Every 25 years there’s a paradigm shift in retail. The last was ecommerce in 2000, preceded by bigbox retailers in the 80s, and shopping malls in the 50s. We believe retail is on the cusp of its next paradigm shift: commerce at home. Specifically, experiential commerce at home. While retail giants such as Amazon, Walmart and Apple have succeeded with various retail models, the experiential commerce at home opportunity has yet to be cracked.

This is the third installment in a multi-part series rethinking retail, which is based on three premises:

- Ecommerce is just commerce at home. Today, almost all retail transactions involve some digital elements. Shopping now happens on a spectrum between the store and home (e.g., ordering online for in-store pickup). As such, the term ecommerce no longer serves us. What we think of as ecommerce today is better understood as commerce at home. Read more in part 1: Rethinking Ecommerce as Commerce at Home.

- All great retailers focus on convenience or the experiential. Retail succeeds at either end of the spectrum between convenience (speed, selection, self-service) and the experiential (personalized, curated, high-touch). Either can be a great experience. Convenience retailers deliver a great experience by ruthlessly eliminating the need for human interaction. Experiential retailers emphasize human interaction, consultation, and support. Read more in part 2: Convenience vs. the Experiential.

- There is an open opportunity in experiential commerce at home. These two spectrums, store-based vs. commerce at home, and convenience vs. experiential retail, set up a four-box paradigm to consider. Walmart was a pioneer and long-term winner in store-based convenience retail; Amazon delivers that same convenience at home. Apple reinvented experiential retail with services like the Genius Bar, but has struggled to bring that same experience to the home. Conversely, Amazon has established new norms for speed, selection and convince, but has struggled with attempts at the experiential (e.g., TV mounting). This leaves an open opportunity in experiential commerce at home.

We’re investors in Enjoy, a technology company that partners with premium brands, including Apple, to offer a high-touch retail experience in the comfort of home. Think of it as all the best elements of a store coming to you. Enjoy is a pure play on experiential commerce at home.

The company is going public via a SPAC with Marquee Raine Acquisition Corp, valuing Enjoy at an enterprise value of $1.2B. We see fair valuation two years from now closer to $2.8B. Read more about Enjoy’s plans to go public in the company’s blog post.

Enjoy is a pure play on experiential retail at home

We believe that Enjoy is one of a few companies well-positioned to capitalize on experiential commerce at home. The company’s founder and CEO is Ron Johnson, the former head of retail at Apple who founded the Apple store, including the concept of the Genius Bar.

It’s no coincidence that brands like Peloton, Carvana, Tesla, and Apple are excelling at experiential retail at home. Premium brands seek to deliver a premium experience, because that’s what their customers want. Enjoy is a pure play on the theme, unlocking that opportunity for premium retailers at scale, driving customer engagement, increasing customer satisfaction, pushing average order values higher with accessories, and ultimately increasing a customer’s lifetime value. Eventually, we believe all premium brands will offer an in-home experiential commerce strategy, which we believe could eventually account for up to a third of these brands’ revenues.

Our opinion on valuation

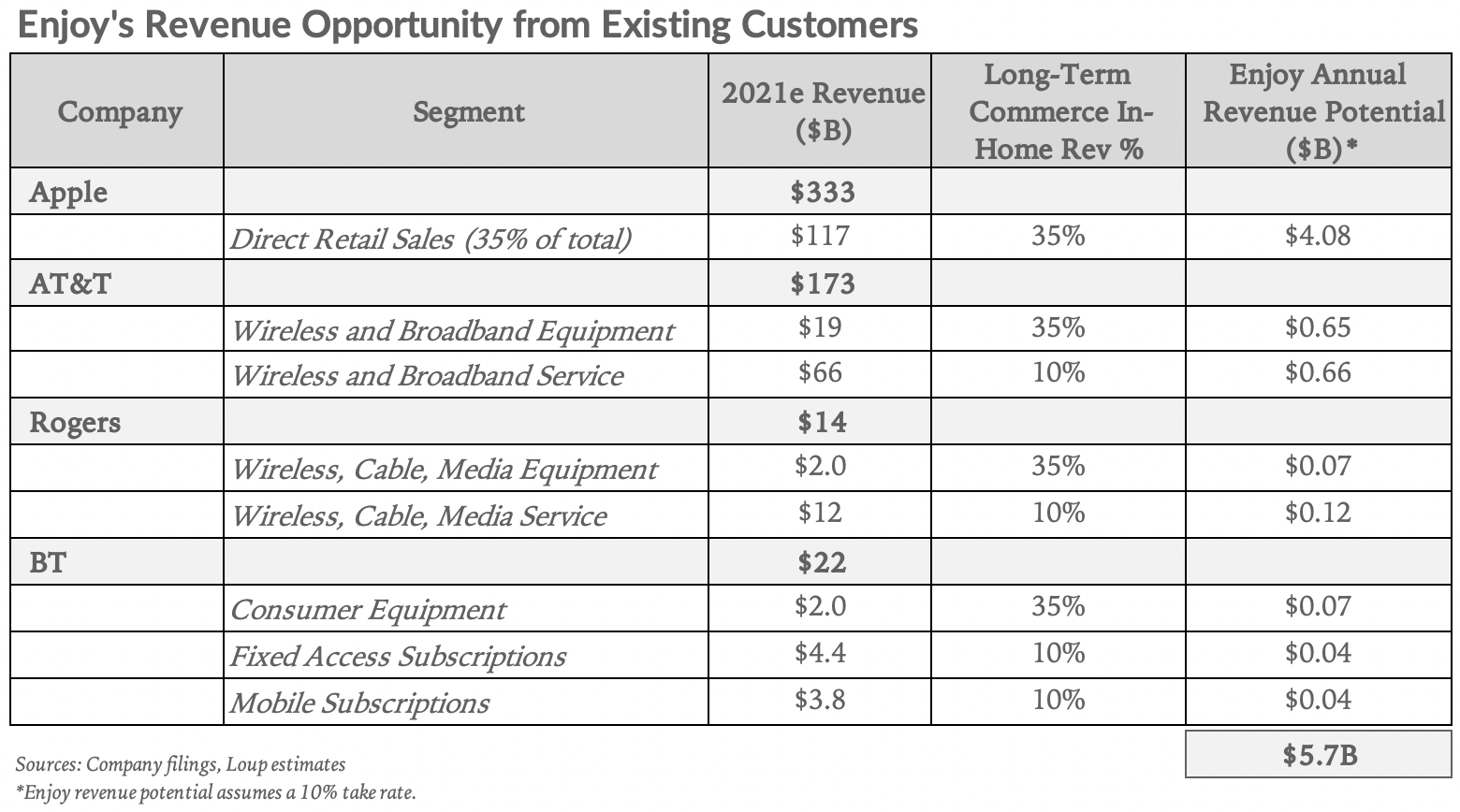

We estimate Enjoy’s addressable revenue opportunity from its four existing customers to be $5.7B annually, 90x greater than the company’s 2020 revenue of $64m. Further, the company has an uncapped opportunity to help new partners bring their premium store-based experience into the home.

As mentioned, Enjoy is going public via SPAC and is currently trading under the ticker MRAC. The company projects revenue will grow from about $100m this year to $1B in 2025. We believe these revenue growth targets are achievable based on the following factors:

- Size of current and potential customers

- Indoor visits return as vaccinations become widespread. Enjoy experts going through the door increases revenue per visit.

- Live catalog feature which allows customers to live shop Enjoy inventory.

- Cross-selling from other partners.

- International expansion starting in 2023.

- Commerce at home growth trend.

In our opinion, fair valuation today should apply a 5.6x revenue multiple on 2022 sales estimates, which yields a $1.4B valuation, versus Enjoy’s current $1.2B valuation. Looking out two years from now, valuation will likely be based on 2024 revenue estimates, which should be around $700m. Applying a 4x revenue multiple to 2024 sales, which is more conservative than the current comp group’s multiple, yields a $2.8B valuation (more on comp groups below).

The pandemic impact

Enjoy’s revenue grew at 23% in 2020. We view that growth as a positive given the company’s core value, in-home visits, declined dramatically last year. In 2020, about 15% of visits went through the door, compared to 90% in the last quarter of 2019. The drop in in-home visits reduces opportunities for experts to recommend accessories and add-on services.

The Enjoy experience

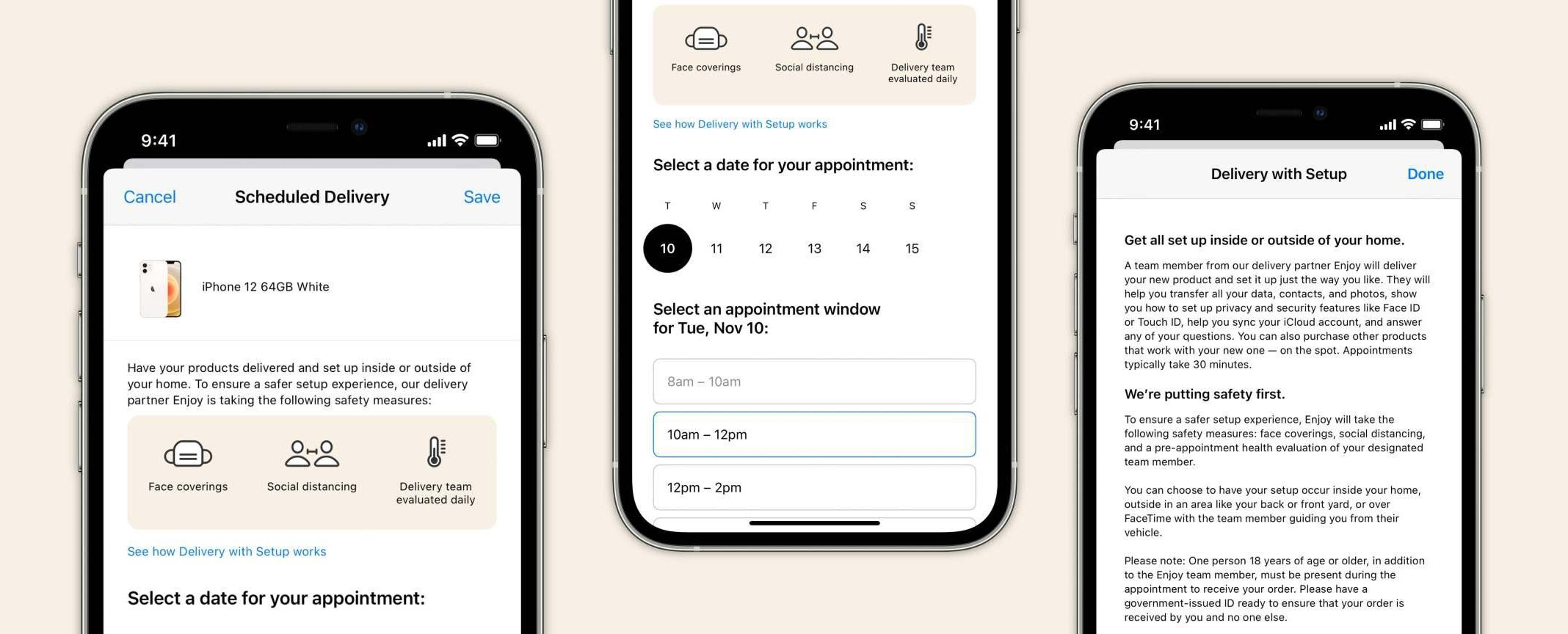

Online shoppers first encounter Enjoy as a delivery and setup option during the checkout process. In the future, we expect awareness to grow as brands advertise the Enjoy experience directly to their customers. With Enjoy, these brands bring their full retail experience into the home – a third leg to their retail approach, alongside online and physical stores.

Enjoy manages the entire delivery infrastructure, including order-fulfillment, warehousing, and last-mile delivery through its technology stack. Enjoy also hires and trains experts to provide a high-touch, personalized retail experience in the home. The company has operations in the US, Canada and the UK, with an opportunity to expand into western Europe and Asia.

Here’s how the Enjoy experience works:

- A customer places an order from an Enjoy partner and selects delivery with setup at checkout.

- After selecting a delivery time, typically in less than 24 hours, an Enjoy expert hand delivers the product to the customer’s home, sets up the device, suggests accessories, and helps with any technical questions. The Enjoy shopping experience takes about 30 minutes — significantly less than driving to the store for a similar purchase.

All said and done, Enjoy unlocks multiple experiential retail elements at home, including delivery, setup, activation and demo of devices, and trade-ins, along with on-the-spot shopping for other accessories and add-on services. While other companies address certain aspects of Enjoy’s business, such as delivery, no one bundles them into a premium, high-touch, at home retail experience.

Enjoy’s existing customers

Today, Enjoy is partnered with four retailers, each a category leader in their respective markets:

- Apple – US market share leader in mobile devices.

- AT&T – US telco market share leader by revenue.

- BT/EE – British telco and market share leader in total subscribers.

- Rogers – Canadian telco and market share leader in wireless service.

Brands leverage the Enjoy experience to increase customer satisfaction

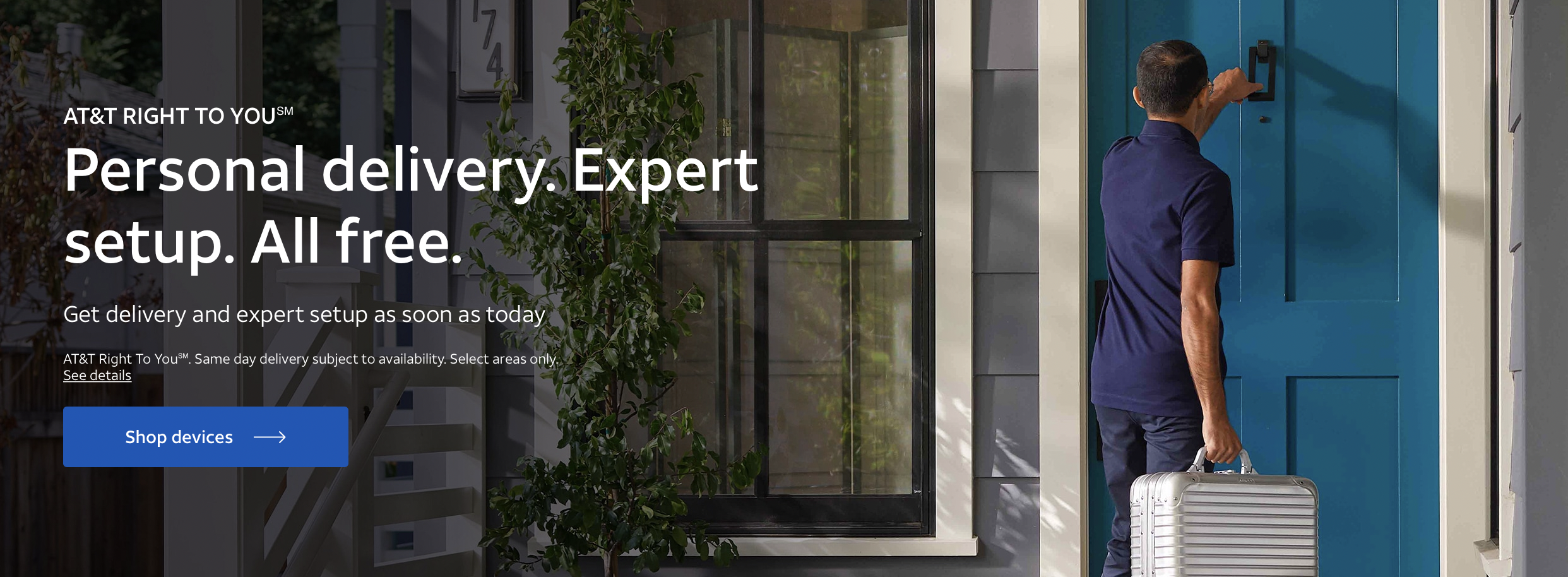

Of the four current Enjoy customers, three wrap their brand around the Enjoy experience. Apple maintains the Enjoy brand as its delivery partner. AT&T markets the service as AT&T’s ‘Right to You’ and Rogers calls it ‘Pro On-The-Go.’ We see this trend of partners branding the Enjoy experience as an endorsement of Enjoy’s core insight: for premium brands to succeed in the commerce at home world, they need to extend experiential retail into the home.

Most importantly, when consumers experience Enjoy, they love it, as evidenced by their NPS of 88. NPS scores range from -100 to 100, with any mark above 0 considered positive, and any score above 70 considered exceptional. To put this into context, Customer.guru reports Apple’s iPhone has an NPS of 63, Tesla 37, Amazon 25, and AT&T 15. Enjoy helps their partners increase customer satisfaction by driving engagement, turning customers into raving fans.

The economics for Enjoy and for its partners

We think of the economics from both sides: Enjoy and its brand partners. More than 50% of Enjoy’s revenue is related to selling services, which typically include adding a line, upgrading a plan, adding insurance, and subscribing to content offerings. Less than 50% of revenue is hardware related. Our model is based on a combination of Loup estimates and publicly available information.

- Enjoy deliveries. Enjoy earns a delivery and setup fee on each order, which we estimate is around $30 on average per order. On the cost front, Enjoy’s costs of delivering an order in 2021 is estimated to be around $72. In 2022, the company believes this cost per visit will decline to $60. Over time, that cost will further decline as Enjoy’s fixed costs of salaries, fleets, are spread out over a greater number of orders. The methodology in calculating these costs is consistent with reporting of other four-wall retailers, and excludes warehouse expenses.

- Enjoy take rate. Enjoy keeps a portion of revenue for incremental hardware, accessories, and service subscriptions sold in the customer’s home. While Enjoy does not disclose its take rate, we estimate it’s around 10%, based on industry norms (more on take rates below). While an average take rate is the best way to frame in the economics, take rates for Enjoy will vary by product. For example, Enjoy’s take rate on hardware upsells likely carry a lower take rate than upsells for subscription services, as subscriptions are more profitable for Enjoy partners.

- Partner order size and profitability. For example, we estimate that Apple’s online orders that start with a single flagship product benefit from additional products, that drive the average order size up by 10%. If the same buyer receives expert advice, we estimate that additional products increase the order size by 65%. Apple noted in a recent earnings call that products like Apple Watch and Apple Care have been negatively impacted by the shift to online shopping because both products normally benefit from the in-person shopping experience with expert advice. Increasing the average order size is a powerful incentive for retailers. In Apple’s case, attaching Apple services to a flagship product adds services revenue with 70% gross margins, higher than the 36% margin on hardware (March 2021 quarter). An iPhone 12 Pro Max, for example, has a gross profit of about $385. If Apple Care is added to an iPhone purchased from an Enjoy expert, the overall order size would increase by $270, and the gross profit generated from the order would increase by $162. In other words, the Enjoy expert would increase the value of the transaction to Apple by 42%.

- Partner infrastructure costs. Enjoy enables its partners to provide high-value customer engagement — a full retail experience — with a variable cost model. By moving from a fixed cost to a variable cost model, the partner increases services attach rates and upsells without retail fixed costs.

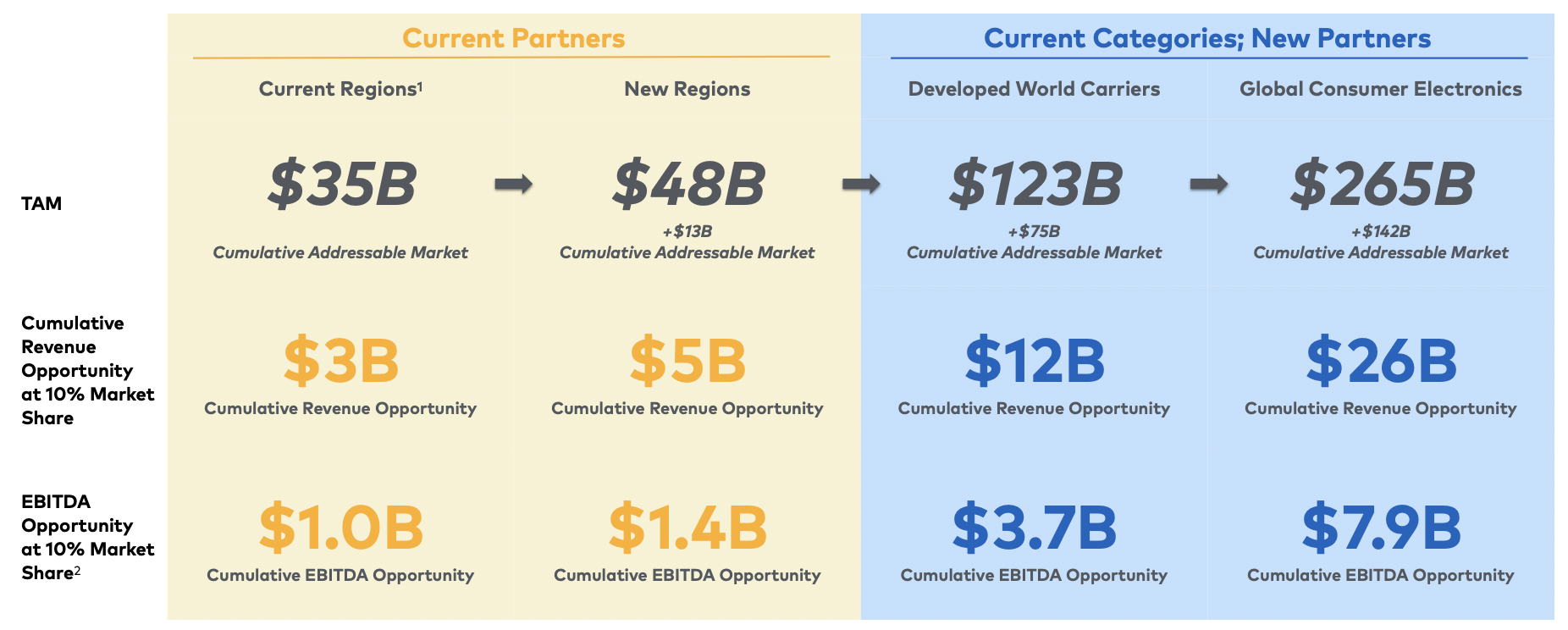

Enjoy’s revenue opportunity from existing customers and TAM

Experiential commerce at home is in the early stages of an open market opportunity. Thus, the long-term revenue opportunity has a wide range of outcomes and will ultimately be determined by Enjoy’s ability to add new partners. Enjoy has the first-mover advantage in a large total addressable market (TAM). From a high level, Enjoy believes its revenue opportunity from existing partners in current regions is $3B (10% share of a $35B addressable market among current partners):

Based on our own revenue opportunity exercise below, we arrived at a current customer revenue opportunity of $5.7B, after accounting for Enjoy’s estimated market share of 10%.

Assuming $5.7B in addressable revenue, Enjoy has room to grow its sales more than 55% compounded annually over the next decade based on its existing partners alone. Here’s the methodology we used to calculate Enjoy’s current addressable revenue opportunity:

- For Apple, we estimate about 35% of the company’s sales are direct, either online or through Apple Stores. This estimate is anchored in prior work from JP Morgan. They estimated that 31% of Apple’s sales were direct in 2019, up from 28% in 2017. We believe the mix of direct sales has drifted upward to about 35% as Apple has prioritized its direct-to-consumer sales channels in recent years. We estimate that about 35% of this direct-to-consumer portion of Apple’s business is available to Enjoy. The addressable opportunity at Apple could expand over time as Enjoy’s value-add to Apple is manifested.

- For the three telcos, AT&T, Rogers, and BT, we segmented their revenue into consumer service (subscription) revenue and consumer equipment (phones, routers) revenue. We assume 10% of service revenue and 35% of equipment revenue is addressable for Enjoy. Equipment revenue is more addressable than service revenue because devices must be physically delivered, and typically require more setup. That said, a portion of service revenue is still addressable for Enjoy. For example, if a customer orders an iPhone 12 from AT&T and during the Enjoy experience they decide to upgrade their data plan to 5G or purchase a device warranty, Enjoy would capture a portion of the service revenue.

- We estimate Enjoy has a 10% take rate on the orders it fulfills. This estimate is based on industry take rates for other delivery and third-party marketplace platforms. For example, eBay’s average take rate is about 8%-10%, DoorDash sees about a 15% take rate, and Amazon’s third-party marketplace take rates hover between 12%-15%.

- Enjoy’s estimated 10% take rate applies to hardware purchases, such as an iPhone, as well as to the lifetime value of service subscriptions, such as an Apple One or AppleCare subscription, or an upgraded phone or internet plan from AT&T. For example, we estimate the average Apple One subscription sold on-site through Enjoy nets the company around $60 in revenue. This $60 implies the average Apple One customer selects the $20/month plan, and that the average customer lifetime is three years.

Enjoy’s Apple opportunity

Apple is noteworthy when considering Enjoy’s potential. That’s in part because Enjoy’s founder, Ron Johnson, served as SVP and head of retail at Apple where he founded the Apple store, including the concept of the Genius Bar, from 2000-2011. During that time, Apple retail grew from zero to 357 locations. Today, Apple partners with Enjoy in 3 US markets: Los Angeles, San Francisco, and Dallas–Forth Worth, which cover about 30 Apple store locations.

These three markets are just scratching the surface of the opportunity. Globally, Apple has about 510 retail stores in 25 countries. Long term, Apple needs to get commerce at home right. To date, they have struggled to deliver the same great Apple store experience to customers ordering online. Perhaps the closest they’ve come is a delightful unboxing experience or a well-timed email offering online setup and support soon after your Apple product arrives. But these efforts fall short of Apple’s premium brand promise.

One possible driver of Apple’s measured start in commerce at home is that the company’s online ordering efforts are split between two teams, logistics and retail. The logistics team is focused on the mechanics of delivery. Apple’s retail team is focused on finding new ways to drive deeper engagement than in the store. This split could be impacting Apple’s broader rollout of the Enjoy partnership. Over time, we expect Apple to quicken its pursuit of commerce at home, and work more closely with Enjoy to expand its domestic and international retail footprint.

Apple has slowed new store additions to a near standstill, after adding an average of 25 stores a year over the last 20 years. We believe the most logical retail expansion strategy for Apple includes expanding its partnership with Enjoy. In doing so, Apple could quickly and cost effectively expand its retail footprint without adding stores. This would be particularly helpful in counties like Germany, which despite being the fourth largest economy in the world, has only 15 Apple stores. The marketing message is clear: We’re opening our newest Apple store right in your home.

Financial model

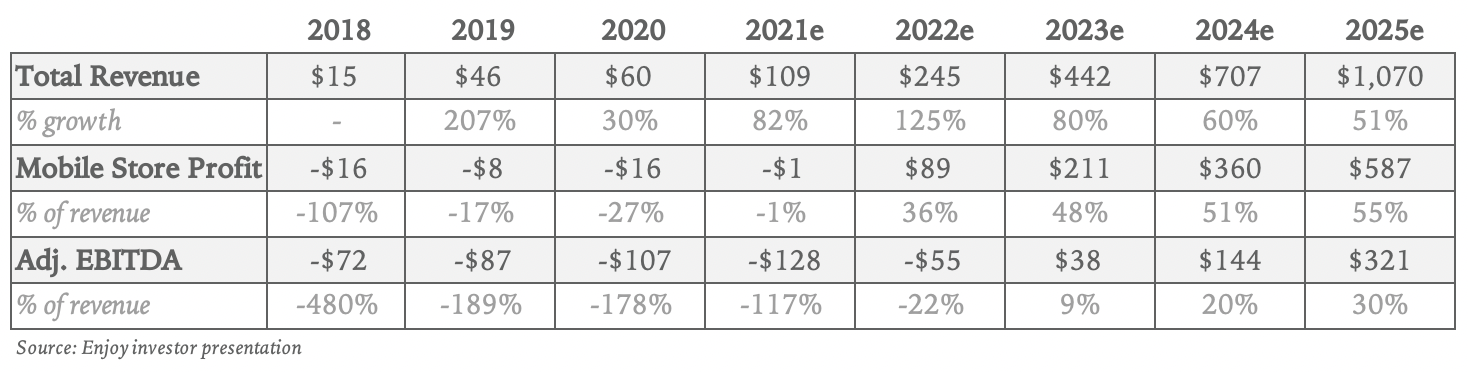

Below are Enjoy’s historical and projected revenues, through 2025:

Given some SPAC targets have been overly aggressive in their forward projections, we approached the Enjoy’s outlook with a cautious eye. However, after considering the levers to growth, we are comfortable with the company’s internal projections.

The principal levers that will drive revenue growth are:

- Size of current and potential customers. We estimate Enjoy has a $5.7B in addressable revenue opportunity with existing customers. If the company capatures 17% of this potential they would reach their $1B 2025 revenue target. This does not factor in new customers.

- In-home visits. Enjoy’s in-home visits declined dramatically in 2020 to about 15% from 90% in late 2019. As vaccinations reach critical mass, consumers will feel more comfortable allowing others into their homes. The magic happens when Enjoy gets through the door, because Enjoy’s average order size and upsell opportunities are materially higher when they have physical touch points with shoppers.

- Live catalog. This is a new feature that allows shoppers to see in real time Enjoy’s inventory on site. For example, a consumer who orders an iPhone is able to browse and shop accessories and other devices that are in the Enjoy delivery van at the shopper’s home. The company’s technology stack, which includes dynamic forecasting of inventory needs, makes this possible. In the end, this also increases the frequency of Enjoy upsells, driving revenue growth.

- Cross-selling. Another new feature, Enjoy will be able to offer consumers products from other retailers. For example, an AT&T customer that is also an iPhone user, could shop for Apple accessories or subscription services during the delivery of the AT&T product or service.

- International expansion. Beyond 2022, Enjoy has international expansion plans outside of its three current markets. In countries such as Germany, where Apple stores are few and far between, this will help drive revenue growth.

- Commerce at home growth. This is what customers of premium brands want. Eventually, all premium brands will need an in-home experiential commerce strategy, which we believe could eventually account for up to a third of these brands’ revenues.

Comp groups and valuation

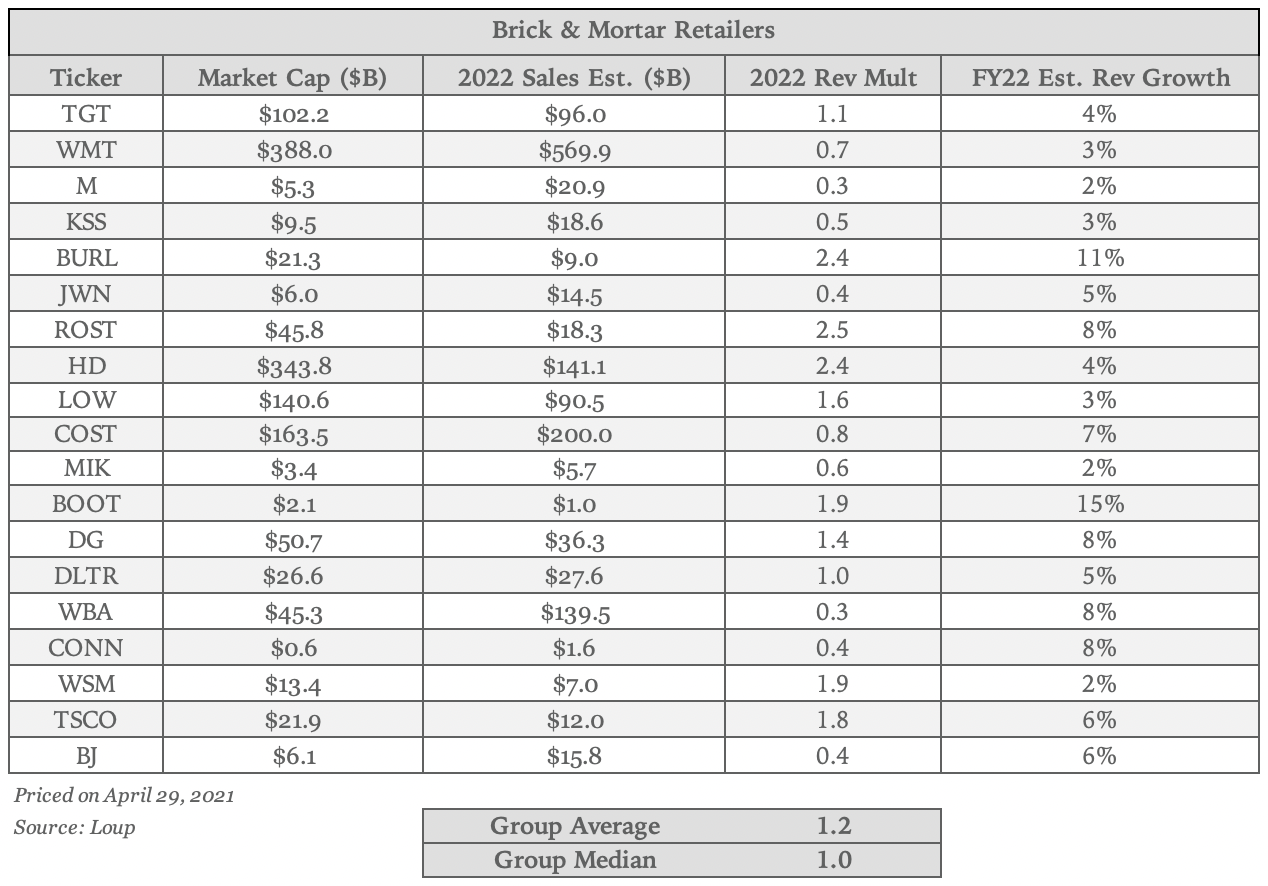

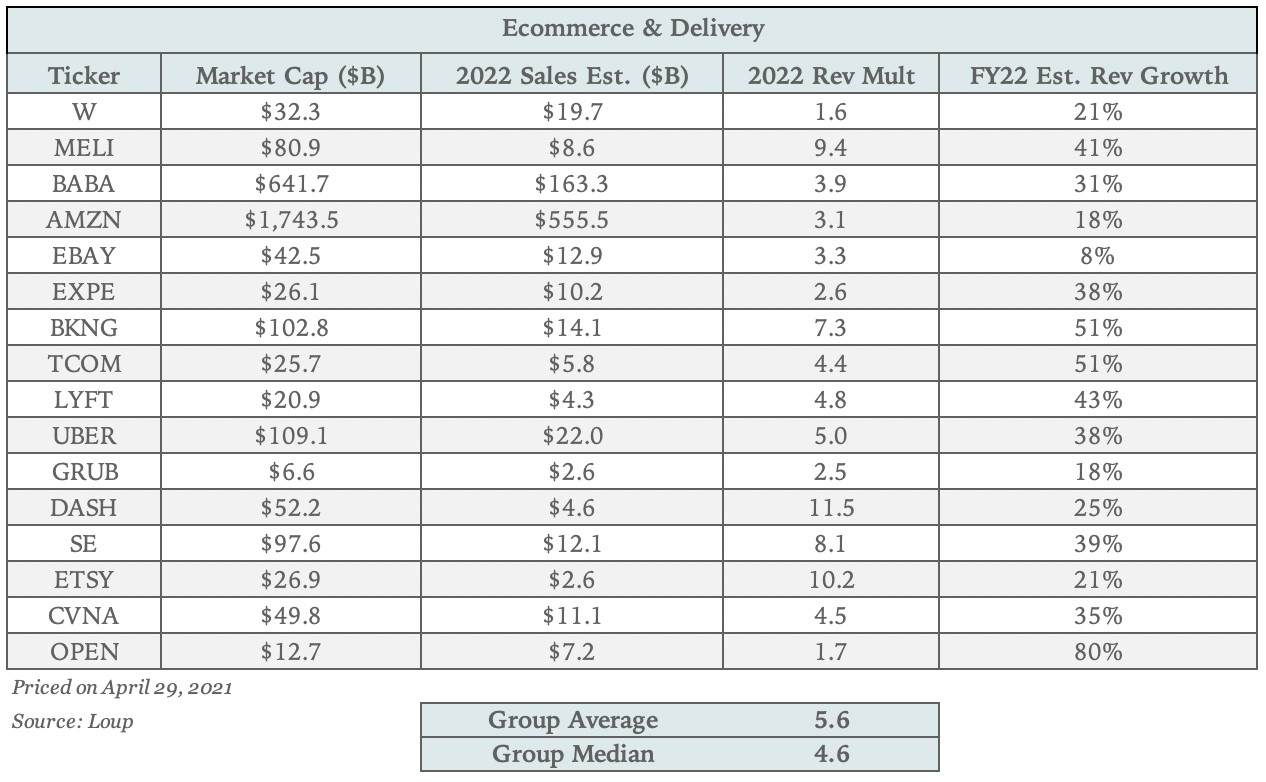

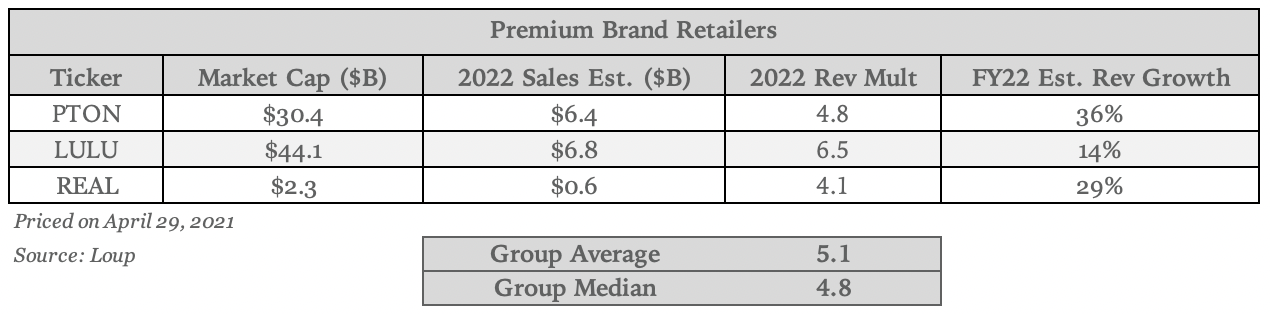

Enjoy plays at the intersection of brick-and-mortar retailers, ecommerce and delivery, and premium brand retailers. We built comp groups for these three segments using a 2022 sales multiple for each group. We think the most appropriate comp is the ecommerce and delivery group.

The ecommerce and delivery segment currently trades at a 5.6x average revenue multiple on next year’s estimates. Applying a 5.6x multiple to Enjoy’s 2022 sales estimates implies a current valuation of $1.4B. Looking two years ahead, we believe Enjoy will grow revenue in line with its projections, and anticipate the comp group’s multiple will decline slightly, given the segment’s overall revenue will likely decline over that time. Applying a 4.0x multiple on projected 2024 revenues of $707m yields a $2.8B valuation.

Conclusion

We believe that Enjoy is one of a few companies well-positioned to capitalize on experiential commerce at home. Ron Johnson’s vision to enable a full retail experience in the home — commerce at home — along with his track record of executing on big ideas, leaves us confident in Enjoy’s future and a fair value closer to $2.8B two years from now.