Amazon exceeded high expectations from the tech community with a slew of new hardware announcements: the Echo device lineup extended to earbuds, eyeglasses, and a ring. Here are our takeaways along with some data that sheds light on the voice computing market.

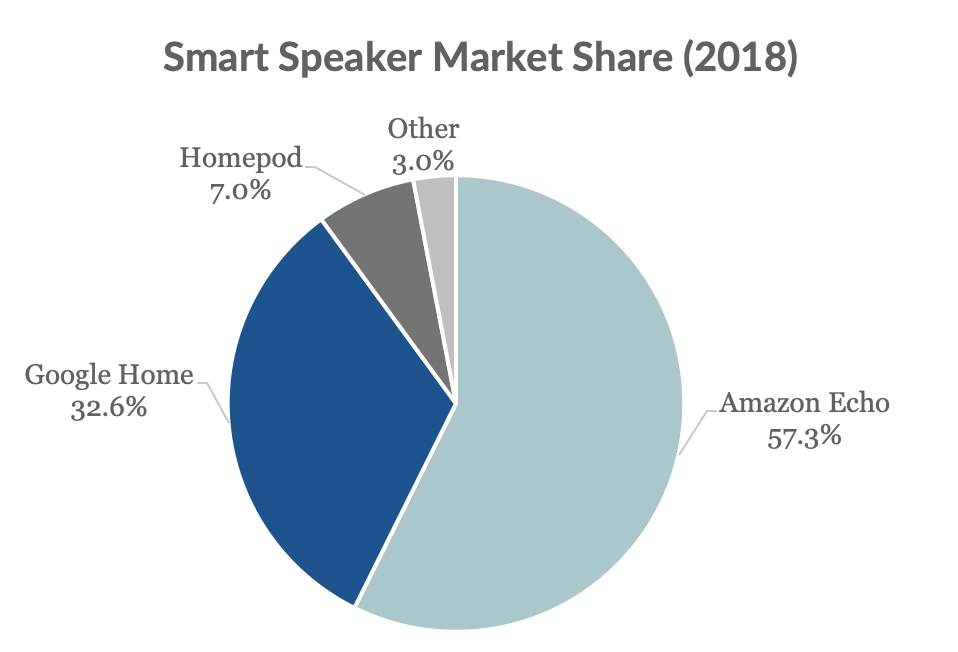

- Amazon is moving quickly to stay ahead of other platforms and retain market share. We estimate that Echo had 57.3% market share in smart speakers vs. Google at 32.6% and Apple at 7%.

- But hardware alone is not enough. Amazon’s Alexa platform is lagging Google Assistant and Apple’s Siri in performance. We test each platform regularly, asking each one 800 questions. Consistently, Alexa comes in behind Google Assistant and Siri.

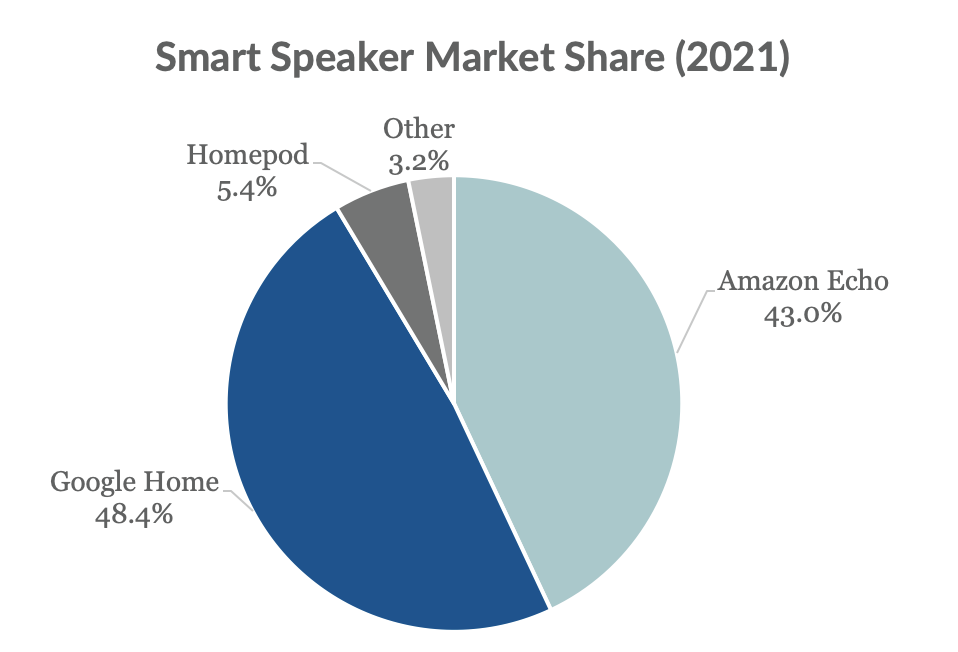

- Eventually, we think this catches up with Amazon. We expect Google to overtake Amazon in the smart speaker space by 2021.

Alexa’s Performance Lags Google Assistant and Siri

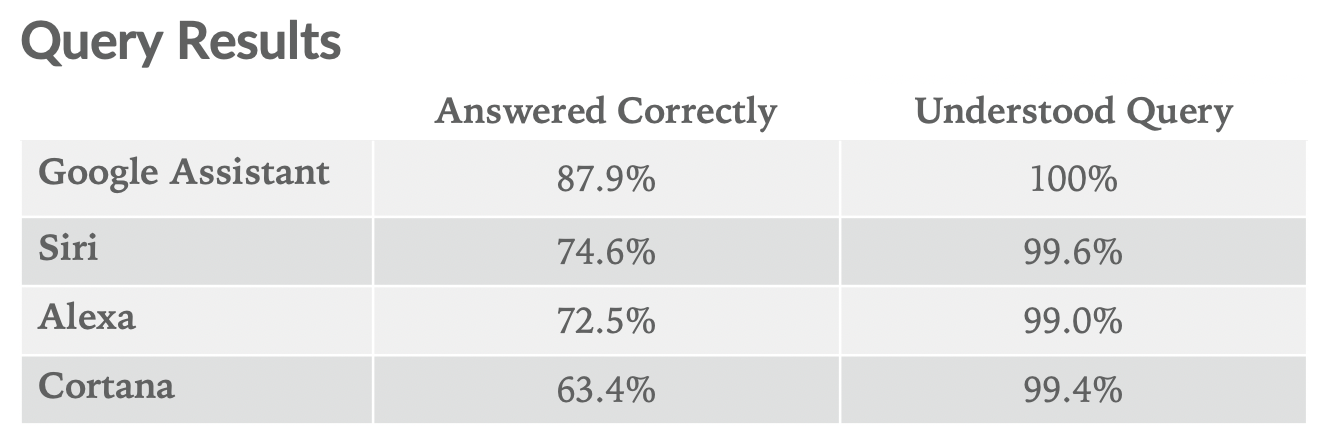

In Dec. 2018, we tested four smart speakers by asking Alexa, Siri, Google Assistant, and Cortana 800 questions each. Google Assistant was able to answer 88% of them correctly vs. Siri at 75%, Alexa at 73%, and the now defunct Cortana at 63%. Last year, Google Assistant was able to answer 81% correctly vs. Siri (Feb-18) at 52%, Alexa at 64%, and Cortana at 56%.

Today’s event underscores Amazon’s commitment to hardware and the Alexa line of products, but to what end? Google’s business model aligns well to the smart speaker business — understanding and collecting information. Apple’s business model also aligns – selling an ecosystem of products and services. Amazon’s isn’t as clear.

Market Share Reflects Age Not Performance

We estimate that Amazon sold 28.5M Echo devices in 2018, representing 57.3% of an estimated 49.7M smart speakers sold worldwide. To compare, we peg Google’s market share at 32.6% and Apple’s market share at 5.4% as of 2018 (3.0% other). Today’s market share is reflective of the device’s time in the market, not performance.

Amazon has an early lead, but we think the better product wins. Specifically, we expect Amazon’s market share to contract to 43.0% by 2021, with Google garnering 48.4% and Apple taking 5.4% (3.2% other).

Amazon, Google, and Apple Are in Voice for Very Different Reasons

The business model for Amazon’s Alexa ecosystem is also a bit of a head-scratcher. It makes sense that Apple sells HomePod as part of its hardware + services model, or that Google gathers information from Google Home to sell ads. But the buying experience on Alexa remains prohibitively challenging. So, it’s not clear what Amazon is really driving through voice other than low-margin device sales. The strategic value of today’s announcements to Amazon’s core business just isn’t clear. However, it can’t be ignored that Amazon is dominating the broader conversation around voice and smart devices. When consumers think of smart homes and voice computing, Alexa has an advantage by being top of mind. While the long-term strategy remains unclear, Alexa’s proliferation is impressive.