Over the past several months we’ve written about a shift in Apple investment thinking to Apple as a Service. To date, the view has been slow to take root as evidenced by AAPL’s recent sell-off due to supply chain concerns. It’s clear that most investors’ mindsets are still centered on an iPhone unit-dominated story, but we believe that will change over the next two years.

- Historical data supports the view that underlying business performance is not correlated to unit sales.

- A unit of sale (i.e. iPhone) is less relevant today than it has been in the past.

- Google search activity for iPhone is increasing, a positive sign for demand.

- The Street is overreacting to supply chain concerns; drawing insights from the supply chain is more of an art than a science.

Apple as a Service Defined

Apple as a Service is the notion that the company is transitioning from primarily manufacturing and selling devices to maintaining and satisfying a large and growing customer base with ever-improving hardware and an increasing portfolio of software services.

New Reporting Methodology

Apple’s most concerted effort to shift the mindset of investors and analysts to Apple as a Service came during the Sept. quarter earnings call when the company announced it will no longer report hardware units numbers. This, rightfully, raised some questions, but the rationale, which we laid out here, suggests that investors should take this transition seriously.

Apple’s Justification of New Reporting

When asked to explain the reason for not reporting units, CFO Luca Maestri said:

“When you look at our financial performance in recent years, take the last three years, for example, the number of units sold during any quarter has not been necessarily representative of the underlying strength of our business. If you look at our revenue, given the last three years, if you look at our net income during the last three years, if you look at our stock price here in the last three years, there’s no correlation to the units sold in any given period.

As you know very well, in addition, our product ranges for all the major product categories have become wider over time and therefore, a unit of sale is less relevant for us at this point compared to the past, because we’ve got this wider sales price dispersion, so unit of sale, per se, becomes less relevant.”

Data Supports Luca’s Rationale

1: Underlying business performance is not correlated to unit sales.

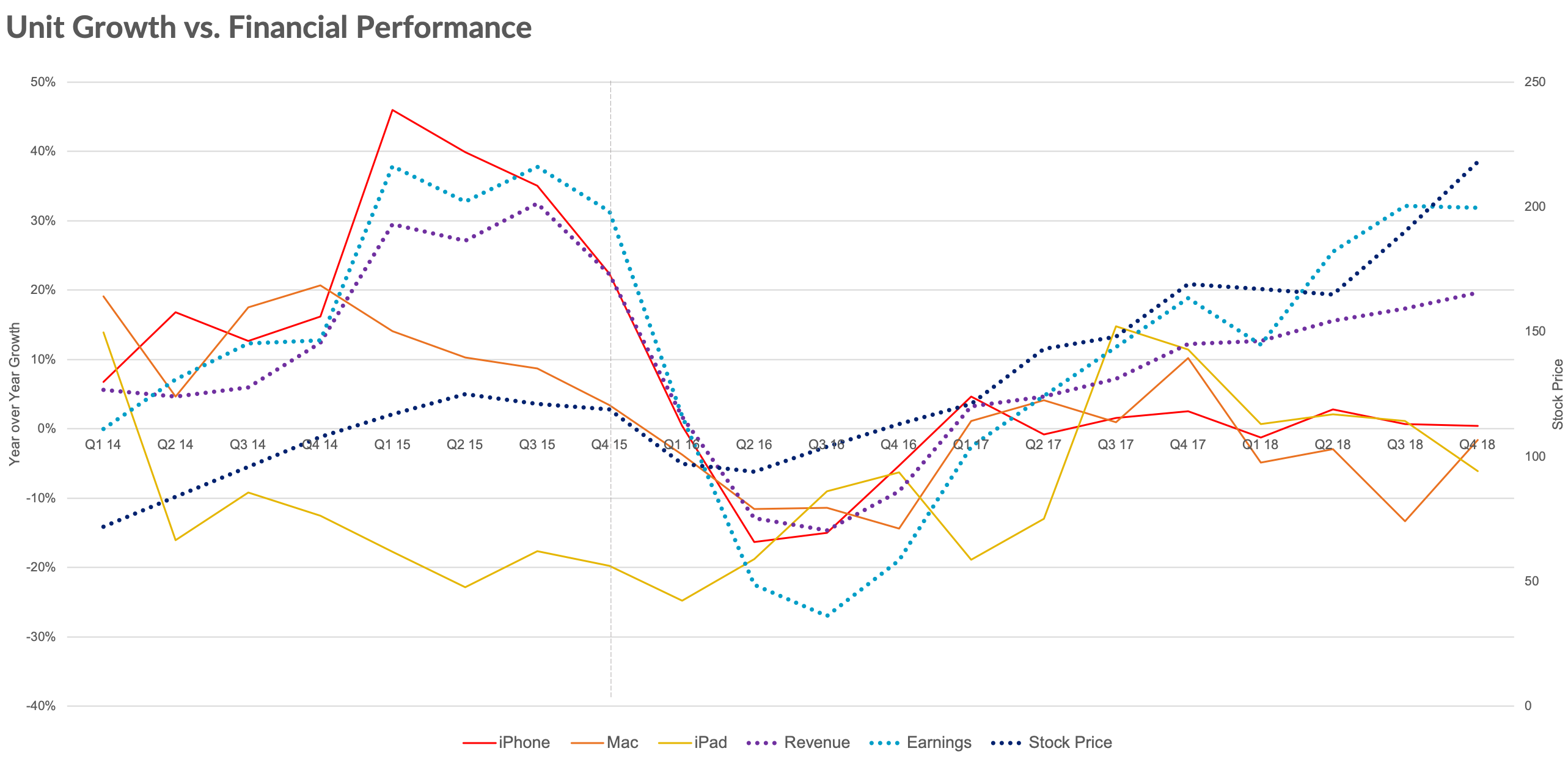

The chart below shows the y/y unit growth of the iPhone, Mac, and iPad compared to revenue growth, earnings growth, and stock price by quarter since 2014. Unit growth metrics are solid lines and financial performance metrics are dotted lines. Note the disassociation between the two after the vertical line that marks three years ago (Sep-15).

2: A unit of sale is less relevant today than it has been in the past.

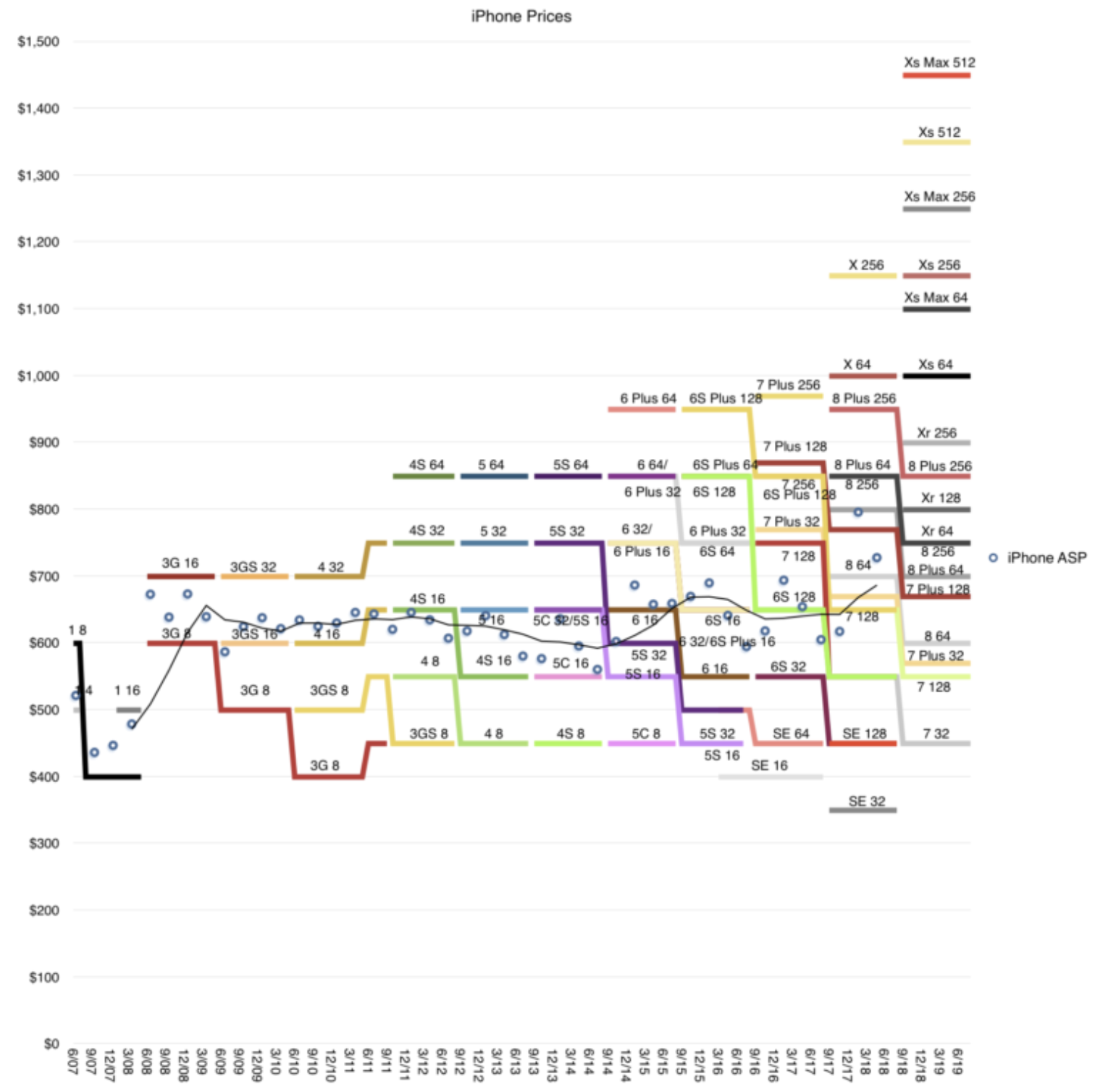

This chart from Horace Dediu demonstrates the price dispersion within the iPhone product line. Mapping out the average selling price and the number of iPhone models over time shows a current lineup of 16 options ranging from $450 to $1,450, a drastic shift from just two years ago. This is important because each unit of sale can now have a very different impact on revenue.

Search Activity for iPhone is Increasing

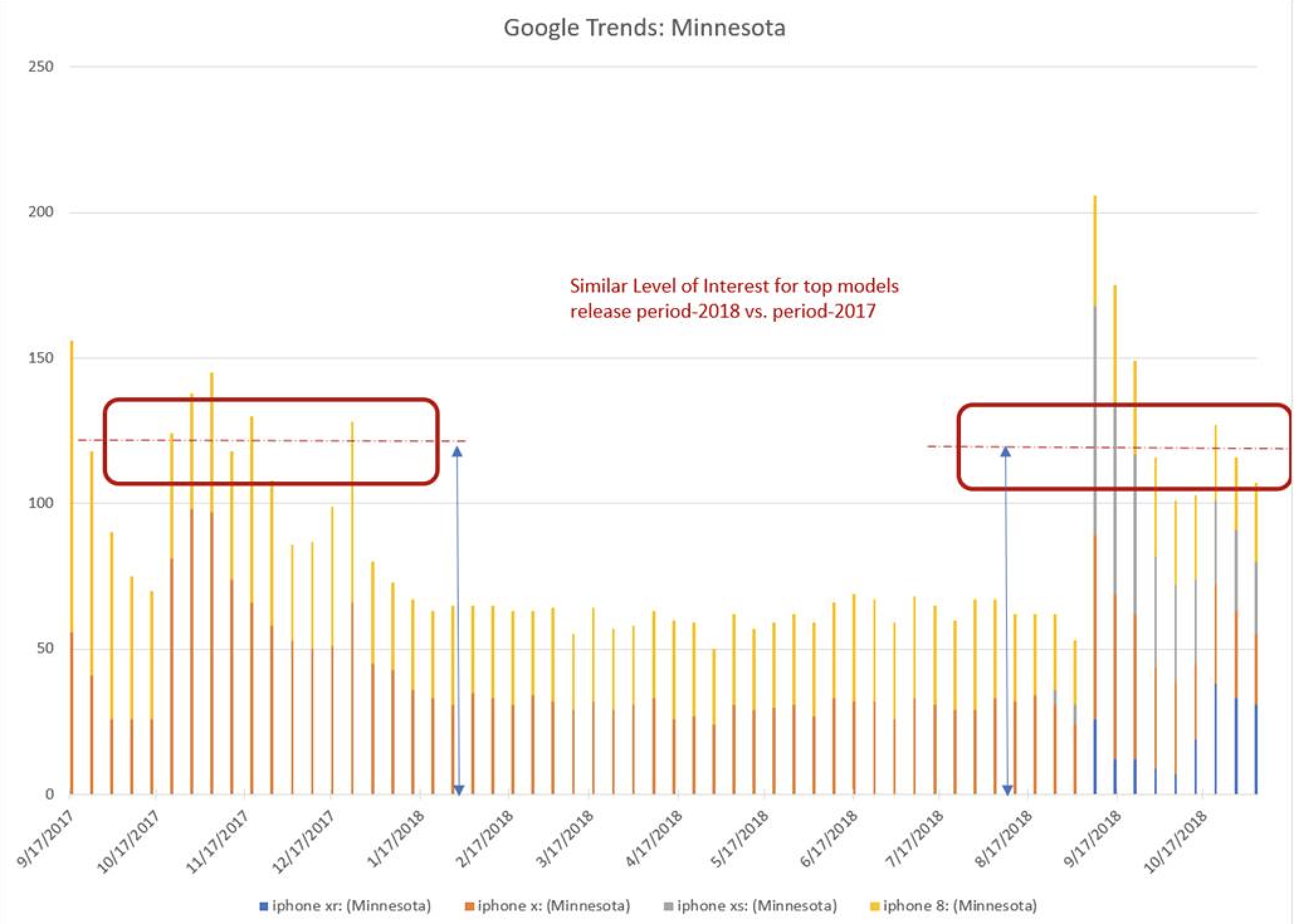

Investors often use Google Trends to compare interest in the latest iPhone to previous iPhones. Over the past four years, the spikes in search traffic for the newest iPhone model has declined, suggesting that interest in the iPhone franchise is softening.

Thomas Paulson at Inflection Capital found that this view may be misleading. He tracked Google Trends related to all iPhone models (not just the latest model) and found that interest, especially around product launches, is not only moving higher, but that it’s also spread across more models. Google searches in the last two months are nearly evenly distributed between iPhone 8, iPhone X, iPhone XS, and iPhone XR. This shows that consumers are interested in more than just the newest devices in the deep iPhone lineup.

Street Overreacting to Supply Chain Concerns

Separately, we think the recent concern around softening iPhone demand is an overreaction by the Street. Interpreting data points around demand from the supply chain is a dangerous art. Historically, investors and analysts (present company included) have drawn the correct conclusion as many times as the incorrect one. In the case of Lumentum, it’s important to note that Apple has been getting closer to its competitors Finisar (the $390m order announced Dec-17) and II-VI (recently acquired Finisar) for sourcing VCSELs. This could account for Lumentum’s disappointing guidance. Separately, it’s well known that Apple frequently changes components and suppliers, which adds complexity to decoding data points from the supply chain.

Apple gave Dec-17 guidance on Nov. 1 that suggested revenue would be 2% below Street expectations. The odds that something has materially changed between then and now is low. Things do change, but typically not that quickly. There would be real cause for concern if we continue to hear cautionary comments from suppliers into mid-December and early January.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.