Patience is a virtue.

We recently gathered data from the nine companies leading the race to build fully autonomous systems for passenger cars. Almost all companies are finding that delivering full self-driving is slow going, more challenging than believed six months ago. Our conclusion is based on findings that despite progress, timelines for most projects continue to be pushed back.

We’re still still years away from seeing self-driving cars become mainstream. Our best guess remains unchanged, that 2025 will be the first year of public availability of level 4. Prior to that, we will likely see level 4 semi-trucks on the road. Our bottom line: passenger car autonomy will take longer than most think, and ultimately be more transformative than anyone can image.

Autonomy 101

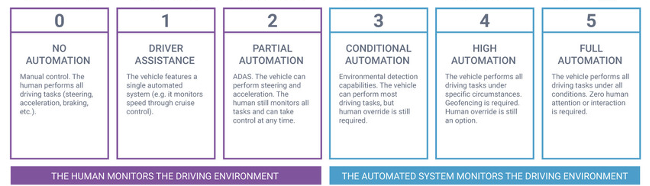

As a baseline to frame what companies pursuing autonomy are doing, it’s important to understand the different levels of automation. The scale goes from 0-5:

Advantage remains Waymo, Tesla and Apollo

In March, Honda (yes, Honda has autonomy ambitions) announced the first-ever production vehicle with level 3 autonomy, which is now available in Japan in limited numbers. It’s possible we see level 3 cars from other big car manufacturers in the coming years, such as Tesla, which has edge level 3 capabilities, now available in the form of FSD beta. Regarding level 4, the most advanced of these projects continues to be Waymo (Alphabet) and Apollo (Baidu), with Waymo being slightly ahead. Both companies have already begun self-driving taxi services limited to beta users in certain geographic regions, and both say they’re on track to expand public availability of these services late this year. Here is a look at the nine leaders and their progress to date:

Ongoing lidar vs. camera holy war

Little has changed year-to-date on the debate between the broader auto industry and their endorsement of Lidar, and Tesla’s camera approach. Most of the level 4 manufacturers continue to believe the vision stack will start with a top-mounted system of 3D sensing cameras, Lidar, radars, and 3D maps of the environments in which they can operate. Tesla continues to stand out for their refusal to use Lidar technology. We believe the industry, including Tesla, will eventually agree that autonomy will require a combination of Lidar, cameras, and digital radar. We see the breaking point for Tesla to endorse Lidar is when sensor prices decline by 50%, likely a couple years away.

Hurdles remain unchanged

The key hurdles to autonomy have remained unchanged over the past six months.

- Geographical boundaries. Progress for Waymo and Apollo relies heavily on further improvements in mapped environments, which means these services will take time to roll out. For example, today, Waymo only operates in a 50-square mile area in the suburbs of Phoenix, while Apollo only operates in the area surrounding the 2022 Olympic village in Beijing.

- Weather. An autonomous car with current technology is incapable of dealing with snow covering a sensor or ice on the road.

- Regulation. Regulatory standards are strict to the point that autonomous systems and cars need to be near 100% reliable before public use approval. A high, irrational bar, considering humans are far from perfect when it comes to auto safety, as evidenced by 39k people losing their lives on US roadways in 2020.