The shift to EVs and autonomy will take longer than most think but will be more transformative in the end than most appreciate. The “take longer than most think” dynamic has played out in the US over the past several years. This reality will undoubtedly create near-term volatility in shares of Tesla, Nio, and the countless SPACs addressing the EV market. In the end, we continue to believe EVs and autonomy will be the foundation of the future of transportation.

Learnings from US EV sales

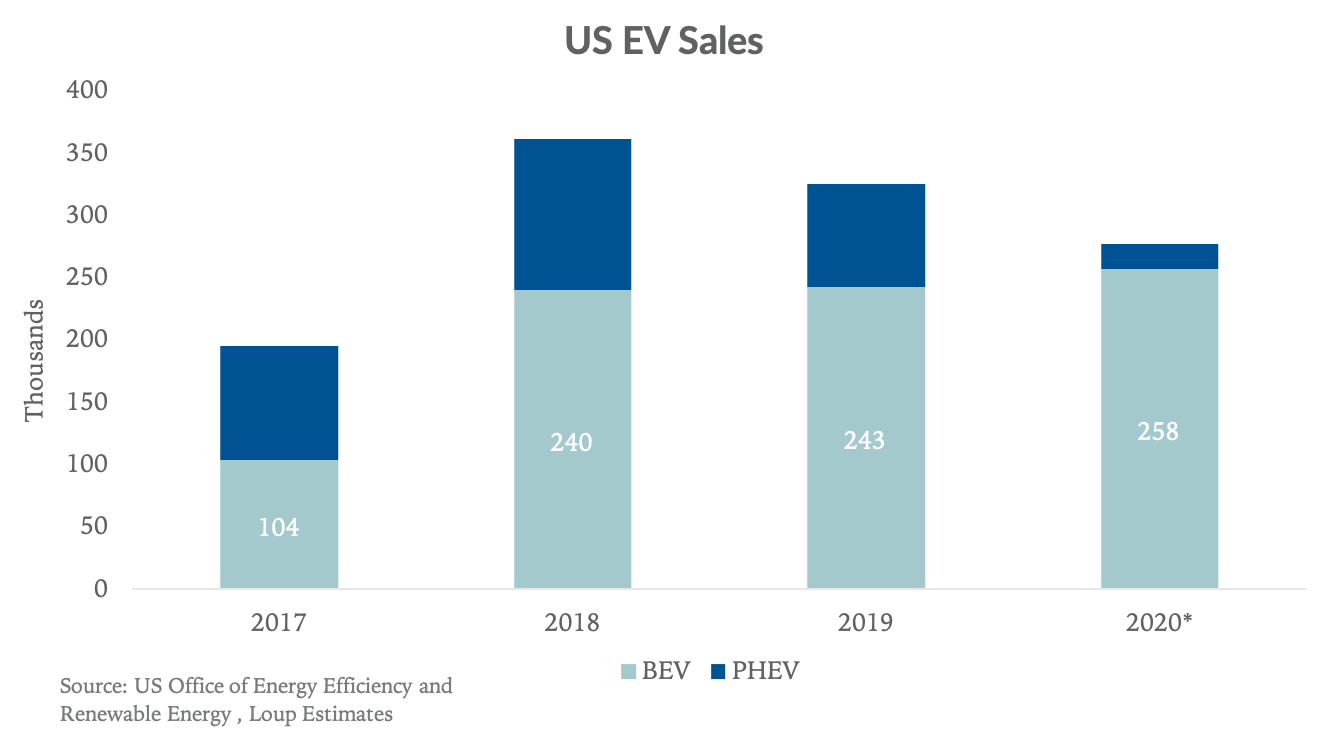

The US Office of Energy Efficiency and Renewable Energy reports electric vehicle sales that include battery electric vehicles and plug-in hybrid electric vehicles (cars with an ICE engine and charging port). Our focus is BEVs (hereon simply referred to as EVs), as that’s where the future is heading.

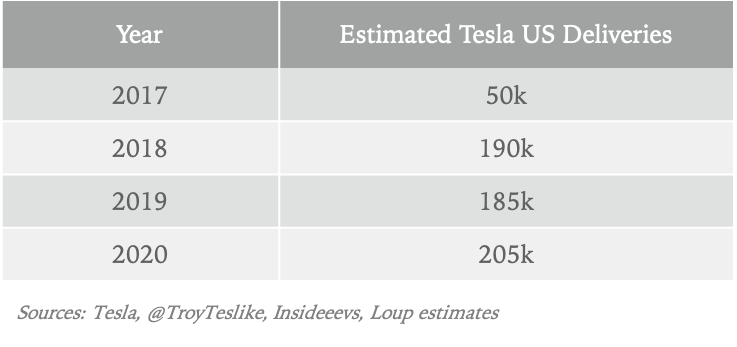

After growing more than 100% y/y in 2018, EV sales were flat in 2019. Based on our projections, we believe EV sales grew about 6% in 2020. Our calculation is based on the fact that Tesla has roughly 80% EV market share in the US, and we estimate the company’s US deliveries grew about 10% in 2020. We assume PHEV sales fell 15% in 2020, in line with the broader US auto sales decline.

The adoption slowdown

Shares of any EV company have been up and to the right over the past year. And yet, EV adoption in the US has been essentially flat over the past few years, a trend that, at first glance, seems illogical. However, further analysis reveals a trajectory that transformation typically follows.

The initial surge, and subsequent leveling off

Transformation starts with early adopters. In this case, it was driven by two years of pent-up demand for Model 3. Preorders began in March 2016 and had grown to more than 450k by the second quarter of 2017, with deliveries starting in the back half of the year. Given Tesla accounts for ~80% of the US EV market, the arrival of the Model 3 was single-handedly responsible for the bulk of the more than 100% increase of EV sales in the US in 2018.

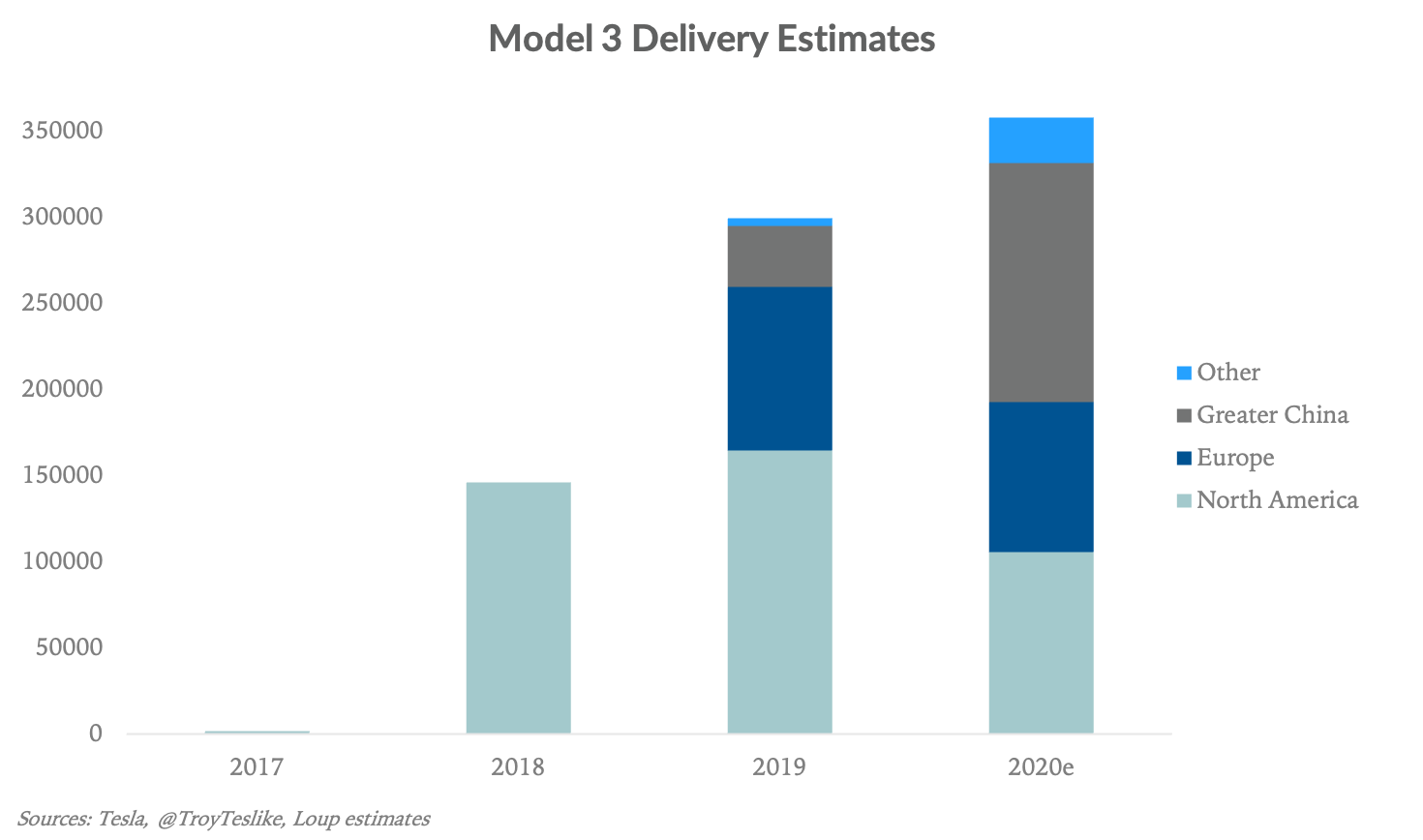

As the Model 3 pre-order book dwindled, US EV sales remained flat in 2019. At the time, there were a lot of questions about the sustainability of EVs in the US. Meanwhile, Tesla directed more of their Model 3 deliveries to foreign markets:

Gas prices and charging infrastructure

Two near-term headwinds to EV adoption are low gas prices and the availability of charging infrastructure. One of the selling points for EVs is fuel savings for consumers. Since 2018, however, gas prices have fallen about 25%, reducing the attractiveness of such cost savings. Additionally, the US lags areas such as Europe and China when it comes to public EV charging infrastructure. With less developed charging infrastructure, consumers are more likely to choose the certainty and convenience of gas stations over any potential hassle of waiting in line at charging stations.

Subsidies

2020 was a record year for EVs in Europe and China, driven in large part by generous government subsidies. To date, the US has largely rejected subsidies, although, with the incoming Biden administration, that is expected to change.

Moving forward

In any technology curve, the challenge is moving from early adopters to the early majority – a challenge EVs in the US are currently experiencing. We believe Tesla has been the only automaker to date to offer a truly compelling EV alternative to traditional ICE vehicles. In turn, the strength of the US EV market has moved largely in lockstep with developments at Tesla.

The arrival of compelling EV models from automakers like VW, Ford, GM, and Hyundai over the next year should help move the EV adoption curve forward.