At the upcoming fall iPhone event, Apple is expected to announce service bundles which will include combinations of Apple Music, Apple TV+, Apple News+, and iCloud. The company’s ability to promote its own services within its existing hardware-software ecosystem represents a competitive advantage. Since 2016, we’ve compared Spotify and Apple Music to quantify how iOS ownership impacts paid subscriber growth.

Takeaways

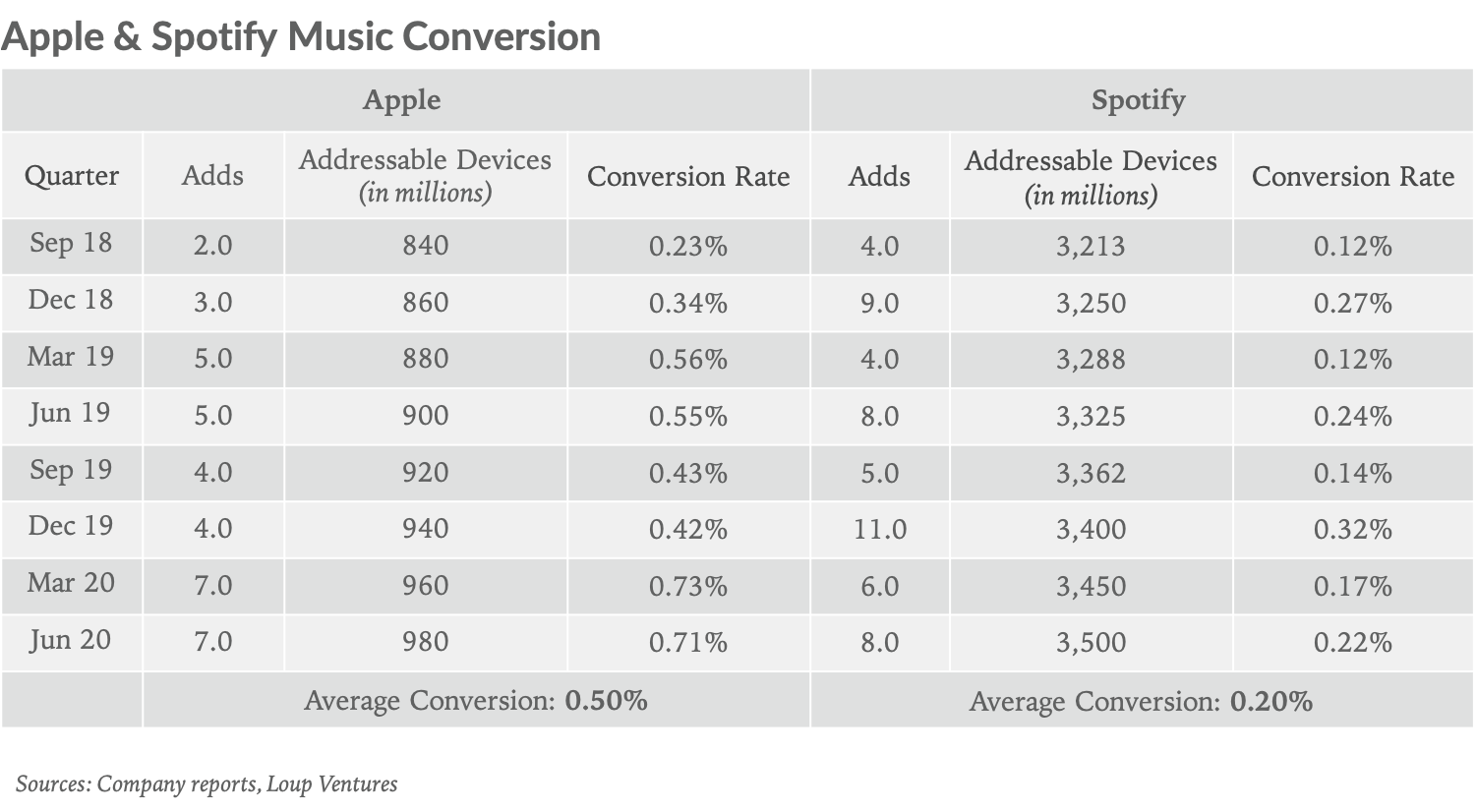

- Adjusting for addressable market (we estimate more than 95% of Apple Music subscribers are on iOS), our estimates indicate that Apple is converting potential customers into paying customers at a rate 2.5x faster than Spotify. We believe this faster conversion is driven by consumers valuing integrated experiences, which Apple’s ownership of iOS provides. Separately, iOS owners have more disposable income than the average Android owner, which also plays into paid subscriber adds.

- Apple Music has room to grow with 82m subs out of 980m active iPhone users (8%) paying for the service.

- We estimate the average Apple Music subscriber is paying about $7.00 per month, which equates to about $6.8B in revenue this year, or 2.5% of total revenue.

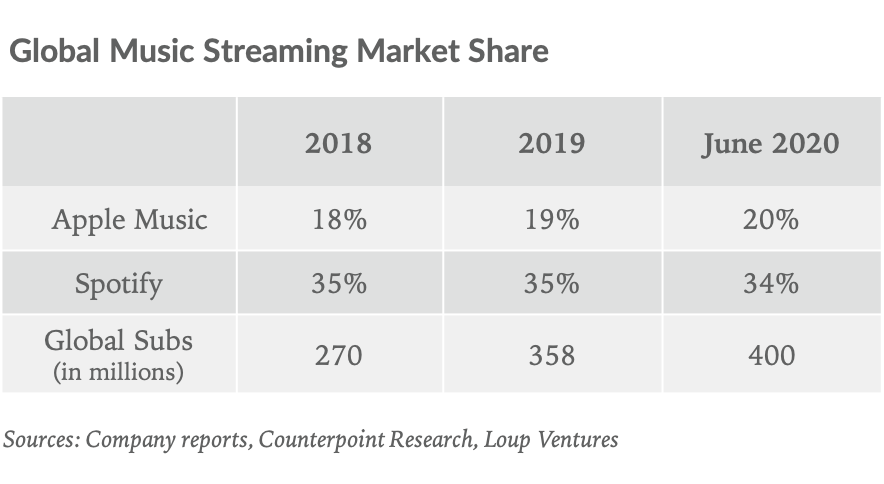

- While Apple Music is growing paid subs faster than Spotify, the overall market share between the two companies has remained stable over the last two years. We currently estimate Spotify has 34% global share compared to 20% for Apple. We estimate market shares for the two companies were 35% and 18% respectively in 2018.

- Notably, the global music streaming market as a whole has become more competitive in the last two years with the rise of Amazon Music, YouTube Music, Tencent Music, and multiple other offerings with fractional market share.

iOS ownership drives market share gains

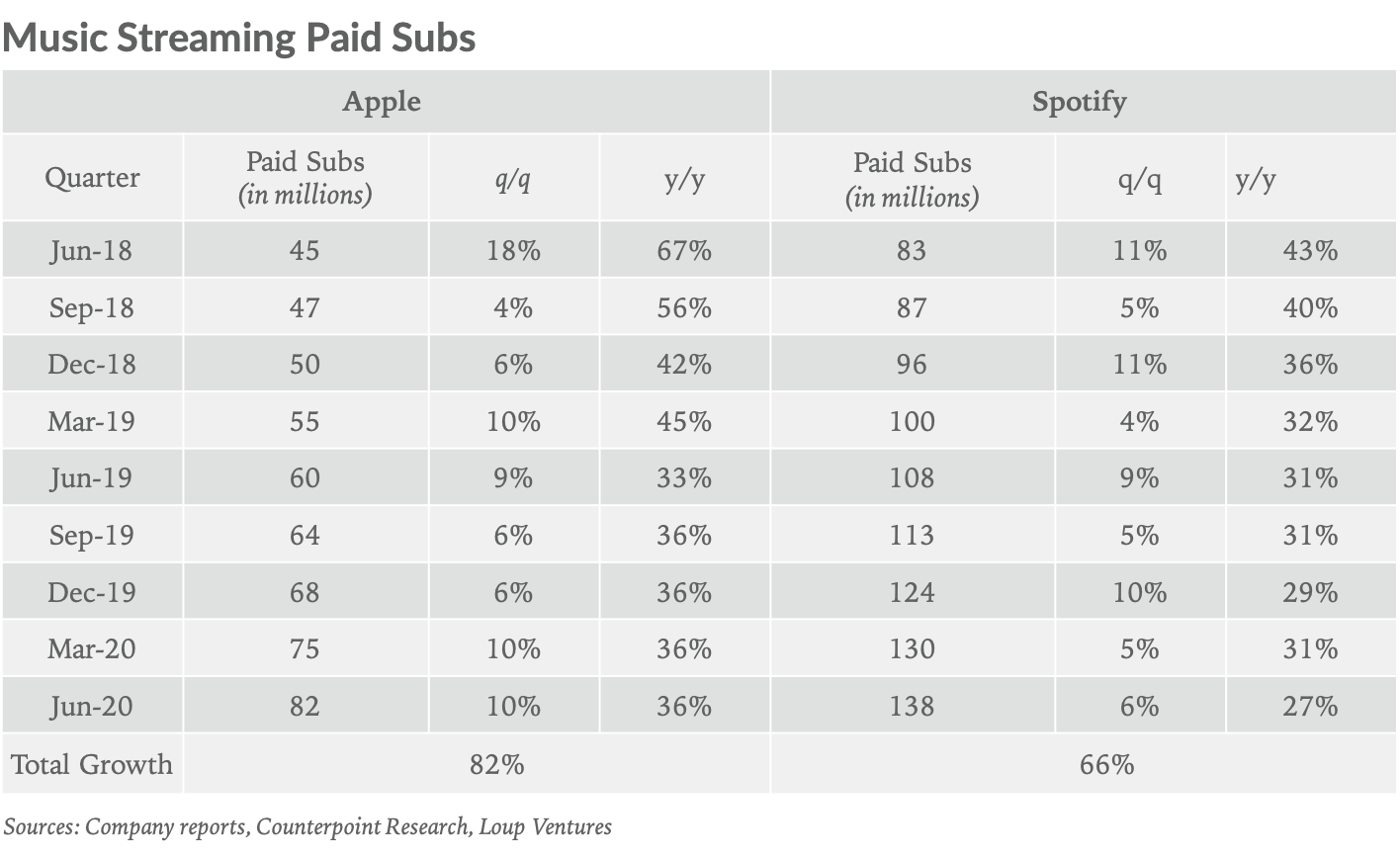

We compared paying subscribers for the top two global music streaming platforms over the last eight quarters. Spotify reports quarterly paid subscribers. While Apple does not report its paid music subscribers on a quarterly basis, the company does report on milestones.

In April 2020, Apple CFO Luca Maestri indicated paid subscriptions for Apple Music was “up strong double digits.” In July 2020, Maestri said Apple Music experienced “strong double-digit growth.” Based on December 2019 estimates from Counterpoint Research of 68m paid subscribers, Loup estimates Apple Music currently has about 82m paid subscribers.

Since June 2018, Apple Music has grown paid subscribers by 82% compared to 66% for Spotify.

Apple has slightly closed the global market share gap on Spotify over the past two years.

Apple Music conversion rates outpace Spotify

Over the past 8 quarters, Apple Music had an average conversion rate of 0.50% compared to 0.20% for Spotify, suggesting Apple has been 2.5x more effective at converting potential subscribers into paying customers. Further, this conversion appears to be accelerating for Apple. From Sep-19 to Jun-20, the company converted on average 0.57% of customers in its addressable market vs. 0.42% from Sep-18 to Jun-19. Across the same two time periods, Spotify registered conversion rates of 0.21% and 0.19% respectively.

Conversion rate methodology

Spotify’s addressable market includes the total number of iOS and Android users as the Spotify experience is the same across both platforms. Conversely, although Apple Music is available to Android users, we believe it is heavily concentrated among iPhone owners, given the app is native to the iPhone and seamlessly integrated with the OS. We estimate less than 5% of Apple Music subs are Android users.

To find conversion rates, we divided the quarterly additions to paid subs by the total number of addressable devices. Apple’s and Spotify’s addressable markets grew by approximately 140m and 285m respectively between Sep-18 and Jun-20, and we assume the growth occurred at a steady q/q rate. While Apple Music is adding fewer paid users in absolute numbers, relative to their addressable market, they are converting potential customers 2.5x more effectively than Spotify.