Following Apple’s product event yesterday, we have updated our AAPL financial model, which can be viewed here.

iPhone X Delayed, ~10M Units Pushed Out; Full Year Units Unchanged

iPhone X will ship on November 3rd, which is roughly six weeks after we had previously expected. We do not anticipate the delay will affect total iPhone demand for FY18, and are maintaining our 237m unit estimate (up 9% y/y), compared to the Street at around 240m. To factor in the iPhone X delay, we moved 10m units out of the Sep-17 and Dec-17 quarters into Mar-18 and Jun-18. In FY18 we expect iPhone X will account for 20% of all new iPhone sales (we’re modeling the iPhone 8 and 8 Plus to account for 26% of units)

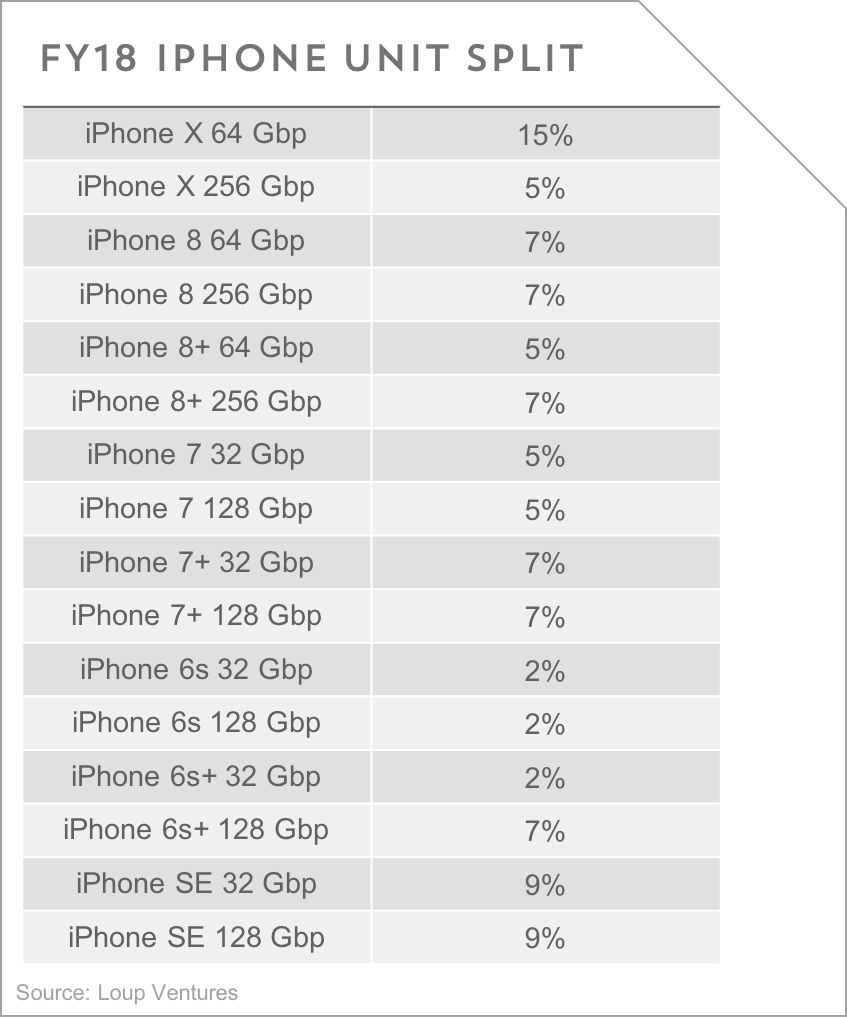

Historically iPhone Buyers Have Been Willing to Pay Up. Investor concern following yesterday’s event revolves around consumers’ willingness to pay a higher price for the iPhone X. Last year Apple’s flagship iPhone (7 Plus) started at $769 compared iPhone X at $999, or a 30% price increase. The best price increase analog was the 15% price increase from the iPhone 5S to the iPhone 6 Plus in 2014. At that time investors expected adoption of the iPhone 6 Plus to be limited due to the 15% price increase, but the opposite happened and the iPhone 6 Plus eventually accounted for over 50% of units pulling overall iPhone ASP’s up 12% during the iPhone 6 & 6 Plus cycle. This time the ASP jump is bigger, and the increase in screen size is smaller, so we’re expecting 20% of units to be the higher priced versions (15% the 64GB version and 5% the 256GB version).

Our Expectations By iPhone SKU. The table below outlines our iPhone estimates by SKU.

Changes To iPhone Estimates. High level summary of our iPhone unit adjustments is in the bullets below:

- Decreased iPhone unit shipments in Set-17 qtr from 49.1M to 47.3M

- Decreased iPhone unit shipment in Dec-17 qtr from 84.5M to 77.5M

- FY18 iPhone unit shipments unchanged at 237.7M

Raising Apple Watch Unit Growth In FY18 To 59% From 9%. With the introduction of LTE to the Apple Watch Series 3, as well as reduced price of the Series 1, we have become meaningfully more bullish on demand for these products. Near term, we have increased our unit assumption from 3.5M to 5.1M, implying 60% y/y growth. Looking longer term, we believe this announcement will add ~10M incremental Apple Watch units in 2018, implying Apple Watch sales grow 59% y/y to 26M in FY18. Due to the reduced price of the Series 1 we have lowered our Apple Watch ASP to imply flat y/y growth in FY18, but due to the higher expected sales we are now modeling the company to record $11.7B (4% of sales) Apple Watch sales in 2018.

Consolidated Income Statement Adjustment. Following these adjustments, we have modestly lowered our Sep-17 revenue estimates from $52.1B to $50.6B due to the delay for iPhone X, but still anticipate revenues to be in the company’s previously guided range ($49 – 52B). Because of lower revenues our Sept-17 EPS assumption has been lowered from $1.94 to $1.86. Looking into FY18, our iPhone unit shipments are unchanged, but due to higher ASPs, as well as stronger demand for Apple Watch we have taken our FY18 revenues up by $9B. Our new revenue estimate is implying 15% year/year growth, which is slightly above the Street’s 14% estimate. High level model changes are below.

- FY18 revenue estimate of $261B vs $252B prior estimate

- FY18 EPS assumption of $10.81 vs. 10.46 prior estimate

Disclaimer: We actively write about the themes in which we invest: artificial intelligence, robotics, virtual reality, and augmented reality. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.