Talk of Apple building a car is not new. In fact, they’ve been orbiting the possibility for the last seven years. During that time, the response from investors could best be described as a collective rolling of the eyes. Until now. A Bloomberg report reignited the Apple Car conversation, pushing shares of AAPL up over 4%, adding about $100B to the company’s valuation. As a point of comparison, Rivian’s current market cap is $109B. In the midst of continued rumors around the project, this report stands out for two reasons: First, it’s the first time we have details about the current direction of an Apple Car, which will lead with autonomy – as in Apple building a car without a steering wheel. Second, the report comes from Mark Gurman, who’s right 90% of the time. Gurman is not saying Apple will release a car. He is saying the company wants to do just that.

Lessons from the past

I’ve studied Apple for almost 20 years. Perhaps my low-light was when I was famously wrong in predicting the company’s internal project to build a television would yield a product. With that lesson in mind, I cautiously explore five thoughts on what an Apple Car would mean for Apple. If you’re wondering, I believe there’s a greater than 50% chance Apple eventually comes out with a car, and it’s likely more than five years away. While the eventuality of an Apple Car is far from certain, the continued talk about Apple’s ambitions in the space is almost certain in the years to come, which should lead to multiple expansion for shares.

What it means for Apple:

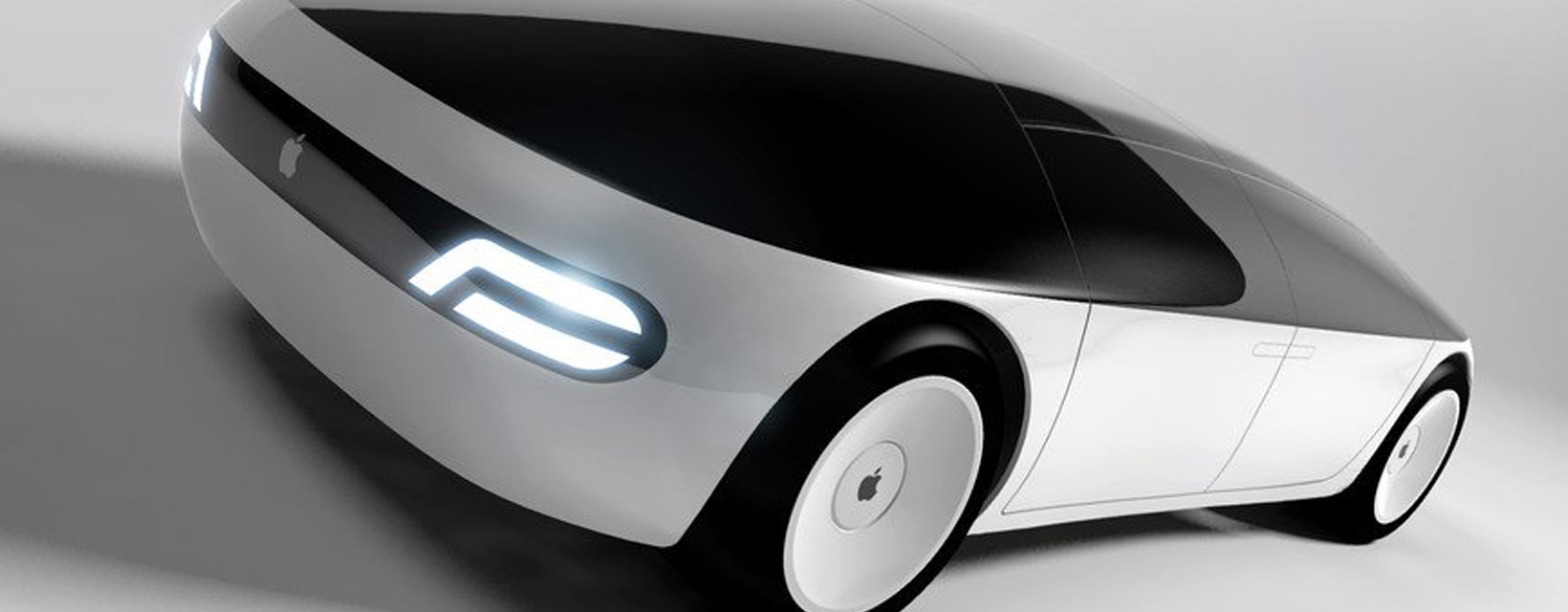

- A car is in Apple’s wheelhouse. Cars will become a computer on wheels – a collection of hardware, software, and services. The nexus of these three elements is what Apple excels at. I think of cars as big tech devices that will have services sold around the hardware. The software will hold it together. This model has supported a 25-30% operating margin, in line with Apple’s current margin structure.

- Just like other Apple devices, Apple would design the car and a third party would build it.

- The revenue impact to the business would be material given the total addressable market for auto is massive. For example, if you assume Apple can capture 10% of the auto market, (they have just under 20% of the phone market today), by selling a $60k car, it equates to $540B in annual revenue. That compares to Apple’s FY22 expected total revenue of $380B.

- In other words, Apple Car revenue could, over the long term, be greater than all of its other businesses combined.

- I caution it’s too early to price in the potential given we don’t know if the car will see the light of day, and even if it does, it’s five-plus years away. That said, the impact on Apple’s valuation could be staggering. Shares of Apple currently trade at 6.8x next year’s revenue forecast. If Apple captures 10% of the global auto market, and investors value auto revenue similar to how they value Apple’s current revenue, the car would add $3T to Apple’s current $2.6T market cap. On the other hand, if Apple captures 1% of the car market, it would add about $300B to the company’s valuation. Using this framework implies the market is now expecting Apple to eventually capture about 0.3% of the global car market.

Auto does not stand alone

Apple’s innovation ambitions go beyond the car. Auto stands next to AR + metaverse as Apple’s two biggest opportunities. The health care opportunity is measurable and yet a distant third.