There’s hope for the digital wallet. Despite 5 plus years of announcements from Google, Samsung, PayPal, Venmo, Square, Stripe, and Apple advancing the digital wallet theme, we believe less than 20% of global smartphone users actually use their phone as a wallet. Eventually, we believe that number will rise to above 80%.

Apple has several advantages to brand the iPhone as the premium digital wallet given its ability to integrate payments into both mobile and desktop operating systems, use its brand to win accepting retailers and supporting banks, and reassure users that transactions are secure and private. Separately, Apple Pay is the only digital wallet with all five payment pillars: mobile, desktop, in-app, peer to peer, and point of sale.

Apple Pay is still too small to move the overall Services business (only 1-2% of Services revenue, growing at 40%). Today, Apple often markets the iPhone around the camera and its filters (portrait, studio, stage), notably with the “Shot on iPhone” campaign. In the future, we expect the digital wallet to be a marketable iPhone feature. Adoption of Apple Pay is growing, and we believe 31% of iPhone users have used Apple Pay in the past year, compared to 25% a year ago.

On Apple’s latest earnings call they shared data points that allow us to back into updated user metrics.

- Over 1 billion cumulative transactions in Jun-18, a 3x increase in transactions y/y (source: Apple).

- Apple Pay now has over 4,900 bank partners (source: Apple).

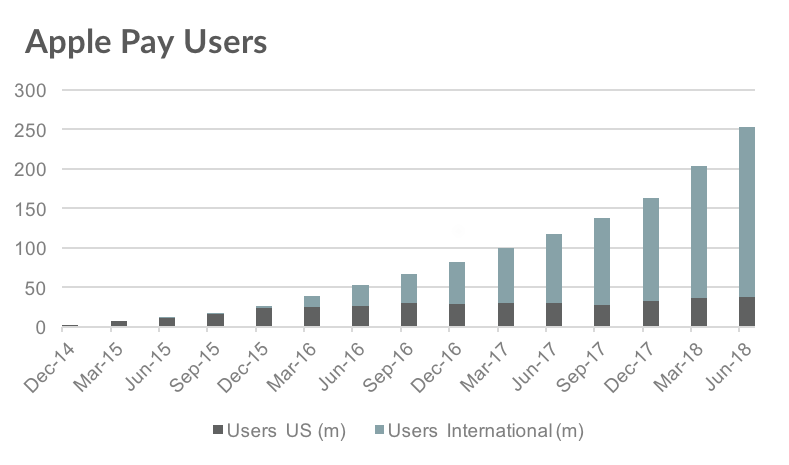

- We estimate that Apple Pay now has over 252 million users, which equates to 31% of the active iPhone base (source: Loup Ventures).

- Adoption of Apple Pay continues to accelerate exponentially overseas compared to the U.S., with 85% of users being international vs. 15% in the US (source: Loup Ventures).

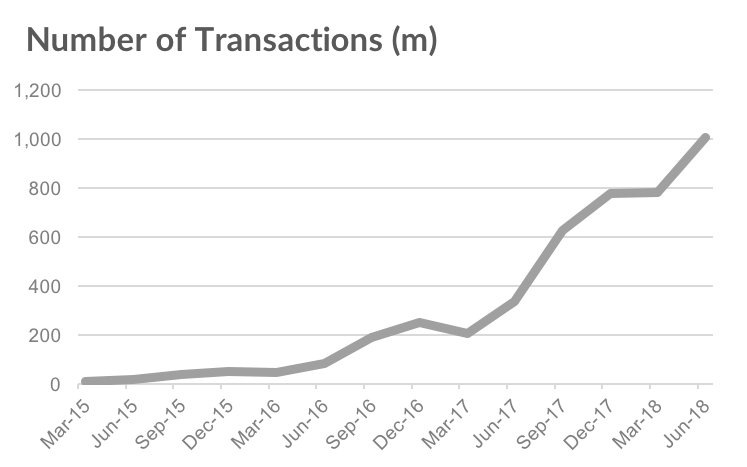

Quarterly transactions are increasing exponentially

Over the last three June quarters, Apple has reported y/y growth of 500%, 400%, and 300%, respectively, bringing the total transaction number “well over 1 billion” (Source: Apple). With the continued expansion into new markets and new partnerships with banks, we expect transaction growth of 200% over the next 12 months.

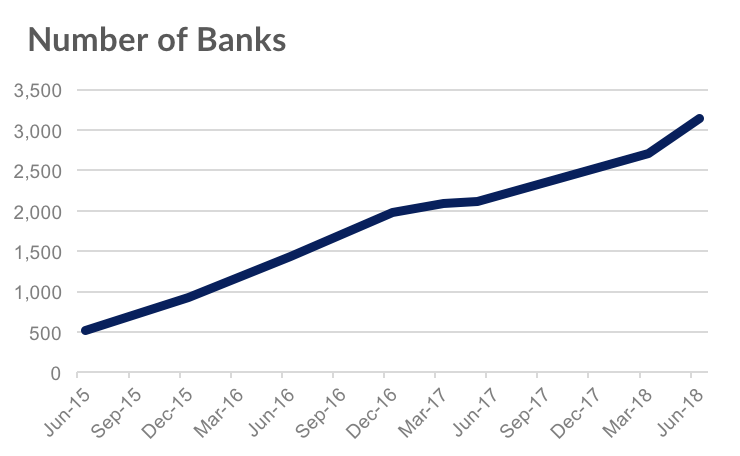

Banks adoption of Apple Pay steps up

Apple announced on their most recent earnings call that they now have over 4,900 banks partnered with Apple Pay. This is the first time that Apple has given a specific number of banks that support Apple Pay. We historically have counted the number of supporting banks listed on Apple’s Apple Pay page, which while the absolute number we found (3,149) does not match the 4900 reported number, it better illustrates the bank adoption trend. For comparative reasons, we are sticking with our previous method of counting banks. We found that since the Dec-16 quarter the total number of banks which have adopted Apple Pay has increased by 1,701. To put that into context, over that same period growth in U.S. & Canada banks increased by 926 (55%), bank adoption in Asia grew by 337 (141%), and adoption in Europe grew by 185 banks (370%).

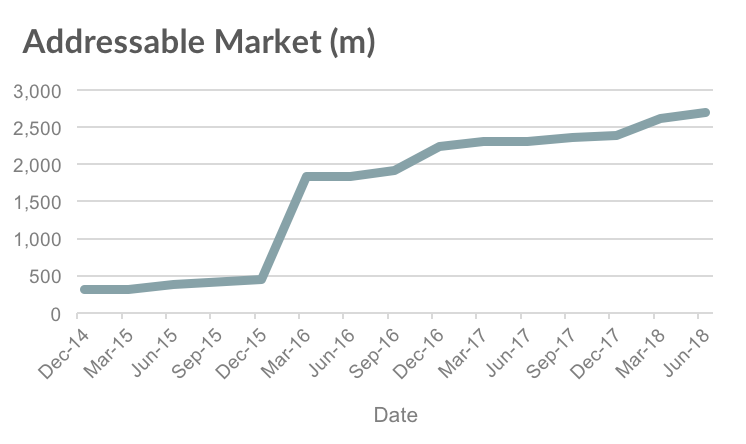

Apple Pay user base up ~24% q/q

In the last year 9 countries have been added to Apple Pay’s addressable market, which has extended its possible reach by about 400 million people, and now totals 2.7 billion. As a point of reference, the jump that occurred between the Dec-15 and Mar-16 quarters is when China (1.38 billion people) was added.

International market continues Apple Pay dominance

With the addition of new countries, it makes sense that international has been the key driver to the Apple Pay story. There are currently 24 countries where Apple Pay is accepted, soon be 25 with the addition of Germany later this year. We now estimate total Apple Pay user base at about 253 million (International at 215m, US at 38m). This means the percentage of Apple Pay users in the U.S. has decreased to 15% and international has increased to 85%.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.