For two years we’ve been cautious on Facebook, in part based on our view that social media is largely toxic and because the company’s innovation has lagged. Some of this has come to fruition, evidenced by FB’s 21% gain over the past year compared to a 43% return for the Nasdaq. Our long-term view is unchanged. That said, our 2021 outlook is becoming more positive given a combination of factors, including continued growth in engagement numbers, an expectation that Street estimates inch higher, and inevitable clarity around regulation.

Facebook properties are addictive

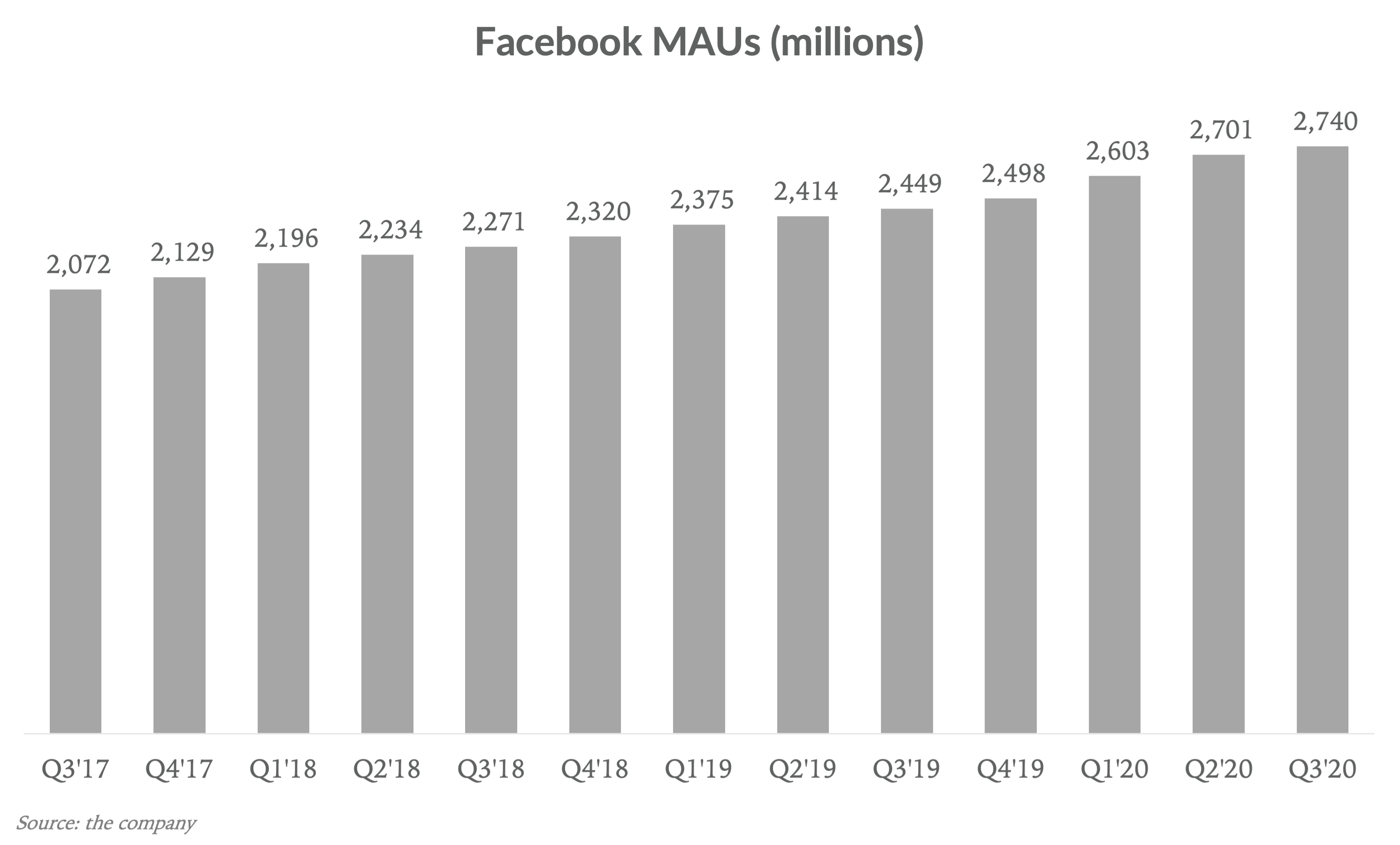

People are addicted to Facebook. In the Sep-20 quarter, more than 2.7B people used Facebook at least once a month, with 66% of those being daily users. As a point of perspective, globally, there are roughly 5B internet users, implying about 55% of the world’s internet population uses Facebook once a month, and that number continues to grow.

MAU growth has stepped up during the pandemic. The company saw 11% growth through the first three quarters of 2020, compared to 8% over the preceding four quarters in 2019. The MAU numbers confirm Facebook is addictive, as user growth continues despite a barrage of negative headlines over the past three years, including Cambridge Analytica, privacy changes covered under GDPR, changes to how the company tracks users which diminishes the platform’s ad targeting ability, and brand impact from antitrust lawsuits.

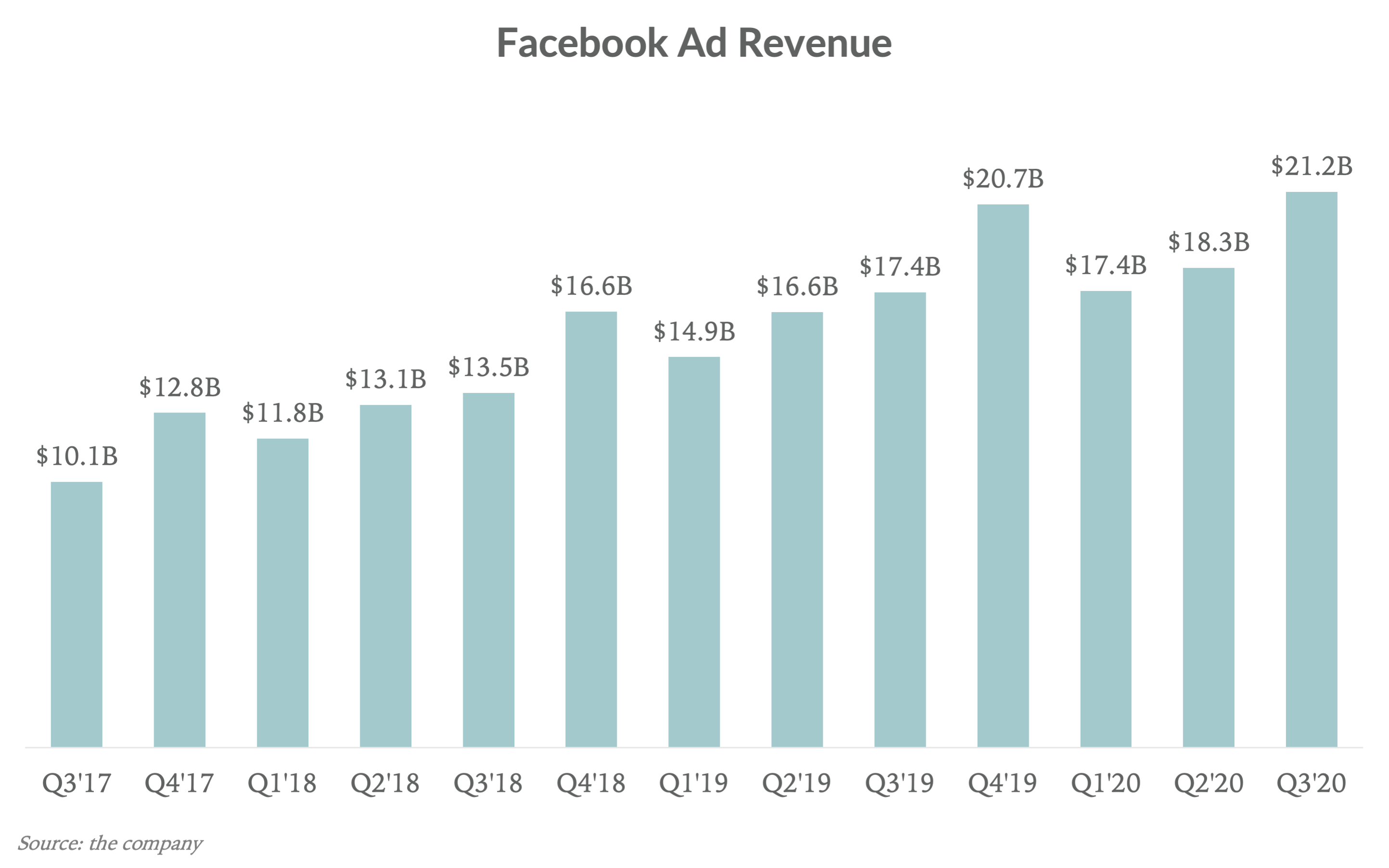

Advertisers are hooked as well. The most remarkable part about the advertising growth is advertisers’ willingness to forgive Facebook for what some view as missteps. Most recently, civil unrest in summer 2020 led to an advertiser boycott that lasted for at most, a couple of months.

The case for near-term upside

The Street is forecasting 25% revenue growth in 2021, which would put the company on a similar growth trajectory as before the pandemic. We believe this 25% growth expectation is conservative, given the first two quarters of 2021 have easy comps, as advertising growth slowed to 17% and 10% in the first two quarters of 2020. In other words, there’s a higher probability that Facebook exceeds these numbers, which would likely have a positive impact on the stock.

Regulation is inevitable, clarity a likely positive

Facebook faces regulatory challenges on two fronts, antitrust and Section 230, which will likely take years to fully resolve. Our view is that some regulation is a certainty, given President Biden’s stance toward tech companies and more recent comments from Biden cabinet members. While we view regulation as a near certainty, it’s difficult to predict what form it will take.

As for antitrust, the likely outcome is that M&A becomes more difficult. While Facebook has unprecedented network effects approaching 3B monthly users, network dilution is possible with upstarts like TikTok.

Section 230 is of course the central topic related to social media and free speech. Surprisingly, there’s a predictable path in how this plays out, and odds are it will be positive for Facebook. While the substance of any regulation matters for providing direction to how the world uses social media, from a business perspective, the content of the regulation matters less than the clarity a resolution would bring. Simply put, the Facebook-Section 230 story will have three chapters: investor concern related to what the regulation will be, followed by specifics on the regulation, and lastly, relief from investors that there’s finally clarity. In the end, Facebook will have to spend more money to monitor content, and consumers and advertisers will continue to support the platform.

The innovation concern remains

Eventually, Facebook will need to return to innovation to yield share outperformance. We’ve long speculated that FB’s earnings multiple will be pressured over time as investors increasingly value more innovative companies. Giving credit where it’s due, Facebook was innovative with social, followed by brilliant acquisitions that leveraged the company’s founding insight. The power of the platform is undeniable. That said, about every decade we believe companies need to reinvent themselves to address large new markets and satisfy investors for the long term. In the future, we believe AR and VR will transform how we communicate, and see Facebook’s Reality Labs as the company’s most potent and underappreciated innovation opportunity.