Google shares traded off ~7% in after-hours trading after reporting soft top-line results and expectations for continued FX headwinds. Separately, deceleration of paid clicks growth from 66% to 39% is likely viewed as a directional negative, given the preference toward strength of clicks growth over cost-per-click.

Bottom Line: Google remains the oxygen of the internet and will maintain that distinction as the company brings the benefits of AI to all of its nearly 50 consumer-facing products in the years to come. Separately, the company is prudently balancing between near-term earnings and investing for long-term revenue growth.

Our takeaways:

- While the company warned that FX will have a negative impact on Jun-19, investors are likely reading between the lines and concluding that the upcoming “softness” is more than just FX. We were not given any insight beyond FX on the call, but we believe that the business is structurally sound (no changes to user behavior or competition) and expect next year’s growth rate to stabilize or step up slightly.

- Where we could be wrong – the biggest negative wildcard is related to regulation and potential changes to products as a result. Apart from the EU fine, Google has largely escaped the general backlash toward companies handling consumer data. Though we believe some form of greater regulation is inevitable and poses headline risk, we think it is unlikely to have a material impact on the business.

- Google still has products with large addressable markets to monetize, most notably Maps, Waymo (transportation, logistics), Verily, and Calico (healthcare). While market sizing would be a guessing game, it is safe to say they are large enough to be incremental even to a company as large as Google.

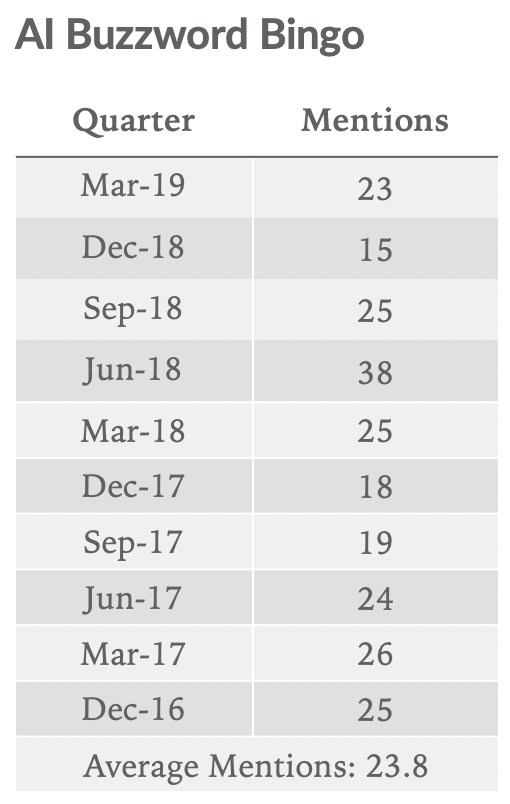

- In our tenth quarter of tracking buzzwords related to artificial intelligence, we counted 23 mentions on the call. As Google continues to brand itself as an AI-first organization, we expect this number to increase. See below for how it has trended over time.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.