Apple released its annual holiday app store numbers. The most important takeaway, despite declines in iPhone unit sales, is that App Store revenue growth continues at 16% driven by an active Apple device installed base which is now likely above 1.5B (1.4B reported end of Jun-19). We believe these results, given the context of the iPhone softness in 2018 and 2019, is further evidence that Services growth is not directly linked to iPhone units. We believe this stability is incremental evidence that Apple shares should trade in-line with other FAANG names that currently trade at a multiple of 26x next year’s earnings, ahead of Apple’s current 20x multiple.

Other Takeaways:

• We believe the App Store accounted for 39% of Services revenue in 2019.

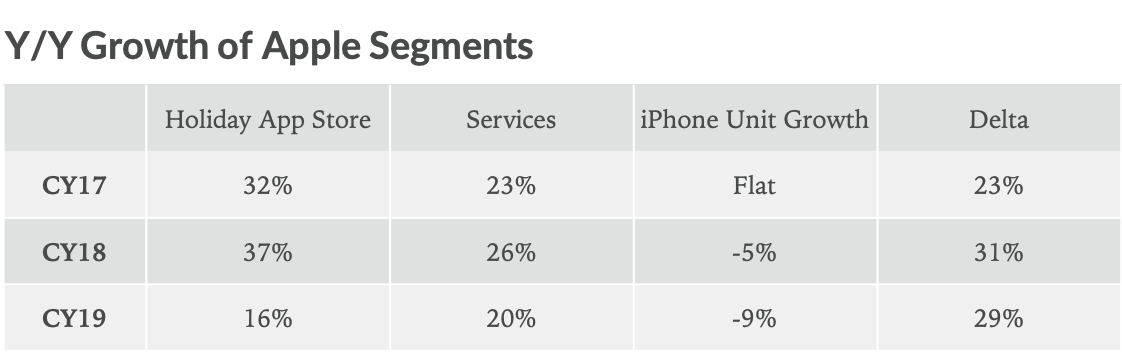

• The 16% holiday period App Store growth in 2019 is below 37% growth in 2018 and 32% in 2017.

• Despite the decline in growth, we remain comfortable with Street Services estimates for 17% growth in Dec-19, given other segments including Apple Pay and, to a lesser extent, Arcade and News are growing faster than the App Store.

• We believe in the past three years, Services growth has outpaced iPhone unit growth by an average of 28%, confirmation that Services growth is benefiting from Apple’s existing users increasing their spend within the Apple ecosystem as well as the company acquiring new Services customers through secondary iPhone. See table below.