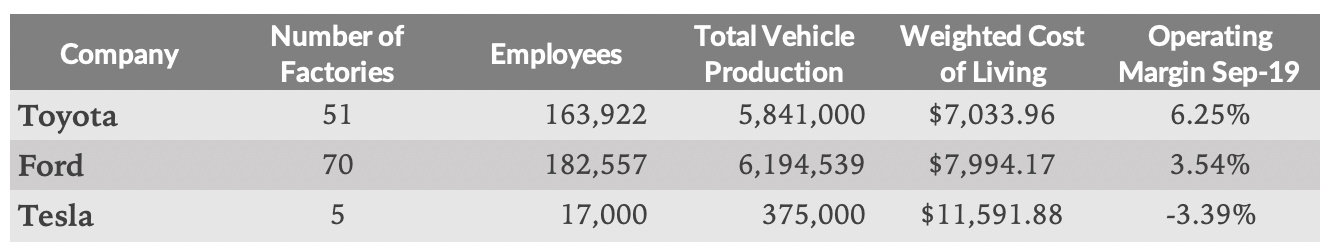

We looked at the cost of living in the cities where automakers manufacture their vehicles, including Toyota’s 51 facilities, Ford’s 70 facilities, and all of Tesla’s current and planned locations. See our workbook here.

The weighted cost of living is based on the number of employees at each location and data from Numbeo. Tesla’s weighted cost of living number os 54% higher than the average of the two larger automakers.

Clearly, diversifying its manufacturing locations will allow Tesla to not only satisfy demand more efficiently, but it will drive down their overhead costs and increase margins.

How we arrived at an 8% margin improvement

Today, Tesla only manufactures vehicles at its Fremont facility with volume deliveries starting soon from the Shanghai Gigafactory. The cost of living in Fremont, CA is $11,592 per person (before rent). By the end of 2022, we expect 60% of Tesla vehicles to be produced in Fremont, 27% in Shanghai ($7,653 cost of living), and 13% in Berlin ($10,123 cost of living). That would bring Tesla’s weighted average to $10,337, a 12% improvement over today. Further, if we assume 65% of the cost of a vehicle is attributable to overhead (costs that would be affected by the cost of living in a given area), it would drive an 8% improvement in the cost of a vehicle.

What about Cybertruck and Model Y?

Beyond 2022, we see even more improvement in Tesla’s costs, as plans to produce Cybertruck and Model Y in central USA come to fruition. For simplicity’s sake, let’s assume they move forward in Tennessee and build a Gigafactory near VW’s new facility in Chatanooga. We have previously estimated that Cybertruck will account for 15% of units when deliveries reach volume. If we rebalance the weighted average cost of living calculation to include 15% in Chatanooga, 20% in Berlin, 42% in Shanghai, and 23% in Fremont, it yields $9,262, a 25% improvement over today and a theoretical 16% improvement to margins. Keep in mind this involves fully constructing, tooling, and supplying two new Gigafactories – likely three to five years away.

Why does this matter?

The fundamental questions surrounding Tesla’s future and market opportunity have shifted from: “can they actually make these vehicles?” to “are people ready for EVs?” to “will they run out of cash?” to “can they make them fast enough?”

The remaining question is: “can they produce EVs profitably?”

The company’s most powerful lever is their software advantage. When you buy a Tesla vehicle equipped with the $7,000 FSD option, that incremental revenue carries a high-margin, and we expect attach rates for FSD to rise in the coming years as the feature set is built out.

Other levers include economies of scale as Tesla produces vehicles in higher volume and manufacturing efficiencies as the company continues to iterate on “the machine that makes the machine.” Evidence of manufacturing efficiencies can be seen in Shanghai, where it took just 10 months for the newest Gigafactory to go from breaking ground to Model 3s rolling off the line.

The location of Tesla’s manufacturing facilities represents another profitability lever that Tesla has yet to exploit. As volume production begins in areas with a lower cost of living than California, margins should inch higher, if only by several percentage points.