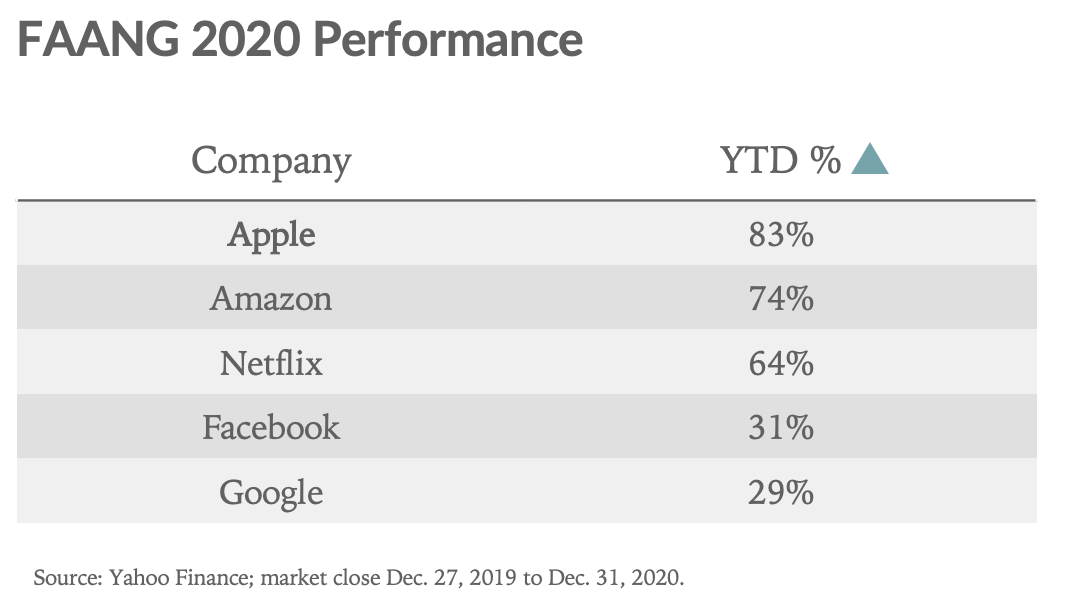

For the past two years, 2019 and 2020, we’ve correctly predicted Apple would be the top performing FAANG stock. Here are the results from 2020:

Predicting a three-peat

We’ve recently made the prediction that Apple will once again be the top performing FAANG stock in 2021. Our thesis is below.

1. Accelerating digital transformation

It’s clear our dependency on tech has accelerated because of the pandemic. While the velocity of this adoption may ease post-pandemic, our view is that much of the change is sustainable moving forward. For example, we estimate the percentage of US knowledge workers working remotely will settle long term at a level 3x greater than before the pandemic. Apple is the cornerstone of this digital transformation with a combination of hardware, software, and services that its competitors cannot match in terms of reach or popularity. A recent point of evidence for this dependence is the 20%-40% growth in the Mac and iPad businesses in the Jun-20 and Sep-20 quarters after flattish growth over the past few years. In short, our reliance on the company will continue to grow in the years to come.

2. Expect FY22 Street estimates to inch higher

While Street FY21 revenue growth estimates of about 15% are in line with our expectations, we believe consensus estimates for FY22 of 5% y/y revenue growth are too low and expect those estimates will inch higher throughout FY21. Ultimately, we believe FY22 revenue growth will be closer to 10%. We believe the drivers of this revenue upside will be a combination of iPad, Mac, and iPhone growth.

3. 5G to initiate multiyear iPhone upgrade cycle

While 5G will impact much more than phones, that segment will be the first to see a lift in consumer spending. Specifically, Apple should enjoy its biggest smartphone upgrade cycle since iPhone 6, when iPhone unit growth went from 13% in FY14 to 37% in FY15. While we expect limited 5G network coverage in the US will initially temper consumer demand for iPhone 5G in the front half of 2021, as 5G coverage and performance improves in the back half of the year, we believe it will spur a multiyear iPhone upgrade cycle versus the typical one-year cycle. Starting in FY22, we believe Apple is positioned to have two to three years of 5%-10% annual iPhone revenue growth. We believe investor consensus is looking for low single-digit iPhone revenue growth during that period.

4. New business segments

We believe shares of AAPL will be rewarded by the anticipation of new business segments. One segment is expanded hardware subscription offerings, eventually moving toward a 360° bundle. We envision Apple building on its current iPhone upgrade program to offer similar subscriptions for Mac, iPad, and Watch. Today, about 55% of the company’s revenue can be purchased as a subscription. By adding Mac, iPad, and Watch subscriptions, that number would approach 85%. This dynamic will increase the company’s revenue and earnings visibility which should, in turn, expand the earnings multiple.

The automotive and broader transportation opportunity. It’s unclear what role Apple will play in the future of automotive and broader transportation. What is clear is that the company is well-positioned to meaningfully contribute to creating the car of the future, given their differentiated technology in silicon, software, batteries, AI, and cameras. Transportation’s addressable market is massive. Take one segment of transportation, auto, for example. Assuming over 80m cars are sold annually at an ASP of $25,000, global auto is a $2T market. For perspective, Apple’s expected revenue for the current fiscal year is $315B. Whether Apple Car materializes in a fully-branded vehicle or the company pursues licensing software and technology to existing automakers, capturing just a slice of this market would translate to a material impact on Apple’s revenue.

If Apple were to build a car, it’s unlikely it would be released before the 2024 target cited in the recent Reuters report. That said, we expect investor optimism regarding Apple’s auto play to increase in 2021, driven by sporadic reporting on the topic.

Putting it together, we believe shares of AAPL will approach $200 (50% upside from current levels) over the next couple years, based on 35x our 2022 EPS estimate of $5.70.