Is the IPO window open?

Investors, bankers, and market commentators answer that question by whether IPOs are getting out. ARM is about to go public. So are Instacart and Klaviyo. If those companies have successful IPOs — judged by demand for the issue and first-day trading — then the IPO window will be deemed “open.”

We think there’s a better way to gauge the IPO window’s openness, and we created the Deepwater IPO Window Index (DIPO) to do just that.

The Deepwater IPO Window Index tracks an equally weighted set of public tech companies with revenue and growth characteristics that we believe investors expect from IPOs:

- Top line revenue of at least $200 million in the outyear

- Top line revenue growth of at least 20% in the outyear

- A $2 billion+ valuation

Our screen identified 36 companies with those characteristics in the broader tech universe that we track. The DIPO Index includes companies you might expect such as SNOW, MELI, CRWD, and RIVN. It also includes giants like TSLA and NVDA that are benefitting from massive growth tailwinds.

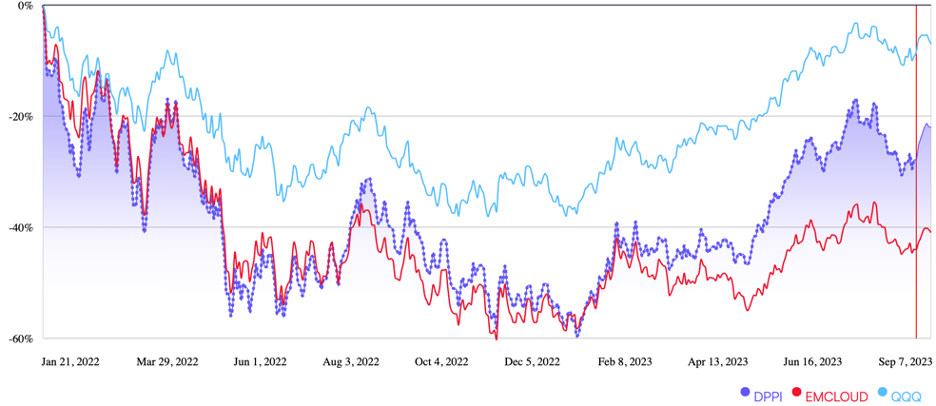

Year to date, the DIPO Index is up 67.2% vs. the Nasdaq 100 (QQQ) up 41.1%. The DIPO Index is also down 20.1% in backtesting to 1/1/2022. The QQQ is down 6.4% over that period. Both the DIPO and QQQ bottomed in late 2022.

IPO-like companies are high-beta vehicles, so that type of wild over and underperformance vs. the QQQ should be expected from IPO-like companies. When markets are in correction, more speculative growth companies tend to get hit harder than mature growth companies. When markets are roaring, speculative growth tends to outperform.

That begs another question: How have late-stage private company valuations fared?

We track those too with the Deepwater Pre-IPO Index (DPIPO). The DPIPO follows 25 high-quality private tech companies with the following characteristics:

- At least $2 billion implied valuation

- Public-quality investor pedigree

- 50% chance of going public in the next three years

- Secondary activity in the past three months

Since private companies do not have public marks, we mark private companies with our own methodology that considers recent secondary transactions, secondary bids/asks, and public marks from public fund holders (e.g. mutual funds, etc.).

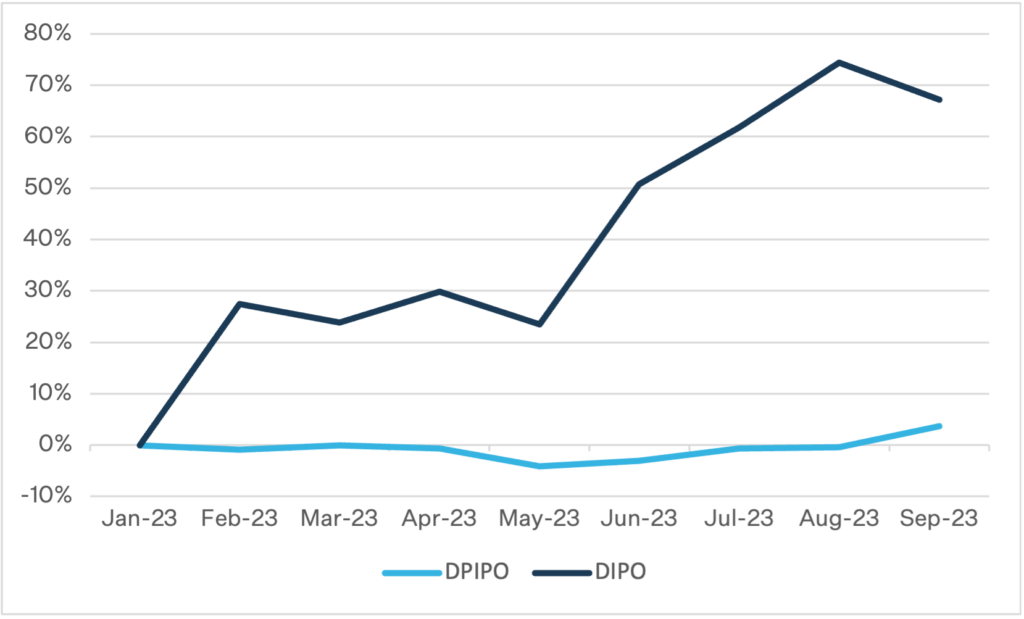

Here’s what’s interesting: Late-stage private valuations appear to be roughly flat YTD per the DPIPO. There’s a lot of dispersion in the set, but late-stage private valuations also seem to have mostly bottomed late last year, they just haven’t ripped back like we’ve seen in the public markets.

That could tell us two things. Either private market investors remain conservative relative to public market investors, or maybe the private marks we were seeing in 2021 and early 2022 were even crazier than those in the public markets, so they need a deeper and more sustained reset. Most likely both things are true.

Recent reports put Instacart’s initial IPO range at $26-28, and I suspect that might get bumped up by the end of this week. If Instacart IPOs around $30 per share it would value the company in line with DASH and UBER on revenue and FCF multiples. A $30 price would be roughly flat from secondary Instacart transactions early in 2023 and 76% below Instacart’s $125 peak share price in March 2021.

Our IPO index data says the IPO window, but we should expect to see more IPOs well below peak prices given what we’re seeing so far in secondary markets. It’s on companies to grow into promises made at higher valuations. Long-term stock performance will tell us how happy investors end up.