From 2017 to 2020, Tesla’s global fleet of vehicles has grown by 390%, from 280k vehicles to about 1.4m. Over the same period, the company’s stock of Service Centers has grown about 90%. This mismatch has at times led to frustration among Tesla owners who must either drive long distances or experience long wait times to get their vehicles serviced.

If Tesla reaches its annual delivery growth target of 50% over the next two years, their vehicle fleet will reach 3.3m in 2022. To maintain customer satisfaction, something Tesla still excels at today, along with eliminating any hesitancies from potential buyers regarding service deserts, the company must scale its service ecosystem faster to keep pace with a rapidly expanding fleet of vehicles.

Tesla service 101

Unlike traditional auto, which relies on a dealership franchise model to service its vehicles, Tesla operates its own service ecosystem, which aligns with the company’s obsession with vertical integration. The one negative to this approach is that it takes longer to scale. Tesla’s service approach has two vectors: Service Centers and Mobile Service Technicians.

Service Centers

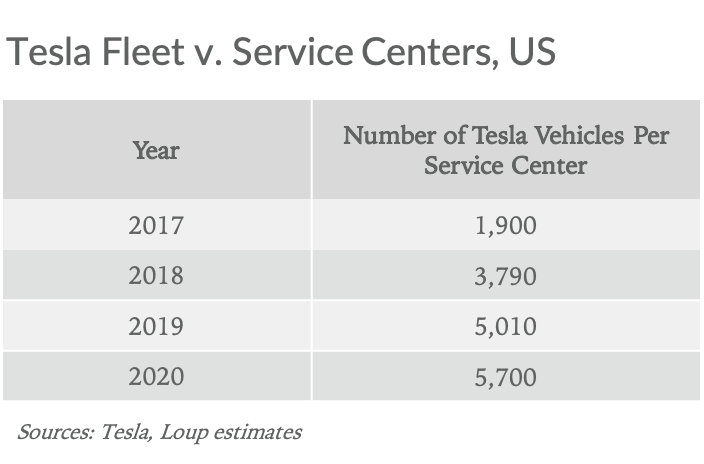

Tesla has about 335 Service Centers globally, of which 128 are in the US. We estimate the total fleet of Tesla vehicles in the US is around 730,000. This implies roughly one US Service Center for every 5,700 vehicles. This ratio has grown steadily over the past three years:

This trend is attributable to the fact that, over the past three years, the US Tesla fleet has grown on average 69% per year, compared to US Service Center annual average growth of 17%. The slow pace of Service Center expansion in the US leads us to believe the company hasn’t fully remedied a problem Musk identified in 2018, the first full year of Model 3 sales:

Looking at the US map below, it’s clear that large geographic gaps still exist.

The company has previously said they’re focusing on expanding Service Centers in the US where demand for their vehicles is high. This raises a chicken and egg question for Tesla. That is, are Service Centers not present in certain areas of the US because demand is weak there, or is demand being tempered by a lack of Service Centers, which makes potential buyers more hesitant. Our view is that service shortages have not been a limiting factor of Tesla adoption in the US to date.

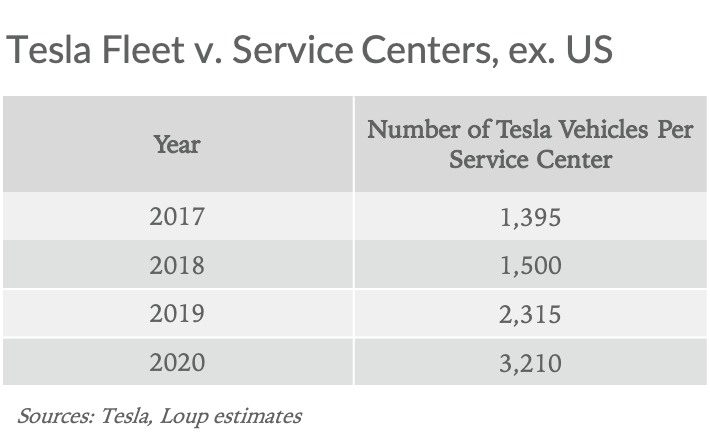

Globally (ex. US), there’s approximately 1 Service Center for every 3,210 Tesla vehicles, a ratio that has grown over the last three years as global deliveries have outpaced Service Center expansion. From 2017 to 2020, the global (ex. US) Tesla fleet grew on average 71% per year, compared to average annual Service Center growth of 30%.

Mobile Service Technicians

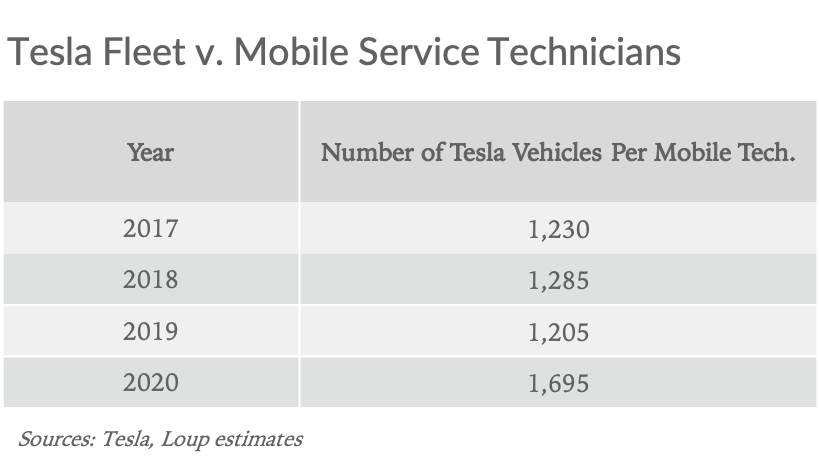

Apart from Service Centers, the company has a crew of approximately 825 Mobile Service Technicians that travel to customers for vehicle repairs. Currently, we estimate the majority of these are in the US, although the company is prioritizing international expansion. With a total Tesla fleet of about 1.4m vehicles on a global level (inc. US), it implies there are about 1,695 Tesla vehicles for every one Mobile Technician.

Compared to the ratio of Tesla fleet/Service Centers, the ratio of Tesla fleet/Mobile Service Technicians has remained more constant over the past three years. From 2017 to 2020, the number of Mobile Technicians has grown on average 53% per year, compared to 24% average annual growth in global Service Centers over the same period. This highlights the company’s prioritization of Mobile Technicians over Service Centers as a more cost-effective, convenient way to handle repairs.

Tesla has a plan

Tesla has said 80% of repairs can be done outside of Service Centers through Mobile Technicians or over-the-air software updates. Assuming this is true, it’s good news for the company, as this service vector is vastly more scalable than building Service Centers. On its December 2020 earnings call, the company said more than 40% of all service calls in North America are currently fulfilled by Mobile Technicians, with the goal to increase this percentage to 50% in 2021. Ultimately, the company’s aim is to build cars that require minimal to no service work, something only software-centric EVs have a chance to achieve.

That said, at least in the near term, expanding brick and mortar locations will remain an essential part of cementing peace of mind for potential buyers. On its most recent earnings call, Tesla said it currently has 140 Service Centers in N. America, with plans to open 46 more in the first half of 2021. If this rate is sustained for the full year, it would imply a 65% y/y increase, compared to about 20% growth in 2020. We believe this step up, along with an elevated service growth trajectory moving forward, positions the company well to meet customer service demand. In a scenario in which the company is unable to sufficiently scale its service ecosystem internally, we believe Tesla is open to an asset-merger with a traditional auto company, specifically, to acquire facilities and workforces.