Eight years ago, we wrote a note titled, “No Such Thing as a Value Stock in Internet?” The hypothesis was that technology stocks, by nature, must be growth stocks to be compelling.

Technology is inherently new, so investors look for growth in tech stocks as companies disrupt and steal market share from other industries. If you aren’t growing relatively quickly, then your technology probably isn’t that good. As such, public market tech investment returns should be higher for growth stocks than for value stocks.

2010 Study

Back in 2010, our hypothesis turned out to be true for our limited coverage universe of 22 stocks. High growth (>20% growth in the out year) stocks had returned 63% YTD as of Oct. 2010, while the non-growth stocks had returned an average of 4%.

We recently revisited our study to see if growth still outperforms “non-growth” in tech. It does. Note that we consider growth companies to be those that grow revenues more than 20% y/y and non-growth to be those growing less than 20% y/y.

2018 Study

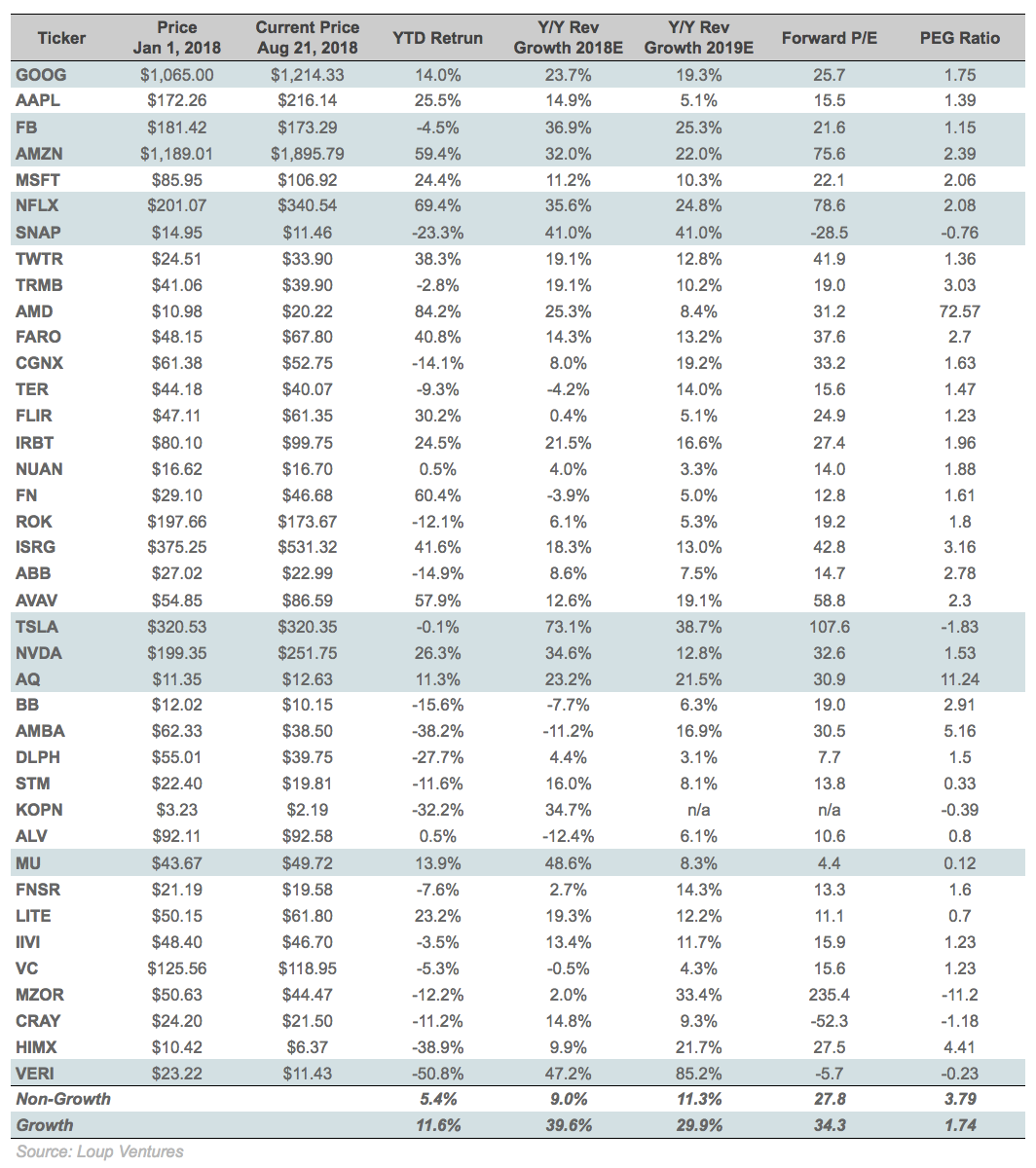

To update our study, we gathered and tested a basket of stocks using two different time frames. The basket included the US-listed stocks in the Loup Frontier Tech Index plus several of the FAANG stocks, totaling 39 names.

First, we looked at analyst expectations for revenue growth in 2018 and 2019. If they averaged more than 20% they were deemed a growth stock. This yielded 10 growth stocks and 29 non-growth stocks. The “growth” group had an average YTD return of 11.6% vs the “non-growth” group at 5.4%.

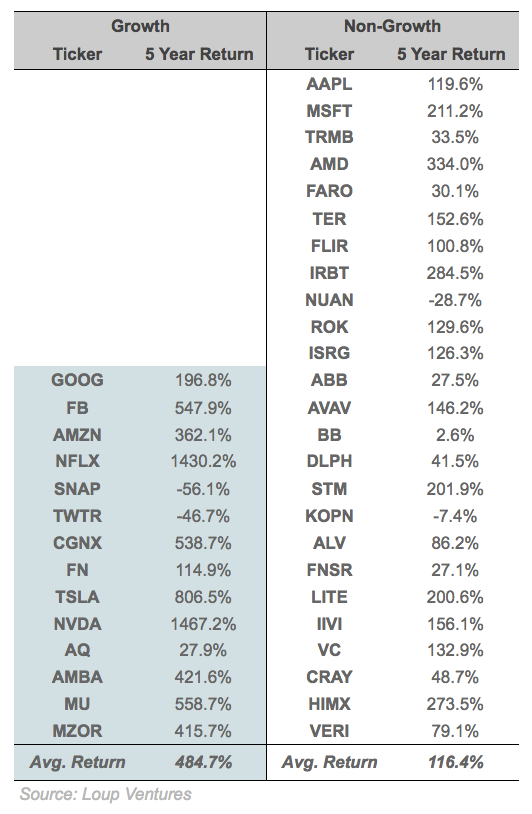

Looking back further, an analysis of 5-year returns shows a more dramatic difference. For the same basket of stocks, we looked at average y/y revenue growth from 2013 to 2017 (in place of consensus estimates). Those with average revenue growth of 20% or more were considered growth stocks and the others “non-growth.” This yielded 14 growth stocks and 25 non-growth. The five-year return for the growth group was 485% vs. the non-growth return of 116%, a more than 4x difference.

It may seem obvious that companies that are growing faster should outperform slower growing ones over time, but on the whole, this has historically not been the case. 26-year annualized returns for U.S. Value indices outperform U.S. Growth indices across small, medium and large-cap. Tech appears to be an exception to this broader reality.

Bottom Line: Tech and Growth are Synonymous

Growth is a core-criteria of the methodology for the Loup Frontier Tech Index — we optimize for growth. It isn’t surprising that higher growth stocks outperform lower growth ones in tech, but it’s a lesson worth remembering.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.