The Deepwater Frontier Tech Index aims to provide investors with exposure to themes that we will be talking about in 3-5 years. Go deeper.

Performance Update:

2023 was a year of strong performance in frontier technology. The Deepwater Frontier Tech Index outperformed the Nasdaq Composite, despite not owning names in excess of $500 billion in market cap. Some of the leading contributors to performance were CrowdStrike, AMD, and Vertiv. It’s no surprise that AI led the way.

The Inevitability of an AI Bubble

Investing is a game of exercising patience until you see a fat pitch. You might only see a few great pitches in a career. Sometimes you don’t realize you’ve been waiting for a pitch until it’s screaming at you.

In Q4, we realized with great clarity that the big AI pitch is coming at us, and it’s time to swing.

Seeing “AI” might cause some eye rolls. AI is obvious. Everyone’s talking about it. Shares of Nvidia and Meta were up 200% last year on AI excitement. Surely that game is over.

We don’t think the AI boom is over. Far from it. It’s only just begun. We believe we’re in 1995 of a technological revolution that will culminate in a bubble bigger than the Dotcom boom of 2000.

Here are a few reasons why:

- CSCO traded at ~100x forward earnings near its peak in 2000. NVDA trades at 24.6x forward today (FactSet).

- The Nasdaq traded at ~100x forward earnings near its peak in 2000. The QQQ trades at 25.1x forward today (FactSet).

- An index of AI companies Doug tracks, the AI Average, trades at 48.6x forward earnings today vs the Nasdaq, again, over 100x in 2000.

- OpenAI isn’t that expensive. At its rumored $86 billion tender value, OpenAI trades at 27x forward sales (our estimate) growing > 200%. CRWD and SNOW trade at > 15x forward sales growing around 30%.

- The markets are not awash with SPACs, NFTs, or product-less AI companies doing IPOs.

There is growing excitement about AI, but megacap tech trading at modestly elevated multiples does not a bubble make.

Bubbles are a necessary and unavoidable part of paradigm-shifting new technologies.

Electricity, railroads, automobiles, and the internet all brought various levels of bubble. The reason technological revolutions need bubbles is because bubbles guarantee more than sufficient capital available for every idea tied to the new technology, ideas good and bad. The maximization of trying all ideas increases the odds that the new technology meets its promise rather than fizzles due to starvation of resources.

A quote from Engines that Move Markets, a book about bubbles, has guided our thinking regarding AI:

A striking feature of each chapter is the fact that while the patterns have not been identical in each case, they have been very similar. First, a new invention is greeted with scepticism from incumbent technology and potential new investors. That scepticism is gradually replaced with enthusiasm, as businessmen come to appreciate the sales potential of the new technology. Soon, new entrants are flocking to the market, and venture capital funding is made available. Companies are started; almost all do well (in terms of share price) in the market on a tidal wave of enthusiasm. So far, so good; but as the technology begins to mature, a sense of realism sets in. Inevitably, for some, cash runs out. Companies begin to fold, only the strong survive and naive investors lose money in the huge rationalisation. Pessimism begins to pervade the marketplace and stock prices fall across the board. Eventually, the market stabilises.

The same pattern occurred with the development of the railroads, electric light, oil, the telephone, the automobile, the radio, the semiconductor.

Given that AI is potentially our greatest innovation yet, and the world is more interconnected than ever before, everyone is paying attention to the rapidly evolving promise of AI. It is logical that AI should create the biggest bubble yet.

Before we go any further, let’s address the bubble in the room.

“Bubble” tends to conjure two responses when people hear it:

- How can I get rich quick from the bubble?

- I can’t wait for the bubble to pop because it’s not real.

Neither response is optimal from an investment mindset.

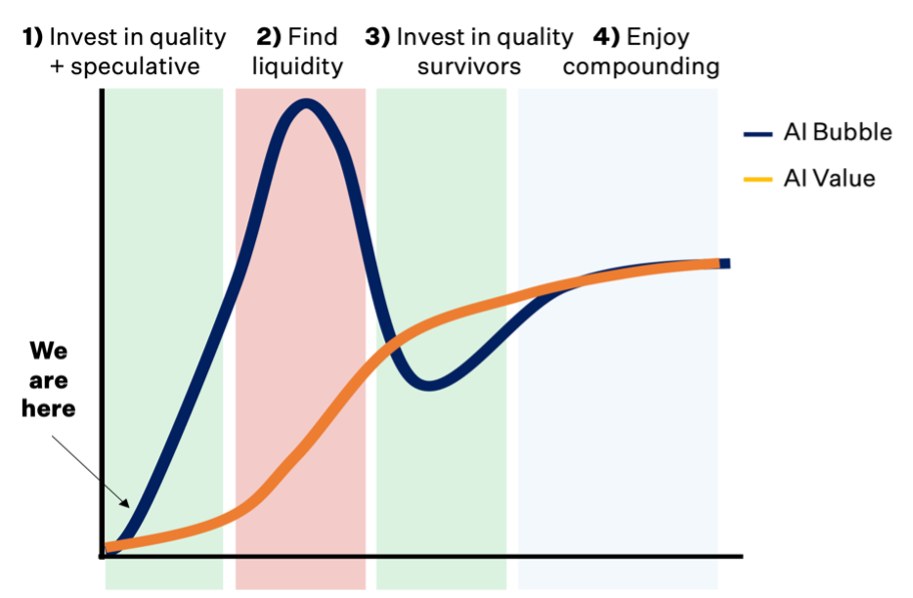

The bubble will create vast paper riches, much of which will evaporate in the inevitable crash and return to sanity. Naysayers and skeptics will be right about the bubble popping, but they never make any real money. They have one good year being short and then go back to underperforming the markets because they miss the recovery.

Real riches are only available to those who can play both sides: optimist and realist.

The smart bubble investor should participate in the coming boom by buying high-quality, thoughtful equity exposure. Then the smart bubble investor must keep his head when the world goes insane and enjoy the liquidity offered when everyone wants in.

That’s not all.

The smart bubble investor must then prepare to buy the best companies that get unduly punished in the crash and hold them as the compound into the new era of technology.

That’s the universal bubble playbook. AI will be no different.

What is Deepwater doing about it?

We have a simple playbook we’ve been executing: Build exposure to high-quality AI winners with strong fundamentals and a strong AI story that will resonate with investors and speculators alike.

While AI is one of the five categories of frontier tech that our index aims to provide exposure to, we believe it’s the most important.

Throughout 2023, we’ve added AI winners to the Deepwater Frontier Tech Index, including Arista Networks, Adobe, Marvell, Vertiv, Smartsheet, Palo Alto Networks, and Confluent.

The greatest challenge on the public market side is finding quality AI exposure outside of the megacap companies. It’s particularly challenging to find quality AI exposure under $10 billion in the public markets.

The issue isn’t that we can’t find companies that tell an AI story, it’s that we don’t think many of them are real AI companies, nor do they have winning solutions relative to either the megacap companies or private competitors. So far, we’ve only added two AI companies to the index with a market cap under $10 billion, Smartsheet and Confluent.

There are two major risks to our AI bubble thesis and playbook:

- An AI bubble never forms.

- Incorrectly timing entry, exit, and re-entry.

It is possible an AI bubble never forms.

The strongest argument for avoiding a bubble is that we just lived through the Everything Bubble of 2021 fueled by government stimulus and pandemic madness. The memory from that bubble is still vivid, so maybe AI is the first technological revolution where the market maintains sanity.

Because of the recent memory of the Everything Bubble, it also feels there’s a heightened awareness and belief in an AI bubble, at least in popular media. However, many investors we’ve spoken to have mentioned fresh memories of the Everything Bubble of SPACs and crypto and late-stage venture, and they’re hesitant to jump back into another boom. Even if there’s an awareness of the AI bubble potential, there isn’t yet manic participation.

That’s exactly the setup that creates bubbles.

Hesitation and doubt mean investors sit on the sidelines. It is investors on the sidelines who suddenly rush into the game en masse that create booms and bubbles.

Regarding AI, the transformational technology is there. The next great companies are being formed now. The ingredients to a bubble, including skepticism, are there too.

The bigger risk is overthinking the bubble. The AI story will only grow from here. Capital will chase. The bubble will form, it will be big, and we will all want to benefit from it.

The timing question is more difficult.

If we’re too early, we risk holding assets that may underperform the market for a short time. Being early also invites the short-term pain of temporary corrections in the process of a building bubble. Those corrections invite doubt and encourage bailing out exactly when we shouldn’t.

If we’re too late, we miss the biggest gains.

We might be early, but we’re certainly not too late. The time is now.

How Can I Invest in the Index?

Deepwater partners with Innovator ETFs to offer the NYSE-listed Innovator Deepwater Frontier Tech ETF. The ticker is LOUP.

To learn more about how to invest, visit the Innovator website.