For the first time, we’re publishing our Apple Wearables, Home, and Accessories model. This category includes two signature products, Apple Watch and AirPods. While Apple does not report details on those segments, the company has made 22 unique comments since Dec. 2014 related to trends in the category, typically in regards to growth rates and trailing revenue.

[button link=”https://www.dropbox.com/s/6ipi4upuu9btvp3/Apple%20Wearables%20Model%2001112019.pdf?dl=0″ class=”with-margins”]Download the model[/button]

Wearables Growth Offsets Recent iPhone Softness

Over the last few years, iPhone revenue growth has slowed. iPhone revenue grew at 6% in CY17, 5% in CY18, and will likely be down 10% this year. The decline in iPhone revenue has been almost entirely offset by growth in Services and Wearables. The strength of these two segments increases top-line visibility over the next 2 years. For example, if during that time iPhone, iPad, and Mac revenue is flat, and Services and Wearables grew at a slightly slower pace from current levels, overall Apple revenue would grow at about 5%. We believe this would be viewed as a positive relative to current investor expectations.

Apple Wearables Segment Drives Growth

The Wearables segment is comprised of Watch, AirPods, and Beats. In Jun-19, Apple reported “accelerating wearables growth of well over 50%.” We estimate the actual number was 52%. Takeaway: Wearables is an important component of the Apple growth story. It’s about half the size of Services (we estimate 7% in CY19) and growing at twice the rate (we estimate 39% in CY19).

Apple Watch: The World’s Most Popular Watch

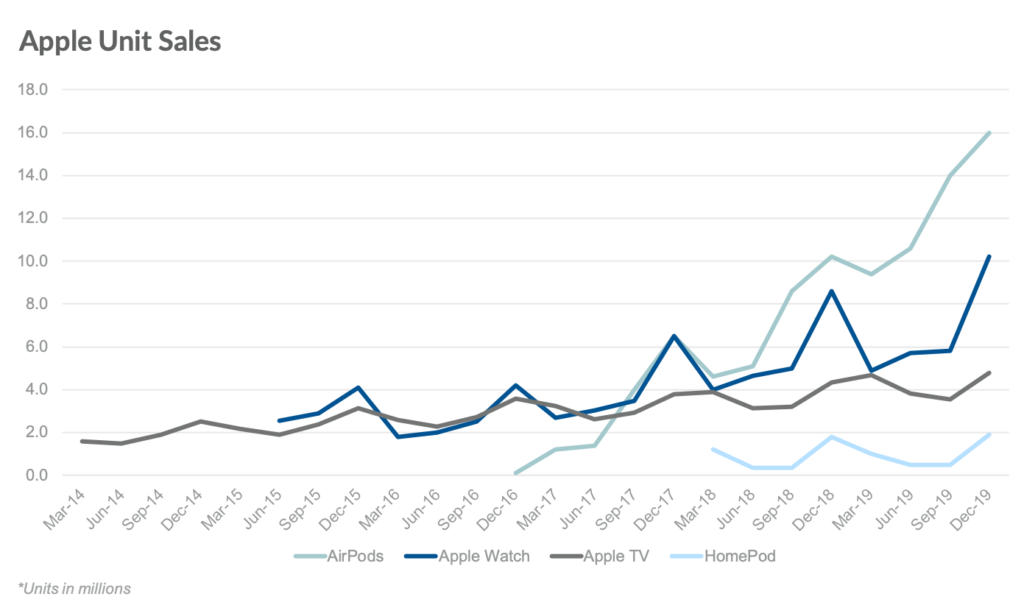

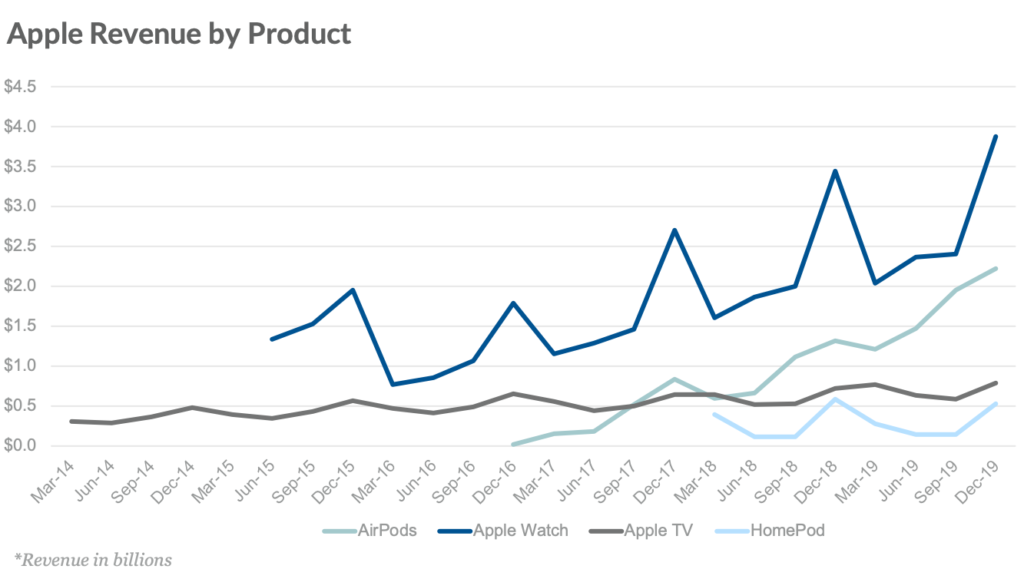

In CY19, we estimate Watch revenue will grow 20% and account for 59% of total Wearables revenue and 4% of total revenue. We expect Watch units of 26.6m in CY19, up from 22.3m in CY18. Since its launch in 2015 through the end of Jun-19, we believe Apple has sold 69m Apple Watches. In the chart above, it’s clear that the holiday quarter is particularly strong for the Watch. Takeaway: Apple Watch had a slow start, with revenue down 7% in its second year (CY16). In CY17 the Watch began gaining traction, growing revenue at nearly 50%, followed by 35% in CY18. While growth rates will likely decline to around 20% this year, the segment has the potential to grow at 10-15% for the next several years. Around 6% of current iPhone owners also own an Apple Watch. Over time, we expect that number to triple.

AirPods: A Cultural Phenomenon

In CY19, we estimate AirPods revenue will grow 86% and will account for 37% of total Wearables revenue and 2.5% of total revenue. We expect AirPods units of 50m in CY19, up from 28.5m in CY18. Since launching in late 2016, we believe Apple has sold 62m pairs of AirPods. Takeaway: In Mar-19 Tim Cook referred to AirPods as a “cultural phenomenon.” The hyper-growth will slow in 2020, but the segment will likely equal Apple Watch revenue by the end of 2023. We continue to expect new AirPods early next year. Down the road, we believe AirPods will include biomarkers to support Apple’s ongoing efforts in health and wellness.

Beats: A Fad

In CY19, we estimate Beats revenue will grow 14% and account for 4% of total Wearables revenue, a fraction of a percent of Apple’s total revenue. This would mark a return to growth for Beats, which has been down from CY15 through CY18 by an average decline of 23% y/y. Takeaway: It’s a good thing Apple purchased beats for music streaming because the headphone revenue rapidly declined post-acquisition. Beats were a fad. The segment has now stabilized but will never move Apple’s growth needle.

Beyond Wearables

Wearables are reported in the Wearables, Home, and Accessories category. This segment also includes Apple TV, Accessories, HomePod, and iPod.

Apple TV: A Starting Point in the Living Room

In CY19, we estimate Apple TV revenue will grow by 15% to $2.8B and account for about 1% of overall revenue. We expect Apple TV units of 16.8m in this year, up from 15.6m in last year. Since its launch in 2007, we believe Apple has sold 81m Apple TVs. The last reported number was in Dec-14 when the company announced it had sold over 25m units life to date. Takeaway: About 25% of US households have an Apple TV, which lags US iPhone share of ~50%. Unit sales may get a fractional lift from the launch of Apple TV+ this fall but it needs a price cut from its $149 starting point to gain share. Long term, Apple TV will likely be less relevant as more third party display manufacturers incorporate the Apple TV app into the display.

Accessories: May Surprise You

In CY19, we estimate Accessories revenue will grow 3% and account for $1.9B in revenue, accounting for almost 2% of overall revenue. Accessories include iPhone cases, cables, charging, storage drives, and other third party products (aka learning toys). Takeaway: We’re surprised how large the accessories business is and its relatively stable growth. Overall, the segment performs better during stronger iPhone cycles.

HomePod: Missed the Mark

In CY19, we estimate HomePod revenue will be down 11% and account for 0.5% of total revenue. When HomePod launched early in 2018, we estimated that it would gain 12% smart speaker market share by 2022. We were wrong, and it’s more likely HomePod will hold between 3-5% smart speaker market share. Takeaway: HomePod will still have a home in Apple’s product lineup given the importance of ambient voice in the home. We welcome a price drop from the current $299. Given the functionality, we see the $150 price level as something that will re-accelerate growth.

iPod: A Rounding Error

iPod is now a rounding error account for 0.25% of overall revenue. Hard to believe given at its peak iPod accounted for just over 50% of revenue. Credit Apple for recognizing the need to move beyond at a time when it was the companies cash cow.