Sometime this year Tesla will host a Battery Day event, which has been postponed due to Covid-19. The battery is one of the four foundations for building the car of the future, along with the motor, the autonomous system, and the design. We believe Tesla has a competitive advantage in batteries that is under-appreciated by investors. In the future, we expect that advantage to widen.

Bottom line: Tesla’s lead in batteries is sustainable and other auto OEMs will struggle to gain measurable ground on the company’s 80% US EV market share.

Bringing cell design and production in-house

For starters, most of the lithium-ion battery cells used to build a Tesla battery are manufactured by Panasonic in a side-by-side partnership with Tesla inside the Gigafactory in Nevada. Tesla also works with Chinese battery supplier CATL and South Korea’s LG Chem. Tesla likely has proprietary cell chemistry that is distinct from the cell chemistry that Panasonic, CATL, and LG Chem sell to other automakers.

We believe more than 60% of Panasonic’s battery cell production is currently going to Tesla. The two companies recently signed a three-year pricing deal for the manufacturing of battery cells at Gigafactory Nevada. That said, Tesla is experimenting with its own battery cell design through its 2019 acquisition of Maxwell Technologies. If those efforts yield a breakthrough in performance, Tesla would keep the cell design and chemistry proprietary. Separately, based on the companies 2019 acquisition of Hibar Systems, we expect Tesla will begin manufacturing its own batteries in the next three to five years.

Those internal efforts don’t change the reality that Tesla will need to continue to work with existing battery suppliers to meet demand. Musk has made comments that he expects deliveries to grow at 40-50% per year over the next decade, which implies ramping annual productions from about 500k vehicles today to over 15 million in 2030. We expect the company to share details of its internal lithium-ion battery cell design and production efforts at Battery Day.

The power of vertical integration

The potential of Tesla bringing battery cell design in-house fits into the company’s long-standing vertical integration approach. Most auto manufacturers take a horizontal integration approach and rely on a myriad of suppliers for both design and production of parts. In contrast, Tesla designs the majority of its parts in-house but outsources the production of most parts.

The disadvantage of vertical integration is billions of dollars in capital expenditures related to factories and production equipment, along with the high cost of recruiting and maintaining in-house technical design and testing talent. The most significant advantage is that product design cycle times decrease, which quickens the pace of innovation, which is Tesla’s central competitive moat. Additionally, the end product typically yields better performance and reliability compared to products built with horizontal integration.

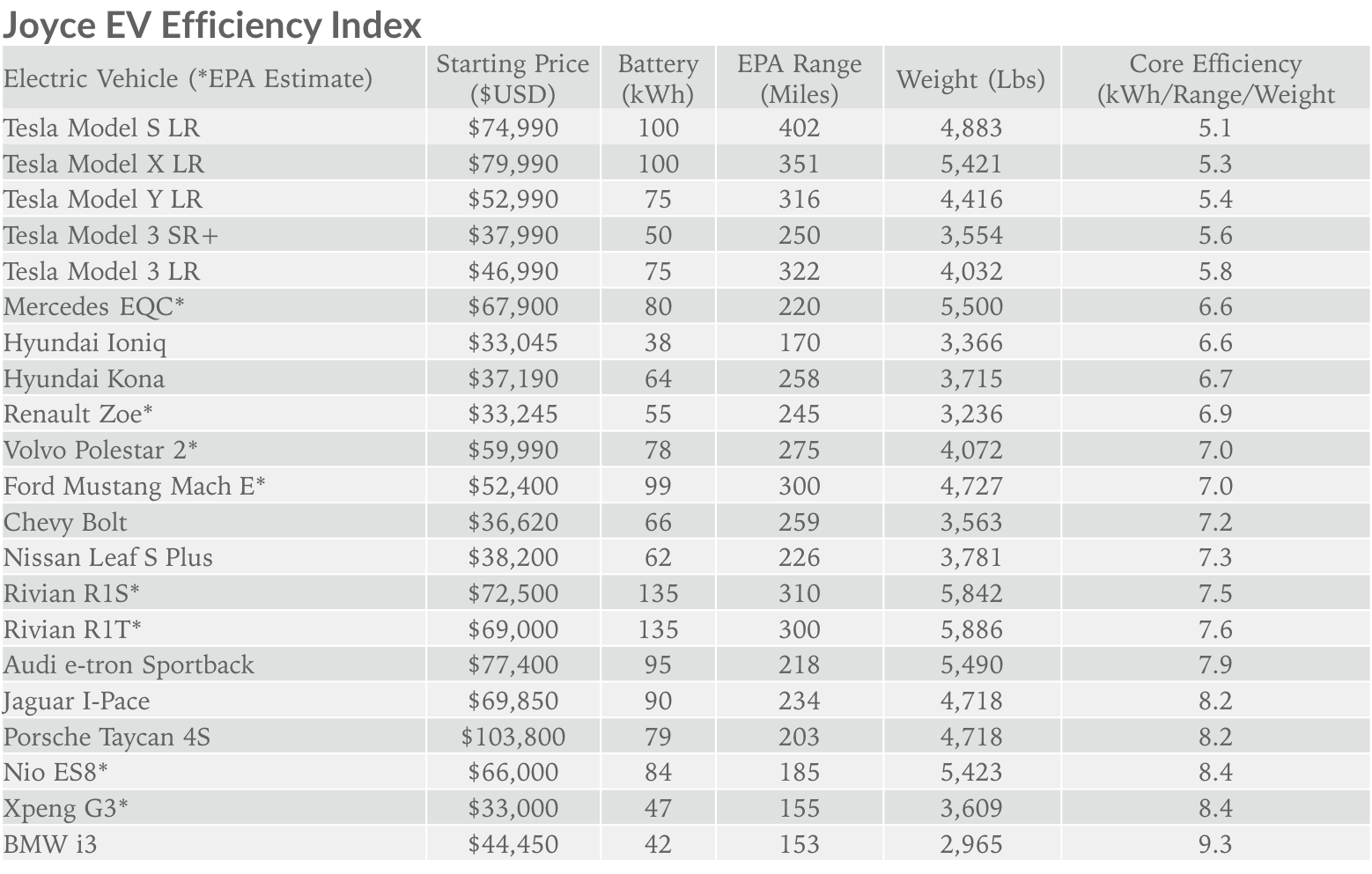

Vehicle range is one example of a performance advantage Tesla has gained through vertical integration. Teslas deliver greater range with similar-sized batteries compared to other carmakers. Independent Tesla analyst Matt Joyce has been tracking this dynamic since 2019 and has created a core efficiency rating to compare EV batteries. The metric factors in battery size (in kWh) along with the range and weight of the vehicle. A lower number represents greater vehicle efficiency, a combination of the battery pack, electric motor, and wind drag coefficient.

In the table below (updated in June 2020), the average core efficiency for Tesla is 5.5, compared to 7.8 for the 15 other EVs available in the US market. This suggests Tesla delivers 42% more efficiency per kWh compared to the average EV model.

Potential for Austin Gigafactory announcement at Battery Day

As an aside, we also expect Tesla to announce plans for a factory located in Austin at Battery Day given this factory would likely also produce battery cells.

400 miles is the optimal range

The guiding principles of battery innovation are to increase cycle life (number of times it can be charged, which is correlated to the expected lifetime miles) while decreasing cost, weight, and charging time. Improvements in batteries address range anxiety, which is one of the biggest inhibitors to the adoption of EVs. Simply put, many consumers are concerned that their cars will run out of charge.

Range anxiety is understandable given in 2019 (excluding Tesla models) the average range of a US EV was 170 miles. At the same time, the average Tesla range was ~300 miles. Tesla continues to make outsized progress in range and recently announced that the Model S Long Range Plus hit an official EPA range of 402 miles. This is about a 20% increase from the 2019 Model S with the 100D battery, with the improvement outpacing the annual lithium-ion energy density gains of about 6% per year. We view the 400-mile range threshold as both critical and optimal, given that it represents a full day of driving (50mph average over 8 hours) and should all but eliminate range anxiety.

Extending beyond a 400 mile range will likely have diminishing returns for automakers. In our view, the best approach is for car makers to apply future lithium yield improvements to lower the price of the EV. The number of new buyers that would be won over by a vehicle that offers a 400+ mile range would likely be fewer than the number of new buyers won over by maintaining the range at 400 miles and applying improved battery yields to lower the overall price of the car.

Tesla won the race to the 400-mile range battery. The next closest contender is the Ford Mustang Mach E at 300 miles; the majority of non-Tesla EVs offer battery range of less than 235 miles.

The software advantage

Beyond Tesla’s vertical hardware integration, the EV maker also has superior software compared to its peers. Tesla’s hardware + software approach is similar to the Apple ecosystem. Both have easy to use interfaces, end to end integration of the user experience, connectivity, over the air software updates, apps, and autonomous data collection. Additionally, Tesla is capitalizing on its software advantage, unlike any other carmaker, by selling a $7k software package that contributes a nearly 90% incremental margin. Additionally, the company’s new Hardware 3.0 computer chip will accelerate its neural network and autonomous software capabilities, an additional opportunity to up-sell customers.