The pandemic has been great for food delivery platforms. DoorDash is expected to grow revenue around 225% in 2020, an acceleration from already parabolic growth of 205% in 2019. Uber Eats gross bookings were up 108% in 2020 compared to 85% in 2019, and has been the company’s bright spot throughout the pandemic. This acceleration in food delivery prompted us to conduct a simple case study across three delivery platforms to compare pricing and consumer fees. We were left with three takeaways:

- Food delivery is expensive, with premiums ranging from 41% to 58% plus for a ~$30 order. Including a 15% tip the premium is closer to 90%.

- There’s a combination of hidden fees and variable pricing across delivery platforms, ultimately driving up the cost of food delivery.

- Despite its high costs, consumers are willing to pay for the convenience factor.

The basics of a food delivery order

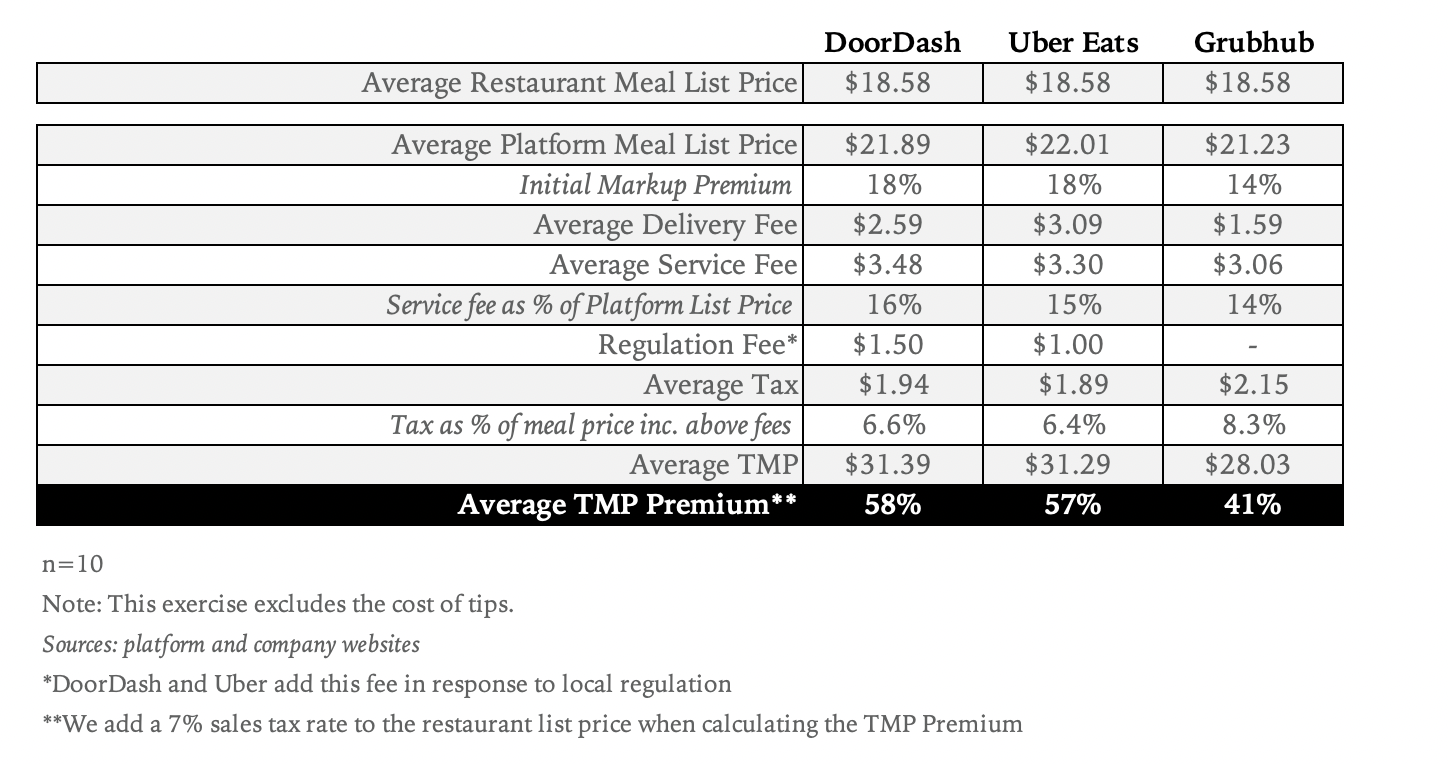

We made ten identical food orders and did a fee average across DoorDash, Uber Eats, and Grubhub. We then compared it to the price a consumer would pay going direct to the restaurant. The table below summarizes our findings related to the total meal price (TMP) premium. Note, this exercise excludes tips which typically add 15% to the overall order price.

The same Minneapolis delivery address was used for all orders. While delivery, service, and tax fees certainly vary across the country, we believe the basic insights are applicable more broadly. Here’s a Google Sheet with the individual restaurant orders and respective fees.

Food delivery is more expensive than you think

The first thing that stands out is the initial markup premium, which is 14%-18% across the platforms. The initial markup premium is the difference between the meal price a restaurant lists on its own website and the base price on the delivery app. We believe most restaurants raise the price of their menu on delivery apps to offset the 15%-20% take rate delivery companies charge restaurants.

Delivery fees ranged from $1.59 to $3.09 on average. Because delivery fees remain constant on orders over $10, their contribution to the total meal price varies with the order size. Said another way, a $2.50 delivery fee on a $15 order is a 17% add-on compared to an 8% add-on for a $30 order. Service fees are determined as a percentage of the platform meal list price, usually around 15%. This means that the dollar amount paid in service fees increases as the order size grows.

While it’s not explicitly stated when the sales tax is applied, we think it’s applied after delivery, service, and regulation fees have been added, implying average tax rates of 6.4% to 8.3%. This is more or less in line with the MN sales tax of just under 7%.

A temporary regulation fee is currently being charged by both DoorDash and Uber. Many cities across the US, including Minneapolis, have capped service fees at 15% during the pandemic over concerns food delivery platforms are overcharging consumers. It appears DoorDash and Uber Eats are finding a way to mitigate this change. In the case of DoorDash, a $1.50 fee on a $22 meal base price is an extra 7% in fees. While we won’t speculate in depth on the legality of this apparent workaround, it at the very least suggests food delivery is a Wild West as it relates to regulation.

Putting it together, the average TMP premium ranged from 41% on Grubhub to 58% on DoorDash.

Importantly, our exercise does not include tips, which are set to 15%-25% by default. While consumers can opt out, our belief is that tipping is the norm. Adding insult to injury, gratuity is calculated from the total order price, which includes the above list of fees.

There’s little price consistency

Apart from the initial markup, which remained fairly consistent, we noticed a lack of fee consistency across delivery apps. While in aggregate the service fee was ~15% for each platform, within our sample of ten orders it varied from 10% to 19% depending on the individual restaurant (Uber Eats was the exception, charging 15% for all restaurants). For example, McDonald’s carried a 10% fee on both DoorDash and Grubhub, while Taco Bell carried a 19% fee on DoorDash but a 17% fee on Grubhub. Delivery platforms say their service fees are determined on a restaurant-by-restaurant basis, and we believe there is some pricing power for top brands.

Average delivery fees ranged from $1.59 on Grubhub to $3.09 on Uber Eats. We believe this variability is in part attributable to driver availability on each platform. The average tax was meaningfully higher on Grubhub compared to DoorDash and Uber Eats. While taxes are not our focus area, it appears there’s some flexibility in what platforms can charge beyond the standard Minnesota sales tax.

Time is money

In terms of cost of delivery, we found the markups to be egregious. That said, with food delivery, consumers are buying time. All said and done, we estimate it typically takes 30 minutes to drive and pick up a meal. Factoring in a 50% delivery premium on a $20 order means the customer is valuing their leisure time at $20/hour, and typically people value this higher than their work time. In other words, delivery is expensive and worth it for “time is money” consumers.

Delivery memberships only make sense for power users

Each of the delivery platforms offers a monthly membership:

- DashPass: $9.99/month for no delivery fees on order subtotals over $12 from eligible restaurants.

- Grubhub+: $9.99/month for no delivery fees on order subtotals over $12 from eligible restaurants.

- Uber Eats Pass: $9.99/month for no delivery fees and 5% off food orders over $15 from eligible restaurants.

While these memberships are advertised as providing “free delivery,” that’s deceptive. First, setting the minimum subtotal at $12 means many consumers likely add items to their orders simply to qualify for free delivery – a single customer ordering two Big Macs from McDonald’s or a chicken bowl from Chipotle won’t qualify for free delivery. And while memberships remove delivery fees, they still leave the initial markup, service and regulation fees, and gratuity.

Assuming an average delivery fee of $2.50 per order, subscribers must place at least five orders a month for it to make economic sense. Despite the high payoff threshold, DoorDash disclosed late last year that about 27% of its user base subscribes to DashPass. Under its current pricing, we find it hard to envision subscription adoption reaching 50%. Our prediction may be viewed as bearish given the success of Amazon Prime, which enjoys greater than 85% US household adoption.

What it would take to make DashPass the next Prime

Apart from the reliability and speed of package delivery, the magic of Prime is twofold: first, an expansive selection of Prime-eligible items, and second, no purchase minimum to qualify for free shipping on said Prime items. In plain English, this means you can buy anything from an iPhone charger to a bag of coffee to a single pack of envelopes for less than $8 and get free shipping.

For food delivery memberships to enjoy similar adoption rates as Prime, we believe four things are necessary:

- The universe of deliverable items expands to include things like convenience store items, alcohol, and basic household essentials. A larger selection of deliverable items means occasional users become regular users, increasing the value proposition of a monthly subscription.

- $5 or less minimum purchase order to qualify for free delivery on said items. This will lead to a wider range of possible orders, such as single item deliveries, that make sense from a consumer price standpoint.

- Priority delivery for members that reduces average wait times from 30-60 minutes currently, to 15-20 minutes. Shorter wait times increase convenience, and in turn, demand.

- Service and regulation fees are eliminated or materially reduced. At this point, a delivery membership shifts from a luxury service to a utility service.

In the end, food delivery is here to stay, but to achieve Amazon Prime-like adoption material changes need to be made.