China impact on guidance

Shares of AAPL traded down 0.5% following earnings and guidance that calls for a slowdown in Mar-24.

Taking a step back, the December quarter was solid, reporting 2% revenue growth (Street was looking for 1% growth) along with 4% earnings upside. Overall, the iPhone grew at 6% YoY, the best growth since Sep-22. That growth was achieved despite China sales (18% of revenue) being down 13% YoY in the quarter. It was the worst quarter in China since Sep-20 when revenue declined 28%. The reason for the China softness is mostly macro-related, given the iPhone gained market share in the quarter, based on data from IDC. To put the strength coming from the rest of the world into perspective, Japan grew at 15%, Europe at 10%, and the Americas at 2%.

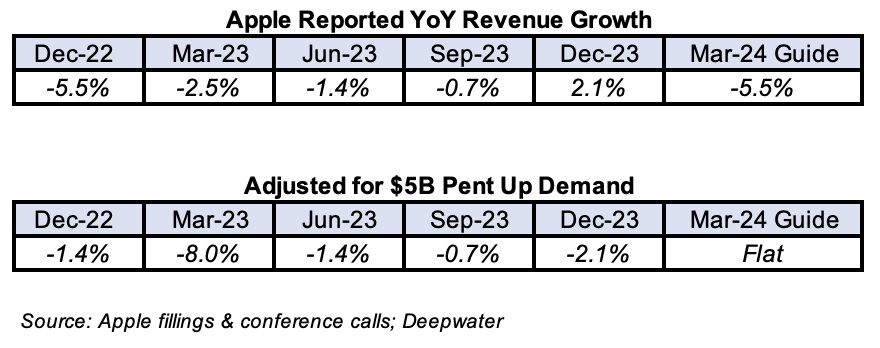

The impact of China was especially felt in the guidance. Apple expects sales in the March quarter to be down about 5% YoY, compared to previous expectations for 1% growth. Apple explained the Mar-24 weakness was in part due to difficult comps resulting from an unexpected boost in Mar-23. When iPhone 14 production shut down due to COVID-19 in November 2022, Dec-22 orders went unfilled until the following quarter. That shutdown pushed about $5B in sales from Dec-22 into Mar-23 creating a tough comp in Mar-24.

The company highlighted that adjusting for this $5B, revenue in Mar-24 would be flat YoY. While this perspective helps understand Apple’s true growth rate, it begs the question: Why did the company not mention the $5B benefit when they reported the Mar-23 quarter? I believe the reason is it would have made the Mar-23 quarter look less impressive.

Setting aside my disappointment that Apple has been inconsistent in reporting material one time items, the company’s true growth in Mar-24 (flat YoY) should be the best since Sep-22.