Hidden beneath Apple’s Mac announcements at its Unleashed event was progress the company has seen in making chips. Five years ago, the thought of Apple designing a chip that competed or exceeded Intel specs was farfetched. While there is room for interpretation, our view is that Apple is now beating Intel at its own game, with chips that deliver a better Mac experience compared to machines powered by Intel.

All consumers care about is a better user experience

Stepping back from comparing specs on M1Pro, M1Max, and the Intel family, it’s clear that in designing its own silicon, Apple is able to optimize the chips for its proprietary hardware and software (apps). This customization results in greater compute efficiency and is another iteration of Apple becoming more vertically integrated as a company. Two examples of this increased efficiency include:

- The newest MacBook Airs don’t have cooling fans because the chip consumes less power, resulting in a quieter computing experience.

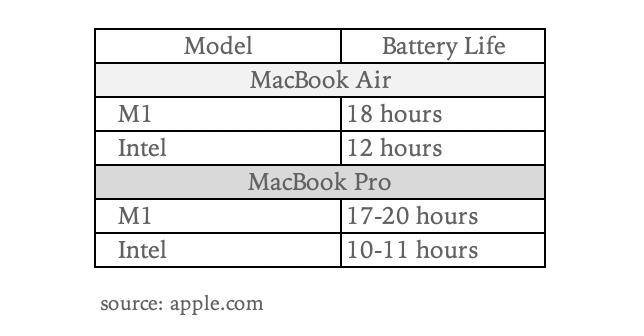

- The battery life on the new M1 computers have seen step-function increases from their Intel predecessors:

At the end of the day, 99% of consumers don’t care about the technical specs. They just want a faster, quieter, and more efficient computer.

Cycle of mutual benefit

From a strategic perspective, using ARM-based chips instead of Intel strengthens the Apple ecosystem. In the past, iOS apps had to be reconfigured and custom-built for macOS, a time- and capital-intensive project, especially for small developers. However, now that both iPhone and Mac run on ARM-based Apple chips, iOS apps can be published by default on macOS.

- Developers benefit because they can now easily reach the high-end, 10% of the personal computer market that is on Mac without having to spend more on app development.

- Mac users benefit because more apps will be available on the Mac store.

- Apple benefits because it increases the value proposition for potential Mac buyers if they know more apps will be available with better performance.

Preparing to power the metaverse

The demands on silicon will increase as we slowly move into the metaverse. Apple is the only company that can monetize their current development costs at scale and transfer the relevant pieces of M1 chip building blocks to the hardware of the metaverse. In other words, over the next five years, our laptops will be one onramp into the metaverse, and Apple machines will be positioned to capitalize on the trend.

Apple inches ASP higher and consumers still win

The biggest surprise of the event was related to pricing increases. The price of the new 16 in. MacBook Pro increased by 4%, entry-level AirPods by 13%, and 54% for the new 14 in. MacBook Pro compared to the previous 13 in. model. We don’t expect the higher prices to soften demand because Apple’s a case study in virtuous cycles of mutual benefit. The idea is that the company benefits from increased prices, while consumers are happy to pay the higher prices for the increased utility. It’s a win-win that ultimately benefits $AAPL investors.

Rounding out the product announcements

- 3rd generation entry-level AirPods with spatial audio. Even with the 13% price increase, we believe Apple is going to sell as many AirPods this holiday season as they can make. Overall, AirPods is about 4% of revenue and is estimated to grow 15% in 2022 (Loup estimate).

- Apple Music “Voice Plan” gives access to the entire music library through Siri for $4.99/month (half the price of the individual plan). The idea is to give a monthly discount to incentivize users to help train Siri. We don’t think it’ll move the Apple Music revenue needle.

- Adding colors to HomePod mini follows the time-tested roadmap of Apple sparking demand. HomePod is less than 0.5% of revenue, so the colors will be negligible for revenue.