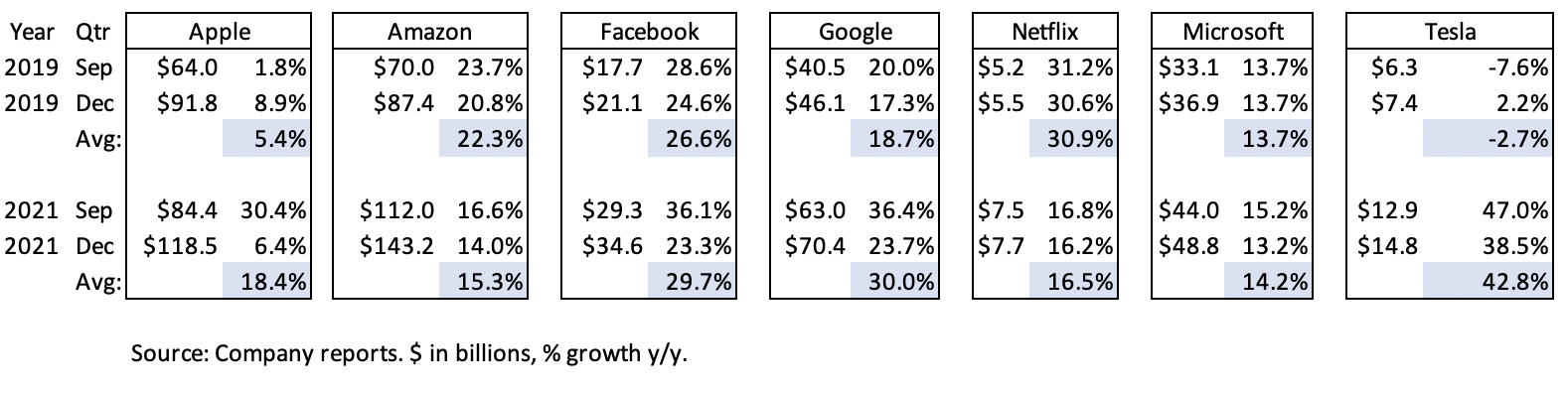

June quarter earnings for big tech shared a common theme, debating the giants’ sustainable revenue growth rates. Facebook and Amazon shared the most on the topic of modeling growth rates exiting the pandemic, both pointing to the back half of 2019 (aka the two-year stack) as a baseline for growth in the back half of this year. We applied that perspective to FAANG, along with Microsoft and Tesla, to better predict growth over the next two quarters and compare that to where Street estimates now stand. The table below shows the two-year growth comparisons for these companies.

Apple

Apple grew revenue in the back half of 2019 at 5.4% y/y. Since then, growth peaked in the March 2021 quarter at 53.6% and declined to 36.4% in the June 2021 quarter. Street estimates call for September 2021 revenue growth of 30%, well ahead of the average growth exiting 2019. At first take these expectations seem aggressive, however, factoring in the change in timing of the iPhone launch from the December quarter last year into the September quarter this year, suggests these estimates are achievable. Specifically, average revenue growth in the back half of this year, which normalizes for changes in the timing of the iPhone release, is 18.4%. Bottom line: While it’s a step up from 2019 growth levels, we see current expectations for the back half of 2021 as reasonable given the company is benefiting from two sustainable tailwinds that were not around in 2019: a multiyear 5G upgrade cycle and the accelerating digital transformation, including work and learn from anywhere.

Amazon

Amazon grew revenue in the back half of 2019 at 22.3% y/y. Since then, growth peaked in the March 2021 quarter at 43.8% and declined to 27.2% in the June 2021 quarter. Using the two-year stack methodology, growth will slow to mid-teens for the balance of this year. It’s worth noting the Street’s 17.3% growth for September is ahead of company guidance of 10-16%. In June, Amazon reported revenue at the midpoint of their guidance range. In other words, if Amazon does what it did in June, and reports at the midpoint of guidance, they will miss Street growth target by 2-4%. The bottom line: We expect Amazon will come in line with guidance, and slightly miss Street estimates for September.

Facebook grew revenue in the back half of 2019 at about 26.6% y/y. Since then, growth peaked in the June quarter at 55.6%. The explosion in ad revenue in the first half of 2021 due to inflation and advertisers rushing to capture eager buyers has propelled both Google and Facebook growth to new heights. On their earnings call, the company guided for quarterly growth to decline slightly in the second half of the year compared to growth in the back half of 2019. Despite that commentary, analysts are looking for Facebook to exceed guidance and grow at 29.6% in the back half of this year, compared to 26.6% in 2019. Bottom line: Given management’s historical conservative nature when it comes to guidance, we believe the Street’s expected outperformance is reasonable.

Google grew revenue in the back half of 2019 at about 18.7% y/y. Similar to Facebook, growth also peaked this June at 61.6%. During their June earnings call, Google, similar to Facebook, pointed to tough comps ahead. Current Street estimates call for 29.1% growth in the back half of the year, compared to 18.7% in 2019. Bottom line: While growth rates should step up given the strength in cloud and YouTube is outpacing 2019 levels, the 10% plus increase in growth from 2019 is outside our comfort range.

Microsoft

Microsoft grew revenue in the back half of 2019 at about 13.7% y/y. Since then, growth peaked in June 2021 at 21.3%. Microsoft’s growth estimates for the second half of this year of 14.1% are in line with their growth in 2019. Bottom line: Given the high-visibility and low variability of the company’s business model, we believe the Street has the back half of the year modeled correctly.

Netflix

Netflix grew revenue in the back half of 2019 at about 30.9% y/y. Since then, growth peaked in the March 2020 quarter at 27.6% and declined to 19.4% in the June 2021 quarter. The Street expects a significant drop in growth for Netflix’s two-year stack, declining to 16.5% from 30.9%. We see this decline as reasonable given a combination of tough comps and lower usage with the return to work and school. Bottom line: We expect growth to dip slightly below current expectations for the back half of 2021.

Tesla

Tesla revenue in the back half of 2019 declined by 2.7% y/y. The reason for the decline was tough comps related to the ramp of Model 3 in 2018. Since then, growth has accelerated and peaked last quarter in June 2021 at 98.1%. Given the timing of Model 3’s impact on 2019 growth, the two-year stack exercise is less valuable. We believe taking a conservative view on the company’s expected 50% compound growth rate over the next decade is appropriate. Street estimates of 43.5% growth in the back half of this year are comfortably below the 10-year 50% growth target, and well below the first half of 2021 growth of 80%. Bottom line, the EV and autonomy markets are big enough for the company to maintain September 2021 growth rates of 40% plus over the next several years.