The Loup Frontier Tech Index tracks the performance of publicly-traded companies that influence the future of technology including AI, robotics, autonomous vehicles, computer perception, and virtual and augmented reality. We will be publishing periodic pieces, to highlight specific companies in the index and their impact on frontier tech.

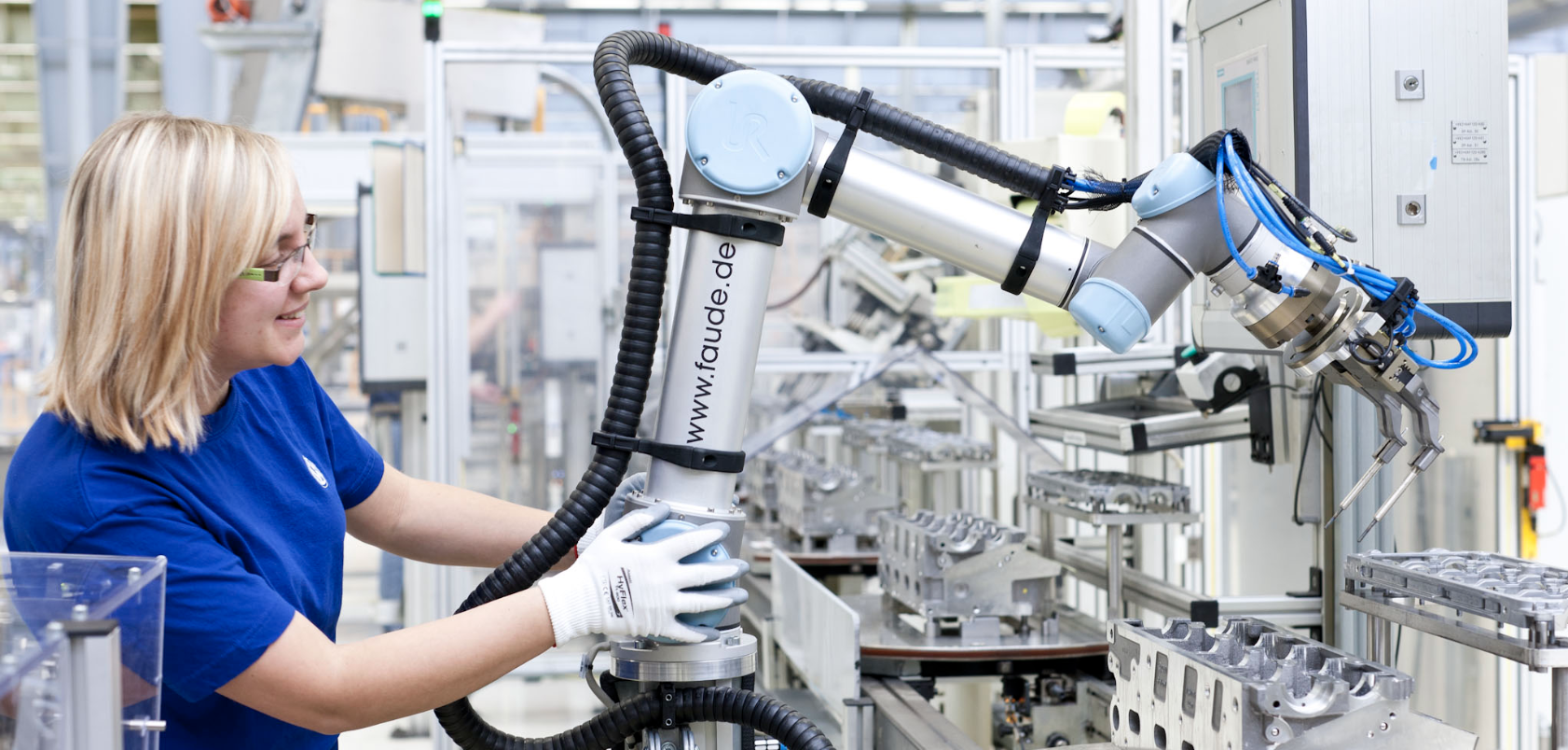

We believe we are seeing a paradigm shift in the manufacturing sector, where robots and humans are beginning to work together side-by-side. These robots are known as collaborative robots (co-bots) and autonomous mobile robots (AMR). Following the acquisition of Universal Robots in 2015 and Mobile Industrial Robots (MiR) in 2018, Teradyne (TER) has become a clear leader in two of the fastest growing robotics markets.

- Universal Robots develops co-bot arms to automate dull, dirty, or dangerous jobs such as pick and place applications. Programming these robots is less sophisticated than traditional robots, which lowers overall cost, improves flexibility and allows robot automation to become more accessible outside of large industrial manufacturing. The Universal Robot business generated $170M in 2017, which is up 72% year/year and the company expects this business to grow 50% in 2018.

- MiR develops collaborative autonomous mobile robots (AMRs) to improve logistic efficiencies within industrial applications. For example, instead of pushing or driving materials around a warehouse, MiR’s robots do it autonomously. Before being acquired in 2018, MiR was profitable in 2017 with annual revenue of $12M, more than tripling 2016 revenues.

Today, both these segments account for less than 15% of Teradyne’s total revenue, but we believe we have hit an inflection point for co-bot and AMR demand. Traditional industries and new markets alike are finding meaningful value in these robots. We anticipate the co-bot market to grow from $0.7B in 2017 to $9.1B in 2025, representing a 56% CAGR. We expect the AMR space to grow 28% annually to an $8.9B market opportunity over the same time period. Given Teradyne’s leadership, we expect sales to grow 50% per year in both these segments for the next several years becoming a material catalyst to overall revenue and earnings, as well as the company’s overall stock performance.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.