Heading into next month’s iPhone announcement, we surveyed 530 U.S. consumers regarding their intent to purchase the upcoming phones. Our survey suggests demand for the next iPhone cycle will slightly outpace investor expectations. The survey supports our modeling, which calls for 3% iPhone unit growth in FY19 vs. Street expectations of flat (0%) unit growth.

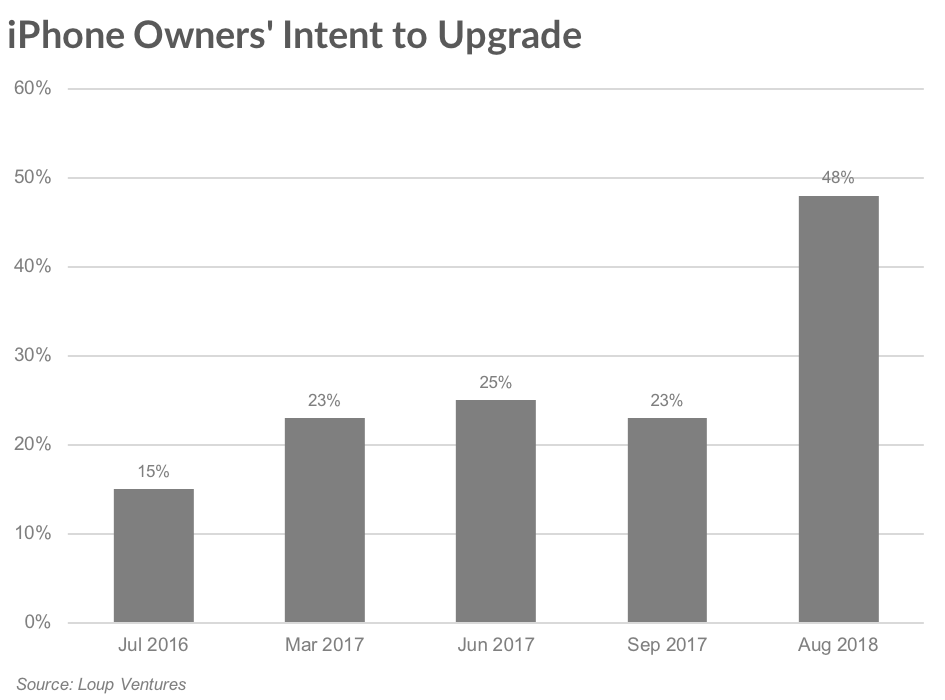

- This survey showed a surprisingly high intent to upgrade, suggesting 48% of current iPhones owners intent to upgrade to a newer iPhone in the next year, compared to 25% in June of last year.

- This 48% is an outlier, and therefore should be tempered (intent to buy vs. actual purchase conversion varies cycle to cycle), but the survey is nonetheless a positive indicator of upcoming iPhone demand.

- 19% of Android users surveyed indicated they plan on switching to an iPhone in the next year, compared to 12% last year.

- Survey’s bottom line: there is greater interest in this upcoming iPhone cycle than we had anticipated.

The Bigger Picture

iPhone is entering a period of stability (0% to 5% unit growth for the next several years) driven by 805m+ active iPhones with a high (90%) retention rate. Assuming a 3.5-year upgrade cycle and a 90% retention rate implies 207m iPhones sold each year, slightly below the Streets 219m expected in FY18 and FY19.

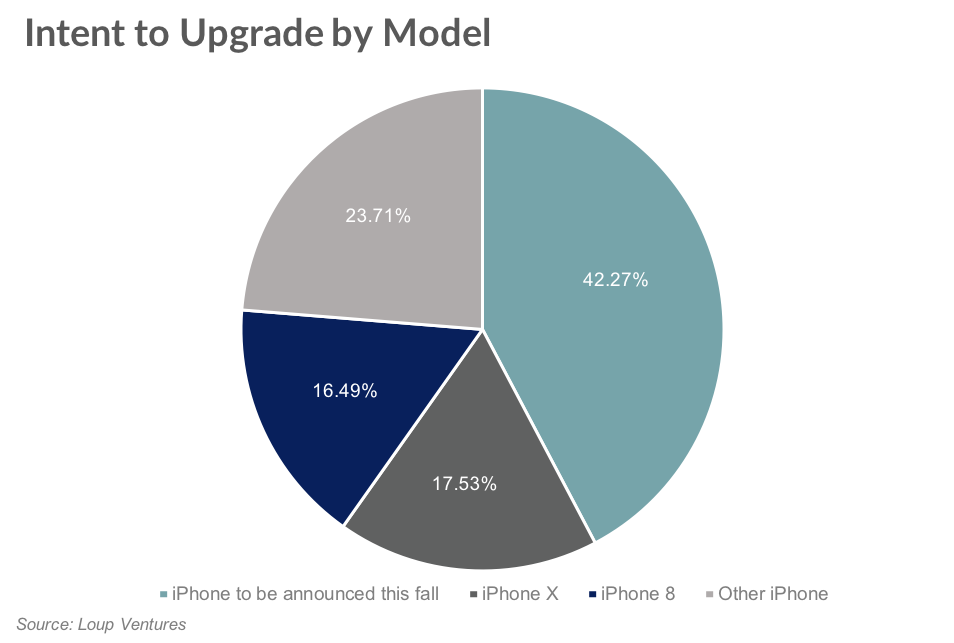

Of those that plan on buying an iPhone, 42% of them plan on buying one of the three to be announced this fall, 18% iPhone X, 16% iPhone 8, and 24% another iPhone.

Further, of the 530 respondents, 212 (40%) were Android users. Of the Android group, 41 (19%) intended to buy an iPhone in the next year. This compares to 12% of Android users planning to make the switch last year.

Slight Increase in AR Interest

We also asked if the respondent would have more, less, or unchanged interest in buying a phone that had more powerful augmented reality capabilities. This time, 32% of respondents said they would be more interested, compared to 21% when we asked the same question in September of 2017. While the most common answer is still “unchanged,” the uptick in interest reflects the slow but steady progression of mobile AR’s importance.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.