- Apple’s capital return framework is the 3rd of 4 pillars to our Apple as a Service thesis.

- Getting to net cash neutral is one of Apple’s biggest levers to move shares higher.

- We expect Apple to be net cash neutral in 3 years, ahead of investor expectations of 5 plus years.

- To become net cash neutral, Apple will have to reduce its cash balance by $145B. We expect Apple to return $300B to investors in 3 years (cash from operations + cash draw down from balance sheet), with ~85% through buybacks.

- The mechanics are simple. Buybacks lower share count and raise EPS, which should theoretically move shares of AAPL higher by 24% over the next 3 years.

- To better illustrate the road to net cash neutral, we’re introducing our Apple cash flow model here.

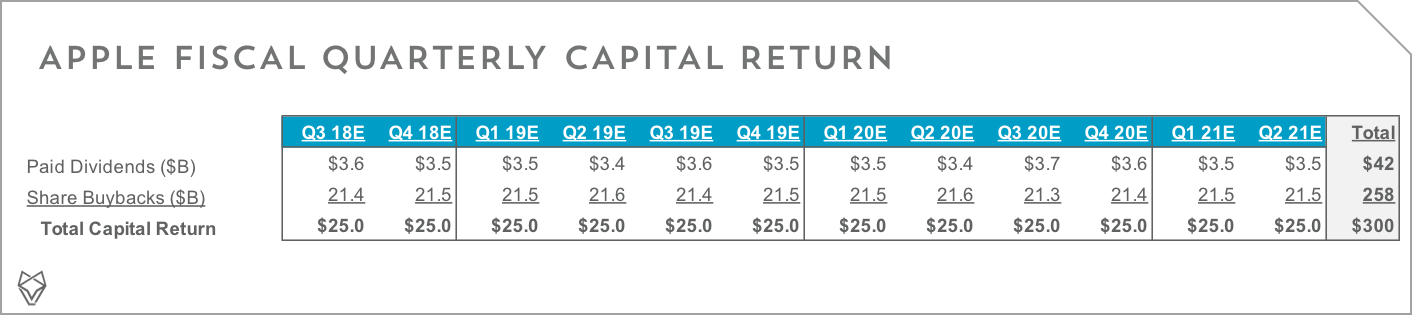

Apple net cash neutral by FY21. Tim Cook said on the Mar-18 earnings call that Apple will be net cash neutral “over time,” but stopped short of specifying a timeline. Over the next 12 quarters, we expect Apple to return $300B to shareholders and to be net cash neutral by the end of the Mar-21 quarter. This would more than double the current pace of capital returns. Apple has distributed $234B over the previous 6 years. As shown in the table below, we expect Apple to maintain, through the Mar-21 quarter, a capital return pace consistent with the just reported Mar-18 pace of $26.8B per quarter ($23.5B buybacks and $3.3B in dividends). This would be made up of about $21B to $22B in share buybacks and cash paid for dividends of $3.4B to $3.7B quarterly. We’re modeling for dividends to increase by 5% each year, in line with the percentage increase in FY17.

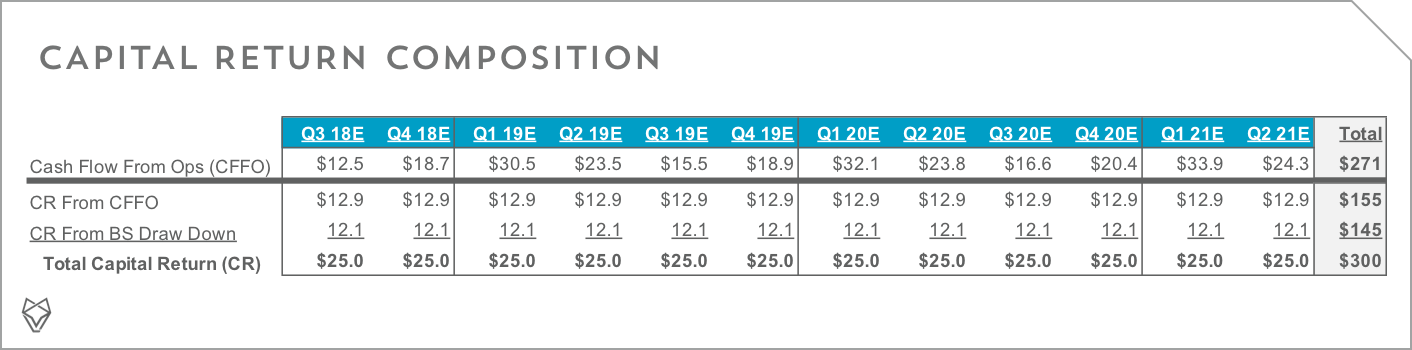

Our 3 year expectation is reasonable. While our timeline to net cash neutral may sound aggressive, we believe it is realistic given the amount of cash the company generates from operations alone, as well as the need to draw down the balance sheet an additional $145B to make good on their net cash neutral goal. As shown in the table below, we are assuming capital returned from balance sheet draw down will remain relatively constant at $12.1B per quarter, while the remaining $12.9B will be generated by cash flow from operations. Even after returning this capital, the company will have an additional $6B to $12B quarterly in cash from operations that will be used for content, M&A, vertical integrations, updating their current 499 retail stores (remodeled roughly once every 5 years), and building out new campuses across the U.S.

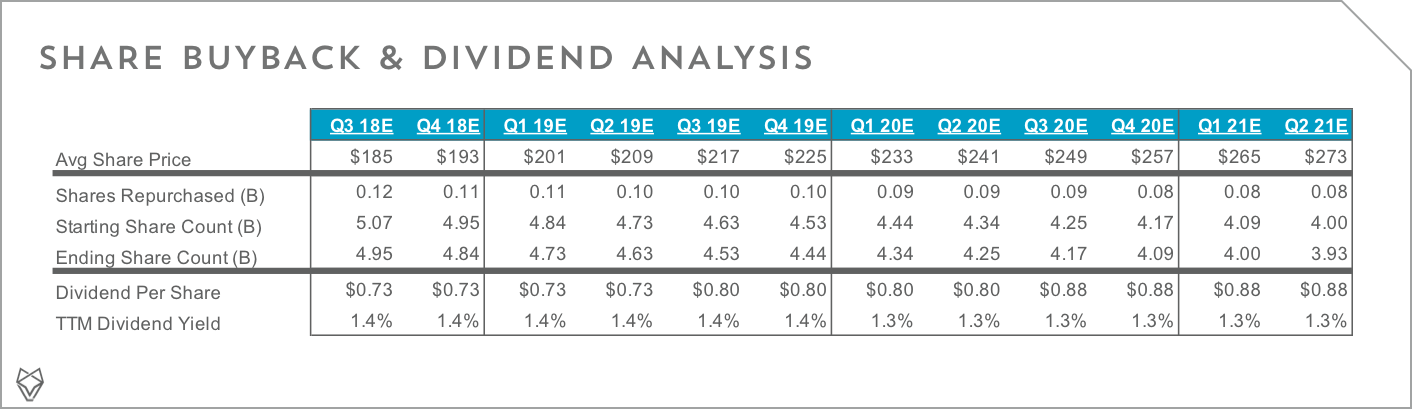

The buyback math that inches AAPL higher. We believe the buyback alone could move shares of AAPL higher by 24% over the next 3 years. This is based on 4 assumptions that would reduce share count by 24%, and raise EPS by a similar amount.

- $300B in capital will be returned from Jun-18 through the end of the Mar-21 quarter.

- ~85% of capital is returned through buybacks.

- Average buyback share price increases $8 per quarter (current price $185).

- Earnings multiple remains unchanged.

The party can continue beyond 3 years. After a 3-year period, capital distribution levels will normalize, going from about $100B a year to about $50B+. We anticipate Apple to maintain it’s net cash neutral approach into perpetuity. To do this, the company will need to return $50B+ each year, with 85% coming in the form of buybacks. This would still leave the company with about $6B in additional cash per quarter to invest in areas of the business outlined above.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.