Today we’re making changes to our Apple model. While the fallout from coronavirus is impossible to estimate, we believe Apple will be well-positioned when we turn the corner. Bottom line: Apple investors should rest easy.

As long-term investors, we seek to understand the five-year picture and beyond. That said, we understand the desire to forecast the medium-term, as the impact of the world’s response to the virus will be felt for years to come. We caution, however, that the number of unknowns related to the timing and magnitude of the impact makes forecasting a very precarious exercise that should begin with modesty. Apple will report the Mar-20 quarter on April 30th.

There are three primary drivers of almost every company’s performance over the next one to two years:

- The world’s success at arresting the spread of COVID-19 and restarting economic activity.

- How quickly and effectively fiscal/monetary support is absorbed by global economies.

- The pace of the rebound in the economic activity once we turn the corner after the virus.

We believe many analysts are forecasting for an overly optimistic bounce back for Apple. Nevertheless, we rest well knowing that FY21 will undoubtedly be better than FY20 and that Apple is among the best-positioned major tech companies when we turn the corner.

What We Do Know About the Long Term

2020 and early 2021 are unknowns. We have greater visibility beyond 2021, however, because the powerful trends that were in place within technology, media, and health will still be in place when this current period of uncertainty ends. Some of these trends include:

- 5G driving both a device upgrade cycle and trailing benefits from what the technology enables.

- Original content and SVOD increasing share of media time spent

- Software services continuing to penetrate more industries.

- Health becoming personal and preventative – wearables for data collection, AI for analysis, and consumer software as the interface.

- Augmented Reality emerging as the next major computing platform.

In other words, many of the prevailing tailwinds over the next decade are at Apple’s back. Additionally, the 2020 downturn may prove to be a positive for the company given Apple’s financial strength, anchored by $99 billion in cash at the end of Dec-19, which will be used to retain and acquire talent and companies to advance their agenda. This net cash position is second only to Google with $117B.

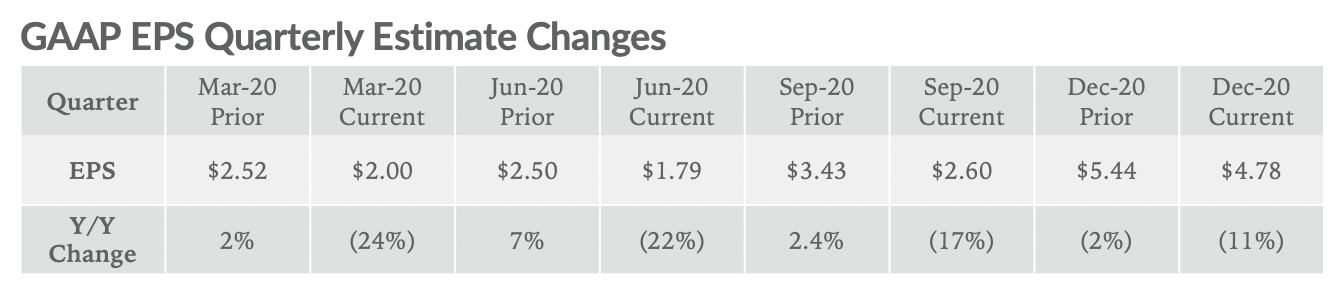

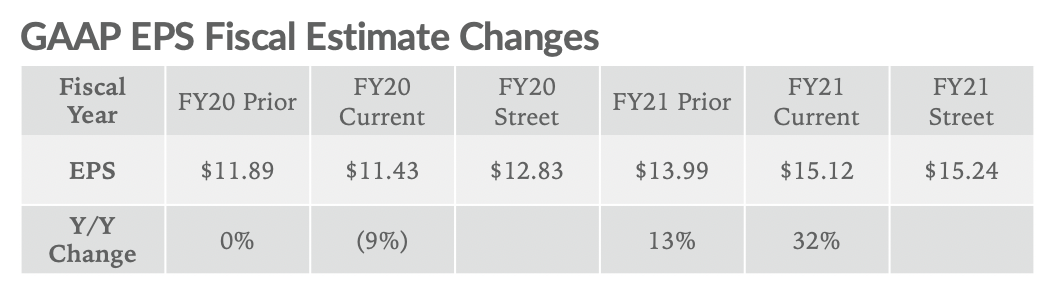

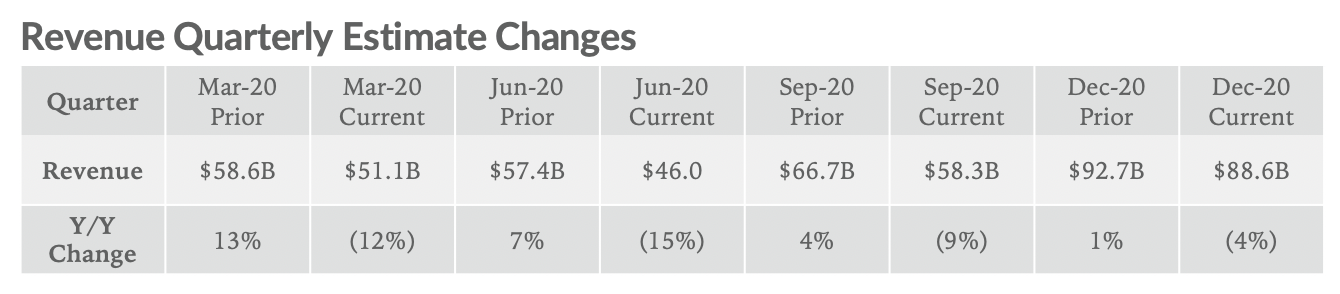

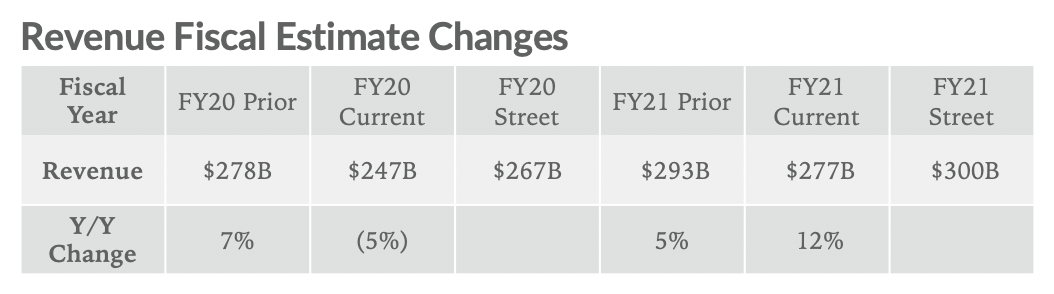

Changes to Estimates

Discussion about FY20 is largely a waste of time, so the conversation is better directed to FY21. There’s a prevailing belief among Apple investors that FY21 will be a bounceback year. We share that view and are modeling for 12% revenue growth next year compared to down 5% this year. The earnings step up is more powerful, with our expectations of 32% GAAP EPS growth in FY21 compared to down 4% this year (keep in mind, Apple already reported favorable first quarter of FY20 results). Our sense is that the Street’s FY21 estimates are still too high at $300B (we’re at $277B and $15.12). Many analysts have yet to update their numbers. Others have made adjustments, often pushing FY20 revenue into FY21, suggesting next year could exceed $325B in revenue and almost $17 in GAAP EPS.

We mentioned that we caution against high expectations related to the magnitude of next year’s bounce back. We recommend resting well knowing that FY21 will be better than FY20, and Apple’s long-term future is among the brightest of the major tech companies. Despite the company’s $1.14 trillion market cap, we remain confident it will be the top-performing FAANG stock in 2020, as investors increasingly look forward to the company capitalizing on the trends laid out above.

Notable Changes to Model

Click here for our updated AAPL model.

Here, we use calender year to better frame our attempt to model the downturn and rebound.

- Overall. We’re modeling for revenue in CY20 to be down 9% and in CY21 to be up 20%. Overall revenue was up 2% in CY19.

- iPhone (51% of revenue). We’re modeling for iPhone revenue in CY20 to be down 19% and in CY21 to be up 22%. Overall iPhone revenue was down 8% in CY19.

- Wearables (9% of revenue). We’re modeling for Wearables revenue in CY20 to be up 17% and in CY21 to be up 33%. We estimate overall Wearables revenue was up 53% in CY19.

- Services (18% of revenue). We are not making any changes to our Services estimates. This will be the most reliable segment, and we continue to expect CY20 to be up 16% and in CY21 to be up 14%. Services revenue was up 18% in CY19.