Our fourth annual Apple Pay availability study is complete. We found 20% plus increased adoption from banks and top retailers across desktop sites, mobile web, and apps. These growth rates, off an increasingly bigger base, suggest Apple Pay is becoming a must-have payment option for retailers and banks.

Today, we estimate just under 30% of top retailers offer Apple Pay on desktop, ~40% on mobile, and 43% in apps. Given the majority of low-hanging fruit has now been captured, we expect retail adoption growth rates to decline in the next year, in combination with Apple Pay consumer usage rates accelerating year over year. Putting it all together, Apple Pay is increasingly becoming an effective customer acquisition and retention feature for Apple.

Methodology

We check the desktop websites, mobile websites, and iOS apps of a cohort of 100 of the top online US retailers for the ability to use Apple Pay at checkout. While there is some movement in this cohort of retailers every year regarding their relevance to consumers, we keep the list constant to maintain comparable results (see last year’s results here).

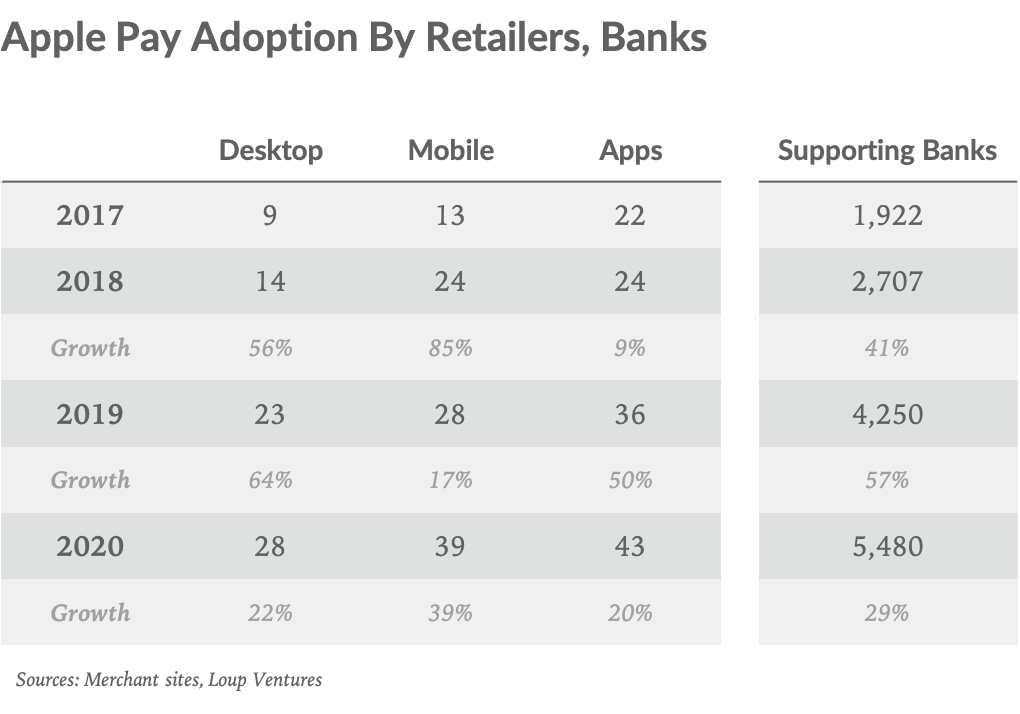

This year we found 20% plus y/y growth across the board, with the mobile segment growing fastest:

- Desktop adoption increased to 28 of 100 sites compared to 23 a year ago, up 22% y/y.

- Mobile jumped to 39 of 100 sites versus 28 last year, up 39% y/y.

- iOS apps were 43 of 100 compared to 36 last year, up 20% y/y.

- Supporting banks increased to 5,480 globally, up 29% y/y.

The above findings suggest that merchants and banks continue to align their payment offerings with consumer behavior and preference. E-commerce as a percentage of total retail shopping has roughly doubled since the start of the pandemic, growing from low teens pre-pandemic to mid-20s today. As consumers make a greater share of their purchases online, we believe the convenience, speed, and security of digital wallets like Apple Pay are becoming more apparent to consumers.

A thought on in-store adoption

We no longer track Apple Pay adoption at in-store point-of-sale systems. That said, in January 2019 Apple announced that Apple Pay was accepted at 74 of the top 100 US retailers and available at 65% of all US retail locations. Now, we estimate these numbers are about 95 of 100 and 85% respectively, as more consumers are using contactless payments during the pandemic to avoid spreading germs.

What is Apple saying about Apple Pay?

The short answer is not much. On Apple’s Dec-19 earnings call, CEO Tim Cook reported that Apple Pay revenue and transactions “more than doubled year-over-year with a run-rate exceeding 15 billion transactions a year.” During the company’s Sep-20 earnings call this month, Cook said, “Apple Pay is doing exceptionally well” and that “contactless payment has taken on a different level of adoption.”

How many iPhone users have activated Apple Pay?

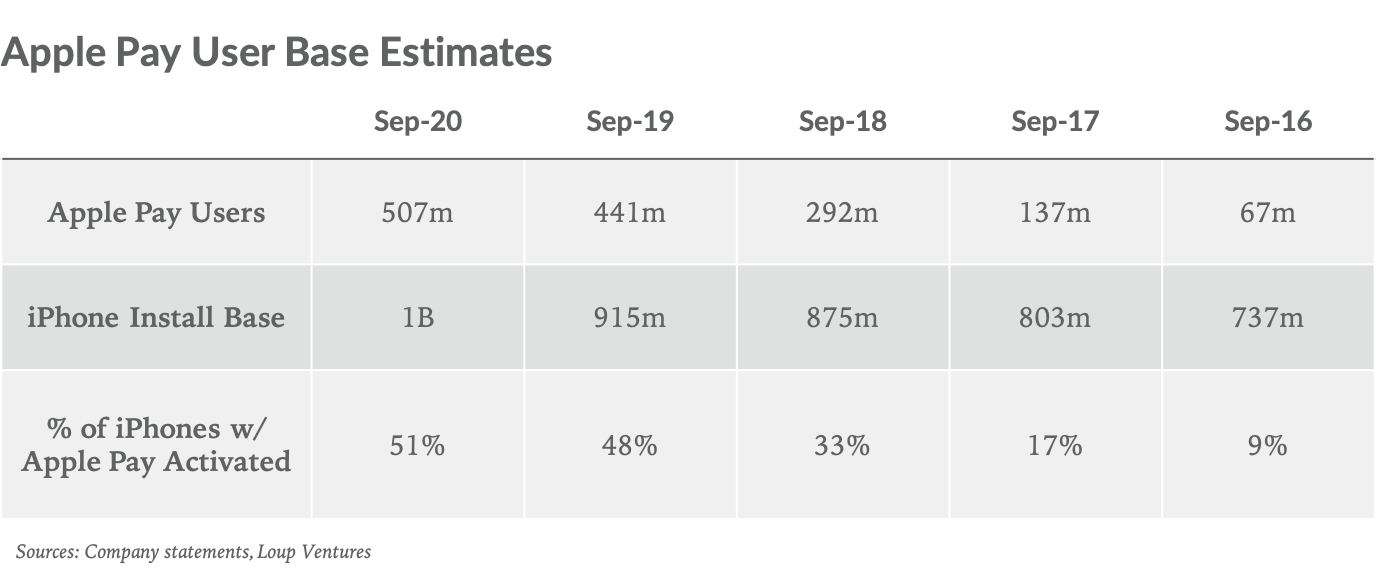

Based on our estimates of 9% growth in active iPhones (now at 1B total), along with greater usage of contactless payments during the pandemic, we estimate the percentage of active iPhone users that have enabled Apple Pay has increased from 441m in Sep-19 to 507m in Sep-20.

This implies 51% of active iPhone users have set up Apple Pay, compared to our estimate of 48% a year ago. This 15% y/y growth in activations does not capture the greater growth in Apple Pay transactions, which we estimate to be growing north of 30% over the past six months.