Apple and Epic Games (creator of Fortnite) are in the third week of their bench trial with Judge Yvonne Gonzalez Rogers, the culmination of a feud between the two companies regarding App Store take rates and in-app purchases (IAP). As a reminder, Apple removed Fortnite from its App Store last September after Epic placed its own in-app payment system into the game. Epic argues that Apple has a monopoly when it comes to the distribution of apps and IAP, and in turn uses this control to charge anticompetitive commission rates. A decision from Judge Rogers is expected in early June, which of course, will likely be appealed.

What’s at stake?

- At stake for Apple is billions of dollars high-margin revenue (likely 75%-80% operating margins). We estimate the App Store accounts for 35%-40% of Services revenue, or about 8% of the company’s overall revenue, and likely 15%-20% of Apple’s total operating income. Needless to say, the App Store is a substantial part of Apple’s business.

- At stake for Epic is the continued loss of Fortnite revenue, 7% of which came from iOS (around $700m in total between 2018 and 2020), along with negative sentiment from its user base.

While the springboard for Epic’s lawsuit was the removal of Fortnite from the App Store, it touches on more fundamental questions: How should markets be defined in a digital era? What constitutes a monopoly in such markets?

From the highest level, given these questions touch on mostly uncharted legal territory, we believe any ruling from Judge Rogers will likely be appealed and ultimately pushed to the Supreme Court, thereby taking years to fully resolve.

Two weeks in, we believe the odds are that Apple will win this case. The burden of proof falls on Epic to show that Apple is hurting consumers through its App Store policies, a difficult standard to meet given most consumers are pleased with the App Store experience. Additionally, history shows that successful antitrust challenges are few and far between, which makes an Epic victory unlikely.

Why we believe Apple will win

- Consumers are pleased with the App Store experience. Vertically integrating software and hardware makes using the App Store, including downloading apps and making purchases, seamless and convenient for consumers. Consumer welfare is more of an emphasis than competition in US antitrust law, and we believe it will be difficult for Epic to meet the burden of proof that the App Store harms consumers.

- Epic’s potentially contradictory motivations. Epic’s public stance for its lawsuit has been to fight for all app developers against Apple’s App Store monopoly, with the goal being lower commission rates. Hence the name of its public IR campaign, “Project Liberty.” However, during Epic CEO Tim Sweeney’s testimony last week, he said he would have accepted an exclusive lower commission rate if Apple would have offered it during their negotiations:

Lawyer: If Apple had told you that it would offer you a deal and no other developers, would you have accepted that?

Sweeney: Yes, I would have.

This gives some credence to Apple’s argument that the primary reason Epic filed the lawsuit was not to fight the good fight, but rather, to revive the flailing financial performance of Fortnite, which saw revenues decline more than 30% from 2018 to 2019.

- Apple’s commitment to security. Apple created the App Store as a closed garden to ensure user security and privacy as users downloaded third-party apps. This gave iPhone users confidence that what they were downloading was safe, and allowed the App Store to rapidly grow from 500 apps at its inception to more than 2m today. Opening iPhone to third-party app stores has the potential to weaken security and privacy, thereby harming consumers.

Where we could be wrong

- Uncharted legal territory. Given that questions about how to define a relevant market in the digital era, along with determining what constitutes a monopoly in said market, largely lack precedent, it’s unclear how Judge Rogers will rule. If she rules that the market in question is gaming platforms more generally (as Apple is arguing), it’s unlikely Apple has a monopoly because Fortnite users have the option to play on other platforms such as PlayStation, Xbox, and Nintendo. If the relevant market is iOS apps, by definition Apple has a monopoly. And while Fortnite mobile users could play on Android, they would experience significant switching costs to do so.

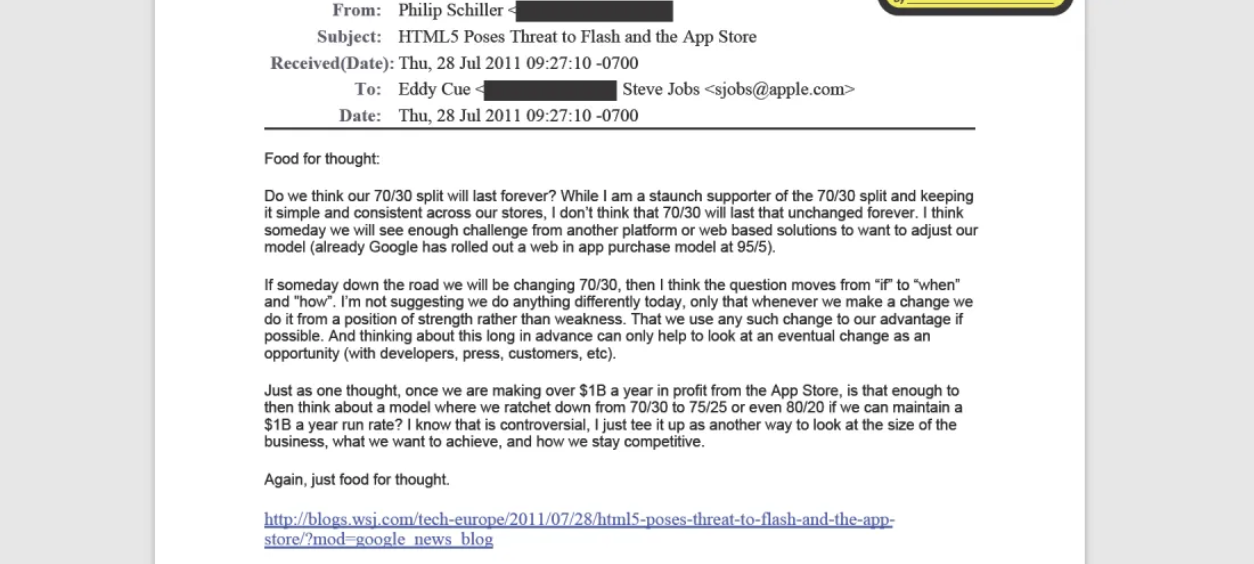

- Phil Schiller’s email. In a 2011 email to Steve Jobs and Eddy Cue (VP of Services), Phil Schiller (former VP of marketing) raised the idea of cutting App Store take rates as low as 20% to remain competitive:

Judge Rogers may view this as evidence that Apple’s 30% commission rate is monopolistic pricing, which the company has been able to keep constant due to the lack of competition.

A potential compromise

As it stands today, Apple prohibits developers from informing app users that they can subscribe or make purchases outside the App Store to avoid Apple’s 30% cut, and thus pay lower prices. For example, a Fortnite user could buy V-Bucks (virtual currency) from their web browser or Xbox console and then use them while playing Fortnite on iOS.

Judge Rogers has raised the possible compromise that Apple undo this policy, which would allow developers to explicitly advertise within apps that consumers can subscribe and make purchases outside of the App Store. We believe this compromise would be a reasonable outcome of the trial.

Putting it together

If Apple is victorious, the App Store status quo will carry on. That said, we believe the company will likely proactively moderate their take rates over time to remain in the good graces of government regulators. Apple has already halved its take rate to 15% for small developers earning less than $1m in annual App Store revenues, and we believe this decision foreshadows more favorable pricing for all developers down the road.

The bottom line is that regardless of how Judge Rogers rules, the trial’s resolution will provide near-term clarity and certainty for Apple and its investors, which is always a good thing. That said, one negative for Apple is that the trial is shedding more light on the company’s dominant position as it relates to iOS app distribution and payments. This will likely only increase congressional and regulatory scrutiny towards Apple.