Vision Pro is a breakthrough

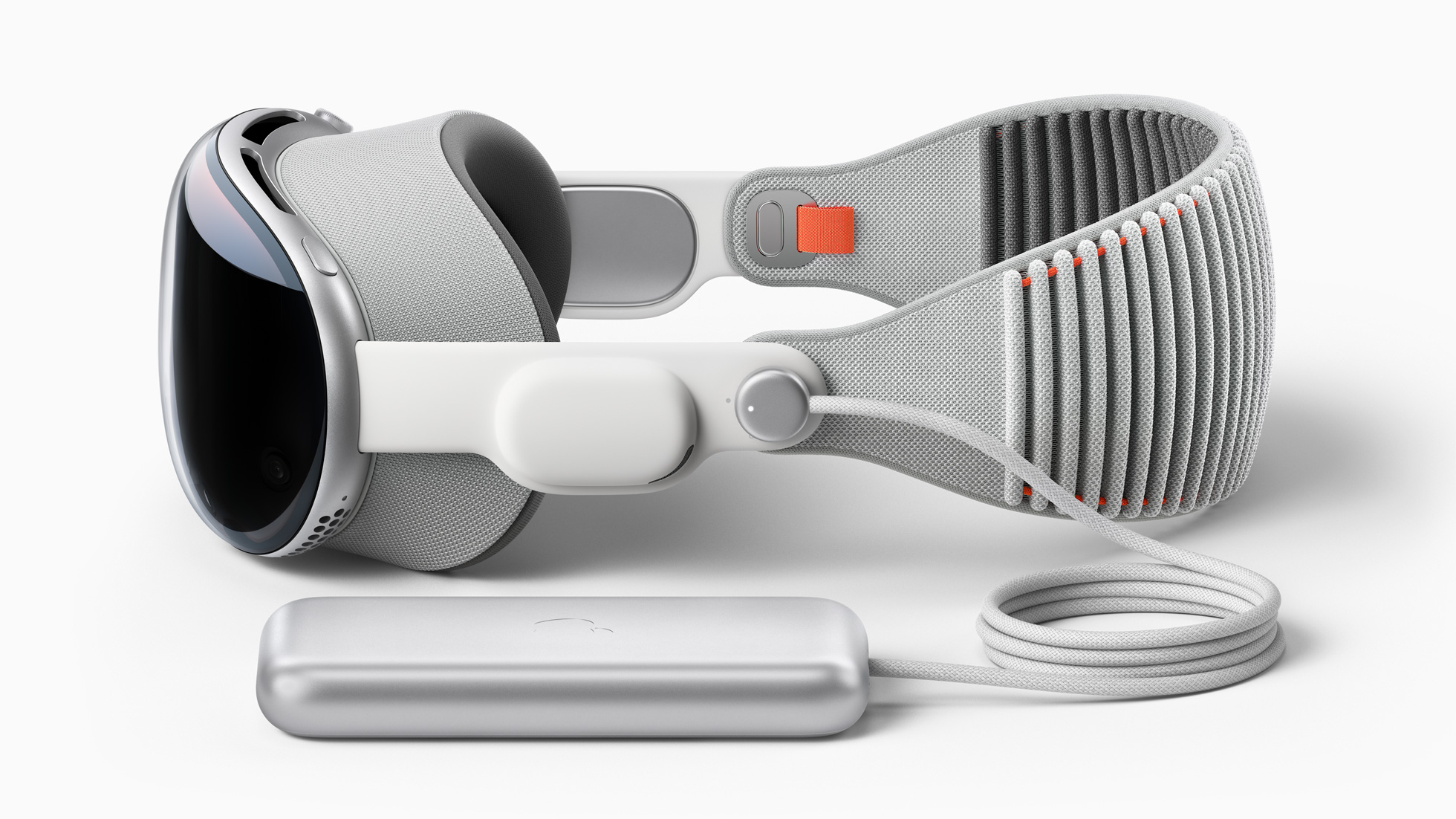

Taking a step back, Vision Pro is a spatial computing headset. Spatial computing is the next logical computing interface, allowing users to interact with digital objects in the real world. Essentially the goal is for the lines between the current phone and computer interface to merge with the real world.

The concept of spatial computing is not new. In 2017, Apple began talking about the potential of augmented reality, and in 2019, Meta launched the Oculus Quest headset, dubbed as computing for the metaverse.

Call it AR, spatial computing, or the metaverse, each is centered on the basic principle of bringing digital objects into the real world. While the concept sounds promising, the substance of the uptake has been disappointing. Meta’s Quest headset has been out for about four years, and I estimate they have sold about 25M units to date. That comes out to about 6M per year, a fraction of what I estimate to be 230M in annual iPhone unit sales. On top of that, its Reality Labs unit will lose just around $15B next year, compared to $13B last year.

While the Quest case study is concerning, it’s a different product than Vision Pro. Yes, both are headsets, but Vision Pro is a breakthrough. The limited 30-minute demo I had with the product back in June made me see, for the first time, that the concept of bringing the digital and real worlds together is here.

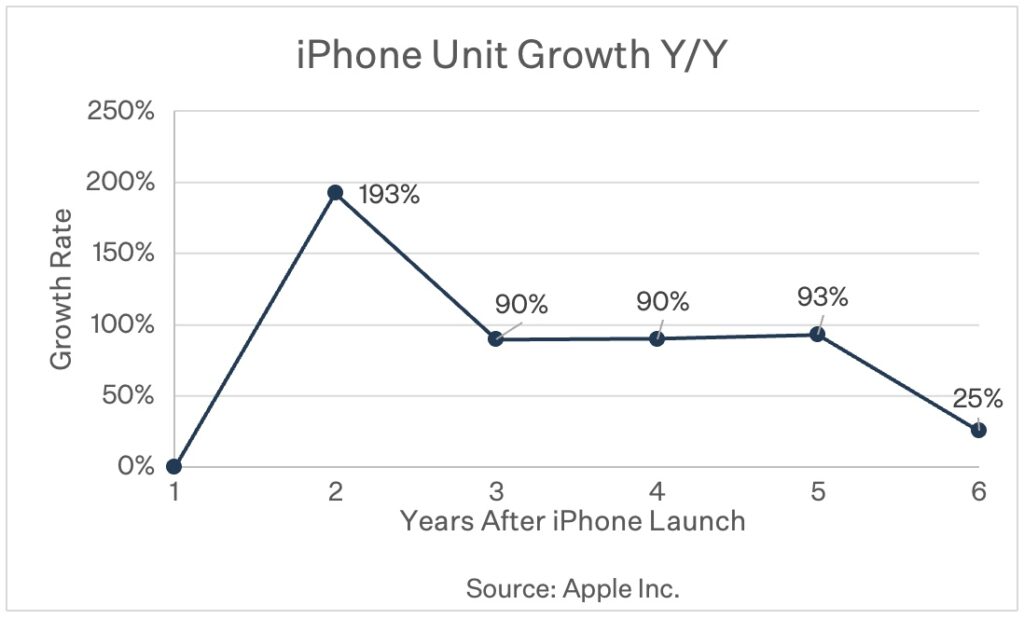

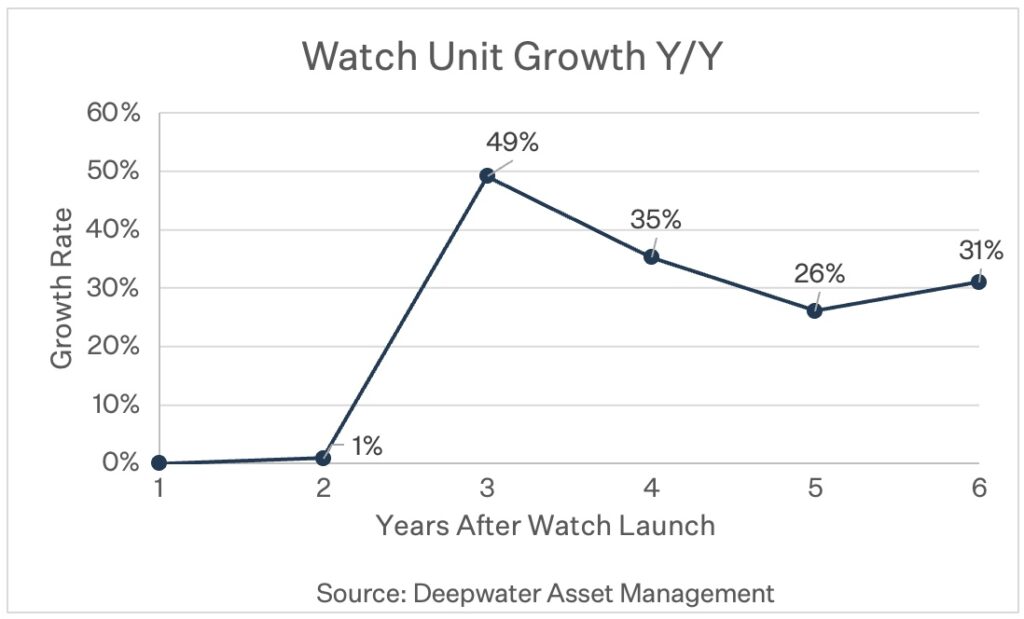

As for timing, no need to buckle up for the next paradigm shift, because it will take five years to take off.

I believe Vision Pro will be the first spatial computing device that consumers will want to use. Others have tried over the past eight years, including Microsoft with HoloLens and Meta with Quest, and have yet to capture a groundbreaking product. Vision Pro, at its core, is the first product to have spatial computing at breakthrough quality.