We recently surveyed 500 US consumers about their intent to purchase and perception of electric vehicles. The results, on the whole, show a lower-than-expected excitement level about EVs and the persistence of common misconceptions about owning EVs.

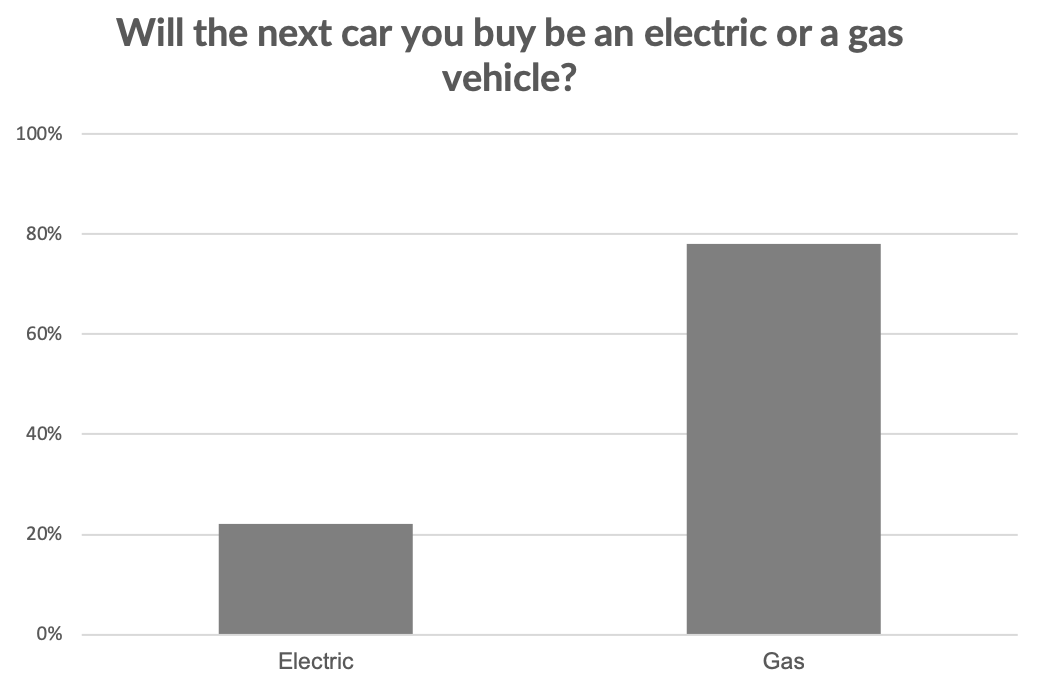

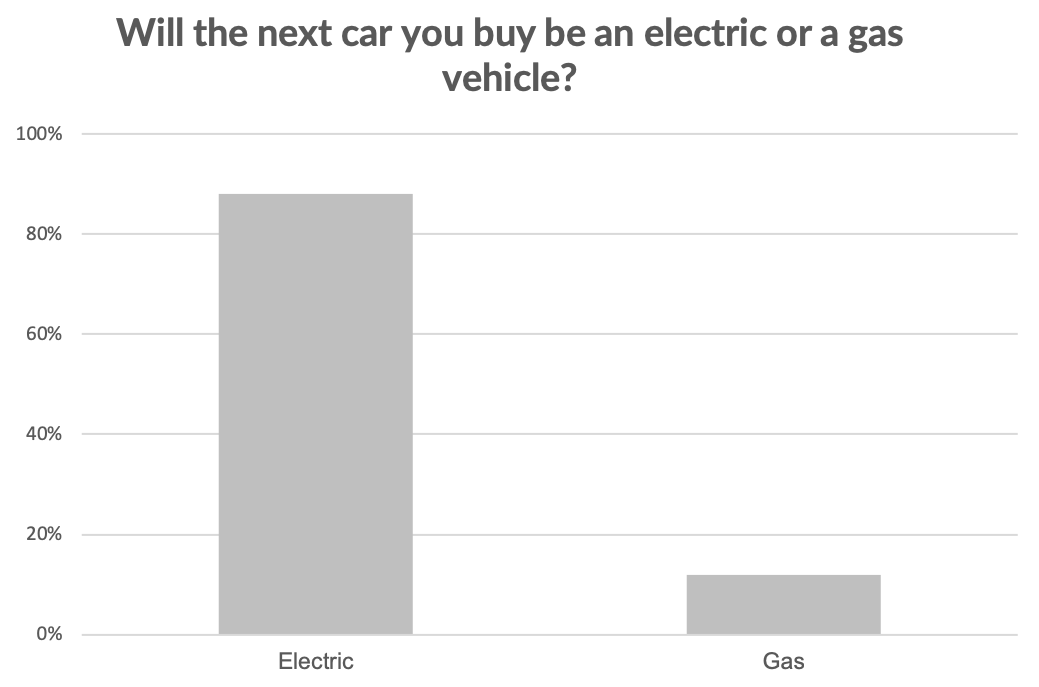

78% of consumers said the next car they purchase will be a gas car; 22% plan to buy an electric car. 59% of respondents indicated that they plan to buy a new car in the next 3 years.

If EVs represented 22% of new vehicle sales in the next several years that would be a steep adoption curve. However, there is always a difference between expressing intent on a survey and actual purchases. Eventually, we will have comparable data to track changes in consumer sentiment, but this is our first ever survey on the topic.

As a baseline, when it comes to consumer perception, there is a long way to go until EVs are mainstream.

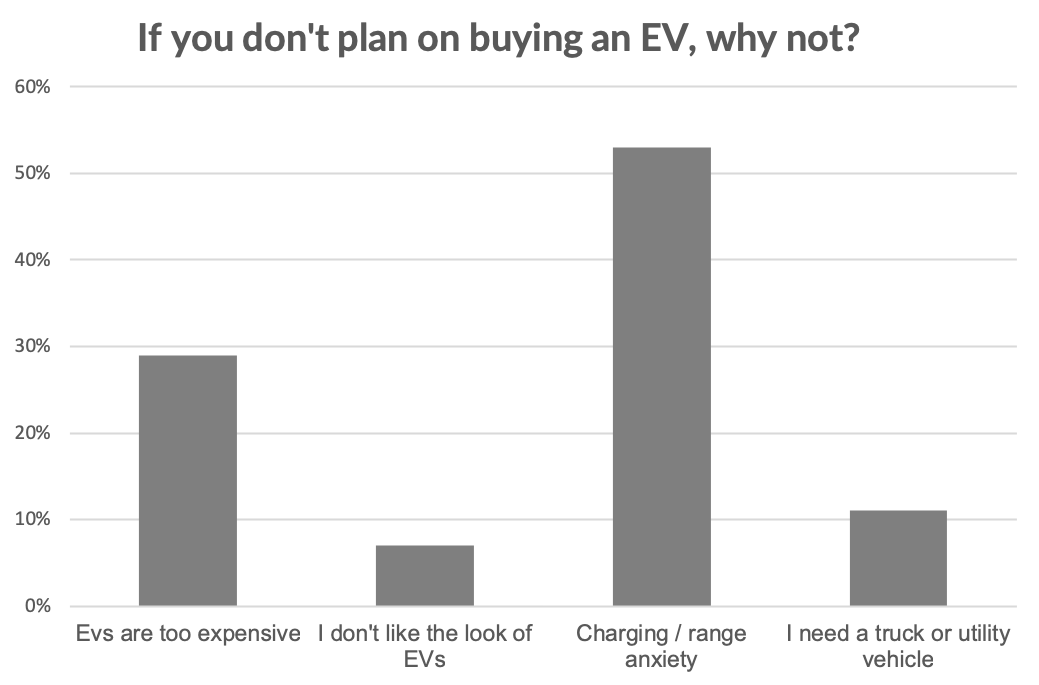

We asked about the reasons behind why respondents plan to buy a gas car.

The most common answer was anxiety related to range and where to charge the vehicle. See more on the topic here. Another 30% of respondents said that EVs are simply too expensive. Range anxiety and charging infrastructure are issues of perception that will fade with growing adoption, but price is still a major hurdle.

While we measure the rate of adoption by new car sales (or the % of new car buyers that choose electric), we see the true inflection point for EV adoption coming when a viable used car market emerges. The used car market is over twice the size of the new car market.

Although the entry-level Model 3 costs about the same as the average new car sold in the US and there are several cheaper EV options, an outlay of over $30k is simply too much for most people. It will still be several years until a robust used market for EVs brings in buyers that would like to drive an EV, but won’t buy a new car. Note that EVs require less maintenance, have a longer useful life, and hold their value better, so we are bullish long-term on the used EV market.

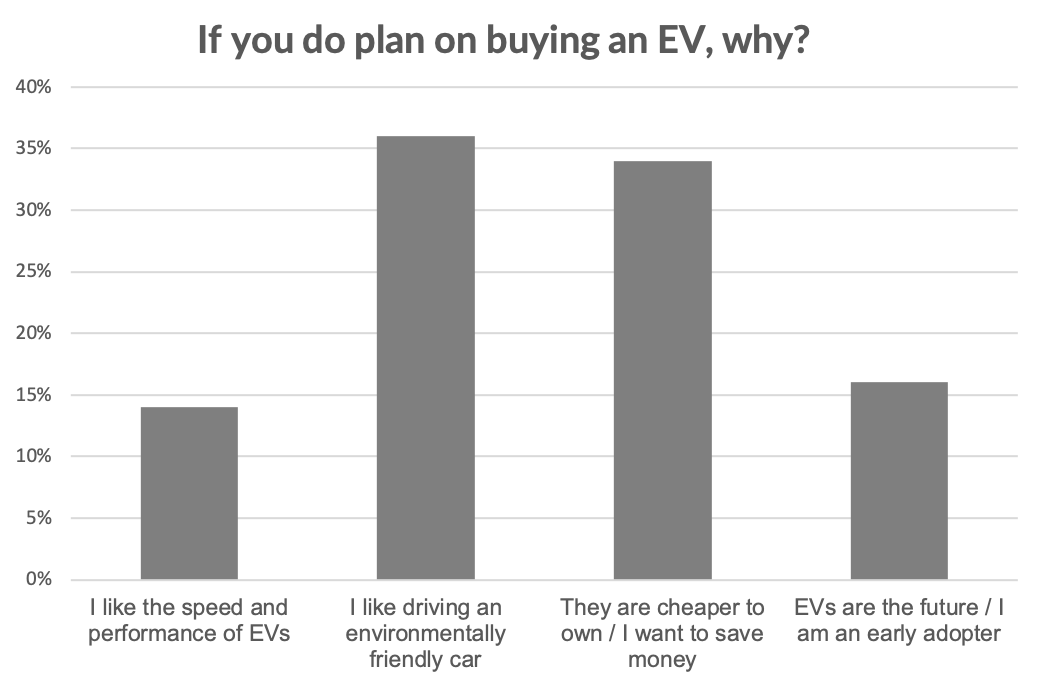

We also asked why respondents plan to buy an EV. Answers were split mostly among cost of ownership savings (contrary to answers above) and the desire to drive an environmentally friendly car.

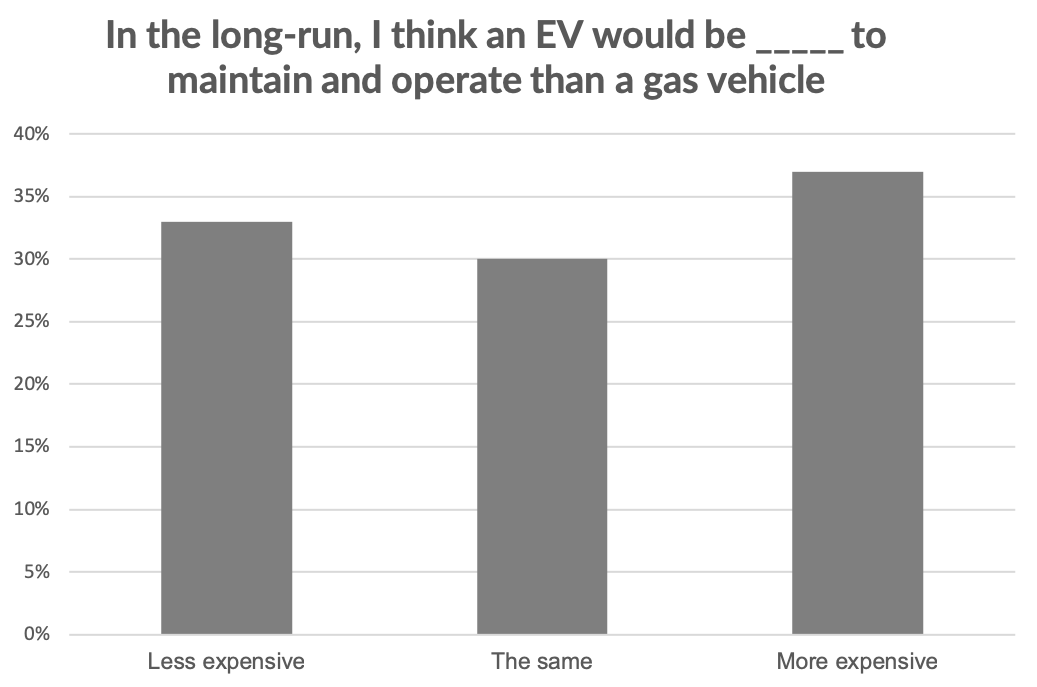

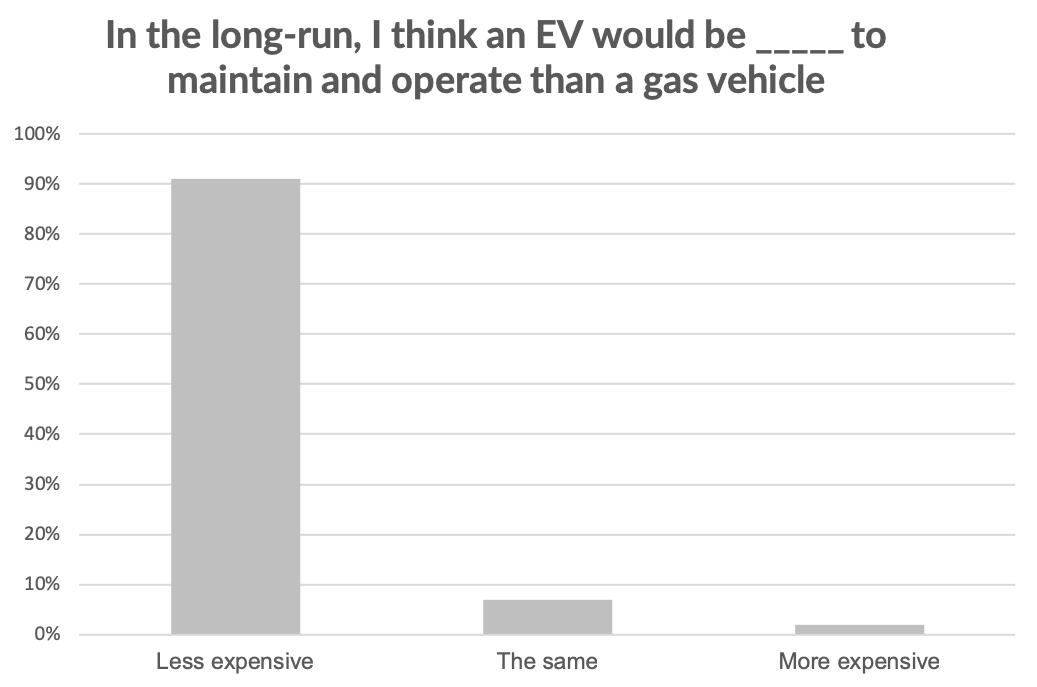

When asked about the perceived cost of ownership of EVs, the lack of consumer awareness becomes clear. We recently did a study that showed the 5-year cost to own a Tesla Model 3 is cheaper than that of a Toyota Camry. While answers were split nearly evenly, the majority of consumers believe that maintaining and operating EVs is more expensive than gas cars.

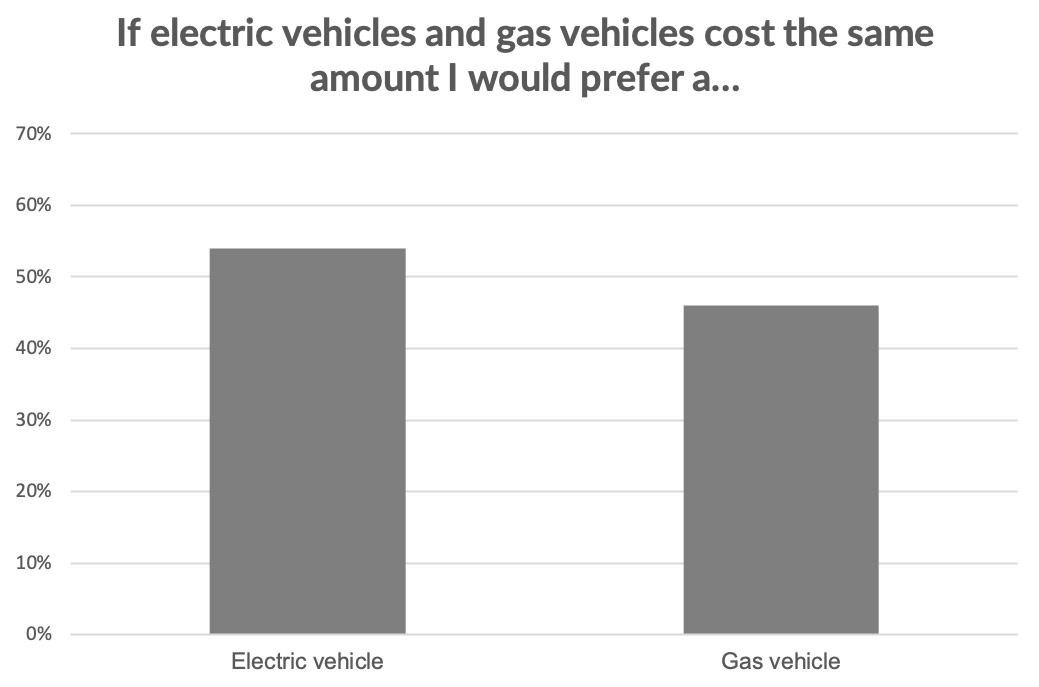

Surprisingly, even if the cost issue is eliminated, many consumers still prefer gas cars. This is hard to understand at first glance but shows just how cemented car culture is in society and how long it will take for all of them to be converted to electric drivetrains.

We also posted the same survey on our twitter page, which has a following that is skewed toward Tesla owners and investors, tech enthusiasts, and futurists. The responses from this audience (only 113 respondents) were drastically different from the general population and highlight the perception issues that EVs face.

For example, when asked if the next car they purchase will be gas or electric, the chart completely flips, with 88% of respondents planning to buy EVs.

Our followers also believe EVs are cheaper to own and operate than gas cars. Further, if both EVs and gas cars cost the same, 98% would prefer an EV.

While these two audiences may not perfectly represent the “uninformed” and the “informed” consumer with respect to EVs, these discrepancies illustrate the perception hurdle in front of the mass adoption of EVs. For that to happen, range needs to improve, charging infrastructure needs to expand, cost needs to come down, a robust used market needs to develop, and consumer perception needs to shift in favor of electric vehicles.