iRobot is the leading manufacturer of robotic vacuums and wet floor products in the world. Based on holiday pricing trends we believe the company sold more robots than expected in the Dec-17 quarter. In addition, we believe the domestic robot market is one of the fastest growing robotic segments, and given iRobot’s positioning and premium tech, we expect the company to sustain 20%+ revenue growth in 2018. While increased competition has been a growing threat to iRobot’s market share in recent quarters we believe these threats are overblown and believe the company is in position to outperform current expectations over the next year.

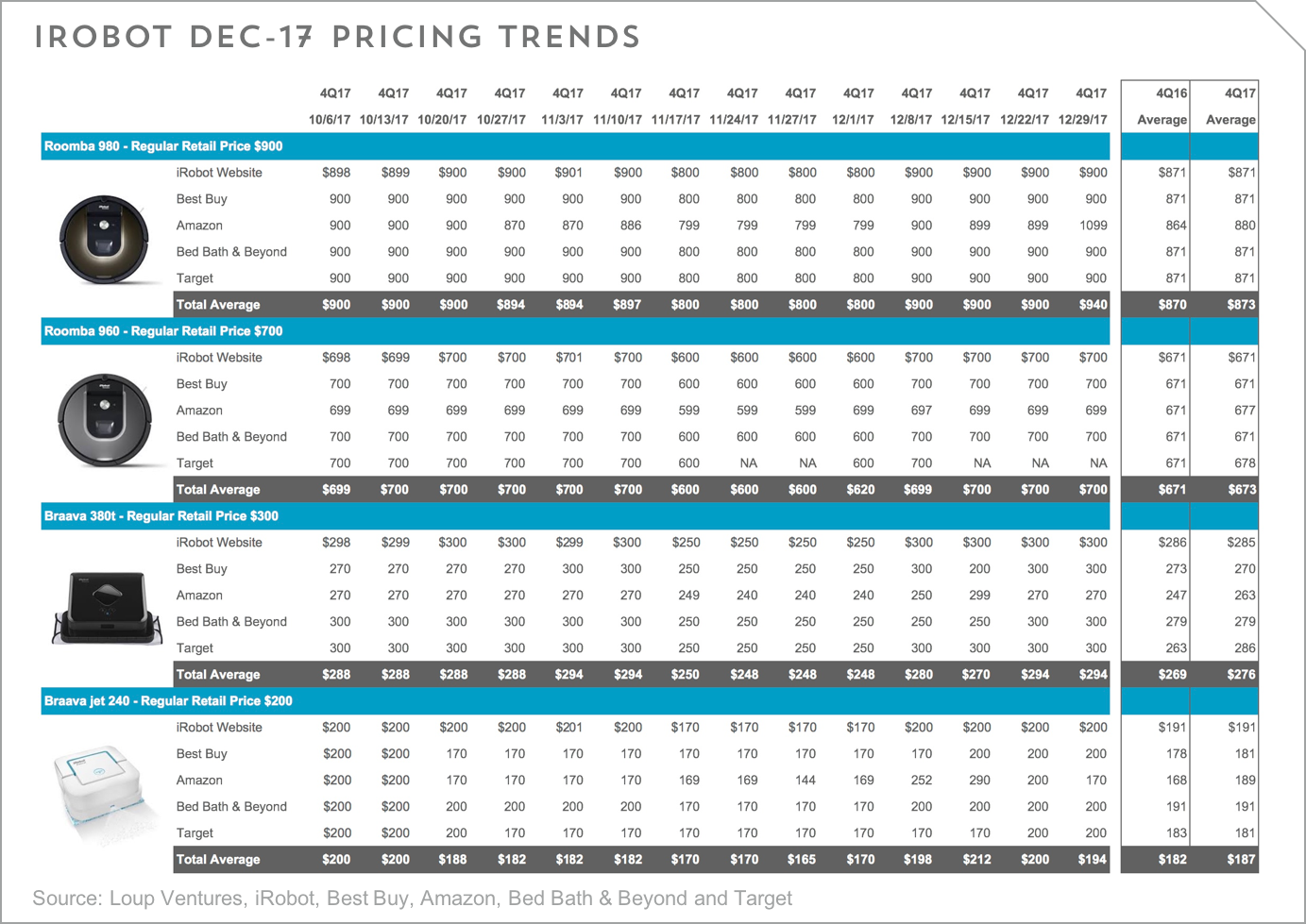

Strong Pricing Trends Across Entire Portfolio. Over the last 3 years, we have tracked iRobot pricing across the company’s 4 larger US distributors (Best Buy, Amazon, Bed Bath & Beyond and Target) on every Friday in the quarter. While pricing is not a perfect indicator to demand trends, price discounting has historically had a solid correlation to iRobot’s quarterly results. As displayed in the chart below, the company experienced on average higher pricing across all products we track (Roomba 980, Roomba 960, Braava 380T and Braava Jet) in the Dec-17 quarter than they did in the Dec-16 quarter. We find this encouraging because we felt pricing last holiday season was strong, which translated into the company beating Dec-16 Street revenue expectations by ~$6M (or 3%), and EPS by $0.08 (or 20%). Given these strong pricing data points, coupled with Management’s history of providing conservative guidance we expect the company to once again exceed Dec-17 Street estimates.

While pricing remained similar Y/Y at Best Buy, Bed Bath & Beyond, and Target in Dec-17 quarter, we would like to highlight prices on Amazon increased over regular retail price regularly throughout the quarter. Given Amazon’s pricing strategy is based more on supply and demand trends, we believe above regular retail pricing late in the Dec-17 quarter is the strongest sign of demand.

Expect Solid 2018 Guidance, but Likely Conservative Although we expect iRobot to beat Dec-17 Street estimates, the key number investors will focus on is how the company guides for 2018. Despite concerns about increased competition, the domestic robot market is inflecting, and given the most penetrated robotics vacuum market in the world (the U.S.) is less than 10%, we believe there is plenty of room to run both domestically and internationally. The Street is currently expecting iRobot to guide 2018 revenues to ~$1.0B, which implies ~16% Y/Y growth. iRobot has experienced 3 consecutive quarters of 20%+ growth and is on pace to grow over 30% in CY17. In addition, we anticipate the robotic vacuum market to grow 26% Y/Y in 2018. (Link to domestic macro model here.) Given the current market dynamics and iRobot’s market positioning, we believe Street numbers are conservative. However, given Management’s history of consistently beating expectations, we wouldn’t be surprised if the company guides in-line to modestly above consensus, but expect multiple beat and raise quarters throughout the year.

Robot Lawnmower Positive 2018 Catalyst. While iRobot continues to not provide any color on when they will release a lawnmower, we continue to believe it is likely they will introduce a robot lawnmower in 2018. However, most importantly this a “when” not an “if”, they will introduce a robotic lawnmower. We’re modeling for the lawn mower to launch in Mar-18 (and account for 5% of revenue in the Jun-18 quarter) and account for 8% of 2020 revenue. The Street is not modeling the lawn mower.

Model Adjustments. Given the expectation for better than expected demand in the Dec-17 quarter, we are raising our revenue estimates to the high-end of the company’s 2017 guidance ($870 – 880M vs cons $875M). We are leaving our 2018 estimates largely unchanged, but would like to note our current estimates of $1.1B are above consensus ($1.0B) due to our model factoring in ~$60M in lawnmower revenue. Assuming the lawnmower gets pushed out till 2019, we still believe iRobot can grow ~23% Y/Y. Link to model here.

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.